Search Market Research Report

Chloromethane Market Size, Share Global Analysis Report, 2022 – 2028

Chloromethane Market Size, Share, Growth Analysis Report By Product (Methylene Chloride, Methyl Chloride, Carbon Tetrachloride, Chloroform, Others), By Application (Refrigerant, Industrial Solvent, Silicone Polymers, Laboratory Chemicals, Chemical Intermediates, Methylating & Chlorinating Agent, Propellant & Blowing Agent, Catalyst Carrier, Herbicide, Local Anesthetic, Adhesives and Sealants, Others), By End-Use (Pharmaceutical, Agrochemicals, Textile, Automotive, Construction, Paints & Coatings, Personal Care Products, Plastics & Rubber, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

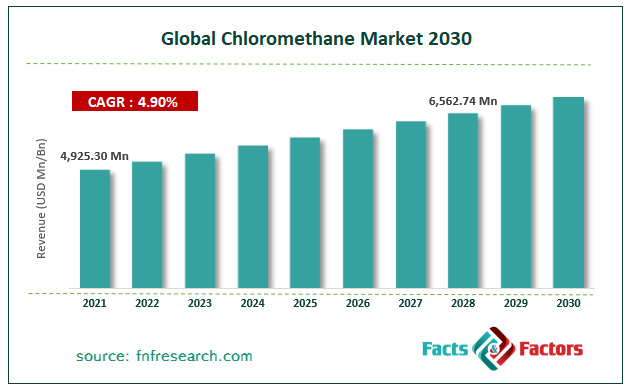

[218+ Pages Report] According to the report published by Facts Factors, the global chloromethane market size was worth USD 4925.30 million in 2021 and is estimated to grow to USD 6562.74 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.90% over the forecast period. The report analyzes the chloromethane market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the chloromethane market.

Market Overview

Market Overview

Chloromethane is a toxic, colorless derivative of methane that is also very flammable and has a faintly pleasant smell. It is created through a chemical reaction between methanol and hydrogen chloride. Due to its toxicity and flammability, chloromethane was phased out of use as a refrigerant. This is frequently used in the synthesis of silicone and active pharmaceutical ingredients, as well as in other chemical processes. The growing demand for chemical industries would influence the chloromethanes market's expansion rate. The main factors propelling market expansion are the soaring demand for silicone elastomers in various end-use sectors, such as construction, elective, and automotive, as well as the soaring need for tire replacements from rising nations. The chloromethane market is also driven by expanding urbanization and silicone used in personal and medical applications.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has had a significant influence on many different industries. Many nations implemented lockdowns and strict government measures, including wearing masks, keeping a safe distance from others, banning travel, regularly using hand sanitizer, closing business and educational sectors, and many more. These variables entirely threw off the supply and demand chain, resulting in a fall in demand for chloromethane in various industries, including personal care, agriculture, chemicals, and others. Following the end of the lockdown, the demand for chloromethane surged quickly due to its advantages and use in various applications and is anticipated to stabilize in 2021.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global chloromethane market value is expected to grow at a CAGR of 4.90% over the forecast period.

- In terms of revenue, the global chloromethane market size was valued at around USD 4925.30 million in 2021 and is projected to reach USD 6562.74 million by 2028.

- The main factors propelling market expansion are the soaring demand for silicone elastomers in various end-use sectors, including construction, electronics, and automotive, and rising nations' soaring need for tire replacements.

- By product, the methylene chloride category dominated the market in 2021.

- By application, the silicone polymers category dominated the market in 2021.

- The Asia Pacific dominated the chloromethane market in 2021.

Growth Drivers

Growth Drivers

- The rising demand for chloromethane as a chemical intermediate drives the market growth

The global chloromethane market is driven primarily by rising silicone usage in cosmetic and medicinal products during the projected period. Since silicone polymer is produced using chloromethane, end-use industries like the automobile, personal care, and electronics sectors have higher demand. The silicone is a perfect candidate for an intermediate due to its exceptional qualities, including flexibility, solubility inorganic solvents, and water repellency. In addition, rising sales of passenger automobiles and rising affordability are also anticipated to stimulate market expansion. The automobile industry's need for silicone polymers rises due to the lighter weight of vehicles.

Restraints

Restraints

- Government regulations and health problems posed by chloromethane may hamper the market growth

Government laws that are too strict may result in health problems like confusion, drowsiness, and breathing problems related to the storage, use, and handling of chloromethane, as well as other environmental problems. These elements may hamper the market growth.

Segmentation Analysis

Segmentation Analysis

The global chloromethane market is segregated based on product, application, end-use, and region.

Based on product, the market is divided into methylene chloride, methyl chloride, carbon tetrachloride, chloroform, and others. Among these, the methylene chloride segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Methylene chloride is primarily employed in producing polyurethane foams, adhesives, and aerosols as an industrial solvent and chemical intermediary.

Based on the application, the market is divided into refrigerant, an industrial solvent, silicone polymers, laboratory chemicals, chemical intermediates, methylating & chlorinating agents, propellant & blowing agents, catalyst carriers, herbicides, local anesthetic, adhesives and sealants, and others. Among these, the silicone polymers segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Most of these polymers are employed in electronic products like keyboards, mobile parts, and copier rollers. Silicone is significantly used in manufacturing consumer goods, particularly kitchen and personal care items. Thus, one of the key industries driving the need for silicone polymers is the rapidly growing personal care and electronics industries.

Based on the end-use outlook, the market is divided into pharmaceuticals, agrochemicals, textile, automotive, construction, paints & coatings, personal care products, plastics & rubber, and others. Among these, the pharmaceuticals segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. A process intermediary in the creation of pharmaceuticals is chloromethane. In extracting several pharmaceutical chemicals and manufacturing antibiotics and vitamins, methylene chloride is primarily used as a re-crystallization and efficient reaction solvent.

Recent Development

Recent Development

- April 2019: Nouryon Company announced that it would begin work on a project to expand its chloromethane production facility in Frankfurt, Germany, to meet increased global customer demand for chloromethane.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4925.30 Million |

Projected Market Size in 2028 |

USD 6562.74 Million |

CAGR Growth Rate |

4.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Asahi Glass Co. Ltd., Tokuyama Corp., AGC Chemicals Ltd., Occidental Chemical Corp., AkzoNobel N.V., Shin-Etsu Chemical Co. Ltd., Solvay S.A., INEOS Group, Gujarat Alkalies, Chemicals Ltd., and others. |

Key Segment |

By Product, Application, End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the chloromethane market in 2021

The Asia Pacific dominated the global chloromethane market in 2021. The production of chloromethane is expected to be boosted by China's enormous shale gas deposits and wide-ranging feedstock availability. These factors have also greatly increased the region's chemical manufacturing. Major firms are now refocusing on high-opportunity economies, like China and India, where skilled labor and raw materials are more easily accessible at lower prices.

Competitive Landscape

Competitive Landscape

- Asahi Glass Co. Ltd.

- Tokuyama Corp.

- AGC Chemicals Ltd.

- Occidental Chemical Corp.

- AkzoNobel N.V.

- Shin-Etsu Chemical Co. Ltd.

- Solvay S.A.

- INEOS Group

- Gujarat Alkalies

- Chemicals Ltd.

Global Chloromethane Market is segmented as follows:

By Product

By Product

- Methylene chloride

- Methyl chloride

- Carbon tetrachloride

- Chloroform

- Others

By Application

By Application

- Refrigerant

- Industrial solvent

- Silicone polymers

- Laboratory chemicals

- Chemical intermediates

- Methylating & chlorinating agent

- Propellant & blowing agent

- Catalyst carrier

- Herbicide

- Local anesthetic

- Adhesives and sealants

- Others

By End-Use

By End-Use

- Pharmaceutical

- Agrochemicals

- Textile

- Automotive

- Construction

- Paints & coatings

- Personal care products

- Plastics & rubber

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Asahi Glass Co. Ltd.

- Tokuyama Corp.

- AGC Chemicals Ltd.

- Occidental Chemical Corp.

- AkzoNobel N.V.

- Shin-Etsu Chemical Co. Ltd.

- Solvay S.A.

- INEOS Group

- Gujarat Alkalies

- Chemicals Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors