Search Market Research Report

Agricultural Robots and Drones Market Size, Share Global Analysis Report, 2022 – 2028

Agricultural Robots and Drones Market Size, Share, Growth Analysis Report By Type (Milking Robots, UAVs/Drones, Automated Harvesting Systems, Driverless Tractors, Others), By Farm Produce (Fruits & Vegetables, Field Crops, Dairy & Livestock, Others), By Farming Environment (Indoor, Outdoor), By Application (Harvest Management, Field Farming, Dairy & Livestock Management, Soil & Irrigation Management, Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

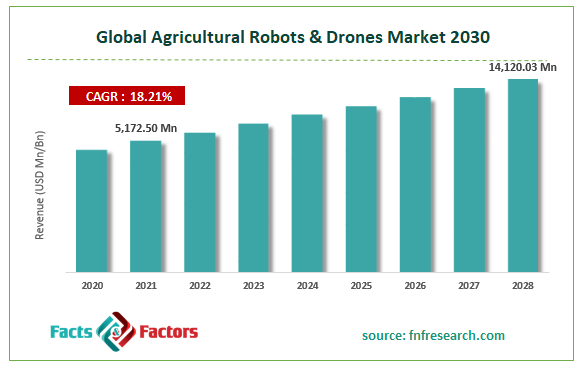

[221+ Pages Report] According to Facts and Factors, the global agricultural robots and drones market size was valued at USD 5,172.50 million in 2021 and is predicted to increase at a CAGR of 18.21% to USD 14,120.03 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global agricultural robots and drones market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the agricultural robots and drones market.

Market Overview

Market Overview

Farmers can focus on increasing overall production yield by using agricultural robots to automate slow, repetitive, and boring tasks. Unmanned aerial vehicles (UAVs) or drones, milking robots, automated harvesting systems, driverless tractors, and other robots are examples of agricultural robots. However, due to the rapid commercialization of driverless tractors, they are expected to outperform drones and milking robots within the next three to four years. Growing population and labor shortages, as well as maturing IoT and navigation technologies, are some of the factors accelerating the use of robots in agriculture.

Furthermore, untapped market potential and scope for agriculture automation, increased use of electrification technology in agricultural robots, and use of real-time multimodal robot systems in fields have created a number of opportunities for manufacturers. Besides that, untapped market potential and scope for agriculture automation, increased use of electrification technology in agricultural robots, and use of real-time multimodal robot systems in fields have created numerous opportunities for manufacturers of driverless tractors, milking systems, and drones.

Growth Drivers

Growth Drivers

Growing population and labor shortages encourage automation. The agriculture industry is under pressure from the world's growing population and the need for increased productivity from existing farmland. Changing demographics and urbanization, for example, are now having an impact on the agricultural industry. With an aging farmer population limiting the supply of manual labor, the labor shortage has become a global issue. The younger generation is less likely to pursue farming, and children from farming families frequently relocate to urban areas in search of better career opportunities.

Multimodal or heterogeneous platforms that combine ground and aerial vehicles enable targeted support, intelligence, and mission planning. Because tasks can be completed in parallel, collaborative and cooperative behavior among different robots becomes advantageous for large-scale agriculture and dairy operations, resulting in better economies of scale. Robots and autonomous systems of various types can now be brought together in a systemic approach.

COVID-19 Impact

COVID-19 Impact

Businesses around the world have suffered revenue losses and supply chain disruptions as a result of the COVID-19 outbreak. Worldwide, factory shutdowns and quarantine measures have been implemented, limiting movement and business activities. The economic impact is growing, and the world's top economies are expected to enter a global recession. The global COVID-19 pandemic has had an impact on the agricultural robotics market. It has been observed that the market in 2020 will be lower than in 2019. Market participants have observed a decrease in demand for certain types of robots across a variety of applications. This crisis has impacted most types of agricultural robots, and it is expected to have a short-term impact. Many players experienced negative or slow growth rates in 2021.

The complete research study looks at both the qualitative and quantitative aspects of the global agricultural robots and drones market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Agricultural Robots and Drones market is segregated based on Type, Farm produce, Farming environment and Application.

By Type, the UAVs are expected to be the leading segment. The cost of agricultural drones has steadily decreased over the years, making them an appealing investment for many modern farmers. The emergence of low-cost multispectral cameras has also aided in keeping costs as low as possible. With authorities such as the Federal Aviation Administration (FAA) laying the groundwork for regulations on the use and operation of drones, the adoption of UAVs for agricultural applications has skyrocketed. As a result, UAVs have the largest market share.

By Application, the field farming application is likely to hold a major share of the agricultural robots market over the projection period due to the high penetration rate of UAVs and the high average selling price of driverless tractors. Drones and self-driving tractors are helping to automate field farming. The market for driverless tractors is predicted to eclipse the market for milking robots as the use of driverless tractors for automating field farming applications continues to expand. The market for milking robots is maturing, as they have already been marketed. As a result, it will grow at the slowest rate, causing dairy and livestock management applications to grow at a slower rate than other farming applications.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,172.50 Million |

Projected Market Size in 2028 |

USD 14,120.03 Million |

CAGR Growth Rate |

18.21% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Deere & Company (US), DJI (China), CNH Industrial NV (UK), AGCO Corporation (US), DeLaval (Sweden), Trimble Inc. (US), BouMatic Robotics (The Netherlands), Lely (The Netherlands), AgJunction (US), AgEagle Aerial Systems (US), YANMAR Co. (Japan), Deepfield Robotics (Germany), ecoRobotix (Switzerland), Harvest Automation (US), Naïo Technologies (France), ROBOTICS PLUS (New Zealand), KUBOTA Corporation (Japan), HARVEST CROO (US), Autonomous Tractor Corporation (US), Clearpath Robotics (Canada), DroneDeploy (US), Agrobot (Spain), FFRobotics (Israel), Fullwood Packo (UK), Monarch Tractor (US), and Others |

Key Segment |

By Type, Farm Produce, Farming Environment, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

North America had the highest proportion of the market for agricultural robots. Due to growing labor scarcity and high labor expenses in the region, robotics and automation are being used to improve production and maintain quality requirements. North America's aviation authorities have established guidelines for the use of drones in commercial applications in the United States, Canada, and Mexico. North America is also a potential market for driverless tractors because it is one of the main markets for auto-steering tractors. The players in this region are extensively spending in R&D operations in order to build low-cost, high-productivity robots.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global Agricultural Robots and Drones Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global Agricultural Robots and Drones Market:

List of Key Players in the Global Agricultural Robots and Drones Market:

- Deere & Company (US)

- DJI (China)

- CNH Industrial NV (UK)

- AGCO Corporation (US)

- DeLaval (Sweden)

- Trimble Inc. (US)

- BouMatic Robotics (The Netherlands)

- Lely (The Netherlands)

- AgJunction (US)

- AgEagle Aerial Systems (US)

- YANMAR Co. (Japan)

- Deepfield Robotics (Germany)

- ecoRobotix (Switzerland)

- Harvest Automation (US)

- Naïo Technologies (France)

- ROBOTICS PLUS (New Zealand)

- KUBOTA Corporation (Japan)

- HARVEST CROO (US)

- Autonomous Tractor Corporation (US)

- Clearpath Robotics (Canada)

- DroneDeploy (US)

- Agrobot (Spain)

- FFRobotics (Israel)

- Fullwood Packo (UK)

- Monarch Tractor (US)

The global agricultural robots and drones market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Milking Robots

- UAVs/Drones

- Automated Harvesting Systems

- Driverless Tractors

- Others

By Farm Produce Segment Analysis

By Farm Produce Segment Analysis

- Fruits & Vegetables

- Field Crops

- Dairy & Livestock

- Others

By Farming Environment Segment Analysis

By Farming Environment Segment Analysis

- Indoor

- Outdoor

By Application Segment Analysis

By Application Segment Analysis

- Harvest Management

- Field Farming

- Dairy & Livestock Management

- Soil & Irrigation Management

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Deere & Company (US)

- DJI (China)

- CNH Industrial NV (UK)

- AGCO Corporation (US)

- DeLaval (Sweden)

- Trimble Inc. (US)

- BouMatic Robotics (The Netherlands)

- Lely (The Netherlands)

- AgJunction (US)

- AgEagle Aerial Systems (US)

- YANMAR Co. (Japan)

- Deepfield Robotics (Germany)

- ecoRobotix (Switzerland)

- Harvest Automation (US)

- Naïo Technologies (France)

- ROBOTICS PLUS (New Zealand)

- KUBOTA Corporation (Japan)

- HARVEST CROO (US)

- Autonomous Tractor Corporation (US)

- Clearpath Robotics (Canada)

- DroneDeploy (US)

- Agrobot (Spain)

- FFRobotics (Israel)

- Fullwood Packo (UK)

- Monarch Tractor (US)

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors