Search Market Research Report

Aircraft Generators Market Size, Share Global Analysis Report, 2025 - 2034

Aircraft Generators Market Size, Share, Growth Analysis Report By Aircraft Type (Fixed Wing and Rotary-Wing), By Current Type (Alternating Current (AC) and Direct Current (DC)), By Power Rating (Less than 100 KW, 100-500 KW and More than 500 KW), By Technology (Electric and Conventional), By End Use (OEM and Aftermarket) And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

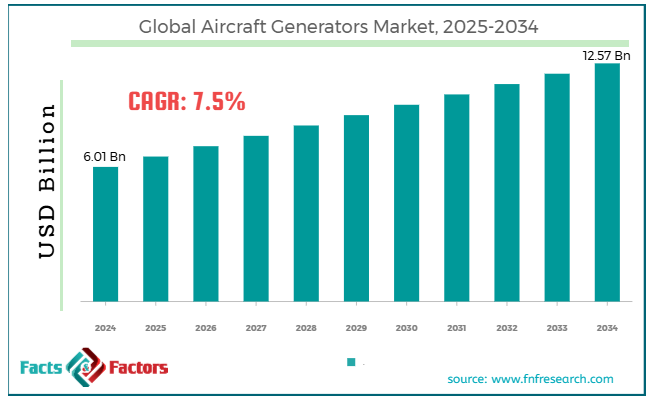

[218+ Pages Report] According to Facts & Factors, the global aircraft generators market size was worth around USD 6.01 billion in 2024 and is predicted to grow to around USD 12.57 billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034.

Market Overview

Market Overview

To operate systems like the navigation system, lighting, inbuilt radios, landing and taxiing equipment, and other devices, the majority of aircraft need an electrical power supply. While classic airplanes employ a generator for these purposes, aircraft built after the 1960s typically run this equipment on an alternator. Through the creation of a stationary magnetic field within which a coil is rotated, the generator assists in supplying electricity to the aircraft. Voltage is produced as the coil revolves inside the field. This voltage is detected by a commutator or slip rings, and it is then sent to the required equipment via a complex wire system.

Even with a dead battery, which may occur from extended idle time on the tarmac, aircraft generators are still capable of producing electricity. As long as the aircraft's engine is running, which is typically at 1,200–1,500 rpm, the generator can start to recharge the battery. When the airplane is operating at a steady cruise speed, this occurs.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global aircraft generators market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- In terms of revenue, the global aircraft generators market size was valued at around USD 6.01 billion in 2024 and is projected to reach USD 12.57 billion, by 2034.

- The increasing aviation industry is expected to drive market growth over the forecast period.

- Based on the aircraft type, the fixed wing segment is expected to dominate the market during the forecast period.

- Based on the current type, the Alternating Current (AC) segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Advancements in electric architecture in modern aircraft drive market growth

The increasing demand for efficiency and performance among industry stakeholders has led to an increase in the number of electric modern aircraft. The goal of increasing the electric power generation and distribution systems in airplanes has been the focus of substantial research and development. The Boeing 787 is at the forefront of commercial electrification innovations. It was the first commercial aircraft to adopt an electric system for both system actuation and control. Reduction in wiring is another benefit of advances in making airplanes more electric.

For instance, the Boeing 787 managed to remove about 20 miles of wiring. The number of deployed RATs is significantly improving according to developments in electric aircraft systems. Even though the Boeing 787 is the first generation electric aircraft, RAT remains a necessary component for emergency power generation. As a result, advancements in electric aircraft systems are increasing the effectiveness of RATs, which is expected to propel market expansion over the projected period.

Restraints

Restraints

- High cost hinders market growth

The process of creating and producing cutting-edge aircraft generators is expensive. Growth in the market may be constrained by the high expenses of R&D and production, especially for smaller producers. To guarantee reliability and efficiency, aircraft generators also need routine maintenance, repair, and overhaul (MRO). The high cost of maintenance, repair, and overhaul (MRO) services may discourage airlines from making improvements or new generator purchases. Thus, the cost is a major restraining factor for the market growth.

Opportunities

Opportunities

- Rising collaboration offers an attractive opportunity for market growth

The rising collaboration is expected to offer a potential opportunity for market growth during the forecast period. For instance, in April 2024, Flying Whales Quebec decided to use Honeywell's 1-megawatt generator to power their new hybrid-electric airship, the LCA60T. A contract was inked by both businesses to integrate and deliver Honeywell's one-megawatt generator. FLYING WHALES, a French and Canadian company, is creating a 200-meter vertical take-off and landing (VTOL) aircraft designed for the heavy-load transport industry.

Honeywell's 1-megawatt generator system has demonstrated excellent power density and efficiency, enabling seamless integration with operational and propulsion systems for piloted or autonomous aircraft. Without any changes, it can also be utilized as a 1-megawatt motor for electric propulsion engines. The 1-megawatt generator on board the LCA60T will combine with a gearbox and a turbine that runs on both jet fuel and sustainable aviation fuel (SAF) to produce a hybrid propulsion system. Similar to how hybrid-electric cars operate, the Honeywell generator will provide electricity to the electric engines, resulting in a more sustainable and efficient mode of transportation.

Challenges

Challenges

- The presence of alternative technology poses a major challenge to market expansion

Conventional airplane generators face competition from emerging power production technologies like fuel cells and advanced batteries. The market share of traditional generators may be eroded by these new technologies. Thus, the presence of alternative technology poses a major challenge to the market growth during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 6.01 Billion |

Projected Market Size in 2034 |

USD 12.57 Billion |

CAGR Growth Rate |

7.5% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

HEICO Corporation, Honeywell International Inc., General Electric Company, RTX Corporation, Boeing Co., Safran S.A., Thales Group, Ametek Inc., TransDigm Group Inc., Regal Beloit Corporation, Diehl Stiftung & Co. KG, Smiths Group PLC, Woodward Inc., Sinfonia Technology Co. Ltd., Crane Aerospace & Electronics LLC, Astronics Corporation, PBS Aerospace Inc., Dayton-Granger Inc., Calnetix Technologies LLC, Chelton Limited, Aerolec Technology Corporation, Duryea Technologies Inc., Epropelled Systems Private Limited, Motor Magnetics Inc., Technodinamika Corporation, Plane Power Alternators LLC, Arc Systems Inc., and others. |

Key Segment |

By Aircraft Type, By Current Type, By Power Rating, By Technology, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global aircraft generators industry is segmented based on aircraft type, current type, power rating, technology, end use and region.

Based on the aircraft type, the global aircraft generator market is bifurcated into fixed wing and rotary-wing. The fixed wing segment is expected to dominate the market during the forecast period. Many nations are investing in the modernization of their fleets of military aircraft, which involves swapping out antiquated electrical systems for more sophisticated ones. One major factor is the need for dependable power sources for the complex avionics and mission-critical systems found in military aircraft.

Furthermore, advancements in generator technology—such as lighter, more dependable, and efficient systems—are propelling expansion. To minimize overall weight and fuel consumption while supporting ever-more complex electronic systems, modern fixed-wing aircraft need sophisticated power solutions.

Based on the current type, the global aircraft generator industry is bifurcated into Alternating Current (AC) and Direct Current (DC). The Alternating Current (AC) segment is expected to capture the largest market share over the projected period. More lightweight and efficient AC generators are being developed, which will contribute to lowering the total weight of airplanes and increasing fuel efficiency.

For both commercial and military applications, where weight savings can result in large operational cost reductions, this is especially crucial. Greener AC generator technologies are also being developed as a result of the aviation industry's focus on lowering carbon emissions and enhancing sustainability. To produce generators that meet strict emission laws and are more ecologically friendly, manufacturers are investing in research and development.

Based on the power rating, the global aircraft generators market is divided into less than 100 kw, 100-500 kw and more than 500 kw.

Based on the technology, the global aircraft generator industry is bifurcated into electric and conventional.

Based on the end use, the global aircraft generators industry is segmented into OEM and Aftermarket.

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America held the largest market share and is expected to continue the same pattern over the forecast period. The rise of the regional market is ascribed to the existence of prominent companies like General Electric, and Honeywell, among others. For these firms to stay competitive in the market, they invest heavily in several sectors, including aerospace and energy.

For instance, in March 2024, GE announced plans to invest more than $450 million in its current U.S. manufacturing facilities this year to position the company and its American workforce for a successful future ahead of the company's planned creation of two independent, industry-leading companies in the energy and aerospace sectors. This investment will be made by upgrading the facilities and buying cutting-edge machinery. Moreover, the increasing air traffic in the area and the rising spending on military aircraft are projected to propel the market expansion in the region.

Competitive Analysis

Competitive Analysis

The global aircraft generators market is dominated by players like:

- HEICO Corporation

- Honeywell International Inc.

- General Electric Company

- RTX Corporation

- Boeing Co.

- Safran S.A.

- Thales Group

- Ametek Inc.

- TransDigm Group Inc.

- Regal Beloit Corporation

- Diehl Stiftung & Co. KG

- Smiths Group PLC

- Woodward Inc.

- Sinfonia Technology Co. Ltd.

- Crane Aerospace & Electronics LLC

- Astronics Corporation

- PBS Aerospace Inc.

- Dayton-Granger Inc.

- Calnetix Technologies LLC

- Chelton Limited

- Aerolec Technology Corporation

- Duryea Technologies Inc.

- Epropelled Systems Private Limited

- Motor Magnetics Inc.

- Technodinamika Corporation

- Plane Power Alternators LLC

- Arc Systems Inc.

The global aircraft generators market is segmented as follows:

By Aircraft Type

By Aircraft Type

- Fixed Wing

- Rotary-Wing

By Current Type

By Current Type

- Alternating Current (AC)

- Direct Current (DC)

By Power Rating

By Power Rating

- Less than 100 KW

- 100-500 KW

- More than 500 KW

By Technology

By Technology

- Electric

- Conventional

By End Use

By End Use

- OEM

- Aftermarket

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- HEICO Corporation

- Honeywell International Inc.

- General Electric Company

- RTX Corporation

- Boeing Co.

- Safran S.A.

- Thales Group

- Ametek Inc.

- TransDigm Group Inc.

- Regal Beloit Corporation

- Diehl Stiftung & Co. KG

- Smiths Group PLC

- Woodward Inc.

- Sinfonia Technology Co. Ltd.

- Crane Aerospace & Electronics LLC

- Astronics Corporation

- PBS Aerospace Inc.

- Dayton-Granger Inc.

- Calnetix Technologies LLC

- Chelton Limited

- Aerolec Technology Corporation

- Duryea Technologies Inc.

- Epropelled Systems Private Limited

- Motor Magnetics Inc.

- Technodinamika Corporation

- Plane Power Alternators LLC

- Arc Systems Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors