Search Market Research Report

Active Pharmaceutical Ingredients Market Size, Share Global Analysis Report, 2023 – 2030

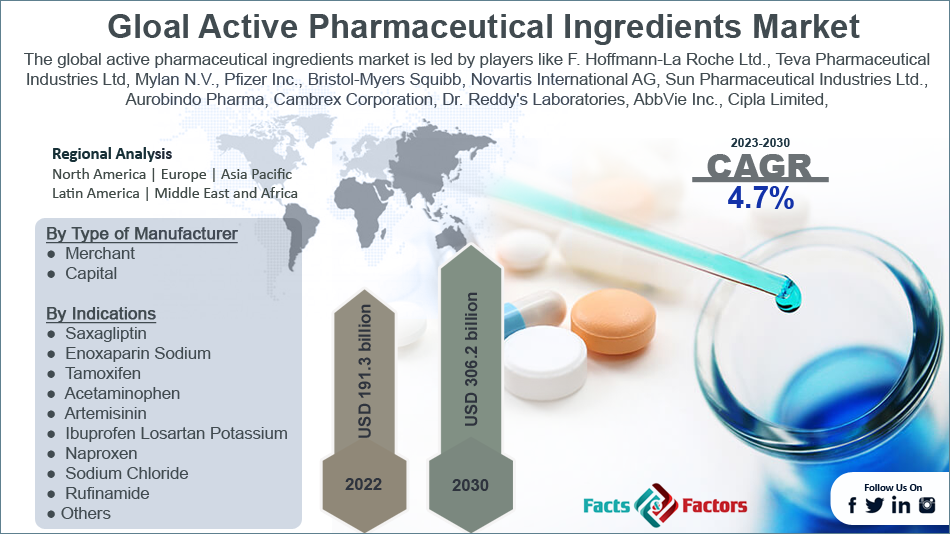

Active Pharmaceutical Ingredients Market Size, Share, Growth Analysis Report By Type (Generic Active Pharmaceutical Ingredients and Innovative Active Pharmaceutical Ingredients), By Molecule (Large and Small), By Type of Manufacturer (Merchant and Capital), By Indications (Saxagliptin, Enoxaparin Sodium, Tamoxifen, Acetaminophen, Artemisinin, Ibuprofen Losartan Potassium, Naproxen, Sodium Chloride, Rufinamide, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

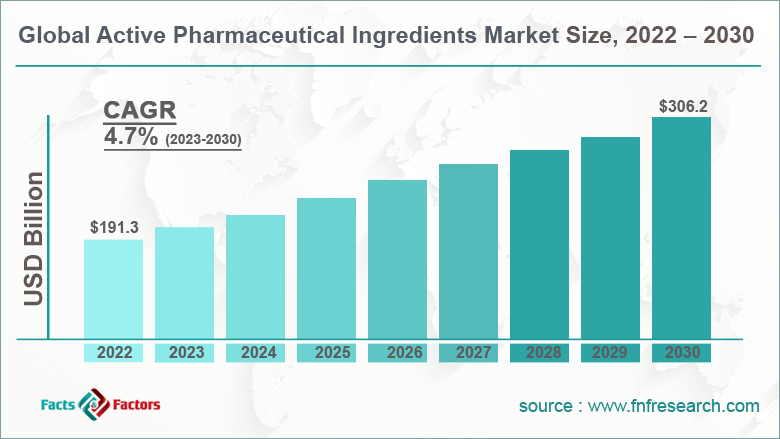

[225+ Pages Report] According to the report published by Facts Factors, the global active pharmaceutical ingredients market size was worth around USD 191.3 billion in 2022 and is predicted to grow to around USD 306.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.7% between 2023 and 2030. The report analyzes the global active pharmaceutical ingredients market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the active pharmaceutical ingredients market.

Market Overview

Market Overview

The market, also known as the API market, refers to the activities surrounding the production and sales of chemical compounds that are used in the process of pharmaceutical drug production. The ingredients are medication components used to produce desired therapeutic results and are biologically active. The industry is one of the crucial segments of the larger pharmaceutical sector as these ingredients form integral components during the process of safe and effective drug production.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global active pharmaceutical ingredients market is estimated to grow annually at a CAGR of around 4.7% over the forecast period (2022-2030)

- In terms of revenue, the global active pharmaceutical ingredients market size was valued at around USD 191.3 billion in 2022 and is projected to reach USD 306.2 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing demand for effective drugs

- Based on the type of manufacturer segmentation, the capital was predicted to show maximum market share in the year 2022

- Based on type segmentation, generic active pharmaceutical ingredients was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Growing demand for effective drugs to propel market demand

The global active pharmaceutical ingredients market is projected to grow owing to the increasing demand for effective drugs due to several factors. One of the crucial reasons is the increasing number of people suffering from a range of medical conditions. The population is prone to suffering from generic conditions like cold, fever, headache, and others while there is a growing segment that suffers from more serious medical conditions like cancer, arthritis, cardiovascular diseases, and diabetes to name a few. Furthermore, with an increasing diagnosis of people contracting mental health conditions like anxiety and depression due to several socio-economic-political factors increasing at a rapid rate.

Restraints

Restraints

- Cost pressure to restrict the market growth

One of the key growth restraints in the global industry is the cost pressure that is associated with the production of APIs and their distribution. The rising price of raw materials impacted by changing political tension and dynamics along with the significant cost attributed to the requirement of intense research and study to develop effective APIs and meet regulatory compliances are factors that can potentially limit the growth trajectory of the industry.

Opportunities

Opportunities

- Growing demand for personalized medicines to provide growth opportunities

The global industry players can benefit from the rising demand for personalized medicines across the globe. Factors that are contributing to the customization of medicines include the increasing prevalence of complex diseases, advancements in molecular biology and genomics, the cost-effectiveness of personalized medicines, the increasing availability of health data, and patient empowerment.

Challenges

Challenges

- Concerns over intellectual property rights to challenge market growth

The market struggles with maintaining momentum in terms of innovation and competition due to the protection of intellectual rights undertaken by industry players. This can potentially limit the availability of affordable APIs in the pharmaceutical industry leading to a large segment of the population outside the consumer group.

Furthermore, growing concerns over the availability of poor-quality products due to the absence of laws for reinforcing regulatory procedures could impact the trust of the stakeholders which can create multiple challenges during the projection period.

Segmentation Analysis

Segmentation Analysis

The global active pharmaceutical ingredients market is segmented based on type, molecule, type of manufacturer, indications, and region.

Based on type, the global market segments are generic active pharmaceutical ingredients and innovative active pharmaceutical ingredients

- Although both segments are crucial for overall market growth, the revenue size for generic APIs is more than innovative segment

- The major factors driving the segmental growth are increasing demand for affordable healthcare and the generally low prices of generic medicines as compared to the counterparts

- Innovative APIs are new biologics or drugs and are developed through extensive research and development programs. These APIs are protected against infringement with the help of patents causing the producer to charge higher prices

- As per a 2019 study by the IQVIA Institute for Human Data Science, generic medicines in the US were recorded to be 94% less in cost as compared to innovative medicines

Based on the molecule, the global market divisions are large and small.

Based on the type of manufacturer, the global market segments are merchant and capital.

- Both capital and merchant segments can lead the market depending on several factors

- However, in 2022, the industry was dominated by the capital segment

- In most cases, APIs are developed by capital-intensive players like Teva Pharmaceuticals, Pfizer, and other

- Since research & development of APIs is expensive and required advanced resources, it is generally the large companies that play an extensive role in the development of new APIs

- In 2020, Teva Pharmaceuticals generated over USD 16.5 billion in revenue

Based on indications, the global market is divided into saxagliptin, enoxaparin sodium, tamoxifen, acetaminophen, artemisinin, ibuprofen, losartan potassium, naproxen, sodium chloride, rufinamide, and others.

Recent Developments:

Recent Developments:

- In October 2021, Everest Organics Limited, an India-based manufacturer of generic medicines, announced that it had started the development of API for the generic version of molnupiravir, developed by Merck & Co. The medicine is an experimental antiviral drug that is used for the treatment of mild to moderate Covid-19 infection

- In March 2022, the Indian Union Ministry announced that the production of 35 APIs was already initiated in the country which was encouraged by the announcement of a production scheme for the region’s pharmaceutical sector. The 35 APIs are a part of 53 APIs, for which the country currently has an import dependence of 90%

- In February 2023, the US Food and Drugs Administration (FDA) authority initiated new measures to restrict and control the illegal import of Xylazine APIs and associated finished products. The chemical is increasingly being incorporated into illicit drugs giving rise to growing public health concerns

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 191.3 Billion |

Projected Market Size in 2030 |

USD 306.2 Billion |

CAGR Growth Rate |

4.7% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd, Boehringer Ingelheim, Sanofi, Mylan N.V., Pfizer Inc., Bristol-Myers Squibb, Novartis International AG, Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cambrex Corporation, Dr. Reddy's Laboratories, AbbVie Inc., Cipla Limited, BASF SE, GlaxoSmithKline plc, Merch & Co, Lonza Group, Daiichi Sankyo Company Limited, and others. |

Key Segment |

By Type, Molecule, Type of Manufacturer, Indications, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to witness the highest growth

The global active pharmaceutical ingredients market is projected to witness the highest growth in Asia-Pacific during the projection period as it is currently the most dominant region in the industry. The growth is led by countries like China and India which are witnessing tremendous growth in the production of APIs due to several factors. The countries boast of a well-established pharmaceutical sector especially in the manufacturing wing since they are home to large-scale production sites with a client base from across the globe.

Furthermore, the regional governments have amped up their efforts to promote the industry even higher and reduce import dependence on medicines from international countries. Additionally, India and China have a large pool of skilled professionals along with supportive governmental regulations for the production of APIs. Europe and North America are also important contributors due to the growing research and product innovation activities.

Competitive Analysis

Competitive Analysis

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd

- Boehringer Ingelheim

- Sanofi

- Mylan N.V.

- Pfizer Inc.

- Bristol-Myers Squibb

- Novartis International AG

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Cambrex Corporation

- Dr. Reddy's Laboratories

- AbbVie Inc.

- Cipla Limited

- BASF SE

- GlaxoSmithKline plc

- Merch & Co

- Lonza Group

- Daiichi Sankyo Company Limited.

The global active pharmaceutical ingredients market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Generic Active Pharmaceutical Ingredients

- Innovative Active Pharmaceutical Ingredients

By Molecule Segment Analysis

By Molecule Segment Analysis

- Large

- Small

By Type of Manufacturer Segment Analysis

By Type of Manufacturer Segment Analysis

- Merchant

- Capital

By Indications Segment Analysis

By Indications Segment Analysis

- Saxagliptin

- Enoxaparin Sodium

- Tamoxifen

- Acetaminophen

- Artemisinin

- Ibuprofen Losartan Potassium

- Naproxen

- Sodium Chloride

- Rufinamide

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd

- Boehringer Ingelheim

- Sanofi

- Mylan N.V.

- Pfizer Inc.

- Bristol-Myers Squibb

- Novartis International AG

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Cambrex Corporation

- Dr. Reddy's Laboratories

- AbbVie Inc.

- Cipla Limited

- BASF SE

- GlaxoSmithKline plc

- Merch & Co

- Lonza Group

- Daiichi Sankyo Company Limited.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors