Search Market Research Report

Vegan Supplements Market Size, Share Global Analysis Report, 2023 – 2030

Vegan Supplements Market Size, Share, Growth Analysis Report By Sales Channel (Online Retail Stores, Department Stores, Convenience Stores, Pharmacies & Drug Stores, Hypermarkets, And Others), By Ingredients (Vitamins & Minerals, Amino Acids & Protein, Herbals & Botanicals, And Others), By Form (Gummies, Bars, Gels, Tablets, And Powders), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

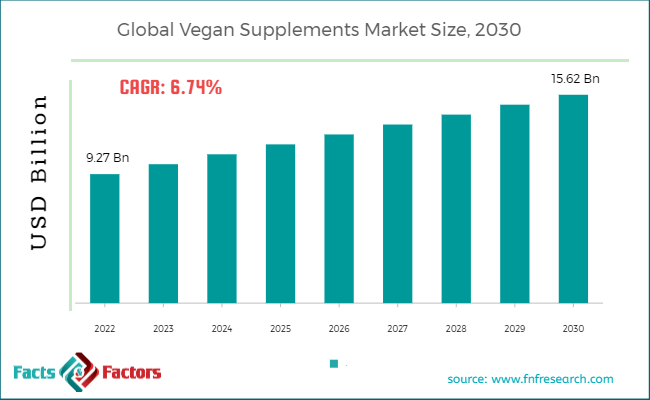

[228+ Pages Report] According to Facts and Factors, the global vegan supplements market size is valued at USD 9.27 billion in 2022 and is anticipated to reach USD 15.62 billion during 2023-2030. The global vegan supplements market is expected to grow at an annual compound rate of 6.74% during the forecast period.

The report comprehensively analyzes the vegan supplements industry’s growth factors, barriers, opportunities, and challenges during the forecast period. It also covers the geographical market and offers a comprehensive study of the competitive landscape in the global marketplace.

Market Overview

Market Overview

Vegan supplements refer to plant-based dietary supplements. These supplements do not include any animal-derived ingredients and are ideal for people who choose to follow the vegan lifestyle. Vegan supplements help bridge nutritional gaps in the plant-based diets to fulfill daily nutritional requirements.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global vegan supplements market size is estimated to grow annually at a CAGR of around 6.74% over the forecast period (2023-2030).

- In terms of revenue, the global vegan supplements market size was valued at around 9.27 billion in 2022 and is projected to reach 15.62 billion by 2030.

- Increasing awareness regarding vegan diets is likely to drive the growth of the global vegan supplements market.

- Based on the sales channel, the pharmacies & drug store segment is noted to observe significant growth in the global market.

- Based on the ingredients, the vitamins & minerals segment accounts for the largest share of the global market.

- Based on the form, the powder segment is expected to register a prominent growth rate in the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing awareness regarding vegan diets is expected to boost the growth of the global market.

Growing awareness regarding the harmful effects of animal-based diets on the human body is diverting people towards plant-based vegan diets. Additionally, the rising issues of environmental health and animal cruelty are further encouraging people to go for vegan products.

Therefore, such a landscape will propel the growth of the global vegan supplements market during the forecast period. People are increasingly focusing on their health and awareness, which in turn is also expected to accentuate the growth of the industry. For instance, Beyond Meat in January 2021 partnered with PepsiCo. The collaboration aims to offer the best quality plant-based drinks and snacks.

Restraints

Restraints

- Limited nutrient sources are expected to hamper the growth of the global market.

Omega 3 fatty acids, vitamin B12, and others are majorly found in animal-based products. Therefore, manufacturing supplements with such ingredients is a big challenge in the vegan supplements industry. Additionally, creating similar tastes and texture is also likely to hamper the growth of the industry.

Opportunities

Opportunities

- Innovation and product development are likely to offer lucrative growth opportunities in the global market.

Companies are increasing their investments in research and development activity to come up with new and improved vegan supplements. Companies are constantly improving their formulations to achieve nutritional profiles as their animal counterparts and also improve flavor and texture. Such innovations are expected to appeal to a broader audience, thereby widening the scope of the global vegan supplements market.

Fitness enthusiasts and athletes are increasingly adopting plant-based diets to support muscle recovery and enhance performance which in turn positively influences other people to come up with vegan diets and supplements. For instance, Nutritional Growth Solution came up with multivitamin shakes in 2022 for kids and children in the vegan sector.

Challenges

Challenges

- Consumer skepticism is a major challenge in the global market.

Misleading marketing tactics and greenwashing of the practices confuse consumers. Also, consumers are confused regarding the sustainability and authenticity of vegan supplements, which is a big challenge in the global vegan supplements industry. Moreover, the availability of limited options in vegan supplements, which in turn is also likely to slow down the group of the global market.

Segmentation Analysis

Segmentation Analysis

The global vegan supplements market can be segmented into sales channels, ingredients, form, and region.

By sales channel, the market can be segmented into online retail stores, department stores, convenience stores, pharmacies & drug stores, hypermarkets, and others. The pharmacies & drug store segment is noted to observe significant growth in the forthcoming years due to the wide expansion of pharmacy retail stores. Drug stores are ubiquitously increasing, thereby offering convenience to customers to buy pharmaceutical products like supplements.

Also, the health care professional recommendation impacts the minds of consumers, which in turn propels them to purchase the products from the advised pharmacist or drug stores, thereby leading to an increase in the sales of the segment.

However, the online retail store segment is also likely to grow steadily in the forthcoming years due to the increasing coverage of online e-commerce stores globally. Online stores offer discounts, convenience, a wide number of products, and several other attractive parameters to encourage people to shop online. Therefore, the online retail store segment is likely to flourish in the vegan supplement industry.

By ingredients, the market can be segmented into vitamins & minerals, amino acids & protein, herbals & botanicals, and others. The vitamins and minerals segment accounts for the largest share of the global vegan supplements market. The growth can be highly attributed to the nutritional requirements of the human body. Vitamins and minerals are the essential micronutrients required for the proper working of the human body. Vegan diets require additional supplementation to meet the daily needs of individuals.

Additionally, there are certain ingredients that are only found in animal-based products, which limits vegan diets. Therefore, supplementation helps in preventing these deficiencies in the human body. Certain essential nutrients like vitamin D, calcium, iron, and Vitamin B12 are required externally to meet the nutritional requirement.

By form, the market can be segmented into gummies, bars, gels, tablets, and powders. The powder segment is expected to register a prominent growth rate during the anticipated period due to the high sales of vegetarian protein powder.

Additionally, the sports and fitness community is inclining more towards plant-based nutrition, thereby increasing the popularity of a vegan lifestyle. Vegetarian protein powder, meal replacement powders, and other powdered supplements are the most consumed vegan supplements all across the globe. Powder supplements offer a convenient and easy way to consume the ingredient without much hassle. Additionally, it is more easily digested in the body than the other available forms.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 9.27 Billion |

Projected Market Size in 2030 |

USD 15.62 Billion |

CAGR Growth Rate |

6.74% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

PepsiCo Inc., Ora Organic, Nutrazee, NOW Foods, Nestlé S.A., Jarrow Formulas Inc., HTC Health, Eversea Inc., DuPont de Nemours Inc., Deva Nutrition LLC, Amway Corp., Aloha Inc., Garden of Life, Vega, Sunwarrior, Nutiva, Nature's Plus, Now Foods, Pure Synergy, Amazing Grass, and Others. |

Key Segment |

By Sales Channel, By Ingredients, By Form, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America accounts for the largest share of the global market.

North America accounts for the largest share of the global vegan supplements market in the forthcoming years due to the high demand for vegan protein powder in the region. The major reason for the growth of plant-based protein is the growing cases of lactose intolerance in the region.

Furthermore, the shifting perception of people from animal-based supplements to plant-based food products is also likely to support the growth trajectory of the regional market. Additionally, the retail sector in the region is adopting plant-based food items, which is further expected to thrive the growth of the market.

Asia Pacific is likely to grow steadily during the forecast period due to the rising trend of preventive healthcare practices. Growing cases of vitamin deficiency among people in the region are also anticipated to strengthen the growth of the regional market. Manufacturers and retailers are coming up with innovative solutions like customization according to individual requirements which are also expected to swipe larger market revenue.

For instance, Indian vegan supplements and sports nutrition came up with a range of innovative products, sublingual from beetroot extract to caffeine strips, to enhance the health quality of endurance athletes in April 2022.

Europe is another region expected to experience a high growth rate during the forecast period. The growing intervention by the government regarding the labeling of ingredients on products is also promoting the adoption of vegan products in the region. Moreover, the rising awareness among people regarding the health benefits of vegan supplements will also support the market's growth during the anticipated period.

Competitive Analysis

Competitive Analysis

The key leaders in the global vegan supplements market include:

- PepsiCo Inc.

- Ora Organic

- Nutrazee

- NOW Foods

- Nestlé S.A.

- Jarrow Formulas Inc.

- HTC Health

- Eversea Inc.

- DuPont de Nemours Inc.

- Deva Nutrition LLC

- Amway Corp.

- Aloha Inc.

- Garden of Life

- Vega

- Sunwarrior

- Nutiva

- Nature's Plus

- Now Foods

- Pure Synergy

- Amazing Grass

For instance, Holland & Barrett revealed its collaborations with Deliveroo in 2020 to provide a range of its health products profile on the Deliveroo app.

The global vegan supplements market is segmented as follows:

By Sales Channel Segment Analysis

By Sales Channel Segment Analysis

- Online Retail Stores

- Department Stores

- Convenience Stores

- Pharmacies & Drug Stores

- Hypermarkets

- Others

By Ingredients Segment Analysis

By Ingredients Segment Analysis

- Vitamins & Minerals

- Amino Acids & Protein

- Herbals & Botanicals

- Others

By Form Segment Analysis

By Form Segment Analysis

- Gummies

- Bars

- Gels

- Tablets

- Powders

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- PepsiCo Inc.

- Ora Organic

- Nutrazee

- NOW Foods

- Nestlé S.A.

- Jarrow Formulas Inc.

- HTC Health

- Eversea Inc.

- DuPont de Nemours Inc.

- Deva Nutrition LLC

- Amway Corp.

- Aloha Inc.

- Garden of Life

- Vega

- Sunwarrior

- Nutiva

- Nature's Plus

- Now Foods

- Pure Synergy

- Amazing Grass

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors