Search Market Research Report

CBD-Infused Beverages Market Size, Share Global Analysis Report, 2021 – 2026

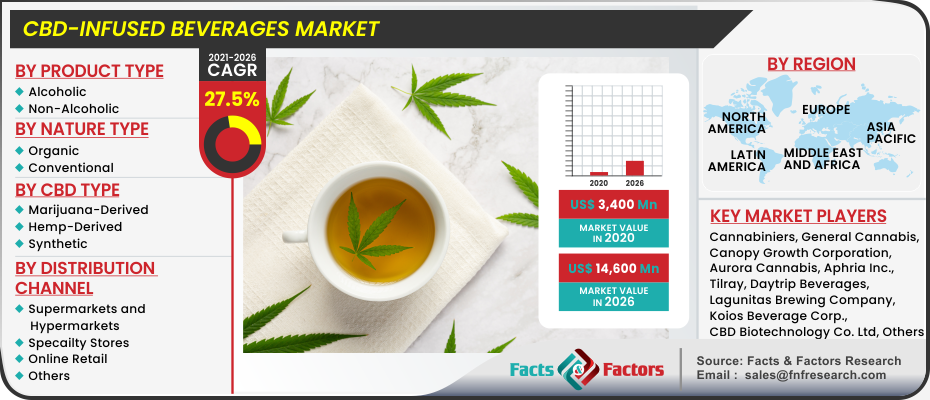

CBD-Infused Beverages Market by Product Type (Alcoholic and Non-Alcoholic), By Nature Type (Organic and Conventional), By CBD Type (Marijuana-Derived, Hemp-Derived, and Synthetic), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others) By Region: Global and Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

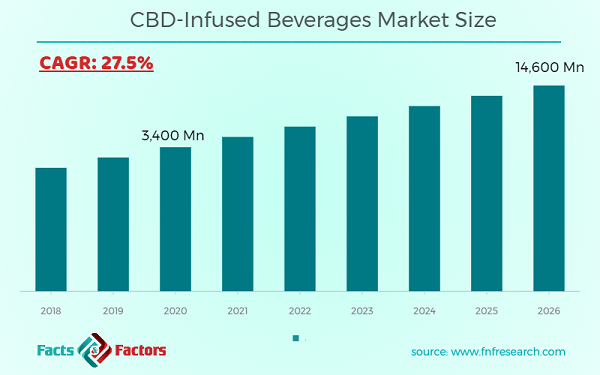

[194+ Pages Report] According to the report published by Facts and Factors, the global CBD-infused beverage market size was valued around USD 3,400 million in 2020 and is expected to grow to around USD 14,600 million by 2026 with a compound annual growth rate (CAGR) of roughly 27.5% between 2021 and 2026. The report analyzes the global CBD-infused beverage market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the CBD-infused beverage market.

Market Overview

Market Overview

CBD is the abbreviation for cannabidiol. It's the second most common active component in cannabis (marijuana). CBD is extracted directly from the hemp plant, which is a relative of the marijuana plant and is an important component of medicinal marijuana. Despite the fact that CBD is a component of marijuana, it has no hallucinogenic effects on the human mind. "In people, CBD displays no effects suggestive of any misuse or dependency potential," according to a World Health Organization report. To date, there has been no evidence of public health issues linked to the use of pure CBD and its derivatives.

Water is injected with CBD particles to create CBD-infused beverages. The end product is a canned, usually sparkling beverage that tastes like flavored sparkling water or spiked seltzer. There are some “CBD-only” drinks on the market, but finding one without a trace of THC can be difficult. This is due to the difficulty of extracting pure CBD from cannabis plants without some THC remaining. CBD beverages are becoming more popular as cannabis-infused goods, such as medicinal and recreational marijuana, become legalized across the United States and around the world. CBD's appeal has been fuelled by its expanding availability combined with a growing health trend, with more and more people opting for "better-for-you" alternatives to sugary drinks. CBD-infused drinks of various types provide a great alternative, with health advantages to boot, because CBD beverages are sourced from a natural source.

Industry Growth Factors

Industry Growth Factors

The market for CBD-infused drinks is largely driven by the rising authorization and certification for recreational cannabis in countries, such as the United States and Canada. Furthermore, because of the increasing incidence of numerous respiratory disorders, there is a growing movement away from smoking cannabis and adopting healthier edible options, which is pushing the market growth. Furthermore, the common accessibility of CBD-infused drinks such as coffee, fruit punch, cannabis cola tea, and other CBD-infused beverages across various legal marijuana outlets further augments the global industry.

Several key players manufacturing CBD-infused beverages also prefer investing in developing newly flavored beverages. For instance, in June 2018, US craft brewer Lagunitas, a subsidiary of Heineken, launched a 5mg CBD-infused beverage named a Hi-Fi Hops. The company aimed at providing a no-calorie beverage infused with cannabis as a new innovative product for the company’s growth in the future.

Aside from that, the rising usage of CBD-infused drinks in cancer patients to treat nausea, weight loss, and poor appetite is fueling market expansion. Furthermore, its growing popularity as a functional drink among athletes and sportspeople has resulted in increased product demand in the sports nutrition industry. Numerous advancements in cannabis microdosing have resulted in the creation of alcohol-free beer produced from CBD, which is likely to fuel market expansion.

However, the market is expected to be hampered by stringent regulation and a lengthy approval procedure for CBD products, as well as severe negative effects associated with CBD intake. Nevertheless, the growing prevalence of the consumers towards organically sourced CBD usage in the beverages provides lucrative market growth opportunities for the market.

Segmentation Analysis

Segmentation Analysis

The global market is segregated based on product type, nature type, CBD type, distribution channel, and region

Based on type, the CBD-infused beverage market is divided into non-alcoholic and alcoholic categories. The market is increasing as more businesses enter the alcohol brewing industry to infuse the beer with CBD. People who utilize cannabis and alcoholic beverages are also contributing to the rise. Furthermore, the rising desire for spirits and beer among cannabis consumers is expected to boost product demand in the coming years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 3,400 Million |

Projected Market Size in 2026 |

USD 14,600 Million |

CAGR Growth Rate |

27.5% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Cannabiniers, General Cannabis, Canopy Growth Corporation, Aurora Cannabis, Aphria Inc., Tilray, Daytrip Beverages, Lagunitas Brewing Company, Koios Beverage Corp., CBD Biotechnology Co. Ltd, G&Juice, K-Zen Beverages Inc., NewAge Inc., Alkaline88, LLC, Phivida Holdings Inc., CANNABIS SATIVA, INC, Puration and Honeydrop Beverages amongst others. |

Key Segment |

By Product Type, By Nature Type, By CBD Type, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America, followed by Europe, accounted for the biggest proportion of the market in 2020. The easy accessibility of cannabis as per the requirement, technological advancements in the production of CBD-infused drinks, availability of CBD consumers along with their growing perception toward CBD consumption for numerous health benefits, and increasing investments from leading players are all factors that contribute to this region's large share.

The second-largest market for CBD-infused beverages in Europe as the number of people willing to experience CBD-infused drinks is surging and manufacturers are also fulfilling the growing demand by introducing new flavored CBD-infused beverages. For instance, in November 2019 Endo Sport entered the CBD market by launching the UK’s first CBD-infused sports drink with two flavors: berry and orange consisting of 10mg CBD per 500ml bottle. The company claimed that their drink would help in muscle recovery and improve sleep aid. These drinks were made available by the brand in local convenience stores.

Competitive Players

Competitive Players

Some main participants of the global CBD-infused beverages industry are :

- Cannabiniers

- General Cannabis

- Canopy Growth Corporation

- Aurora Cannabis

- Aphria Inc.

- Tilray

- Daytrip Beverages

- Lagunitas Brewing Company

- Koios Beverage Corp.

- CBD Biotechnology Co. Ltd

- G&Juice

- K-Zen Beverages Inc.

- NewAge Inc.

- Alkaline88 LLC

- Phivida Holdings Inc.

- CANNABIS SATIVA INC

- Puration

- Honeydrop Beverages

By Product Type Segment Analysis

By Product Type Segment Analysis

- Alcoholic

- Non-Alcoholic

By Nature Type Segment Analysis

By Nature Type Segment Analysis

- Organic

- Conventional

By CBD Type Segment Analysis

By CBD Type Segment Analysis

- Marijuana-Derived

- Hemp-Derived

- Synthetic

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Supermarkets and Hypermarkets

- Specailty Stores

- Online Retail

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- Cannabiniers

- General Cannabis

- Canopy Growth Corporation

- Aurora Cannabis

- Aphria Inc.

- Tilray

- Daytrip Beverages

- Lagunitas Brewing Company

- Koios Beverage Corp.

- CBD Biotechnology Co. Ltd

- G&Juice

- K-Zen Beverages Inc.

- NewAge Inc.

- Alkaline88 LLC

- Phivida Holdings Inc.

- CANNABIS SATIVA INC

- Puration

- Honeydrop Beverages

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors