Search Market Research Report

Smart Lighting Market Size, Share, Growth, Trends Analysis Forecast 2020-2026

Smart Lighting Market By Installation Type (New Installation, and Retrofit), By Offering (Hardware, Software, and Services), By End-use Application (Indoor and Outdoor), and By Communication Technology (Wired, and Wireless): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Industry Insights

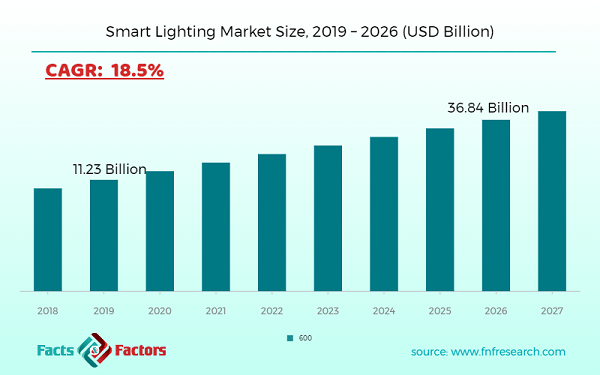

[195+ Pages Report] According to the report published by Facts and Factors, the global smart lighting market size was valued around USD 11.23 billion in 2019 and is expected to grow to around USD 36.84 billion in 2026 with a compound annual growth rate (CAGR) of roughly 18.5% between 2020 and 2026. The report analyzes the global smart lighting market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the smart lighting market.

Market Overview

Market Overview

Smart Lighting is one of the most important lighting solutions for offering solutions for both outdoor and indoor uses using the latest upgraded technology products like LEDs, fluorescent bulbs, Luminaires, and other lighting solutions. When opposed to conventional incandescent and halogen lighting, smart lighting has greater energy efficiency. The key aim is to have longevity in terms of breakage resistance and vibration immunity. Street lighting, tunnel and bridge lighting, architectural, industrial, office lighting, and projection lighting are all examples of smart lighting applications. Smart lighting is a lighting industry innovation that uses a control system to intelligently control light based on parameters such as occupancy, movement, temperature, amount of natural light, and so on. Lighting uses a lot of electricity, so it's expensive.

Industries and government agencies are concentrating on lowering energy consumption by replacing obsolete and advanced lighting control systems with more powerful and advanced lighting systems. Automated lighting control not only provides cost-effective and versatile lighting, but it also keeps track of the users' tasks. As a result, the market for smart lighting systems is skyrocketing. Wireless networking, for example, is a modern technology that is rapidly gaining traction. Smart lighting may be used in a range of environments, including residential, government buildings, manufacturing, and automobiles.

Industry Growth Factors

Industry Growth Factors

Government regulations around the world are pushing the smart lighting industry by restricting the use of outdated lighting technologies. Governments all over the world are trying to phase out outdated lamps like incandescent and halogen lamps and promote the use of environmentally sustainable lighting. Tungsten halogen and compact fluorescent lamps will be phased out of use in Europe by 2020, according to new EU regulations. According to the current Ecodesign Law, lamps must have a maximum standby capacity of 0.5W and a minimum energy requirement of 85 lumens. This will promote the selling of energy-saving lamps in the country. Governments around the world are also providing tax cuts and incentives to facilitate the use of more energy-efficient lighting technologies. This is a significant factor in the market's expansion.

The market's adoption has been driven by the rapid increase in the number of smart city development projects and investments. When the world becomes more industrialized and urbanized, so does the amount of energy consumed in cities. Cities are thought to consume more than 60% of the world's resources, with lighting alone accounting for 19% of global electricity consumption. Governments are dependent on advanced technology technologies to leverage assets and resources more efficiently in order to reduce energy usage and effectively manage resources. This is promoting the growth of smart city projects around the world, which will help the smart lighting industry meet demand.

However, when compared to conventional lighting alternatives, the massive prices of smart lighting solutions are a major stumbling block to the market's growth. Furthermore, the security problems surrounding the use of wired lighting and smart lighting systems will stymie market expansion.

Global Smart Lighting Market: Segmentation

Global Smart Lighting Market: Segmentation

Global smart lighting market is segmented into four notable segments which are offering, communication technology, installation type, and application type.

The industry is divided into three groups based on what they offer: hardware, software, and services. In 2019, the hardware segment is projected to expand at the fastest CAGR, reaching USD Billion in the forecast period of 2019 to 2026. Because of the increased use of LED lighting items such as luminaires, bulbs, and lamps for indoor and outdoor spaces, as well as increasing awareness about energy usage in LED lighting, the hardware segment is expected to dominate the global smart lighting market.

The market is divided into two groups of installations: new installations and retrofit installations. In the forecast period of 2019 to 2026, the retrofit installation category has the highest CAGR. Due to its lower installation cost as compared to new fixtures, the retrofit installation segment is expected to dominate the global smart lighting market.

The market is divided into wired and wireless network technology segments based on communication technology. In the forecast period of 2019 to 2026, wired technologies are projected to develop at the fastest CAGR. Wired infrastructure is gaining a greater share of the market because it is 20 percent to 30 percent less costly than wireless and uses less electricity. Due to growing accessibility of open source software and advances in wireless technologies, as well as rising demand for wireless smart lighting systems for both building and home automation, wireless technology is expected to develop at the fastest CAGR during the forecasting era.

The market is divided into two categories based on application type: outdoor application and indoor application.

Global Smart Lighting Market: Regional Analysis

Global Smart Lighting Market: Regional Analysis

Based on regions, the global Smart Lighting market can be divided into five main regions.

The Asia-Pacific area has seen substantial growth in the smart lighting industry over recent years and is projected to rise quickly over the predicted time span. Smart technology in the region is generated and developed; scaled up the smart lighting platform in both the private and trade sectors; and growing public infrastructure investments are raising demand growth in the region.

GSMA predicts that China will make up about one third of the world IoT connections by 2025 by about 4.1 billion IoT connections. The largest trend beneficiary over the projected timeframe is predicted to be smart lighting systems. The smart device technologies are being launched by technology giants in the region, including Tencent, JD, Baidu and Alibaba. In these giants, the majority of China's market share is spread. These brands are trendy and can fuel business demand.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 11.23 Billion |

Projected Market Size in 2026 |

USD 36.84 Billion |

CAGR Growth Rate |

18.5% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Awox SA, Control4 Corp, Cooper Lighting Solutions, Crestron Electronics Inc, Eve Systems GmbH, General Electric Company, Insteon (Smartlabs), KEA Systems BV, LG Electronics, Lutron Electronics, Sengled USA Inc, Signify Holdings, Wiz Connected Lighting, Wyze Labs Inc., and Others. |

Key Segment |

By Installation Type, By Offering, By End-use Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players in the Smart Lighting market

Some of the key players in the Smart Lighting market

- Awox SA

- Control4 Corp

- Cooper Lighting Solutions

- Crestron Electronics Inc

- Eve Systems GmbH

- General Electric Company

- Insteon (Smartlabs)

- KEA Systems BV

- LG Electronics

- Lutron Electronics

- Sengled USA Inc

- Signify Holdings

- Wiz Connected Lighting

- Wyze Labs Inc.

The global Smart Lighting market is segmented as follows:

By Installation Type:

By Installation Type:

- New Installation

- Retrofit

By Offering:

By Offering:

- Hardware

- Lights & Luminaires

- Smart bulbs

- Fixtures

- Lighting Controls

- LED drivers & ballasts

- Sensors

- Switches

- Manual on/off switches

- Electronic switches

- Dimmers

- Wired dimmers

- Wireless dimmers

- Relay units

- Gateways

- Software

- Local/Web Based

- Cloud Based

- Services

- Pre-installation Services

- Post-installation Services

By End-use Application:

By End-use Application:

- Indoor

- Residential

- Commercial

- Industrial

- Others

- Outdoor

- Highways & Roadways Lighting

- Architectural Lighting

- Lighting for Public Places

By Communication Technology:

By Communication Technology:

- Wired

- DALI

- PLC

- POE

- Wired Hybrid Protocols

- Wireless

- ZigBee

- Bluetooth/BLE

- EnOcean

- Wi-Fi

- 6LoWPAN

- Wireless Hybrid Protocols

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- The Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Mexico

- The Middle East and Africa

Table of Content

Industry Major Market Players

- Awox SA

- Control4 Corp

- Cooper Lighting Solutions

- Crestron Electronics Inc

- Eve Systems GmbH

- General Electric Company

- Insteon (Smartlabs)

- KEA Systems BV

- LG Electronics

- Lutron Electronics

- Sengled USA Inc

- Signify Holdings

- Wiz Connected Lighting

- Wyze Labs Inc.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors