Search Market Research Report

Chromatography Reagents Market Size, Share Global Analysis Report, 2022 – 2028

Chromatography Reagents Market Size, Share, Growth Analysis Report By Type (Solvents, Buffers, Derivatization Reagents, Ion-Pair Reagents, Others), By Separation Mechanism (Adsorption, Partition, Ion Exchange, Size Exclusion, Affinity, Others), By Application (Pharmaceutical testing, Biopharma-Biotech Applications, Cosmeceutical Applications, Environmental Testing, Food and Beverage Testing, Petrochemical Analysis, Forensic Testing, Clinical Testing, Research And Academic Applications), By End-User (GC Reagents, LC Reagents, Super Critical Fluid Chromatography (SFC) Reagents, TLC, Paper Chromatography, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

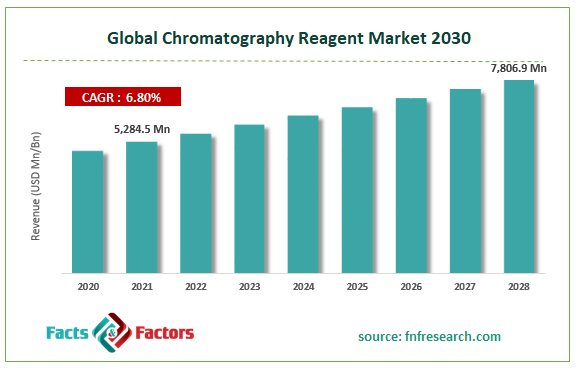

[209+ Pages Report] According to Facts and Factors, the Global Chromatography Reagents Market size was valued at USD 5,284.5 million in 2021 and is predicted to increase at a CAGR of 6.8% to USD 7,806.9 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global chromatography reagents market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the chromatography reagents market.

Market Overview

Market Overview

Chromatography is a technique of separating materials by dividing them into two phases. The stationary phase remains fixed, while the mobile phase transports the mixture's components through the medium. In the pharmaceutical industry, chromatography is used for a variety of purposes, including identifying and analyzing samples for the presence of chemicals or trace elements, separating chiral compounds, detecting mixture purity and the presence of unknown compounds, and preparing large quantities of extremely pure materials, and drug development. This is propelling market expansion over the predicted period. In the domain of proteomics, chromatography has recently become the dominant separation technology.

Growth Drivers

Growth Drivers

The proteomics industry is predicted to increase significantly in the next years since it is regarded as an excellent method for bridging the gap between genomic sequence and cellular behavior. Chromatography techniques are becoming more popular for identifying and analyzing samples as well as detecting mixture purities. The increasing stringency of regulatory standards for drug development and safety, as well as the increasing number of clinical trial projects and R&D activities for therapeutic areas, will contribute to sector expansion. Furthermore, increased R&D expenditure on proteomics and the rising purchasing power of large research institutes due to the availability of funds from various organizations are projected to fuel market expansion.

The appropriate use of analytical methods like chromatography, PCR, and NGS necessitates the usage of experts with the required experience and understanding. Various technical advancements in the chromatography reagents market are raising the demand for qualified personnel that can operate chromatography equipment successfully. A lack of understanding about the best approach to use results in a number of direct and indirect costs, as well as an increase in medication time to market.

COVID – 19 Impact

COVID – 19 Impact

The COVID-19 pandemic has boosted drug discovery and research efforts while putting extra demand on pharmaceutical businesses and clinical laboratories. Although the COVID-19 pandemic is still transforming the evolution of numerous businesses, the outbreak's immediate impact is still diversified. While some industries may see a reduction in demand, many others will stay steady and exhibit potential development prospects.

The market for chromatography reagents has risen dramatically over the years; however, due to the unexpected COVID-19 outbreak, the industry is likely to expand even more in 2020, owing to the increasing use of chromatography procedures in pharmaceutical approval. Furthermore, technical advances and the growing relevance of chromatography in hospital labs, forensic laboratories, and pharmaceutical industries will boost market growth throughout the projection period.

Segmentation Analysis

Segmentation Analysis

The Global Chromatography Reagents Market is segregated based on Type, Separation Mechanism, Application, and End-User.

In terms of Type, in the forecast period, the market for Chromatography Reagents was led by Solvents Chromatography. Solvents chromatography (SC) is a chromatographic analytical technique used to separate ions or molecules that have been dissolved in a solvent. This differentiation arises as a result of the sample's interactions with the mobile and stationary phases. The analyte's preference for both the stationary and mobile phases determines separation from liquid chromatography. One of the most frequent Solvents-chromatography adsorbent materials is silica. The primary need for the mobile process is that the components be dissolved to the concentration required for detection. The type of mobile step used can have a big impact on the separation retention time as well as the downstream detection ionization of the components.

In terms of application, pharmaceuticals will dominate market demand. To ensure the least level of risk to patients, all pharmaceutical items must be of the highest quality. Researchers, producers, and developers use a variety of technical equipment and analytical procedures, such as liquid chromatography, to ensure that the things meet the criteria during the development process. Since drug products must be both safe and effective, the pharmaceutical business is one of the most strictly regulated in the world. Chromatography is used in the pharmaceutical industry for a variety of tasks such as identifying and analyzing the most important analytical technique utilized in the pharmaceutical industry for identifying and measuring medicines is HPLC chromatography. This is employed during the research, development, and manufacturing of medicine, either in the active pharmaceutical ingredient or in the formulations. As a result, with the expansion of the pharmaceutical industry, the need for chromatography reagents is expected to rise in the coming years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,284.5 Million |

Projected Market Size in 2028 |

USD 7,806.9 Million |

CAGR Growth Rate |

6.8% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Agilent Technologies (US), Thermo Fisher Scientific (US), Merk Group (Germany), Sigma-Aldrich (US), Avantor Performance Materials (US), Waters Corporation (US), Bio-Rad Laboratories (US), GE Healthcare (UK), Regis Technologies (US), Santa Cruz Biotechnology (US), Loba Chemie (India), and Others |

Key Segment |

By Type, Separation Mechanism, Application, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The North American area controlled the majority of the worldwide market share. The region's need for chromatography reagents is being driven by the rising use of chromatography techniques, particularly in the food and beverage and pharmaceutical industries. The United States is the main market for chromatography reagents, with increased investments in genomics research and development, as well as the availability of sophisticated technology, expected to fuel market expansion in the future years.

Recently, funding for cancer research has been boosted in order to combat the rising threat of chronic diseases in Canada. Due to the obvious aforementioned causes, North America is likely to have a high demand for the market studied in the near future. Many changes are taking place in the country's life sciences industry, with an increase in R&D and drug discovery operations.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the Chromatography Reagents Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Chromatography Reagents Market:

- Agilent Technologies (US)

- Thermo Fisher Scientific (US)

- Merk Group (Germany)

- Sigma-Aldrich (US)

- Avantor Performance Materials (US)

- Waters Corporation (US)

- Bio-Rad Laboratories (US)

- GE Healthcare (UK)

- Regis Technologies (US)

- Santa Cruz Biotechnology (US)

- Loba Chemie (India)

The global chromatography reagents market is segmented as follows:

By Type

By Type

- Solvents

- Buffers

- Derivatization Reagents

- Ion-Pair Reagents

- Others

By Separation Mechanism

By Separation Mechanism

- Adsorption

- Partition

- Ion Exchange

- Size Exclusion

- Affinity

- Others

By Application

By Application

- Pharmaceutical testing

- Biopharma-Biotech Applications

- Cosmeceutical Applications

- Environmental Testing

- Food and Beverage Testing

- Petrochemical Analysis

- Forensic Testing

- Clinical Testing

- Research And Academic Applications

By End-User

By End-User

- GC Reagents

- LC Reagents

- Super Critical Fluid Chromatography (SFC) Reagents

- TLC

- Paper Chromatography

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Agilent Technologies (US)

- Thermo Fisher Scientific (US)

- Merk Group (Germany)

- Sigma-Aldrich (US)

- Avantor Performance Materials (US)

- Waters Corporation (US)

- Bio-Rad Laboratories (US)

- GE Healthcare (UK)

- Regis Technologies (US)

- Santa Cruz Biotechnology (US)

- Loba Chemie (India)

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors