16-May-2024 | Facts and Factors

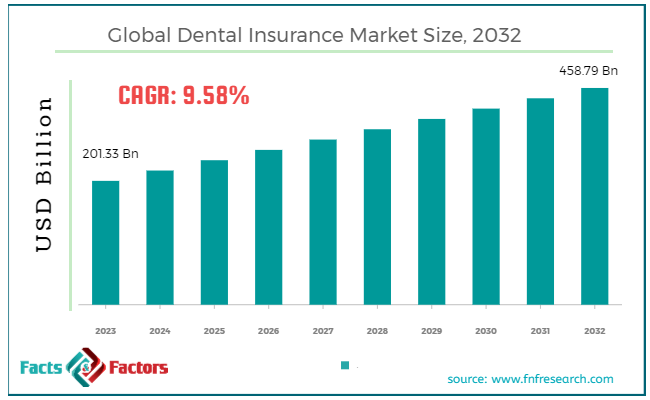

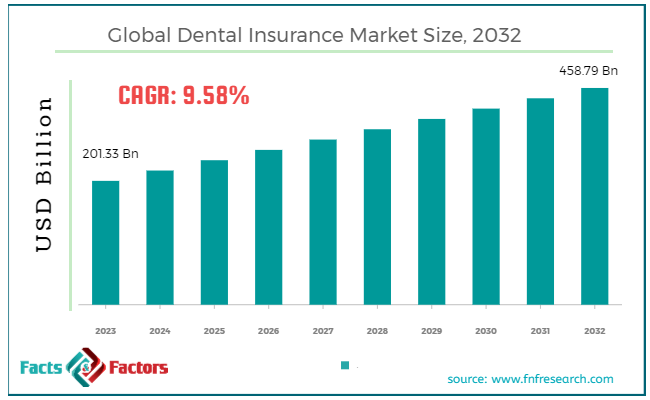

Facts and Factors Market Research has published a new report titled "Dental Insurance Market Size, Share, Growth Analysis Report By Coverage Type (DPPO (Dental Preferred Provider Organization), Indemnity Plans, DHMO (Dental Health Maintenance Organizations), and Others), By Procedure (Preventive Care, Basic Procedures, and Major Procedures), By End User (Individuals, Families, and Corporates/Groups), By Distribution Channel (Direct Sales, Brokers/Agents, and Online Distribution), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032”. According to the report, the global dental insurance market was valued at approximately USD 201.33 Billion in 2023 and is expected to reach a value of around USD 458.79 Billion by 2032, at a CAGR of around 9.58% between 2024 and 2032

Dental insurance is the kind of health insurance that takes into consideration the oral health of an individual. It is insurance coverage for individuals to support them in paying up for dental expenditure. Moreover, it ensures a person against dental treatment expenditure and care of the oral ailment as well as an accident to the teeth. The most common kinds of dental insurance plans are preferred provider organizations and dental health maintenance organizations.

Browse the full “Dental Insurance Market Size, Share, Growth Analysis Report By Coverage Type (DPPO (Dental Preferred Provider Organization), Indemnity Plans, DHMO (Dental Health Maintenance Organizations), and Others), By Procedure (Preventive Care, Basic Procedures, and Major Procedures), By End User (Individuals, Families, and Corporates/Groups), By Distribution Channel (Direct Sales, Brokers/Agents, and Online Distribution), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032” Report at https://www.fnfresearch.com/dental-insurance-market-report

High occurrence of oral ailments to steer the market expansion

Oral disorders are common non-communicable ailments and can impact people throughout their lifespan causing pain as well as discomfort. Many of the oral ailments include tooth decay, oral cancers, periodontal disorders, oro-dental trauma, oral manifestations of HIV, noma, and cleft lip & palate. They account for a large part of the oral ailment burden. All these factors are expected to steer the growth of the dental insurance market over the forecast timeline.

Moreover, escalating cases of oral disorders witnessed among the geriatric population are predicted to generate awareness pertaining to dental insurance among individuals as a result of recurrent dental treatment for oral disorders. This, in turn, will boost market growth trends. Apart from this, high costs of dental treatments are likely to boost the expansion of the dental insurance industry over the forecast timeline. Nevertheless, growing medical tourism activities across the globe will inhibit the growth of the market over the forecast period.

Basic/Minor segment to dominate the insurance type landscape

The basic/Minor segment is predicted to register the highest growth in terms of both revenue and CAGR. It is likely to record the highest CAGR of nearly 5.6% during the period from 2021 to 2027. The segment offers coverage to major dental problems like emergency care for stainless steel (prefabricated) crowns, root canal treatment, periodontal surgery, periodontal scaling & root planning, routine tooth extractions, pain relief, recementing dental crowns, composite fillings, sedative fillings, and non-routine x-rays.

Corporates segment to contribute majorly towards the overall market growth

The corporates segment is expected to accrue proceeds worth nearly USD 100 billion by 2032. Moreover, dental insurances are directly purchased by the corporate firms and they are provided in groups in the various corporate offices. In addition to this, corporate dental insurances have become the latest trend. All these aspects will steer the segmental growth over the forecast period.

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 201.33 Billion |

Projected Market Size in 2032 |

USD 458.79 Billion |

CAGR Growth Rate |

9.58% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Aetna Inc., AFLAC Inc., Allianz SE, Ameritas Life Insurance Corp., AXA, Cigna, Delta Dental Plans Association, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions LLC, United Concordia, United HealthCare Services Inc., and others., and Others. |

Key Segment |

By Coverage Type, By Procedure, By End User, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

North America to lead the overall market revenue growth

The regional market expansion is credited to the high presence of the key industry players in the region along with high consciousness pertaining to the advantages of purchasing dental insurance in the region. Apart from this, huge costs of dental treatments in countries like the U.S. have forced people to purchase dental insurance.

Key players involved in dental insurance business include Aetna Inc., AFLAC Inc., Allianz SE, Ameritas Life Insurance Corp., AXA, Cigna, Delta Dental Plans Association, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions, LLC, United Concordia, United HealthCare Services, Inc., and others.

This report segments the dental insurance market as follows:

By Coverage Type

- DPPO (Dental Preferred Provider Organization)

- Indemnity Plans

- DHMO (Dental Health Maintenance Organizations)

- Others

By Procedure

- Preventive Care

- Basic Procedures

- Major Procedures

By End User

- Individuals

- Families

- Corporates/Groups

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Distribution

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com