Search Market Research Report

Cosmetic Preservatives Market Size, Share Global Analysis Report, 2022 – 2028

Cosmetic Preservatives Market Size, Share, Growth Analysis Report By Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganic, Quaternary Compounds, Organic Acids & Their Salts, Others), By Application (Lotions, Facemasks, Sunscreens, & Scrubs, Shampoos & Conditioners, Soaps, Shower Cleansers & Shaving Gels, Face Powders & Powder Compacts, Mouthwashes & Toothpastes, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

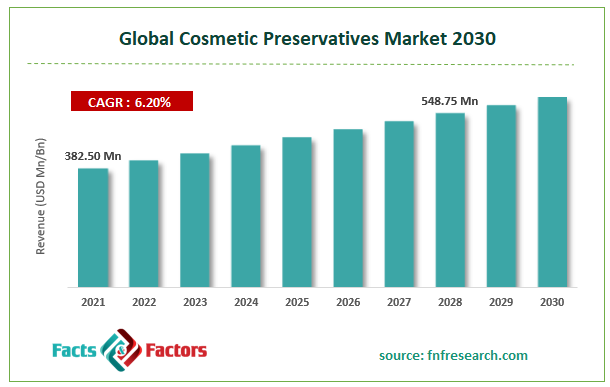

[234+ Pages Report] According to Facts and Factors, the cosmetic preservatives market size was worth USD 382.50 million in 2021 and is estimated to grow to USD 548.75 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.20% over the forecast period. The report analyzes the cosmetic preservatives market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the cosmetic preservatives market.

Market Overview

Market Overview

Cosmetic preservatives are a broad category of additives added to cosmetic products, especially to stop contamination and microbial development during production, transit, storage, or use. They safeguard the recipe and ensure the longevity and stability of the product when exposed to air and moisture. Some commonly used cosmetic preservatives include parabens, organic acids, formaldehyde releasers, phenoxyethanol, and isothiazolinones, as well as natural preservatives, including oil extracts from clove buds, curry leaves, and cinnamon. They are typically found in personal care products, including face masks, lotions, sunscreens, scrubs, hair conditioners, face powders, soaps, and other goods of a similar kind. Consumers' increasing preference for customized cosmetic products and the general public's awareness of beauty are two major factors driving the market's expansion. Because they contain water and oil, cosmetic products are easily affected by germs and fungus. Cosmetic preservatives are frequently included as antioxidants, antimicrobials, and stabilizers to prevent skin infections and other problems. The demand for the product benefits from this.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 outbreak has hampered the cosmetics sector's supply chain for cosmetic preservatives. In 2020, more than 100 nations closed their international and domestic trade and travel borders. The leading cosmetics consumers, the UK, the US, Italy, Spain, Germany, Japan, China, and France, experienced almost complete economic stagnation. The viral outbreak had a significant impact on these nations. Companies in less-affected nations could not deliver goods to their customers because of limitations on commerce and transportation. As a result, the market for cosmetic preservatives has been significantly impacted by supply chain interruptions brought on by the epidemic.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the cosmetic preservatives market value is expected to grow at a CAGR of 6.20% over the forecast period.

- In terms of revenue, the cosmetic preservatives market size was worth USD 382.50 million in 2021 and is estimated to grow to USD 548.75 million by 2028.

- Consumers' increasing preference for customized cosmetic products and the general public's awareness of beauty are two major factors driving the market's expansion.

- By type, the quaternary compound segment dominated the market in 2021.

- By application, the shampoo and conditioners segment dominated the market in 2021.

- North America dominated the global cosmetic preservatives market in 2021.

Growth Drivers

Growth Drivers

- Increase in purchasing power of consumers to drive the market growth

Consumers' quality of life has increased over the past several years, increasing the population's purchasing capacity and, as a result, their demand for high-end cosmetics and natural personal care products. The industry for cosmetic preservatives is anticipated to grow more quickly due to this. Global technological advancements and the rate of urbanization have made it possible for people to access international brands easily. The average person's spending power has multiplied due to economic growth and the emergence of new purchasing methods that have supplanted conventional ones. An increase in disposable income causes more people to use luxury goods in their daily lives, which raises the consumption of cosmetics globally and fuels the expansion of the cosmetic preservatives industry.

Restraints

Restraints

- The high cost of organic products may hinder the market growth

Given the increased cost of raw materials or feedstock, organic cosmetics are more expensive and can only satisfy the market's need for premium-priced goods. This makes it difficult for manufacturers to use the necessary resources for R&D projects. The market for cosmetic preservatives is therefore constrained in its expansion by the high cost of organic raw ingredients and other overhead expenses.

Opportunity

Opportunity

- The rising demand for natural and organic preservatives in cosmetics presents market opportunities

Personal care product producers favor organic preservatives over conventional preservatives, including parabens, formaldehyde donors, and others. Organic or natural preservatives are recommended because they don't cause skin issues. Preservatives made from organic materials don't or mildly affect the skin. In the European and North American markets, it is anticipated that demand for organic and natural cosmetic preservatives will increase significantly.

Segmentation Analysis

Segmentation Analysis

The cosmetic preservatives market has been segmented into type and application.

Based on type, the cosmetic preservatives market is divided into paraben esters, formaldehyde donors, phenol derivatives, alcohol, inorganic, quaternary compounds, organic acids & their salts and others. The quaternary compounds sector dominated the global cosmetic preservatives market share in 2021. Quats, also known as quaternary compounds, are substances that contain nitrogen and have a positive charge when added to a chemical solution. Quaternary substances exhibit the capacity to stop microbial development in cosmetic products. Benzalkonium chloride, benzethonium chloride, cetalkonium chloride, cetrimide, and cetrimonium bromide are a few of the compounds found in quats. In cosmetic goods, benzalkonium chloride stops microbial growth and reproduction. The quaternary compounds found in cosmetics considerably aid in conditioning hair in wet and dry situations.

Based on application, the cosmetic preservatives market is divided into lotions, face masks, sunscreens, & scrubs, shampoos & conditioners, soaps, shower cleansers & shaving gels, and face powders & powder compacts, mouthwashes & toothpaste and others. In terms of value and volume, the shampoo and conditioners segment dominated the global cosmetic preservative market in 2021. To increase the shelf life of shampoos and conditioners, manufacturers add preservatives. Because shampoos and conditioners contain a lot of water and oxygen, it is advised to add either natural or synthetic preservatives in their formulation. Piroctone olamine, quaternary substances, and phenol derivatives are preservatives in shampoos and conditioners most often utilized.

Recent Developments-

Recent Developments-

- June 2022: To increase the availability of its bio-based products in the personal care sector, Dow engaged in a contract with EcoSynthetix. The partnership's initial goal is to provide consumers with advantages beyond comparison. By satisfying the growing customer demand for biodegradable and bio-based technologies that offer distinctive and high-performance advantages, the collaboration enables businesses to profit from their key capabilities.

- November 2020: Under the SENSICARE C 2060 brand, Chemipol introduced a new product line with antimicrobial qualities to safeguard cosmetic formulations. With this introduction, the company hopes to expand its product line in response to the rising demand for cosmetic formulas.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 382.50 Million |

Projected Market Size in 2028 |

USD 548.75 Million |

CAGR Growth Rate |

6.20% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Ashland Group Holding Inc., Symrise AG, Arkema S.r.l, Clariant AG, Evonik Industries, Chemipol, International Flavors & Fragrances Inc., Salicylates & Chemicals Pvt. The Dow Chemical Company, Sharon Laboratories, Thor Group Ltd., Brenntag AG, Dadia Chemical Industries, ISCA UK Ltd., and Others |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominates the cosmetic preservatives market in 2021

North America dominated the global cosmetic market in 2021 because more consumers are choosing vegan, all-natural, and organic cosmetics. The rising demand for organic beauty products to combat the negative impacts of sun, dust, and other elements could raise the regional requirement for natural cosmetic preservatives. The changing consumer habits and a growing FMCG industry in North America are driving toiletry sales, which should be advantageous for the economy. A wide variety of soaps and other toiletry products have been created thanks to expanding R&D activities, which will boost regional market share. In North America, consumer interest in organic, natural, and herbal cosmetic products is expanding, boosting demand for cosmetics manufacturing. Social media and other digital media are major factors affecting the local cosmetic industry.

Competitive Landscape

Competitive Landscape

- BASF SE

- Ashland Group Holding Inc.

- Symrise AG

- Arkema S.r.l

- Clariant AG

- Evonik Industries

- Chemipol

- International Flavors & Fragrances Inc.

- Salicylates & Chemicals Pvt.

- The Dow Chemical Company

- Sharon Laboratories

- Thor Group Ltd.

- Brenntag AG

- Dadia Chemical Industries

- ISCA UK Ltd.

Global Cosmetic Preservatives Market is segmented as follows:

By Type:

By Type:

- Paraben Esters

- Formaldehyde Donors

- Phenol Derivatives

- Alcohols

- Inorganics

- Quaternary Compounds

- Organic Acids & Their Salts

- Others

By Application:

By Application:

- Lotions, Facemasks, Sunscreens, & Scrubs

- Shampoos & Conditioners

- Soaps, Shower Cleansers & Shaving Gels

- Face Powders & Powder compacts

- Mouthwashes & Toothpaste

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Ashland Group Holding Inc.

- Symrise AG

- Arkema S.r.l

- Clariant AG

- Evonik Industries

- Chemipol

- International Flavors & Fragrances Inc.

- Salicylates & Chemicals Pvt.

- The Dow Chemical Company

- Sharon Laboratories

- Thor Group Ltd.

- Brenntag AG

- Dadia Chemical Industries

- ISCA UK Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors