Search Market Research Report

Automotive USB Power Delivery System Market Size, Share Global Analysis Report, 2025 - 2034

Automotive USB Power Delivery System Market Size, Share, Growth Analysis Report By Type (USB Power Delivery [PD] Controllers and USB PD Transceivers), By Application (Charging Ports, Infotainment Systems, and In-Car Connectivity), By End-User (OEMs and Aftermarket), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

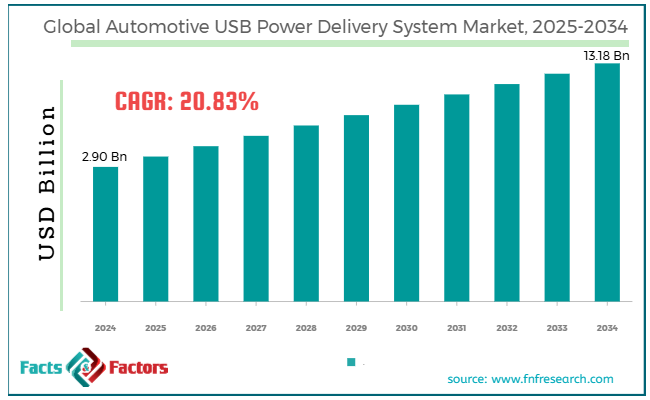

[221+ Pages Report] According to Facts & Factors, the global automotive USB power delivery system market size was worth around USD 2.90 billion in 2024 and is predicted to grow to around USD 13.18 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.83% between 2025 and 2034.

Market Overview

Market Overview

An automotive USB PD system offers data transfer, high power, and flexible vehicle charging. It supports current and dynamic voltage levels, enabling devices like tablets, laptops, and smartphones to charge faster and more efficiently than ever. The leading drivers of the worldwide automotive USB power delivery system market include the mounting use of hybrid and electric vehicles, growing demand for in-car connectivity, and improvements in battery technology. The rising adoption of hybrid and electric cars demands advanced charging infrastructure, comprising USB PD, to facilitate the high energy demands of these vehicles.

Moreover, consumers increasingly demand smooth connectivity in cars, fueling the incorporation of USD PD systems to support data transfer and fast charging for tablets, smartphones, and other devices. Furthermore, the present improvements in battery technology, especially in EVs, add to the rising demand for well-developed charging solutions. USB power delivery is key in facilitating faster charging and high power levels.

Nevertheless, limited standardization in devices and safety and heat generation issues are a few restraints to the market progress. The lack of global standards in diverse devices and automobile makers offers a challenge to smooth incorporation, hampering mass adoption in the automotive market. Furthermore, the fast-charging nature of USD power delivery systems may produce notable heat, resulting in safety issues, especially in extreme heat periods or environments and prolonged use.

Still, the automotive USB power delivery system industry is projected to grow progressively due to opportunities from the rising use of USD Type-C connectors, emphasis on sustainability, and innovations in charging technology. The global automotive industry is inclining towards adopting USB Type-C connectors, which facilitate fast charging and data transfer, making it highly suitable in the automotive and consumer electronics sectors. Manufacturers are also emphasizing the development of energy-efficiency USB power delivery systems to comply with the universal trends, minimizing carbon emissions and enhancing the overall energy efficacy of vehicles. In addition, constant improvements in charging technology, like wireless charging and fast charging, offer key opportunities for industry growth.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global automotive USB power delivery system market is estimated to grow annually at a CAGR of around 20.83% over the forecast period (2025-2034)

- In terms of revenue, the global automotive USB power delivery system market size was valued at around USD 2.90 billion in 2024 and is projected to reach USD 13.18 billion by 2034.

- The automotive USB power delivery system market is projected to grow significantly due to the increasing demand for hybrid and electric vehicles, rising focus on driver and passenger experience, and surge demand for in-car connectivity.

- Based on type, the USB power delivery (PD) controllers segment is expected to lead the market, while the USB PD transceivers segment is expected to grow considerably.

- Based on application, the charging ports segment is the dominating segment, while the infotainment systems segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the OEMs segment is expected to lead the market as compared to the aftermarket segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Surging consumer demand for enhanced connectivity fuels market growth

Modern consumers demand smooth integration of their electronic devices with vehicle infrastructures. The USB-PD technology facilitates fast data transfer and fast charging, catering to the changing consumer needs and accommodating a growing number of devices like laptops, smartphones, and tablets in vehicles. This demand for improved connectivity forces manufacturers to integrate enhanced USB power delivery systems to satisfy the mounting consumer needs for efficiency and convenience.

- Improvements in charging solutions and integration with enhanced infotainment systems drive market growth

The development of smart charging is transforming the automotive USB power delivery system market. These systems present smart power distribution, communication protocols, and adaptive charging profiles that enhance charging efficacy depending on the device's needs. These modernizations add to vehicles' more innovative and energy-efficient charging procedures. This ultimately improves user experience and facilitates the dispersion of connected vehicle solutions.

The rising complexity of in-car infotainment systems demands strong power delivery technologies. USB power delivery is essential for powering these improved systems, including features like entertainment, connectivity, and navigation. As vehicles become more connected and intelligent, the demand for effective power delivery systems to back these solutions continues to rise.

Restraints

Restraints

- Safety concerns and lack of global standardization negatively impact market progress

Fast charging capabilities innate in USB power delivery systems may produce notable heat. There is an increased threat of overheating without efficient thermal management solutions, which may hamper system reliability. Addressing these issues demands advanced engineering solutions, contributing to the cost and intricacy of system development. Moreover, despite the rising use of USB Type-C connectors, the lack of universal standards in automakers and devices results in compatibility issues. This breakup may lead to unreliable charging experiences for consumers, thus impacting the broad adoption of USB power delivery systems in cars.

Opportunities

Opportunities

- The growing integration with autonomous and electric vehicles positively impacts market growth

The rising adoption of EVs and the development of autonomous driving solutions offer significant opportunities for the automotive USB power delivery system industry. Electric vehicles need effective power delivery technologies to facilitate their improved electronic systems like navigation, autonomous driving sensors, and infotainment. The USB PD solution allows reliable and fast charging of multiple devices concurrently, boosting the overall user experience in these automobiles.

Challenges

Challenges

- Incorporation with evolving vehicle designs limits the growth of market

The speedy revolution of vehicle technologies, like autonomous driving systems and electrification, makes incorporating USB power delivery systems difficult. Promising compatibility with modern vehicle frameworks and maintaining system performance amongst technical advancements need constant adaptation and innovation. Failure to incorporate smoothly may result in users' dissatisfaction and hamper the adoption of USB power delivery systems.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 2.90 Billion |

Projected Market Size in 2034 |

USD 13.18 Billion |

CAGR Growth Rate |

20.83% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Diodes Incorporated, Monolithic Power Systems (MPS), Infineon Technologies, Cypress Semiconductor, Renesas Electronics, NXP Semiconductors, Texas Instruments, STMicroelectronics, ROHM Semiconductor, Aptiv PLC, Lear Corporation, Bosch, Continental, Denso, Yazaki, and others. |

Key Segment |

By Type, By Application, By End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global automotive USB power delivery system market is segmented based on type, application, end-user, and region.

Based on type, the global automotive USB power delivery system industry is divided into USB power delivery (PD) controllers and USB PD transceivers. The USB power delivery (PD) controllers segment registered a larger market share in 2024 and is projected to dominate in the future due to its vital role in fast charging capabilities and power management. USB PD controllers are essential components that manage power distribution and negotiation between the vehicle's connected devices and power source. They allow features like power delivery and fast charging over USB Type-C edges. The global USB PD controllers industry is witnessing substantial growth with estimations denoting a rise from $ 146 million to $ 566 million by 2030, signifying a CAGR of 25.2% over the forecast period.

Based on the application, the global automotive USB power delivery system industry is segmented into charging ports, infotainment systems, and in-car connectivity. The charging ports segment led the market in the past few years and is expected to continue its dominance. Charging ports that support USB PD standards and USB Type-C are paramount to newer vehicles. They offer high-speed charging capabilities for a broad range of electric devices. The elevating consumer demand for in-car connectivity has compelled automakers to emphasize the incorporation of enhanced charging ports in their cars.

Based on end-user, the global market is segmented as OEMs and aftermarket. The 'OEMs' segment held a substantial market share by incorporating USB PD systems into cars during production. The rising demand for advanced charging and in-car solutions fuels this incorporation. Manufacturers emphasize enhancing the overall driver experience by embedding vehicles with cutting-edge USB PD systems, increasing current vehicles' modern charging capabilities.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America holds a leading share of the global automotive USB power delivery system market due to its strong automotive manufacturing presence, technological improvements, and speedy adoption of EVs in the region. North America is home to prominent semiconductor companies investing highly in R&D to offer smart USB power delivery solutions for the automotive industry. This dispersion of market leaders nurtures a strong and competitive environment, accelerating product diversifications and advancements. The region also brags about its strong automotive market with prominent original equipment manufacturers like Tesla, Ford, General Motors, and the chain of tier 1 dealers. These companies are incorporating USB PD systems in their vehicles to satisfy the changing demand of consumers, such as charging and advanced in-car connectivity solutions.

Furthermore, the speedy adoption of EVs in North America has fueled the need for improved charging solutions. Till February, the region recorded 84,191 charging stations, especially in Canada and the United States. This broad charging infrastructure backs incorporating USB power delivery systems in vehicles, improving the overall EV driving experience.

Europe is anticipated to hold a second-leading position in the global automotive USB power delivery system market due to its strong manufacturing base, commitment to sustainability and electric mobility, and growth of charging infrastructure. Europe is home to well-known automakers like BMW, Volkswagen, Stellantis, Renault, and Mercedes-Benz. These companies are incorporating enhanced USB power delivery in their cars to satisfy the growing consumer demand for connectivity and high-speed charging features.

Furthermore, the region’s strict environmental rules and commitment to decreasing carbon footprints have boosted the use of hybrid and electric vehicles. The EU’s Fit for 55 and Green Deal packages aim to lessen gas emissions by 2030 by at least 55%, thus promoting the change to electric mobility. This move demands the incorporation of enhanced charging solutions like USB power delivery to back the rising number of EVs on the road.

Moreover, the development of widespread charging networks in Europe backs the adoption of EVs. For instance, efforts by IONITY, a joint venture of key automakers, recorded 684 charging stations with almost 4,359 charging points, supporting long-distance travel for EV owners.

Competitive Analysis

Competitive Analysis

The global automotive USB power delivery system market comprises leading players, including:

- Diodes Incorporated

- Monolithic Power Systems (MPS)

- Infineon Technologies

- Cypress Semiconductor

- Renesas Electronics

- NXP Semiconductors

- Texas Instruments

- STMicroelectronics

- ROHM Semiconductor

- Aptiv PLC

- Lear Corporation

- Bosch

- Continental

- Denso

- Yazaki

Key Market Trends

Key Market Trends

- Emergence of high-power USB PD systems:

With the rising energy demands of newer electric devices, automotive USB power delivery systems are developed to support high-power delivery potential. The recent USB power delivery standards allow power delivery to 240W, charging high-power devices like gaming consoles, laptops, and e-bikes. This improvement promises that vehicles' rising number of power devices can be safely and speedily charged.

- Strategic collaborations and partnerships:

Technology companies and automakers are increasingly associating to modernize and integrate USB power delivery in vehicles. These partnerships allow companies to share expertise and resources in growing ultra-modern charging solutions that can be smoothly incorporated into the vehicle's framework. As consumer demand for advanced connectivity and fast charging grows, these partnerships will play a vital role in fueling advancements.

The global automotive USB power delivery system market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- USB Power Delivery (PD) Controllers

- USB PD Transceivers

By Application Segment Analysis

By Application Segment Analysis

- Charging Ports

- Infotainment Systems

- In-Car Connectivity

By End-User Segment Analysis

By End-User Segment Analysis

- OEMs

- Aftermarket

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Diodes Incorporated

- Monolithic Power Systems (MPS)

- Infineon Technologies

- Cypress Semiconductor

- Renesas Electronics

- NXP Semiconductors

- Texas Instruments

- STMicroelectronics

- ROHM Semiconductor

- Aptiv PLC

- Lear Corporation

- Bosch

- Continental

- Denso

- Yazaki

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors