Search Market Research Report

Airport Management System Market Size, Share Global Analysis Report, 2025 – 2034

Airport Management System Market Size, Share, Growth Analysis Report By Component (Software, Services), By Airport Size (Class A, Class B, Class C, Class D), By Application (Security, Content Management, Logistics, Integration, Collaboration, Gate Management, Performance Management, Business Applications, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

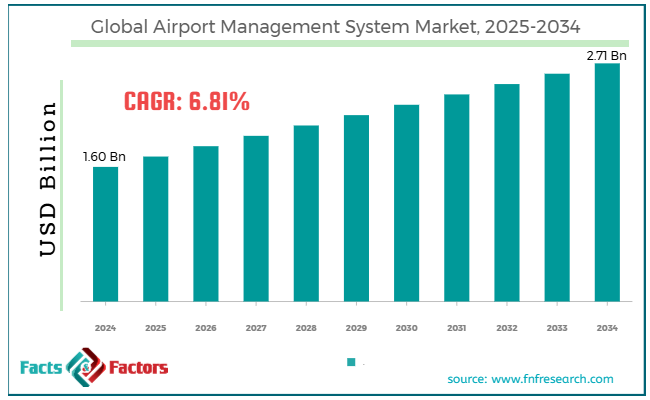

[221+ Pages Report] According to Facts & Factors, the global airport management system market size was worth around USD 1.60 billion in 2024 and is predicted to grow to around USD 2.71 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.81% between 2025 and 2034.

Market Overview

Market Overview

An AMS or Airport Management System is software that handles different aspects of airport operations. It ensures efficient management of resources, services, and processes. It encompasses a broader range of operations, from flight operations and passenger management to airport facilities and aircraft maintenance. AMS enhances overall efficiency and provides real-time decision-making data to optimize airport operations.

The leading drivers of the global airport management system market include growing air traffic, technological improvements, and the need for enhanced passenger experience. The consistent growth in air traffic worldwide, both cargo and passenger, increases the intricacy of airport operations. To manage this growing capacity, airports are adopting innovative AMS systems to manage resources like baggage handling, gates, and aircraft parking.

Moreover, progressing technologies like IoT, AI, machine learning, and blockchain have notably improved airport operations. These technologies allow real-time analytics, improved predictive maintenance, automated check-ins, and fast baggage handling, thus enhancing AMS adoption.

Also, the growing competition in the aviation sector emphasizes improving consumer experiences. Airport management systems enable faster security checks, smooth check-ins, efficient baggage handling, personalized services, and better passenger satisfaction.

Nevertheless, global market growth is witnessing hurdles due to the complexity of integration and the lack of an expert workforce. Integrating airport management systems with existing airport systems can be challenging. Concerns such as compatibility and the need for comprehensive customization can be a time-consuming and complex process, potentially disrupting existing operations and implementation.

Additionally, there is a shortage of skilled personnel to manage and operate advanced AMS systems. Airports must capitalize on training and development, contributing to the operational costs. Yet, the airport management system market will experience substantial growth due to opportunities like IoT integration, smart airports, and cloud-based solutions. The growth of smart airports is a vital opportunity for AMS suppliers. The incorporation of IoT devices enables real-time data collection, enhances overall efficacy, and monitors resources.

Also, the demand for cloud solutions is surging since they offer flexibility, scalability, and comparatively less upfront costs than on-premise systems. This benefits the airports through simplified software updates, real-time data access, and reduced hardware expenditure.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global airport management system market is estimated to grow annually at a CAGR of around 6.81% over the forecast period (2025-2034)

- In terms of revenue, the global airport management system market size was valued at around USD 1.60 billion in 2024 and is projected to reach USD 2.71 billion by 2034.

- The airport management system market is projected to grow significantly owing to mounting passenger traffic, growth of low-cost carriers, and the need for highly efficient airport operations.

- Based on component, the freestanding racks segment is expected to lead the market, while the double-sided racks segment is expected to register considerable growth.

- Based on airport size, the metal segment is the dominating segment among others, while the plastic segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the retail segment is expected to lead the market as compared to the food & beverages segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Operational cost reduction to drive the airport management system market growth

Airports are constantly under pressure to lower operational costs while enhancing or maintaining service quality. Airport management systems enhance resource management by preventing inadequacies, automating tasks, and lessening delays.

George Bush (IAH) Intercontinental Airport, based in Houston, recently adopted novel AMS solutions in 2023. It helps reduce delays and enhance traffic flow during heavy demands or holidays. The system enhanced lane management for traffic and parking, thus contributing to approximately 90% congestion reduction.

AMS solutions also simplify airport parking. For example, (LAX) Los Angeles International implements automated solutions to manage their parking occupancy better, offering updates in real-time to passengers and lowering costs associated with parking management.

- How will technological improvements considerably fuel the airport management system market growth?

Technological enhancements in IoT, AI, and ML are rapidly revolutionizing airport management. These technologies enhance operations, provide data-based insights, and improve security, which boosts decision-making. The global airport management system industry is witnessing notable growth due to automation, AI, and IoT.

In June 2023, a prominent leader in IT & communication services for airlines, SITA, introduced an AI-based intelligence and targeting system. This solution uses real-time customer data to access and predict threats, thus enhancing operational efficacy and airport security.

Furthermore, several airports like Dubai International are incorporating IoT sensors to monitor airfield operations, temperature-controlled cargo, and baggage management.

Restraints

Restraints

- Will significant initial investment costs adversely impact the progress of the airport management system market?

Installing an exhaustive airport management system needs significant upfront costs in hardware, software, and infrastructural upgrades. This financial pressure may be incredibly challenging for regions or airports with restricted budgets. This may restrict or delay the use of advanced AMS systems, thus restraining the adoption and growth of the airport management system market.

CNMC, the Spanish antitrust regulator, froze costs at Aena-powered airports for 2025, thus keeping the yearly maximum revenue at Euro 10.35 per passenger. Aena proposed a hike of €0.05 but was rejected by the CNMC, focusing on balancing service costs and fare stability with revenue. This highlights airports' financial burden and their effect on funding infrastructure enhancements.

Opportunities

Opportunities

- Growing investments in sustainable practices to impact the airport management system market growth

There is a rising focus on sustainability in the aviation industry, resulting in a surge in demand for airport management systems that comply with environmental management. Airports are looking for solutions that can efficiently monitor and decrease energy consumption, minimize emissions, and manage wastage.

Airports are heavily investing in sustainable practices and are projected to witness a 15-20% decrease in power consumption, thus complying with the worldwide environmental objectives.

In the light of elevated passenger volumes and spending power, prominent airports, such as Heathrow, are improving their dining and retail offerings. The strategy aims to strengthen commercial revenue, which is essential for funding expanded infrastructure projects that emphasize sustainability.

Challenges

Challenges

- Operational disturbances during the upgradation of the system restrict the growth of the airport management system market

Launching novel airport management systems may result in downtime or operational insufficiencies, thus impacting routine airport functions. Careful execution and planning are vital to reducing adverse effects during system upgrades. Operational disruptions during installations may make it difficult for airports to adopt novel solutions.

- Generation of predictive insights and management of large datasets to challenge the global industry growth

Advanced airports produce vast data on travelers' movements, air traffic control, maintenance schedules, baggage tracking, and security operations. Managing these different data necessities requires adequate storage, processing capabilities, and security. Several airports lack the infrastructure and specialization to manage big data analytics, thus considerably hampering their ability to develop predictive insights for operational optimization.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.60 Billion |

Projected Market Size in 2034 |

USD 2.71 Billion |

CAGR Growth Rate |

6.81% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Amadeus IT Group, SITA, Honeywell International Inc., Siemens AG, Collins Aerospace, IBM Corporation, Rapiscan Systems, Aena Desarrollo Internacional, JBT Corporation, Thales Group, Orbital Systems, Kiosk Information Systems, Rockwell Collins, AirIT, Mensa Group, and others. |

Key Segment |

By Component, By Material Type, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global airport management system market is segmented based on component, airport size, application, and region.

Based on component, the global airport management system industry is divided into software and services. The software segment registered a significant share of the market compared to the services segment. The growing demand supports the development of integrated solutions that streamline airport operations. These solutions comprise baggage handling, passenger processing, security management, and flight operations modules. Incorporating machine learning and artificial intelligence improves their predictive abilities, thus enhancing passenger satisfaction and operational effectiveness. The rising use of cloud-based systems further fuels the demand for modernized software in the AMS industry.

Based on airport size, the global airport management system industry is segmented into class A, class B, class C, and class D. The class A segment registered a notable market share backed by the heavy volume of passengers managed by airports. Class A airports can handle complex operations, security, and baggage management efficiently.

In addition, they emphasize enhancing passenger processing and satisfaction, which considerably fuels the demand for well-developed AMS systems to ensure compliance and improve efficacy. These airports also have the infrastructure and resources to benefit from and adopt superior AMS.

Based on application, the global market is segmented as security, content management, logistics, integration, collaboration, gate management, performance management, business applications, and others. The security segment held a substantial market share in 2024 and will lead in the future. The growing need for improved security processes at airports impacts this growth.

Also, investments are surging in advanced airport management system solutions, comprising surveillance technologies, automated threat detection, and biometric systems. Incorporating machine learning and artificial intelligence into security systems allows for quick response and real-time monitoring of impending security breaches. Also, the demand for compliance with strict international security rules is propelling the use of exhaustive security systems.

Regional Analysis

Regional Analysis

- What factors will help North America witness significant growth in the airport management system market?

North America held a leading position in the global airport management system market in 2024 and will continue its dominance over the estimated period. The reasons for the regional growth include innovations and technological improvements, smart airport investment and initiatives, and substantial financial investments. North American airports are the primary adopters of superior technologies like biometrics, AI, cloud-based solutions, and IoT. These improvements are incorporated into AMS to enhance passenger experience, operational excellence, and security. Regional airports are actively moving towards 'smart airports' by investing in biometrics, predictive analytics, and AI-based systems to enhance airport operations.

Regional airports also have better financial capacity to spend on the deployment of large-scale AMS, thus offering capital for infrastructure and software upgrades. This financial strength in North America promises the continuity of modern AMS technologies to enhance efficacy, improve service delivery, and reduce costs.

Asia Pacific is projected to progress as the second-leading region in the airport management system industry owing to speedy infrastructure development, rising air traffic, and technological advancements. Nations like India, China, and Southeast Asia spend money on modernizing and developing airport infrastructures to accommodate surging passenger volumes. The Asia Pacific region is witnessing growth in airport modernization projects, thus contributing to its considerable industry share.

Asia Pacific's growing economy and middle class have resulted in a notable increase in air travel. This growth demands improved AMS technologies to manage the increasing flight and passenger volumes effectively. Airports also use advanced solutions like automated check-ins, biometric systems, and real-time data analytics to improve operational excellence and customer experience. The incorporation of these technologies is one of the key reasons for regional growth.

Competitive Analysis

Competitive Analysis

The global airport management system market is led by players like:

- Amadeus IT Group

- SITA

- Honeywell International Inc.

- Siemens AG

- Collins Aerospace

- IBM Corporation

- Rapiscan Systems

- Aena Desarrollo Internacional

- JBT Corporation

- Thales Group

- Orbital Systems

- Kiosk Information Systems

- Rockwell Collins

- AirIT

- Mensa Group

What key trends can be expected in the Airport Management System Market?

What key trends can be expected in the Airport Management System Market?

- Cloud AMS solutions:

Several airports are adopting cloud solutions for better scalability, flexibility, and real-time data sharing among numerous stakeholders. This majorly improves data accessibility and decreases infrastructure costs.

- Real-time data analytics for operational excellence:

The use of predictive analytics and big data to monitor airport operations in real-time, like baggage handling, flight delays, and traffic flow, is increasing globally. This enhances operational excellence and decision-making.

The global airport management system market is segmented as follows:

By Component Segment Analysis

By Component Segment Analysis

- Software

- Services

By Material Type Segment Analysis

By Material Type Segment Analysis

- Class A

- Class B

- Class C

- Class D

By Application Segment Analysis

By Application Segment Analysis

- Security

- Content Management

- Logistics

- Integration

- Collaboration

- Gate Management

- Performance Management

- Business Applications

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Amadeus IT Group

- SITA

- Honeywell International Inc.

- Siemens AG

- Collins Aerospace

- IBM Corporation

- Rapiscan Systems

- Aena Desarrollo Internacional

- JBT Corporation

- Thales Group

- Orbital Systems

- Kiosk Information Systems

- Rockwell Collins

- AirIT

- Mensa Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors