Search Market Research Report

Carbon Disulfide Market Size, Share Global Analysis Report, 2022–2028

Carbon Disulfide Market By Purity (Pure and Impure), By Application (Agriculture, Pharmaceuticals, Packaging, Rubber, Rayon, and Fibers), and By Region - Global and Regional Industry Trends, Competitive Intelligence, Analysis of Data, Statistical Data, and Forecast 2022–2028

Industry Insights

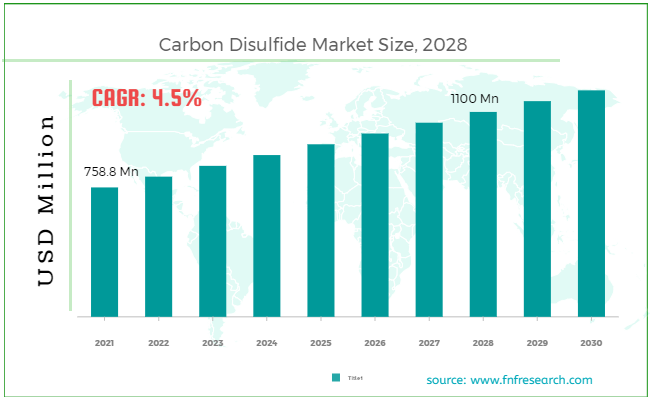

[210+ Pages Report] According to Facts and Factors, during the forecast period of 2022 to 2028, the global carbon disulfide market is estimated to develop at a compound annual growth rate (CAGR) of 4.5%. The global carbon disulfide market was worth USD 758.8 million in 2021, and it is anticipated to exceed USD 1100 million by 2028. The study investigates several elements and their consequences on the growth of the global carbon disulfide market.

Market Overview

Market Overview

Carbon disulfide is a colorless, volatile compound with the molecular formula CS2. It has an ether-like odor and is typically used in liquid form. Carbon disulfide is found in trace volumes in volcanic eruptions. Previously, carbon disulfide was produced by heating coke and sulfur together. Currently, the manufacturing step is performed at a much lower temperature, with natural gas serving as the carbon source and being combined with sulfur and either aluminum or silica gel acting as a catalyst.

In spectroscopes, carbon disulfide is used as an insecticide, fumigant, non-polar solvent, and optical dispersant. It is also used as a building block in the manufacture of various chemicals. Furthermore, carbon disulfide is used in the manufacture of chemicals such as cellophane, carbon tetrachloride, agricultural chemicals, rubber chemicals, and pharmaceuticals.

COVID-19 Impact

COVID-19 Impact

The pandemic of COVID-19 had a substantial impact on the trade segment and market. Manufacturers are figuring out how to recover from the present situation by restructuring their sales channels and product innovation. The timeframe of the virus outbreak remains an important factor in determining the pandemic's overall impact. The global carbon disulfide market, on the other hand, is expected to normalize after 2022.

Growth Drivers

Growth Drivers

- Rising demand for carbon disulfide from end-user industries to boost the market growth

New chemical production accounts for a sizable portion of the carbon disulfide market. Carbon disulfide is used as a building block in the manufacture of these chemicals. Requirements for chemicals such as rayon, cellophane, and carbon tetrachloride are expected to rise due to increased demand in end-use industries such as textiles, food packaging, and refrigeration. This is supposed to propel the carbon disulfide market. Another important application is the use of carbon disulfide as a non-polar solvent. Sulfur, phosphorus, selenium, bromine, iodine, rubber, asphalt, resin, and fats are all dissolved in carbon disulfide. As a result, it is used to clean carbon nanotubes.

Rising demand for nanomaterials, particularly carbon nanotubes, is expected to drive demand for carbon disulfide as a bipolar cleaning solvent. This is expected to boost the market. The market growth for carbon disulfide in the agriculture end-use industry is expected to drive demand for other niche applications such as insecticide and fumigant, boosting the global carbon disulfide market.

Restraints

Restraints

- Government restrictions are expected to slow market growth

Strict government regulations as a result of the negative health effects caused by carbon disulfide are forcing manufacturers to investigate alternatives, which threatens to slow the market growth rate for carbon disulfide over the forecast period.

Segmentation Analysis

Segmentation Analysis

The global carbon disulfide market is segmented on the basis of purity, application, and region.

By purity, the market is divided into pure and impure. Impure carbon disulfide is most commonly used in industrial processes.

By application, the market is divided into agriculture, pharmaceuticals, packaging, rubber, rayon, and fibers. The carbon disulfide market is led by the rubber application, which is growing at a CAGR of 4.4 percent. In the process of vulcanization of rubber, carbon disulfide is used as an accelerator. Rubber demand for non-tire products is increasing as a result of rising vehicle production, which is driving the market growth for carbon disulfide.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 758.8 Million |

Projected Market Size in 2028 |

USD 1100 Million |

CAGR Growth Rate |

4.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Jiangsu Jinshan Chemical Co. Ltd., Parchem Fine & Specialty Chemicals, Arkema Group, Shanghai Baijin Chemical Group Co., Ltd., GFS Chemicals, Inc., Merck KGaA, ShanXi Jinxinghua Chemical Co. Ltd., Akzo Nobel N.V., Liaonian Ruixing Chemical, Seidler Chemical Co., Tedia, Avantor Performance Materials, Inc., Nouryon, Alfa Aesar, and Manass Jinyunli Chemical Co. Ltd., among others |

Key Segment |

By Purity, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific region accounts for a sizeable portion of the market

Asia Pacific region accounts for a sizable portion of the global carbon disulfide market. Due to the expansion of end-use industries such as food packaging, textiles, refrigeration, and agriculture in countries such as India and China, the application of carbon disulfide in the production of various chemicals is expected to be the major market driver in the region.

Europe is expected to experience a similar trend, owing to the presence of a very well food packaging market in the region. Because of the region's high disposable income, the premium clothing and rayon textile industries are expected to further boost the carbon disulfide market in Europe.

Due to the region's stringent food packaging standards, the food packaging industry is expected to drive the carbon disulfide market in North America. Because of the region's increased research activities in nanomaterials, the nanotube sector is predicted to be a highly appealing market for carbon disulfide.

The carbon disulfide market in Latin America is expected to grow steadily over the next few years as the textile and agriculture industries expand in economies such as Brazil. During the forecast period, the Middle East and Africa are expected to be highly profitable markets for carbon disulfide due to the expansion of the textile and packaging industries in the GCC and the agricultural sector in South Africa.

Recent Development:

Recent Development:

- March 2022: Tedia Company, LLC announced that they have formed a strategic partnership with NewHold Enterprises, LLC. Tedia is North America's largest manufacturer of OEM high-purity solvents, with products sold in over 30 countries for life science, pharmaceutical, biotechnology, and laboratory applications.

- November 2021: Avantor, Inc. a global provider of mission-critical customers' needs in the life sciences and technologically advanced & applied materials industries, has completed the previously announced acquisition of Antylia Scientific's Masterflex bioprocessing business and related assets from investment firms GTCR and Golden Gate Capital.

Competitive Landscape

Competitive Landscape

Some of the global carbon disulfide players are :

- Jiangsu Jinshan Chemical Co. Ltd.

- Parchem Fine & Specialty Chemicals

- Arkema Group

- Shanghai Baijin Chemical Group Co. Ltd.

- GFS Chemicals Inc.

- Merck KGaA

- ShanXi Jinxinghua Chemical Co. Ltd.

- Akzo Nobel N.V.

- Liaonian Ruixing Chemical

- Seidler Chemical Co.

- Tedia

- Avantor Performance Materials Inc.

- Nouryon

- Alfa Aesar

- Manass Jinyunli Chemical Co. Ltd.

The global carbon disulfide market is segmented as follows:

By Purity Segment Analysis

By Purity Segment Analysis

- Pure

- Impure

By Application Segment Analysis

By Application Segment Analysis

- Agriculture

- Pharmaceuticals

- Packaging

- Rubber

- Rayon

- Fibers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Jiangsu Jinshan Chemical Co. Ltd.

- Parchem Fine & Specialty Chemicals

- Arkema Group

- Shanghai Baijin Chemical Group Co. Ltd.

- GFS Chemicals Inc.

- Merck KGaA

- ShanXi Jinxinghua Chemical Co. Ltd.

- Akzo Nobel N.V.

- Liaonian Ruixing Chemical

- Seidler Chemical Co.

- Tedia

- Avantor Performance Materials Inc.

- Nouryon

- Alfa Aesar

- Manass Jinyunli Chemical Co. Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors