Search Market Research Report

Flexible OLED Display Market Size, Share Global Analysis Report, 2022 – 2028

Flexible OLED Display Market Size, Share, Growth Analysis Report By Type (AMOLED and PMOLED), By Application (Televisions, Smartphones, Wearables, Laptops and Monitors, and Others), By End-User (Consumer Electronics, Automotive, Sports, Entertainment, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

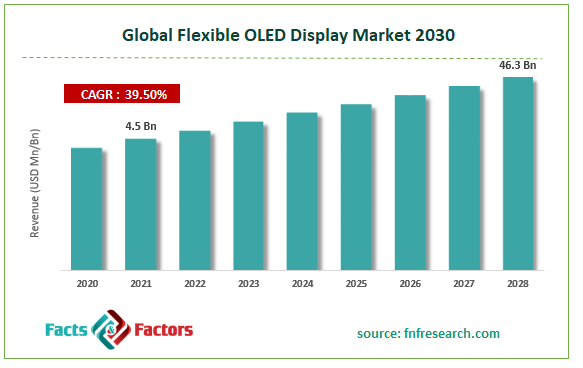

[232+ Pages Report] According to the report published by Facts Factors, the global flexible OLED display market size was worth around USD 4.5 billion in 2021 and is predicted to grow to around USD 46.3 billion by 2028 with a compound annual growth rate (CAGR) of roughly 39.5% between 2022 and 2028. The report analyzes the global flexible OLED display market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the flexible OLED display market.

Market Overview

Market Overview

The self-illuminating flat panel display known as an OLED is one in which organic material is assembled between two conductors. These displays don't need a backlight to function because they can produce brilliant light when an electric current is sent through them. In comparison to LCD and LED displays, OLEDs may be manufactured substantially thinner and more power-efficient without a backlight. Additionally, customers are becoming increasingly interested in organic LED displays because of their improved image clarity and quick pixel flipping.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global flexible OLED display market is estimated to grow annually at a CAGR of around 39.5% over the forecast period (2022-2028).

- In terms of revenue, the global flexible OLED display market size was valued at around USD 4.5 billion in 2021 and is projected to reach USD 46.3 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, the AMOLED segment is expected to hold the largest market share during the forecast period.

- Based on the application, the smartphone segment accounted for the largest revenue share in 2021.

- Based on end users, the consumer electronics segment was dominated in 2021.

- Based on region, the Asia Pacific is projected to dominate the market during the forecast period.

Covid-19 Impact

Covid-19 Impact

The worldwide supply chain disruption caused by the shutdown caused a sharp decline in flexible OLED display output in 2020. The activities of makers of flexible OLED displays, as well as those of their suppliers and distributors, were impacted by COVID-19. The short-term growth of the flexible OLED display industry is anticipated to be significantly impacted by the failure of export shipments and the poor domestic semiconductor demand compared to pre-COVID-19 levels. A lockdown has been imposed in numerous significant economies as a result of the current COVID-19 epidemic. Supply networks have been messed up, which has affected the business of electronic goods. Additionally, the closure of industrial facilities is losing many economies a significant amount of money. The overall situation has therefore limited the market for flexible OLED displays in 2020.

Growth Drivers

Growth Drivers

- The various benefits offered by OLED technology are expected to drive the market

During the forecast period, the global flexible OLED displays market is anticipated to grow due to the lucrative advantages presented by OLED technology. OLED technology has many benefits, including improved contrast ratios, faster refresh rates, and crisper, more vibrant colors. OLED displays are smaller, thinner, and offer superior energy management because they use less electricity overall. Additionally, OLED panels' improved view angle benefits customers in other ways. Thus, these benefits supported the market growth during the forecast period.

- Increasing penetration of smartphones coupled with innovative product launches to propel the market expansion

The rising penetration of smartphones along with innovative product launches is one of the most crucial factors that drive the market growth during the forecast period. For instance, according to the India Brand Equity Foundation, in India, smartphone shipments accounted for over 173 million in 2021 a 14% increase from the previous year. Owning a smartphone is no longer an indulgence due to increased disposable income levels and simple financing options (like EMI). For a young nation like India with a sizable working population, this is a fact of life. In addition, price reductions for smartphones are being driven by ongoing technology advancements and intense rivalry among handset producers, which is enhancing affordability and sales growth. Furthermore, innovative product launches support market growth. For instance, in May 2021, Apple announced that it may launch 8-inch foldable iPhone with a flexible QHD+OLED display in 2023.

Restraints

Restraints

- High manufacturing costs might be hampering the market growth

The global market for OELD displays is anticipated to experience growth restraints during the projected period due to the high manufacturing costs of OLED displays. The price of producing OLED displays is very high. In reality, compared to other modern technologies like LCD, the manufacturing of OLED needs process steps that dramatically increase the overall cost of the finished product.

Opportunities

Opportunities

- Increasing competition between OLED and LCD technology is expected to offer an opportunity for the market

OLED and LCD technology's ongoing competitiveness may present significant business potential. OLED technology has many benefits, with energy efficiency and environmental friendliness being key features. OLED displays are anticipated to become widely used shortly due to their biodegradability in industrialized nations. Due to the growing demand and supply imbalance for electricity internationally, OLED displays are also anticipated to minimize electricity consumption. More characteristics like transparency, thinner dimensions, better flexibility, and improved 3D adaptation increase the number of times per second a display redraws data. The active-matrix OLED (AMOLED) industry is also anticipated to grow in popularity and market share, propelling the worldwide OLED display market.

Segmentation Analysis

Segmentation Analysis

The global flexible OLED display market is segmented based on type, application, end user and region

Based on the type, the global market is bifurcated into AMOLED and PMOLED. The AMOLED segment held the largest market share in 2021 and is expected to show its dominance during the forecast period. Active Matrix Organic Light Emitting Diode is abbreviated as AMOLED. TFT (Thin Film Transistor) layer is included in this technology to give users more control over the light that OLEDs output. Colors are directly emitted from organic diodes on an AMOLED display screen. As a result, it does not need any LED backlights, polarizing filters, or crystals like LCD screens do. This significantly reduces the size of the display screen and saves energy. On the other hand, the PMOLED segment is expected to grow at the highest CAGR during the forecast period owing to its large utilization in medical devices as well as home appliances.

Based on the application, the global flexible OLED display market is segmented into televisions, smartphones, wearables, laptops & monitors, and others. The smartphone segment held the largest revenue share in 2021 and is expected to dominate during the forecast period. The growth in the segment is attributed to the growing need for a better contrast ratio and improved brightness consistency. Moreover, the rising popularity of curved or foldable displays is expected to boost demand for flexible OLED display technology in smartphones. Besides, the wearable segment is expected to grow at the highest CAGR during the forecast period. The rising prevalence of chronic diseases and obesity has aided in the adoption of wearable products such as activity trackers and body monitors, which provide real-time data on the user's overall well-being. These wearable devices also provide information about daily events as well as physiological data such as sleep quality, heart rate, blood oxygen level, blood pressure, cholesterol level, and calories burned. Thus, the wearable segment growing at the highest CAGR during the forecast period.

Based on end-users, the market is segmented into consumer electronics, automotive, sports, entertainment, and others. The consumer electronic segment was dominated in 2021 and is expected to show this pattern during the forecast period. The growth in the segment is attributed to the rising need for thinner, lighter, and more flexible devices. Moreover, the growing investments by private players in R&D to improve the efficiency of the devices as well as improve the safety of the users is expected to boost demand for flexible OLED in numerous consumer electronics such as smartphones, television, and smartwatch among others.

Recent Developments:

Recent Developments:

- In December 2021, LG Display, the world’s leading innovator of display technologies, announced that it will be demonstrating how its flexible OLED technology creates new and different lifestyles at CES2022. The company will showcase two new product concepts to the world – “Virtual Ride” and “Media Chair.” By introducing these two innovative products featuring flexible OLED screens, the company aims to highlight the strong potential and wide versatility of OLED to create new markets.

- In June 2022, Samsung electronics co ltd acquired Cynora Gmbh. Cyonara is developing a new type of organic emitting materials for OLED displays based on TADF (Thermally Activated Delayed Fluorescence) technology. With this technology, the company will be able to commercialize the first high-efficiency blue emitting material on the market, which is the most sought-after material by OLED display makers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4.5 Billion |

Projected Market Size in 2028 |

USD 46.3 Billion |

CAGR Growth Rate |

39.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Sony Corporation, Atmel Corporation, Delta Electronics, DuPont Display, Philips Electronics, Panasonic Corporation, Samsung Electronics Co. Ltd., Pioneer OLED, Optronics, BOE Technology, Japan Display, and others. |

Key Segment |

By Type, Application, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to dominate the market during the forecast period. The growth in the region is attributed to the presence of major players such as Sony Group Corporation, LG Display, Samsung Electronics, and others. In addition to this, the innovative product launch by these players supported the market growth. For instance, in June 2021, Samsung announced the development of a flexible OLED display that could be invaluable to future wearable devices that can be stuck to the skin and conform to its surface. To create a flexible display, Samsung created individual OLED pixels that themselves are ridged and sit on a flexible elastomer surface. Connections between the OLEDs are made using a flexible material, as are the traces that connect the display to the driver system. Furthermore, the rapid growth in consumer electronics especially in the countries like China, India, and Japan is expected to drive the market growth.

Competitive Analysis

Competitive Analysis

- Sony Corporation

- Atmel Corporation

- Delta Electronics

- DuPont Display

- Philips Electronics

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Pioneer OLED

- Optronics

- BOE Technology

- Japan Display

The global flexible OLED display market is segmented as follows:

By Type

By Type

- AMOLED

- PMOLED

By Application

By Application

- Televisions

- Smartphones

- Wearables

- Laptops and Monitors

- Others

By End User

By End User

- Consumer Electronics

- Automotive

- Sports

- Entertainment

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sony Corporation

- Atmel Corporation

- Delta Electronics

- DuPont Display

- Philips Electronics

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Pioneer OLED

- Optronics

- BOE Technology

- Japan Display

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors