Search Market Research Report

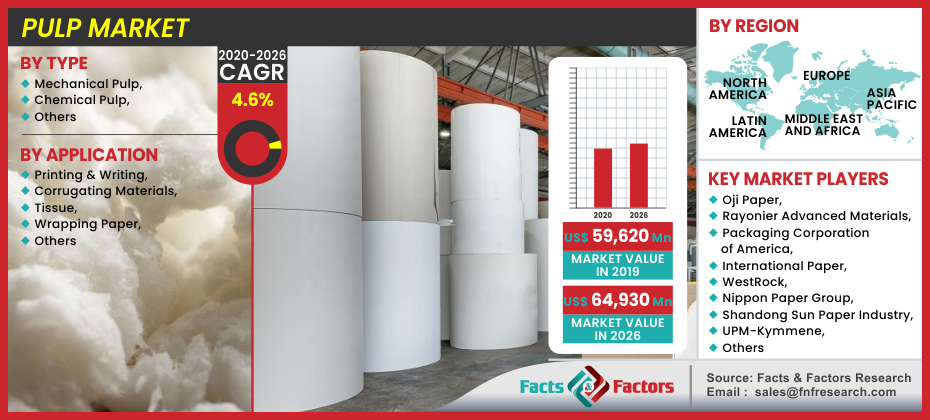

Pulp Market Size, Share Global Analysis Report, t By Type (Mechanical Pulp, Chemical Pulp, and Others), By Application (Printing & Writing, Corrugating Materials, Tissue, Wrapping Paper, and Others) : Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Pulp Market By Type (Mechanical Pulp, Chemical Pulp, and Others), By Application (Printing & Writing, Corrugating Materials, Tissue, Wrapping Paper, and Others) : Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Industry Insights

[195+ Pages Report] The global pulp market is set for rapid growth over the forecast period. In terms of revenue, the global pulp market accounted for USD 59,620.0 Million in 2019 and is anticipated to reach around USD 64,930.0 Million by 2026, growing at a CAGR of 4.6%.

Market Overview

Market Overview

Pulp is a wood-based raw material that is pure, organic, and biodegradable. It can be used to make paper, tissue, sheets, and advanced paper, all of which will be 100% organic bioproducts. Paper pulp is a raw material that is used to make paper. The rest of the paper is made from wood pulp. Paper has been around for a long time and is an important aspect of daily life. Due to increased demand from printing and writing applications, the pulp market is anticipated to grow.

Industry Growth Factors

Industry Growth Factors

The increasing demand from the corrugating materials industry is expected to drive the pulp market. Over the last few years, the textile industry has expanded its research spending. Jute and flax pulp would be easier to produce and products as a result of this trend. In addition, hemp pulp is gaining prominence in the textile industry. The increasing global demand for tissue paper, which is mainly used in kitchens, bathrooms, and homes, is expected to fuel market growth in the upcoming years. Increased demand for wood pulp from the paper industry, increasing customer demand for tissue paper products, and an increase in the trade-in wood pulp products have all been described as market factors. Stringent environmental legislation, especially concerning deforestation, as well as rising energy and transportation costs, have been identified as market restraints.

COVID-19 Impact

COVID-19 Impact

COVID-19's outbreak in 2020 has an impact on the global economy and business situation in major industries around the world. The global lockout has resulted in export constraints, trade practices, supply-chain uncertainty, and other events as a consequence of the pandemic scenario. During this time, primary end-use application industries for pulp, such as printing and writing, corrugated materials, tissue, and wrapping paper, were also impacted. This illustration has been drastically altered by the COVID-19 pandemic. China is now in the early stages of rehabilitation after taking draconian measures to contain the epidemic. The delayed response in the United States and Europe is increasingly evolving into a strong and all-encompassing response.

These policies will have an especially negative economic impact, and they have significantly raised the likelihood of a recession. The global economy has already started to exhibit signs of substantial decline, raising the risk and severity of a slowdown exponentially. Due to weak demand from end-use markets, the high-growth pulp market is projected to slow down in 2020. The economy, on the other hand, is improving, and enterprises have resumed operations with reduced capabilities and in line with government regulations. At the beginning of 2021, all end-use markets are projected to be fully operational, resulting in a strong demand for pulp. As a result, demand is expected to increase rapidly over the forecasted period. Several applicants from the printing and writing, corrugating materials, and paper sectors have shown interest in using pulp products to improve the quality of their products. During COVID-19 lockdowns, the pulp industry faced both a supply and demand crunch.

If COVID-19 infections spread across the workforce, plant capacity may be harmed unless appropriate preventative measures are taken. The lockdown slowed the manufacturing of pulp. Due to the lockdown, the supply of finished goods and the procurement of raw materials were also hindered in the supply chain and logistics. Because the majority of the pulp industry's production workforce is employed in on-site jobs that cannot be performed remotely, the industry may be particularly vulnerable. Furthermore, given the nature of the industry, businesses may need to consider how to generate social distancing in workplaces where workers are often crowded. Trade limitations, market fluctuations, production chain disruption, unpredictable demand, and workforce shortages are estimated to affect the chemical industry as a whole.

Global Pulp Market: Segmentation

Global Pulp Market: Segmentation

The global pulp market is bifurcated into its type, application, and regions. By type, the global market is divided into mechanical pulp, chemical pulp, and others. In 2019, the chemical pulp segment was the leading segment accounted for more than 70% of the market revenue share among the other segments. Based on application, the global pulp market is divided into printing & writing, corrugating materials, tissue, wrapping paper, and others. In 2019, the corrugating materials segment was the leading segment accounted for more than 30% of the market revenue share among the other segments. Geographically, the global pulp market is divided into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Global Pulp Market: Regional Analysis

Global Pulp Market: Regional Analysis

Asia Pacific region dominated the global pulp market in 2019 and is anticipated to continue its dominance in the upcoming years. The Asia Pacific market is also anticipated to a significant growth rate in the forecast period. The dominance of the Asia Pacific market can be attributed to the rapid industrialization and the growing paper industry in the region. The Chinese government has implemented several new regulations on waste paper importation in response to rising environmental awareness and safety concerns, resulting in a surge in demand from China. In terms of consumption, Germany, France, and the United Kingdom dominate the European pulp industry across a broad variety of applications. In addition, the arrival of major players is expected to fuel demand even further. The province's market for pulp would be driven by the heavy presence of influential pulp producers, as well as private sector investment in processing and expansion of R&D operations.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 59,620.0 Million |

Projected Market Size in 2026 |

USD 64,930.0 Million |

Growth Rate |

CAGR 4.6% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Oji Paper, Rayonier Advanced Materials, Packaging Corporation of America, International Paper, WestRock, Nippon Paper Group, Shandong Sun Paper Industry, UPM-Kymmene, Mitsubishi Paper Mills, and Stora Ensoamong others. |

Key Segment |

By Type, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Global Pulp Market: Competitive Players

Global Pulp Market: Competitive Players

Some of the key players in the pulp market are

- Oji Paper

- Rayonier Advanced Materials

- Packaging Corporation of America

- International Paper

- WestRock

- Nippon Paper Group

- Shandong Sun Paper Industry

- UPM-Kymmene

- Mitsubishi Paper Mills

- Stora Enso

Global Pulp Market: Regional Segment Analysis

Global Pulp Market: Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- The Middle-East and Africa

- GCC Countries

- South Africa

- Rest of Middle-East Africa

Table of Content

Industry Major Market Players

- Oji Paper

- Rayonier Advanced Materials

- Packaging Corporation of America

- International Paper

- WestRock

- Nippon Paper Group

- Shandong Sun Paper Industry

- UPM-Kymmene

- Mitsubishi Paper Mills

- Stora Enso

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors