Search Market Research Report

Health Insurance Market Size, Share Global Analysis Report, 2022 – 2028

Health Insurance Market Size, Share, Growth Analysis Report By Insurance Type (Disease Insurance, Medical Insurance), By Coverage (Preferred Provider Organizations (PPOs), Point Of Service (POS), Health Maintenance Organizations (HMOS), Exclusive Provider Organizations (EPOS)), By End User Type (Group, Individuals), By Age Group (Senior Citizens, Adult, Minors), By Service Provider (Public and Private), By Distribution Channel (Direct Sales, Brokers/Agents, Banks, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

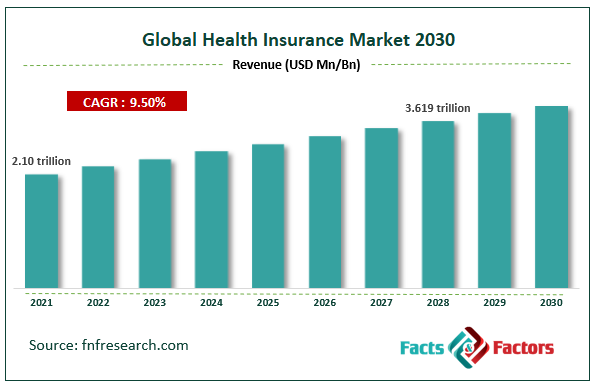

[219+ Pages Report] According to Facts and Factors, the global health insurance market size was worth USD 2.10 trillion in 2021 and is estimated to grow to USD 3.619 trillion by 2028, with a compound annual growth rate (CAGR) of approximately 9.50% over the forecast period. The report analyzes the health insurance market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the health insurance market.

Market Overview

Market Overview

A type of insurance called health insurance covers the price of treating illnesses-related medical expenses. These costs include the cost of prescription medications, hospital expenses, and fees for medical consultations. Health Insurance Program A hospitalization or medical plan is the most fundamental type of health insurance. When individuals with health insurance are admitted to the hospital, the insurance provider covers their medical expenses. Original hospital bills must be provided in order to be paid for the real hospital expenses. Most of these plans protect every member of the family up to a certain amount. Critical illness insurance plans Critical illness insurance schemes cover certain life-threatening illnesses.

Long-term therapy or a change in lifestyle may be necessary for some disorders. Instead of real hospital costs, like with hospitalization plans, payment is based on the consumer's selection of critical illness insurance. You are permitted under the policy to use the money to alter your medicine or way of living. Additionally, it provides financial support when you cannot work because of illness. More precisely, medical, surgical, dental, and prescription medication costs are frequently covered by health insurance for the insured. Health insurance can reimburse the insured for expenditures incurred due to illness or an accident or pay the care provider directly. Because it offers benefits including covering the insured's medical expenses for disease and paying out a lump sum in the event of a long-term illness, the health insurance market is expanding more quickly in rural regions. Additionally, which helps the market expand, consumers in rural regions are becoming more knowledgeable about complete health insurance coverages, such as hospitalization expenses, pre-hospitalization and post-hospitalization fees, ambulance costs, and domiciliary hospitalization costs. Additionally, doctors and educators in rural regions have increased public knowledge of health insurance policies, advancing the health insurance market.

COVID-19 Impact:

COVID-19 Impact:

A surge in the incidence of several illnesses during the COVID-19 pandemic, including cancer, dengue fever, and diabetes, is regarded to be a key factor fueling the growth of the global health insurance market. Additionally, two key market growth reasons include enhancing claim management services and raising awareness of health insurance in rural regions. The Health Insurance Market's potential is nevertheless constrained by two issues: a lack of knowledge about the coverages offered by health insurance policies and an increase in the price of insurance premiums.

Additionally, it is anticipated that the cost of medical treatment would increase due to the rising use of cutting-edge technologies by healthcare experts in treating chronic disorders like cancer and cardiovascular disease.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global health insurance market value is to grow at a CAGR of 9.50 % over the forecast period.

- In terms of revenue, the global health insurance market size was valued at around USD 2.10 trillion in 2021 and is projected to reach USD 3.61 trillion, by 2028.

- The need for health insurance is rising due to rising medical costs and a rise in the number of childcare treatments. This tremendous expansion can also be attributed to the opening up of the economy and the public's increased knowledge of healthcare-related concerns.

- By insurance type, the medical insurance category dominated the market in 2021.

- By distribution channel, the direct sales category dominated the market in 2021.

- North America dominated the global health insurance market in 2021.

Growth Drivers

Growth Drivers

- Increased knowledge of health insurance in remote regions to drive market growth

As a result of its many advantages, including paying a lump payment in extended cases and covering the insured person's disease treatment costs, the health insurance market is growing more quickly in rural regions. Additionally, the market is growing because consumers in rural regions are more aware of complete health insurance coverages such as in-patient hospitalization expenses, pre-hospitalization & post-hospitalization expenses, ambulance expenditures, and domiciliary hospitalization charges. Additionally, physicians and educators in rural regions have raised health insurance knowledge, promoting the market's expansion.

Restraints

Restraints

- Increasing cost of health insurance premiums to restrain market growth

Due to the growth in healthcare costs, including the price of medications, hospital admission fees, and the cost of numerous medical treatments, insurance providers have raised the cost of insurance premiums. Additionally, most customers worldwide have one or more chronic conditions, including diabetes, Alzheimer's, or heart disease. For the treatments of many chronic disorders, healthcare experts have imposed high costs. Therefore, it is the responsibility of insurance firms to solve the high cost of claim settlement, which restrains market expansion.

Opportunity

Opportunity

- Cost-effective insurance plans and government bodies like banks and cooperative banks

Furthermore, by offering cost-effective insurance plans and facilitating the claim-resolution process, government bodies like banks and cooperative banks play a significant role in expanding the use of health insurance products in rural regions. The worldwide industry advances due to greater knowledge of health insurance in rural regions. Health insurance companies have raised premium prices due to growing healthcare expenditures, including the price of medications, hospital admission fees, and several other treatments. Additionally, most clients globally have chronic illnesses, including diabetes, Alzheimer's, and heart disease. Medical professionals have set exorbitant charges for treating chronic illnesses.

Segmentation Analysis

Segmentation Analysis

The global health insurance market is segregated based on insurance type, coverage, end-user type, age group, distribution channel, and region.

Based on type, the market is divided into medical insurance, critical illness insurance, and others. The medical insurance sector is expected to have substantial expansion, supported by a rising obese population. Due to expanding sedentary lifestyle adoption, an escalating obese population with many health conditions, and an increase in unintentional situations, the medical insurance category is anticipated to have the greatest market share over the projection period. The second-largest share belongs to the category of critical sickness insurance. The rising prevalence of chronic diseases will support segmental expansion as cancer, heart illness, disease, diabetes, and others.

Based on coverage, the market is classified into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOS). Preferred Provider Organizations (PPO) are the most revenue-producing segment in the health insurance market. Patients benefit from PPOs' well-managed healthcare plans and more plan flexibility. Patients are given a list of pre-approved physicians, medical facilities, and caretakers to pick from. The segment will grow as a result of increasing the segment's acceptance rate. Additionally, the PPO plan involves less paperwork, which might boost health insurance's market worth.

Based on end-user type, the market is segmented into groups and individuals. The individual sector drove the market for healthcare insurance. Due to the fact that personalized health plans may be customized, many individuals purchase them. Additionally, it does not depend on your work status and allows you greater control over your deductibles, copays, and benefit caps.

The age group market is segmented into senior citizens, adults, and minors. With a revenue share, the adult group controlled the healthcare insurance industry. Throughout the prediction, the category is likewise expected to hold onto its position. The adult population has a significant incidence of lifestyle diseases that raise the risk of future health problems. The populace is more susceptible to hospital-requiring illnesses including cardiac and other ailments.

The market is classified into private and public providers based on the service provider. The market for healthcare insurance was dominated by the public sector, which also contributed the biggest revenue share. The primary insurer and direct supplier of healthcare services is either the state or the federal government. Since the creation of Medicare and Medicaid in 1965, the federal government has assumed a significant role in the healthcare industry. Public healthcare insurance is more economical than private healthcare insurance since it often has fewer administrative expenses and normally does not need co-pays or deductibles.

Based on the distribution channel, the market is classified into direct sales, brokers/agents, banks, and others. Due to the availability of several third-party suppliers and their widespread acceptability in the home market, the direct sales sector is predicted to dominate the global health insurance industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2.10 Trillion |

Projected Market Size in 2028 |

USD 3.619 Trillion |

CAGR Growth Rate |

9.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Aetna Inc., Aia Group Limited, Allianz, Assicurazioni Generali S.P.A., Aviva, Axa, Cigna, Ping An Insurance (Group) Company Of China Ltd., Unitedhealth Group, Zurich, and Others |

Key Segment |

By Insurance Type, Coverage, End-user Type, Age Group, Service Provider, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- June 2021: By collaborating with Vitality, Samsung UK has added Samsung Health to the Vitality Program, providing members with new ways to monitor their activity and enhance their general health. As a consequence of the new partnership with Samsung, participants in the Vitality Programme will be able to connect their Samsung Health profiles to their Vitality Member Zone accounts and automatically collect daily heart rate activity and steps to earn Vitality activity points.

- August 2020: To assist businesses in planning and researching secure overseas travel, Foreign Medical Group, Inc. (IMG) has increased its range of products. The new support programs offered by the business were developed to help customers make plans for 2020 and beyond.

Regional Landscape

Regional Landscape

- North America dominated the health insurance market in 2021

In 2021, North America commands the largest market share in the global health insurance market. The need for health insurance is rising due to rising medical costs and a rise in the number of childcare treatments. The formation of the health insurance industry during the pandemic was encouraged by both the growing cost of medical treatments and the fear of a pandemic. Additionally, health insurance providers provided plans and payment choices for the medical expenses associated with treating policyholders who were infected with the COVID19 virus. Consequently, the health insurance industry has grown quickly, even if the COVID19 pandemic severely impacted other businesses.

Over the predicted period, the area is expected to hold the top spot. This is caused by the existence of several insurance firms that provide health and life insurance products. Additionally, having coverage is required under the American Affordable Care Act. The federal government was supposed to impose sanctions on the states that disobeyed.

Competitive Landscape

Competitive Landscape

Key players within the global Health Insurance market include

- Aetna Inc.

- Aia Group Limited

- Allianz

- Assicurazioni Generali S.P.A.

- Aviva

- Axa

- Cigna

- Ping An Insurance (Group) Company Of China Ltd.

- Unitedhealth Group

- Zurich.

Global Health Insurance Market is segmented as follows:

By Insurance Type

By Insurance Type

- Disease Insurance

- Medical Insurance

By Coverage

By Coverage

- Preferred Provider Organizations (PPOs)

- Point Of Service (POS)

- Health Maintenance Organizations (HMOS)

- Exclusive Provider Organizations (EPOS)

By End-user Type

By End-user Type

- Group

- Individuals

By Age Group

By Age Group

- Senior Citizens

- Adult

- Minors

By Service Provider

By Service Provider

- Public

- Private

By Distribution Channel

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Banks

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aetna Inc.

- Aia Group Limited

- Allianz

- Assicurazioni Generali S.P.A.

- Aviva

- Axa

- Cigna

- Ping An Insurance (Group) Company Of China Ltd.

- Unitedhealth Group

- Zurich.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors