Search Market Research Report

Isocyanate Market Size, Share Global Analysis Report, 2022 – 2028

Isocyanate Market Size, Share, Growth Analysis Report By Type (Aromatic Diisocyanate, Aliphatic), By Application (Rigid Foam, Flexible Foam, Adhesives & Sealants, Paints And Coatings, Elastomers, Binders, Others), By End-Users (Building & Construction, Automotive, Furniture, Footwear, Electronics, Packaging, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

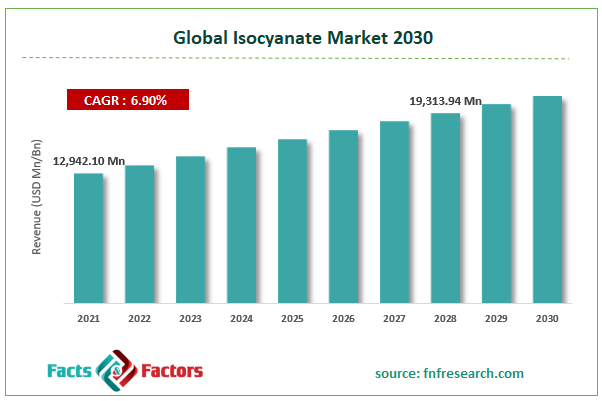

[227+ Pages Report] According to Facts and Factors, the global isocyanate market size was worth USD 12,942.10 million in 2021 and is estimated to grow to USD 19,313.94 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.90% over the forecast period. The report analyzes the isocyanate market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the isocyanate market.

Market Overview

Market Overview

The isocyanate group of phosgene and amines reacts with water to form an organic compound. A reaction between phosgene and amines produces it. There is high demand for isocyanate in the current and emerging markets and technological innovation, contributing to the market's rapid growth. In particular, the construction and automotive industries, a major users of isocyanate, are expected to expand in the coming years, increasing demand for a wide range of isocyanate products. Consequently, rigid foams, coatings, adhesives, and sealants using isocyanates will be in higher demand. Several factors prevent this market's growth, including high raw material costs and huge investments in research and development. Isocyanate is a major raw material that is derived from crude oil. Therefore, crude oil price volatility has played a role in the price of raw materials. In response to the rising feedstock costs, major producers are raising their isocyanate prices.

COVID-19 Impact:

COVID-19 Impact:

Globally, the COVID-19 pandemic began spreading at the beginning of 2020. Affected millions of people around the world. Major economies worldwide have imposed permanent bans and ordered operations to cease. There have been hard times for most life support industries and the isocyanate industry. During the locking down in many parts of the world, there was a shortage of manpower in the manufacturing unit. During the pandemic, the construction industry declined, causing the demand for isocyanate to go down, resulting in a decrease in market growth for isocyanate.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global isocyanate market value is expected to grow at a CAGR of 6.90% over the forecast period.

- In terms of revenue, the global isocyanate market size was valued at around USD 12,942.10 million in 2021 and is projected to reach USD 19,313.94 million by 2028.

- Increasing demand for a wide range of isocyanate products in the automotive and construction industry, emerging markets, and technological innovation are the major factors driving the market's growth.

- By type, the aromatic diisocyanate category dominated the market in 2021.

- By application, the rigid foam category dominated the market in 2021.

- The Asia Pacific dominated the global isocyanate market in 2021.

Growth Drivers

Growth Drivers

- An increased demand from the end-use industries to drive market growth

There are a number of industries that use the superior and unique properties of isocyanates. Based on the changes in their base materials, their applications are constantly evolving. In addition to offering different properties, different types of isocyanates have a wide range of applications. Many end-user industries use isocyanate in rigid foams, flexible foams, paints & coatings, adhesives & sealants, and elastomers & binders. This market will continue to grow as long as isocyanates are used in rigid foam.

Restraints

Restraints

- High raw material prices and stringent government regulation hinder the market growth

A major constraint on the global market for isocyanates is the volatile raw material prices and accessibility, as well as the extremely toxic nature of isocyanate compounds. Further, it has been documented that the use of isocyanates in industries poses several occupational health hazards, including skin irritation, breathing difficulties, and asthma due to prolonged exposure. Thus, the environmental health risks associated with isocyanates limit the market's growth.

Segmentation Analysis

Segmentation Analysis

The global isocyanate market has been segmented into type, application, and end-use.

Based on type, aromatic diisocyanate and aliphatic are segments of the global isocyanate market. In 2021, the aromatic diisocyanate category dominated the global market.

Based on application, the market is classified into rigid foam, flexible foam, adhesives & sealants, paint and coatings, elastomers, binders, and others. In 2021, the rigid foam category dominated the global market.

Based on end-users, the worldwide isocyanate market is segmented into building & construction, automotive, furniture, footwear, electronics, packaging, and others. Building & construction are anticipated to have the highest share in this market, where it is used in various household, commercial, and industrial applications. The most common application of isocyanates is in rigid polyurethane foam (PU foam) as insulation for walls, roofs, panels, and gaps around doors and windows.

Recent Developments

Recent Developments

- April 2021: Lanxess is expanding its trixene aqua blocked water-based isocyanate dispersions range. A new brand has been added to the product line to meet the needs of demanding customers and expand applications.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 12,942.10 Million |

Projected Market Size in 2028 |

USD 19,313.94 Million |

CAGR Growth Rate |

6.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Asahi Kasei Corporation, Metsui Chemicals America Inc., Evonik Industries AG, LANXESS, DowDuPont Inc., Tosoh Corporation, Covestro AG, BASF SE, Wanhua Chemical Group Co. Ltd, Huntsman International LLC, Vencorex, Cangzhua Dahua Group Co. Ltd, Komho Mitsui Chemicals Corp, China National Bluestar (Group) Co.Ltd., and Others |

Key Segment |

By Type, Application, End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the isocyanate market in 2021

China dominates the region as one of the largest producers and consumers of polyurethane globally. The majority of methylene diphenyl diisocyanate (MDI) is utilized in China for the production of rigid and flexible foam as well as other polyurethane products. Polyurethane is one of MDI's main uses in India because of the growth of the middle class, increased disposable incomes, rising urbanization, and significant infrastructure projects. Production of polyurethane has increased in Japan. The demand from the building and automotive industries and rising polyurethane production are projected to be the main drivers of the isocyanates market. Therefore, it is expected that Asia-Pacific will control the market over the forecasting period.

Competitive Landscape

Competitive Landscape

- Asahi Kasei Corporation

- Metsui Chemicals America Inc.

- Evonik Industries AG

- LANXESS

- DowDuPont Inc.

- Tosoh Corporation

- Covestro AG

- BASF SE

- Wanhua Chemical Group Co. Ltd

- Huntsman International LLC

- Vencorex

- Cangzhua Dahua Group Co. Ltd

- Komho Mitsui Chemicals Corp

- China National Bluestar (Group) Co.Ltd.

Global Isocyanate Market is segmented as follows:

By Type

By Type

- Aromatic Diisocyanate

- Aliphatic

By Application

By Application

- Rigid Foam

- Flexible Foam

- Adhesives & Sealants

- Paints And Coatings

- Elastomers

- Binders

- Others

By End Use

By End Use

- Building & Construction

- Automotive

- Furniture

- Footwear

- Electronics

- Packaging

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Asahi Kasei Corporation

- Metsui Chemicals America Inc.

- Evonik Industries AG

- LANXESS

- DowDuPont Inc.

- Tosoh Corporation

- Covestro AG

- BASF SE

- Wanhua Chemical Group Co. Ltd

- Huntsman International LLC

- Vencorex

- Cangzhua Dahua Group Co. Ltd

- Komho Mitsui Chemicals Corp

- China National Bluestar (Group) Co.Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors