Search Market Research Report

Healthcare Information Exchange (HIE) Solutions Market Size, Share Global Analysis Report, 2022 – 2028

Healthcare Information Exchange (HIE) Solutions Market Size, Share, Growth Analysis Report By Type (Directed Exchange, Consumer-Mediated Exchange, and Query-Based Exchange), By Implementation Model (Centralized, Decentralized, and Hybrid), and By Solution Type (Platform-Centric, Portal-Centric, and Messaging-Centric), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

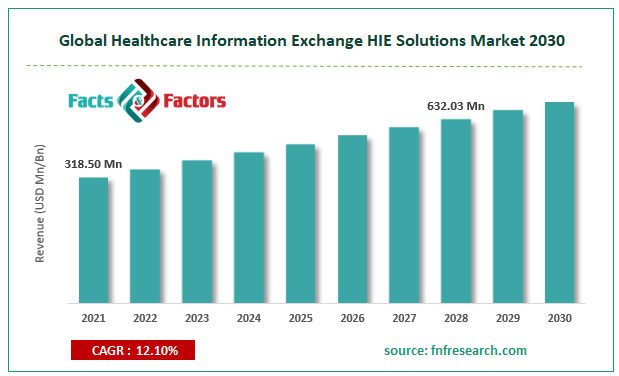

[218+ Pages Report] According to Facts and Factors, the global Healthcare Information Exchange (HIE) Solutions market size was worth USD 318.50 million in 2021 and is estimated to grow to USD 632.03 million by 2028, with a compound annual growth rate (CAGR) of approximately 12.10% over the forecast period. The report analyzes the Healthcare Information Exchange (HIE) Solutions market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the Healthcare Information Exchange (HIE) Solutions market.

Market Overview

Market Overview

The electronic transformation of healthcare-related data between medical institutions, health information organizations, and businesses that demand and regulate the exchange of this data is known as health information exchange. The timeliness, quality, safety, and cost of patient care can all be improved by the appropriate access and secure sharing of a patient's critical medical information electronically between healthcare providers such as doctors, nurses, pharmacists, and patients. The act of transferring information between two or more healthcare organizations or providers and the body in charge of facilitating the communication is referred to as "health information exchange.

The need to reduce healthcare costs, the emphasis on patient-centered care delivery, the growing adoption of EHRs and other HCIT solutions, government initiatives to improve patient care and safety, and government funding for healthcare interoperability are some factors driving this market's growth. However, data privacy issues, the necessity for major infrastructure development investments, the high cost of deployment, and the absence of truly interoperable solutions are anticipated to impede market expansion.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has sparked technical changes that will improve healthcare. Because of the situation, most healthcare organizations now prioritize adhering to data interoperability standards. The requirement for the social distance between doctors and patients has also grown, which has fueled the demand for telehealth and remote patient monitoring solutions, as well as the necessity for the accurate and timely transmission of patient health records. Health information exchange, which offers a framework for increased security in the exchange, sharing, and retrieval of electronic health information, is useful in this regard. With the help of these technologies, healthcare providers and patients can easily communicate and evaluate health-related data for use in clinical decision-making and other contexts.

In addition, the need for EMR and EHR platforms to manage sophisticated patient data has grown due to the rising patient volume. By integrating multiple hospital systems with EHRs, hospitals are placing more and more emphasis on enhancing their capabilities. Players in this industry have also enhanced their software solutions and connected their EHR platforms with telehealth options to further assist healthcare providers in managing COVID-19 sufferers.

Key Insights

Key Insights

- Healthcare Information Exchange (HIE) Solutions market share value at a CAGR of 12.10% over the forecast period.

- The need to reduce healthcare costs, the emphasis on patient-centered care delivery, the growing adoption of EHRs and other HCIT solutions, safety, and government funding for healthcare interoperability are some of the factors driving the growth of the Healthcare Information Exchange (HIE) Solutions market.

- By Type, The Directed exchange has the most substantial market share

- By Implementation Model, the hybrid model segment has the highest market share

- By Solution Type, the portal-centric category has the highest market share

Growth Drivers

Growth Drivers

- Support from the government for the use of EMR solutions

EHRs are essential to healthcare I.T. because they facilitate communication and information exchange among hospital stakeholders. Adoption of EMR technologies also improves disease burden reduction, access to high-quality healthcare, and affordability, all leading to better health outcomes. Due to the benefits of implementing EMR technology, governments in several countries are starting programmes to promote its use. Therefore, it is projected that these benefits and growing government activities in several countries to promote the adoption of EMR solutions will aid in expanding the market for health information exchange.

Restraints

Restraints

- Infrastructure development requires large investments, and deployment is expensive

To properly integrate EHR technologies, hospitals must make major investments in infrastructure development, such as expanding their data storage and processing capacity. Making investments to construct such infrastructure is challenging because healthcare providers already have finite financial resources. Moreover, investments in infrastructure are not the only expenditures involved; EMR system purchases, maintenance, training, and the transfer of paper data to electronic records all have associated costs. Revenue losses are one example of the indirect costs incurred due to the transient loss of patient data. These are the main barriers to EMR solution adoption, especially in small and medium-sized hospitals, which could restrain the market's expansion for health information exchange.

Opportunities

Opportunities

- Expansion of healthcare services in developing countries

It is anticipated that the healthcare sector in developing nations like India, China, Brazil, and Mexico will present major growth potential for businesses that provide solutions for health information exchange. This is explained by the expansion of healthcare data and the increasing use of health I.T. solutions in these nations. Healthcare interoperability solution providers unable to match the standards of the U.S.and developed European nations like Germany and France are projected to benefit greatly from the absence of suitable standards and government restrictions in emerging markets. Due to a lack of awareness, the limited availability of interoperable solutions, a lack of I.T. infrastructure, and societal and budgetary restraints, interoperability solutions in the healthcare business are still in their infancy in most of these rising nations. It is also anticipated that the expanding populations in these nations' healthcare systems would result in an increase in the volume of healthcare data. For market participants, this creates a substantial chance for growth.

Challenges

Challenges

- Data Privacy is a major concern

Healthcare facilities can make good use of health information exchange technologies. However, the adoption of these solutions is somewhat constrained due to worries about data security and privacy. In many nations, patient health data is protected by federal regulations, and any violations or failures to maintain its integrity may be subject to monetary and legal consequences. Patient data must be strictly protected because it contains sensitive information that could be misused. These solutions must follow all the data security rules by governments and regulatory authorities because the interoperable patient care solutions call for access to several health data sets. This is challenging because most interoperability platforms are consolidated and demand a lot of computing power. As a result, patient data or portions of it may need to be stored in a vendor's data center.

Segmentation Analysis

Segmentation Analysis

The Healthcare Information Exchange (HIE) Solutions market is segregated based on type, Implementation model, and solution type

Based on Implementation Model, the market is divided into centralized, Decentralized, and Hybrid. The implementation model segment's hybrid model segment had the most market share and is predicted to expand at the highest CAGR throughout the projected period. The hybrid model combines centralized and decentralized models and has advantages like a huge data storage capacity and cheaper cost, which makes it easier for the utilization rate to expand. Additionally, the hybrid model's incorporation provides increased operational efficiency and patient care delivery, which is anticipated to drive the segment's demand throughout the projection year.

Based on Solution Type, the market is classified into platform-Centric, Portal-Centric, and Messaging-Centric. A significant proportion can be ascribed to the increase in online portal improvements that make getting medical information easier and more convenient. Therefore, platform-centric is anticipated to see profitable growth during the anticipated timeframe. The major elements anticipated to give this market segment a growth platform include government efforts like the Health Information Technology for Economic and Clinical Health Act (HITECH), which strongly emphasizes patient interaction.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 318.50 Million |

Projected Market Size in 2028 |

USD 632.03 Million |

CAGR Growth Rate |

12.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Epic Systems Corporation (U.S.), Cerner Corporation (U.S.), Health Catalyst (U.S.), Intersystems Corporation (U.S.), MEDITECH (U.S.), and Others |

Key Segment |

By Type, Implementation Model, Solution Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In order to provide advanced bidirectional interoperability, E Clinical Works announced a collaboration with Humana Inc., a top health and wellness company, Guide Well, the parent company of a family of innovative businesses focused on transforming healthcare, and Trusted Health Plan, a provider of Medicaid and Alliance Benefits in the year 2019.

- Practice Fusion, a provider of electronic medical records based in San Francisco, was purchased by Allscripts in 2018. The goal of the acquisition was to increase Allscripts' business with independent doctors.

Regional Landscape

Regional Landscape

North America had the highest global market revenue share for health information exchange. Its strong position in the local market is a result of widespread knowledge of HIE systems, The existence of non-profit organizations, and well-known local businesses like Medicity, Inc. and IBM Corporation. Other reasons anticipated to influence the growth of the healthcare information exchange sector include the U.S. government's expanding incentive programs and the high cost of the current health information exchange system.

Due to the growing patient population, which calls for better information systems for effective data management, as well as the rising healthcare costs in emerging economies, such as China and India, the Asia Pacific region is predicted to experience profitable growth opportunities in the future. However, indirect charges are also incurred, including income losses brought on by the temporary loss of patient data. These are the main barriers to EMR implementation, especially in small and medium-sized hospitals, which may be able to restrain the expansion of the market for health information exchange in the Asia-pacific Region.

Competitive Landscape

Competitive Landscape

Key players within the global Healthcare Information Exchange (HIE) Solutions market include

- Epic Systems Corporation (U.S.)

- Cerner Corporation (U.S.)

- Health Catalyst (U.S.)

- Intersystems Corporation (U.S.)

- MEDITECH (U.S.)

The Healthcare Information Exchange (HIE) Solutions market is segmented as follows:

By Type

By Type

- Directed Exchange

- Consumer-Mediated Exchange

- Query-Based Exchange

By Implementation Model

By Implementation Model

- Centralized

- Decentralized

- Hybrid

By Solution Type

By Solution Type

- Platform-Centric

- Portal-Centric

- Messaging-Centric

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Epic Systems Corporation (U.S.)

- Cerner Corporation (U.S.)

- Health Catalyst (U.S.)

- Intersystems Corporation (U.S.)

- MEDITECH (U.S.)

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors