Search Market Research Report

Aircraft Electrical System Market Size, Share Global Analysis Report, 2025 – 2034

Aircraft Electrical System Market Size, Share, Growth Analysis Report By Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation Aircraft, Civil Aviation), By Component (Power Generation Systems, Power Distribution Systems, Power Conversion Systems, and Energy Storage Systems), By System Outlook (Generator, Conversion Devices, Distribution Devices, Battery Management Systems), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

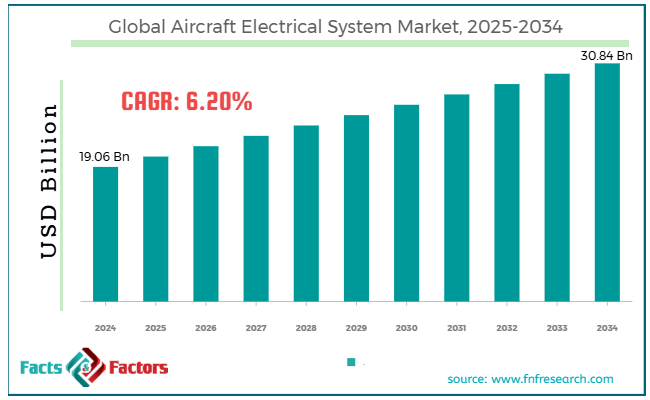

[215+ Pages Report] According to Facts & Factors, the global aircraft electrical system market size was worth around USD 19.06 billion in 2024 and is predicted to grow to around USD 30.84 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.20% between 2025 and 2034.

Market Overview

Market Overview

An aircraft electrical system is a vital unit that powers indispensable functions like communication, navigation, engine starting, instrumentation, and lighting. It usually comprises alternators or generators, bus bars, batteries, wiring, and circuit breakers. The system runs on a combination of 115/200-volt AC and 28-volt DC in large commercial airplanes or a 28-volt DC power supply in small airplanes. The global aircraft electrical system market is expected to grow considerably over the estimated period owing to the rising demand for MEA or more electric aircraft, improvements in battery technology and power electronics, and the emergence of hybrid-electric and electric airplanes.

Manufacturers and airlines plan to reduce emissions and fuel consumption by replacing pneumatic and hydraulic systems with electrical substitutes. More electric airplanes depend on strong electrical systems, thus propelling the industry's growth.

Moreover, improvements in solid-state and lithium-sulfur batteries, along with high-voltage distribution and power converters, are increasing the feasibility of airplane electrification. Furthermore, leading companies like Ampaire and Eviation, also known as Alice aircraft, are developing hybrid and electric airplanes, which require new electrical system designs.

Nevertheless, a few barriers to global market growth comprise significant development and installation charges, technological challenges in aircraft design, and space and weight constraints. Integrating enhanced systems requires high funding, upfront investment, and aircraft system redesign.

Moreover, aviation authorities like EASA and FAA have imposed strict safety regulations. Obtaining novel electrical systems certified is a costly and time-consuming procedure. Electrical systems increase weight and need careful design to prevent impacting aircraft performance and aerodynamics.

However, some opportunities positively impacting the global aircraft electrical system industry include retrofitting older aircraft with improved electrical systems, modernization in battery technology, and assimilation of renewable energy sources. Airlines are capitalizing on upgrading legacy aircraft with newer, efficient electrical systems to improve performance and extend durability.

Also, improvements in energy density, thermal management, and fast charging will unlock more potential in electrical aviation. Furthermore, integrating hydrogen fuel cells and solar panels in aircraft electrical systems, mainly for UAM vehicles and drones, may decrease dependency on fossil fuels and lower carbon footprints.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft electrical system market is estimated to grow annually at a CAGR of around 6.20% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft electrical system market size was valued at around USD 19.06 billion in 2024 and is projected to reach USD 30.84 billion by 2034.

- The aircraft electrical system market is projected to grow significantly owing to the rising demand for more electric aircraft, the growing need to reduce emissions and increase fuel efficiency, and improvements in power electronics.

- Based on aircraft type, the commercial aircraft segment is expected to lead the market, while the military aircraft segment is expected to grow considerably.

- Based on component, the power generation systems segment is the dominating segment among others, while the power distribution systems segment is projected to witness sizeable revenue over the forecast period.

- Based on the system outlook, the generator segment is expected to lead the market as compared to the distribution devices segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- How will the surging adoption of high-power batteries help drive the aircraft electrical system market growth?

Deploying high-power and high-density battery systems is vital for hybrid and electric aircraft. The high-power battery systems allow effective power production and distribution in electric airplanes. Weight reduction is another beneficial quality of using these batteries. Enhanced battery solutions contribute to lightweight airplanes, which offer better fuel efficiency. Also, effective battery systems reduce the need for regular replacement and maintenance.

The worldwide aircraft electrical system market is anticipated to reach 30.84 billion by 2032, driven by the surging demand for electric airplanes to decrease overall weight and maintenance costs of aircraft.

- Technological improvements in electrical systems considerably fuel the market growth

Improvements in power electronics, like integrated modular avionics, high-density batteries, and advanced power management systems, enhance the efficiency and reliability of aircraft electrical systems. It significantly enhances performance, boosts safety, and offers better energy efficacy. Advanced power management systems boost energy distribution, advancing the airplane's performance. Incorporating modular avionics systems improves flight safety and situational awareness. Moreover, high-density batteries provide additional power while enhancing fuel efficiency.

Honeywell Aerospace performed a test flight, demonstrating its (SURF-A) Surface Alert system and Smart X software. It is dedicated to improving safety by offering pilots alerts and warnings during challenging flight phases.

Restraints

Restraints

- Will cybersecurity threats negatively impact the progress of the aircraft electrical system market?

As aircraft electrical systems grow interlinked, they become more vulnerable to cyberattacks. This notably increases threats of attacks and operational disturbances. Aircraft electrical systems are vulnerable to hacking, seeking to gain illegal access. Cyberattacks may compromise flight safety and result in operational troubles.

A recent review underscored that the aviation sector experiences threats from APT (Advanced Persistent Threat) groups associated with state actors to potentially compromise critical systems and intellectual property.

Opportunities

Opportunities

- Are defense and military applications expected to contribute to the aircraft electrical system industry's progress?

The defense industry's demand for improved aircraft with enhanced range, versatility, and reliability fuels the need for modernized electrical systems. Military applications can benefit from improved electrical systems that generate high power and effective energy management.

Safran Electrical & Power accepted the supply of starter-generation solutions for the U.S. Army's FLRAA (Future Long Range Assault Aircraft) program in May 2024. It underscored the rising demand for improved electrical systems in military applications. This significantly impacts the progress of the aircraft electrical system market.

Challenges

Challenges

- System reliability and complexity in integration restrict the growth of the market

Incorporating advanced electrical systems in airplane designs offers significant challenges in promising performance and reliability. Incorporation challenges may result in increased development costs, longer project timelines, and possible reliability issues.

The development of a hybrid-electric eSTOL airplane by Electra.aero incorporates electric propulsion systems to decrease sound and support ultra-short runway functions. It demonstrates the intricacies included in such amalgamations.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 19.06 Billion |

Projected Market Size in 2034 |

USD 30.84 Billion |

CAGR Growth Rate |

6.20% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Safran S.A., Honeywell International Inc., Raytheon Technologies Corporation (Collins Aerospace), Thales Group, GE Aerospace (formerly GE Aviation), Eaton Corporation, Meggitt PLC, Liebherr Group (Aerospace Division), Astronics Corporation, Crane Aerospace & Electronics, AMETEK Inc., Parker-Hannifin Corporation, Diehl Aerospace GmbH, Teledyne Technologies Incorporated, InterConnect Wiring, and others. |

Key Segment |

By Aircraft Type, By Component, By System Outlook, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global aircraft electrical system market is segmented based on aircraft type, component, system outlook, and region.

Based on aircraft type, the global industry is divided into commercial aircraft, military aircraft, general aviation aircraft, and civil aviation. The commercial aircraft segment registered a substantial market share, accounting for more than 66% of the total share. This growth is backed by prominent carriers like Emirates, American Airlines, Air India, and more, which experience higher demand. Airlines also invest in more electric airplane technologies to decrease fuel consumption, maintenance costs, and emissions. The advanced in-flight entertainment, seat power outlets, Wi-Fi, and mood lighting demand strong electrical systems, thus impacting segmental growth. Moreover, commercial airplanes are manufactured in large volumes, elevating the demand for electrical systems.

Based on component, the global aircraft electrical system industry is segmented into power generation, distribution, conversion, and energy storage systems. The power generation systems category registered a maximum market share owing to their vital role in supplying power to the aircraft. Electric aircraft require strong onboard generation systems for avionics and propulsion. Projects like Rolls-Royce and Eviation’s Alice's hybrid-electric propulsion systems are the best examples. Moreover, power demand has noticeably surged with the growing demand for in-flight entertainment, galley systems, and powered seats. Fighter jets utilize advanced generation systems to power weapons, radar, and stealth systems.

Based on the system outlook, the global market is segmented into generators, conversion devices, distribution devices, and battery management systems. The generator segment held a larger market share as it forms the core of an aircraft’s electrical system. Newer airplanes are embedded with electric systems that replace pneumatics and hydraulics with electric actuation. Modern commercial jets require 1 MW of power; for instance, Boeing 787 produces 1000 kW. Furthermore, airplanes like Rolls-Royce Spirit of Innovation, Eviation Alice, and Joby Aviation eVTOL depend on efficient generation systems.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America dominates the global aircraft electrical system market due to industry infrastructure, technological improvements, and strategic initiatives. The region is leading in developing more electrical aircraft, emphasizing replacing older pneumatic and hydraulic systems with electrical systems to optimize fuel efficiency and lessen emissions.

Moreover, major capitalizing on research and development by businesses like Pratt & Whitney, Honeywell, and General Electric fuels innovation in storage technologies, power generation, and conversion. Also, the presence of key aerospace producers like Lockheed Martin and Boeing, coupled with a strong supply chain, backs the demand for improved electrical systems.

Programs like the FAA's NextGen plan to improve aircraft systems and air traffic control, triggering the use of advanced electrical solutions. In addition, associations between research institutions and aerospace companies streamline the deployment and development of modernized electrical systems.

- What factors contribute to the Asia Pacific region's growth in the aircraft electrical system market?

Asia Pacific is projected to progress as the second-leading region in the global aircraft electrical system industry owing to the rising air passenger traffic, expansion of the fleet, defense modernization, and enhancing aircraft manufacturing capabilities. Asia Pacific has been accountable for most global passenger traffic, with a yearly rate of 8.4%, exceeding the global 6.5% average traffic. The region is projected to register over 17,000 modern passenger airplanes in the coming 10 years, demonstrating a roughly 41% rise in global deliveries.

Moreover, economies like China, South Korea, and India are heavily investing in improving their military fleet, propelling the need for advanced electrical systems. Also, nations like India and China are improving their aerospace manufacturing capabilities, adding to the rise of the global market. These countries also emphasize developing indigenous aircraft programs, propelling the need for improved electrical systems.

Competitive Analysis

Competitive Analysis

The global aircraft electrical system market profiles players like:

- Safran S.A.

- Honeywell International Inc.

- Raytheon Technologies Corporation (Collins Aerospace)

- Thales Group

- GE Aerospace (formerly GE Aviation)

- Eaton Corporation

- Meggitt PLC

- Liebherr Group (Aerospace Division)

- Astronics Corporation

- Crane Aerospace & Electronics

- AMETEK Inc.

- Parker-Hannifin Corporation

- Diehl Aerospace GmbH

- Teledyne Technologies Incorporated

- InterConnect Wiring

Key Market Trends

Key Market Trends

- Smart & Digital Power Distribution Systems:

Digital power distribution systems use digital control units and solid-state power controllers (SSPCs) that manage and monitor power flow via airplanes in real-time. It enhances redundancy and operational safety, allows faster fault detection and predictive maintenance, and lessens the risk of circuit failure and power overload.

For example, the Airbus A350 utilizes distributed electrical systems with digital monitoring and smart bus models for better maintenance and enhanced reliability.

- Low-Weight & Modular Electrical Components:

Aircraft Tier 1 suppliers and OEMs are concentrating on decreasing the weight of wire bundles and incorporating modular systems to enhance aircraft performance and design flexibility. It helps save kilograms of weight and reduces carbon emissions and fuel consumption. It also aids modular systems in streamlining upgrades, maintenance, and assembly.

The global aircraft electrical system market is segmented as follows:

By Aircraft Type Segment Analysis

By Aircraft Type Segment Analysis

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

- Civil Aviation

By Component Segment Analysis

By Component Segment Analysis

- Power Generation Systems

- Power Distribution Systems

- Power Conversion Systems

- Energy Storage Systems

By System Outlook Segment Analysis

By System Outlook Segment Analysis

- Generator

- Conversion Devices

- Distribution Devices

- Battery Management Systems

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Safran S.A.

- Honeywell International Inc.

- Raytheon Technologies Corporation (Collins Aerospace)

- Thales Group

- GE Aerospace (formerly GE Aviation)

- Eaton Corporation

- Meggitt PLC

- Liebherr Group (Aerospace Division)

- Astronics Corporation

- Crane Aerospace & Electronics

- AMETEK Inc.

- Parker-Hannifin Corporation

- Diehl Aerospace GmbH

- Teledyne Technologies Incorporated

- InterConnect Wiring

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors