Search Market Research Report

Smart Lighting Market Size, Share Global Analysis Report, 2024 – 2032

Smart Lighting Market Size, Share, Growth Analysis Report By Offering (Hardware, Software, and Services), By Application (Indoor and Outdoor), By Connectivity (Wired and Wireless), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

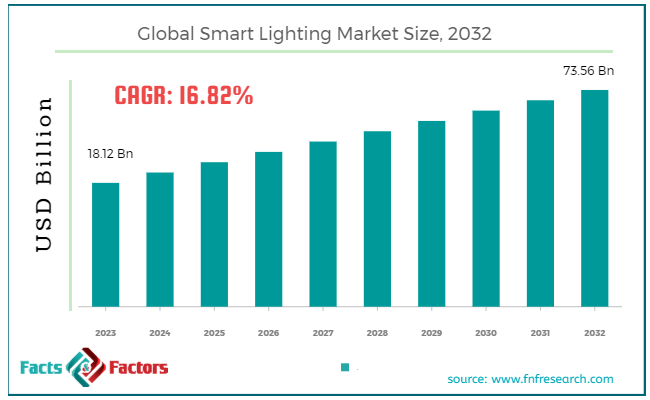

[213+ Pages Report] According to Facts & Factors, the global smart lighting market size in terms of revenue was valued at around USD 18.12 billion in 2023 and is expected to reach a value of USD 73.56 billion by 2032, growing at a CAGR of roughly 16.82% from 2024 to 2032. The global smart lighting market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Smart lighting refers to advanced lighting systems that can be controlled and customized through various methods, including wireless communication, mobile apps, voice commands, and automation. These systems typically involve the use of LED technology combined with intelligent control mechanisms, such as sensors and connectivity to the Internet of Things (IoT). Smart lighting allows users to adjust brightness, color, and lighting schedules remotely, often integrating with other smart home devices to enhance energy efficiency, convenience, and security. Key features of smart lighting include motion detection, daylight sensing, and the ability to create dynamic lighting environments that adapt to user preferences and activities.

The smart lighting market is experiencing rapid growth, driven by increasing demand for energy-efficient lighting solutions, advancements in IoT technology, and the rising adoption of smart home devices. The market includes a wide range of products such as smart bulbs, fixtures, control systems, and software applications. Major factors contributing to the market's expansion include government initiatives promoting energy conservation, the rising trend of smart cities, and consumer preference for technologically advanced lighting solutions that offer convenience and customization.

Key Highlights

Key Highlights

- The smart lighting market has registered a CAGR of 16.82% during the forecast period.

- In terms of revenue, the global smart lighting market was estimated at roughly USD 18.12 billion in 2023 and is predicted to attain a value of USD 73.56 billion by 2032.

- The smart lighting market is poised for significant growth, driven by the demand for energy-efficient solutions, technological advancements, and the increasing adoption of smart home technologies.

- Based on the offering, the hardware segment is growing at a high rate with a revenue share of 58.2% in 2023 and is projected to dominate the global market.

- By application, the indoor segment is projected to swipe the largest market share of around 66.5% in 2023.

- Based on the connectivity, the wired segment is expected to dominate the global market.

- By region, Europe is expected to dominate the global market.

Smart Lighting Market: Growth Drivers

Smart Lighting Market: Growth Drivers

- Energy Efficiency & Cost Savings: Soaring energy costs and growing environmental concerns make smart lighting's energy-saving capabilities highly attractive to consumers and businesses alike.

- Technological Advancements: The continuous evolution of LED technology, coupled with advancements in connectivity and smart home integration, unlocks new possibilities for smart lighting functionality and user experience.

- Rising Adoption of IoT: The increasing integration of the Internet of Things (IoT) in homes and workplaces creates a natural fit for smart lighting, allowing for seamless control and automation.

- Government Initiatives: Some governments are promoting energy efficiency through subsidies or tax breaks for smart lighting adoption, further accelerating market growth.

Restraints:

Restraints:

- Higher Initial Cost: Smart lighting systems typically have a higher upfront cost compared to traditional lighting fixtures, which can be a barrier for some budget-conscious consumers.

- Cybersecurity Concerns: As smart lighting connects to the internet, security vulnerabilities become a concern. Consumers may hesitate if data privacy or potential hacking risks are not adequately addressed.

- Limited Interoperability: Compatibility issues between different smart lighting brands and systems can create frustration for users who want a seamless experience.

- Lack of Awareness: Not everyone is aware of the benefits of smart lighting, and education is crucial to drive wider adoption.

Opportunities:

Opportunities:

- Focus on Affordability: Developing more cost-competitive smart lighting solutions can broaden the market reach and attract a wider range of consumers.

- Enhanced Security Features: Manufacturers who prioritize robust cybersecurity measures and user data privacy will gain a competitive edge.

- Standardization & Interoperability: Industry-wide efforts to promote interoperability between different smart lighting systems will enhance user experience and convenience.

- Integration with Smart Home Systems: Seamless integration with popular smart home platforms will further incentivize adoption and unlock exciting automation possibilities.

Challenges:

Challenges:

- Competition: The smart lighting market is becoming increasingly competitive, with numerous players vying for market share. This can lead to price pressure and the need for constant innovation to stand out.

- Rapid Technological Change: The fast pace of technological advancements in lighting and connectivity can make it challenging for manufacturers to keep their products future-proof and relevant.

- Consumer Skepticism: Overcoming consumer skepticism about the true value proposition of smart lighting requires effective communication and highlighting the long-term benefits.

Smart Lighting Market: Segmentation Analysis

Smart Lighting Market: Segmentation Analysis

The global smart lighting market is segmented based on offering, application, connectivity, and region.

By Offering Insights

By Offering Insights

Based on Offering, the global smart lighting market is divided into hardware, software, and services. The hardware segment is the largest in the smart lighting market, driven by the widespread adoption of advanced lighting components. This segment includes luminaires and lighting controls. Luminaires are complete lighting units, including light fixtures and bulbs. Smart luminaires are integrated with sensors and connectivity features that allow for remote control and automation. They are essential for both residential and commercial applications, providing energy efficiency and customizable lighting solutions.

Lighting controls include switches, dimmers, sensors, and other control devices that enable users to manage lighting settings. Lighting controls are pivotal in creating smart lighting environments, allowing for the automation of lighting based on occupancy, daylight availability, and user preferences.

The hardware segment is expected to dominate the market with a revenue share of 58.2% in 2023 and is expected to continue dominating due to the increasing demand for connected lighting systems. The hardware market is projected to grow at a significant CAGR driven by the popularity of smart bulbs and fixtures that offer features such as colour changing, dimming, and remote control?.

The software segment is crucial for the functionality of smart lighting systems, providing platforms and applications for control, management, and optimization. It is divided into web-based software and cloud-based software. Web-based software allows users to control and monitor their smart lighting systems through web interfaces. They are often integrated with other smart home systems for unified management. Cloud-based solutions offer advanced functionalities such as remote access, data analytics, and integration with IoT ecosystems. They enable seamless updates and scalability, making them ideal for large-scale and commercial applications?.

The software segment is registering growth at a CAGR of 23.4% between 2024 to 2032. This growth is driven by the increasing adoption of smart lighting for data-driven applications in smart cities and commercial environments. Software solutions enhance the efficiency and functionality of smart lighting systems, making them indispensable for modern lighting management

By Application Insights

By Application Insights

On the basis of Application, the global smart lighting market is bifurcated into indoor and outdoor. The indoor segment holds the largest share of the global market, accounting for approximately 66.5% of the total market revenue in 2023. This segment includes industrial, commercial, and residential applications. Indoor smart lighting systems are widely used in homes, offices, warehouses, retail spaces, and industrial facilities. The increasing adoption of smart home technologies drives the demand for smart lighting in residential settings. Homeowners are increasingly opting for smart bulbs, fixtures, and lighting control systems that offer convenience, energy savings, and enhanced aesthetics. Features such as voice control, remote operation, and customizable lighting scenes are particularly appealing to consumers?.

The outdoor segment is growing rapidly, fuelled by smart city initiatives and the need for energy-efficient public lighting solutions. This segment includes street lighting, architectural lighting, and lighting for public spaces such as parks and plazas. Outdoor segment is expected to grow at a CAGR of 23.6% from 2024 to 2032. Governments and municipalities are investing heavily in smart city projects, which include the deployment of smart street lighting systems. These systems are equipped with sensors and connectivity features that enable remote monitoring and control, improving energy efficiency and reducing maintenance costs?. Smart outdoor lighting enhances public safety by providing better illumination in streets, parks, and other public areas. Integrated sensors and cameras can monitor activities and alert authorities to potential security issues, making cities safer for residents and visitors.

By Connectivity Insights

By Connectivity Insights

Based on Connectivity, the global smart lighting market is categorized into wired and wireless. Wired segment holds the largest share of the market, accounting for approximately 65.1% of the total market revenue in 2023. Wired connectivity holds a significant share in the smart lighting market, particularly favoured in commercial and industrial applications where reliability and stability are paramount. Wired systems include technologies like Ethernet, Digital Addressable Lighting Interface (DALI), and Power over Ethernet (PoE).

Wired systems are less susceptible to interference and provide a stable connection, which is essential for critical applications like healthcare facilities, industrial environments, and large commercial buildings??. Wired connections support high data transmission rates, making them ideal for complex lighting systems that require robust communication capabilities? Wired systems offer enhanced security compared to wireless solutions, as they are less vulnerable to hacking and unauthorized access, ensuring safe and reliable operation?.

Wireless connectivity is gaining traction in the smart lighting market, particularly in residential and small to medium-sized commercial applications. Wireless systems include technologies such as Zigbee, Bluetooth, Wi-Fi, and Z-Wave. Wireless systems are easier to install and configure compared to wired systems, making them ideal for retrofitting existing buildings and for applications where flexibility is required?. Wireless lighting systems can be easily expanded or reconfigured, which is beneficial for dynamic environments like offices, retail spaces, and homes?.

Recent Developments:

Recent Developments:

- (January 2024): GE Lighting unveils the Cync Reveal HD+, the first and only full-color, edge-lit smart option in North America. Imagine your kitchen transformed into a vibrant canvas, bathed in a spectrum of hues at your fingertips.

- (May 2023): General Electric's introduction of the C by GE line expands its smart lighting offerings. This comprehensive range includes bulbs, switches, and sensors, all controllable through a dedicated app.

- (March 2023): Itron's contract with Duquesne Light Company signifies a significant step towards smarter cities. Itron's smart street lighting solution combines LED lights, sensors, and software for enhanced efficiency, data collection, and traffic management.

- (January 2023): Smart lighting manufacturer YEELIGHT is future-proofing its products. Their latest releases, including the Cube Smart Lamp, are designed to work seamlessly with the upcoming Matter standard, promoting interoperability across smart home devices.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 18.12 Billion |

Projected Market Size in 2032 |

USD 73.56 Billion |

CAGR Growth Rate |

16.82% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Acuity Brands Lighting Inc., Crestron Electronics Inc., Eve Systems GmbH, General Electric Company, Häfele, Honeywell International Inc., IDEAL INDUSTRIES INC., KEA Systems BV, LG Electronics, Lutron Electronics, Panasonic Corporation, RAB Lighting Inc., Schneider Electric, Sengled USA Inc, Signify Holding, Syska, Verizon, Wipro Lighting, YEELIGHT, and Others. |

Key Segment |

By Offering, By Application, By Connectivity, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Smart Lighting Market: Regional Analysis

Smart Lighting Market: Regional Analysis

- Europe is expected to dominate the global market during the forecast period

Europe accounted for the largest revenue share of 38.2% in 2023. The region is a pioneer in adopting smart lighting technologies, driven by stringent energy efficiency regulations and a strong focus on sustainability. European countries are investing heavily in smart infrastructure, including smart buildings and smart cities, which fuels market growth?. Europe holds a substantial share of the global smart lighting market, with significant contributions from countries like Germany, the UK, and France.

North America, particularly the United States, is a leading region in the smart lighting market due to boasting a diverse range of smart lighting brands, retailers, and a high concentration of early adopter consumers. North America is a leading market for smart lighting, driven by high adoption rates of smart home technologies and a strong emphasis on energy efficiency. The presence of major market players and supportive government policies further bolster market growth.

The Asia Pacific region is expected to experience the highest growth rate, with a projected CAGR of 25.3% during the forecast period from 2024 to 2032. This rapid growth is attributed to increasing urbanization, rising disposable incomes, and significant investments in smart city initiatives. China, Japan, India, and South Korea are leading this growth, driven by their expanding economies and technological advancements?.

Latin America is an emerging market for smart lighting, with growing awareness and adoption of energy-efficient lighting solutions. The region is seeing increased investments in urban development and infrastructure, which supports the market's expansion.

The Middle East and Africa are in the early stages of adopting smart lighting technologies. However, the region holds significant potential due to ongoing urbanization and infrastructure development projects. The market is expected to grow as more countries in the region invest in smart city initiatives.

Smart Lighting Market: List of Key Players

Smart Lighting Market: List of Key Players

Some of the main competitors dominating the global smart lighting market include;

- Acuity Brands Lighting, Inc.

- Crestron Electronics, Inc.

- Eve Systems GmbH

- General Electric Company

- Häfele

- Honeywell International Inc.

- IDEAL INDUSTRIES, INC.

- KEA Systems BV

- LG Electronics

- Lutron Electronics

- Panasonic Corporation

- RAB Lighting Inc.

- Schneider Electric

- Sengled USA Inc

- Signify Holding

- Syska

- Verizon

- Wipro Lighting

- YEELIGHT

The global smart lighting market is segmented as follows:

By Offering Segment Analysis

By Offering Segment Analysis

- Hardware

- Luminaires

- Lighting Controls

- Software

- Web Based

- Cloud Based

- Services

- Pre-installation Services

- Post-installation Services

By Application Segment Analysis

By Application Segment Analysis

- Indoor

- Industrial

- Commercial

- Residential

- Others

- Outdoor

- Street Lighting

- Architectural Lighting

- Lighting For Public Spaces

By Connectivity Segment Analysis

By Connectivity Segment Analysis

- Wired

- DALI

- PLC

- POE

- Wireless

- ZigBee

- Bluetooth

- Wi-Fi

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Acuity Brands Lighting, Inc.

- Crestron Electronics, Inc.

- Eve Systems GmbH

- General Electric Company

- Häfele

- Honeywell International Inc.

- IDEAL INDUSTRIES, INC.

- KEA Systems BV

- LG Electronics

- Lutron Electronics

- Panasonic Corporation

- RAB Lighting Inc.

- Schneider Electric

- Sengled USA Inc

- Signify Holding

- Syska

- Verizon

- Wipro Lighting

- YEELIGHT

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors