Search Market Research Report

Anti-Money Laundering Market Size, Share Global Analysis Report, 2022 – 2028

Anti-Money Laundering Market Size, Share, Growth Analysis Report By Type (Solution, Services), By Deployment Mode (On-premises, Cloud), By Organization Size (SMEs, Large enterprises), By End-User (Banks and Financials, Insurance Providers, Gaming & Gambling), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

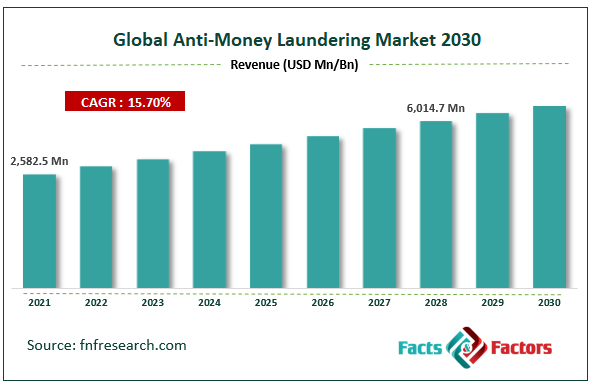

[211+ Pages Report] According to Facts and Factors, the Global Anti-Money Laundering Market size was valued at USD 2,582.5 million in 2021 and is predicted to increase at a CAGR of 15.7% to USD 6,014.7 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global anti-money laundering market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the anti-money laundering market.

Market Overview

Market Overview

Anti-Money Laundering (AML) solutions include a variety of policies, rules, and regulations that aid in the prevention of financial crimes. These guidelines, policies, and laws, among others, are established by global and local authorities present all over the world in order to increase the operation of AML solutions. The primary reasons driving the Anti-money Laundering market include more strict AML regulations and compliances, financial institutions' increased focus on digital payment-related challenges, and the requirement for a comprehensive view of data to combat financial crime. In addition, an increase in information technology (IT) spending is driving up demand for AML solutions.

Growth Drivers

Growth Drivers

The industry is likely to increase as rules and compliance requirements for businesses become strict. Various government entities around the world have established legislation and laws to combat terrorism funding and money laundering. AML rules vary by nation, making it critical for financial institutions to ensure that their operations are in accordance with policies particular to the country of operation. These policies are driving up demand for AML solutions in the industry. Furthermore, the growing use of sophisticated analytics in AML, as well as the incorporation of AI, ML, and big data technologies in the development of AML systems, will present attractive prospects for AML Solution vendors.

Various legislation in different nations requires financial institutions to detect and report customers who engage in fraudulent behavior. Even after the implementation of AML solutions, it is difficult to detect frauds due to the rising incidence of sophisticated attacks such as phishing, card fraud, skimming, identity fraud, money laundering, investment frauds, terrorism funding, and sanction violations. Money laundering has been a big problem for financial service firms due to rigorous rules focusing on financial services and the sophisticated hazards of financial crimes around the world. Obtaining qualified individuals with an in-depth understanding of AML who are also aligned with the evolving regulatory landscape of AML compliance is a barrier to the development of AML solutions.

COVID – 19 Impact

COVID – 19 Impact

COVID-19 has accelerated the advancement of digital technologies. Due to political restrictions around the world, everyone is now reliant on digital platforms to meet their everyday needs. The primary application is digital payments. The use of digital wallets, often known as eWallets, has grown. As a result of this transition, the likelihood of unlawful money transactions has grown. The FATF has issued a warning to banks regarding unlawful money transactions. As a result, the need for AML solutions has increased, and this factor has a significant impact on market growth. Due to the increased use of digital platforms, the amount of data on networks is increasing, putting a strain on the infrastructure security of banks and financial institutions. Despite several safeguards, banks are being attacked by hackers, resulting in massive losses. +

As a result, the need for improved AML solutions is increasing, influencing the market growth. Cybercrime, such as financial fraud, is on the rise as data on networks grows. Banks and financial institutions are increasingly using data analytics tools to improve their security procedures. This is projected to have a significant impact on market growth.

Segmentation Analysis

Segmentation Analysis

The Anti-Money Laundering Market is segregated based on Type, Deployment Mode, Organization Size, and End User.

In terms of Organization Size, the large enterprise category is expected to account for the largest share of the market in the forecast period. Fraudsters are increasingly targeting large organizations across several verticals because the chances of detection are low and the financial advantages are enormous, creating a great demand for AML solutions and services to combat fraudulent activity. AML assists major organizations in preventing and detecting financial crimes, as well as expediting the customer onboarding process.

In terms of Deployment Mode, the cloud segment is expected to increase the most during the projection period. The implementation of anti-money laundering solutions in the cloud assists enterprises in lowering the cost of developing the necessary IT infrastructure. Furthermore, other advantages of cloud-based deployments, such as flexibility and continuous enhancement in security features, are projected to promote cloud solution adoption in the near future. The adoption of security mechanisms such as multi-factor authentication to access stored data provides additional security against the possibility of data laundering.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2,582.5 Million |

Projected Market Size in 2028 |

USD 6,014.7 Million |

CAGR Growth Rate |

15.7% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ACI Worldwide (US), BAE Systems (UK), Nice Actimize (US), FICO (US), SAS Institute (US), Oracle Corporation (US), Experian (Ireland), LexisNexis Risk Solution (US), Fiserv (US),FIS (US), Dixtior (Portugal), TransUnion (US), Wolter’s Kluwer (The Netherlands), Temenos (Switzerland), Nelito Systems (India), TCS (India), Workfusion (US), Napier (UK), Quantaverse (US), Complyadvantage (UK), Acuant (US), FeatureSpace (UK), Feedzai (US), Finacus Solutions (India), CaseWare RCM (Canada), Comarch SA (Poland), and Others |

Key Segment |

By Type, Deployment Mode, Organization Size, End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

In the forecast period, the North American regional market dominated the anti-money laundering industry, accounting for the largest share of worldwide sales. The existence of key market participants in the region can be credited to the region's growth. The existence of a high number of banks is also predicted to drive the region's adoption of anti-money laundering technologies in the near future. Simultaneously, the expansion of inorganic tactics to use artificial intelligence among anti-money laundering providers is projected to fuel market growth.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global Anti-Money Laundering Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Anti-Money Laundering Market:

- ACI Worldwide (US)

- BAE Systems (UK)

- Nice Actimize (US)

- FICO (US)

- SAS Institute (US)

- Oracle Corporation (US)

- Experian (Ireland)

- LexisNexis Risk Solution (US)

- Fiserv (US)

- FIS (US)

- Dixtior (Portugal)

- TransUnion (US)

- Wolter’s Kluwer (The Netherlands)

- Temenos (Switzerland)

- Nelito Systems (India)

- TCS (India)

- Workfusion (US)

- Napier (UK)

- Quantaverse (US)

- Complyadvantage (UK)

- Acuant (US)

- FeatureSpace (UK)

- Feedzai (US)

- Finacus Solutions (India)

- CaseWare RCM (Canada)

- Comarch SA (Poland).

The global anti-money laundering market is segmented as follows:

By Type

By Type

- Solution

- Services

By Deployment Mode

By Deployment Mode

- On-premises

- Cloud

By Organization Size

By Organization Size

- SMEs

- Large enterprises

By End-User

By End-User

- Banks and Financials

- Insurance Providers

- Gaming & Gambling

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ACI Worldwide (US)

- BAE Systems (UK)

- Nice Actimize (US)

- FICO (US)

- SAS Institute (US)

- Oracle Corporation (US)

- Experian (Ireland)

- LexisNexis Risk Solution (US)

- Fiserv (US)

- FIS (US)

- Dixtior (Portugal)

- TransUnion (US)

- Wolter’s Kluwer (The Netherlands)

- Temenos (Switzerland)

- Nelito Systems (India)

- TCS (India)

- Workfusion (US)

- Napier (UK)

- Quantaverse (US)

- Complyadvantage (UK)

- Acuant (US)

- FeatureSpace (UK)

- Feedzai (US)

- Finacus Solutions (India)

- CaseWare RCM (Canada)

- Comarch SA (Poland)

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors