Search Market Research Report

Preventive Medicine Market Size, Share Global Analysis Report, 2025 - 2034

Preventive Medicine Market Size, Share, Growth Analysis Report By Service Type (Screening & Early Detection Services, Vaccination & Immunization Services, Health Risk Assessment Services, Digital Health & Remote Monitoring Services, Genetic & Genomic Services), By Application (Cardiovascular Diseases Prevention, Diabetes Prevention, Cancer Prevention, Infectious Diseases Prevention, Respiratory Diseases Prevention, and Others), By End-User (Hospitals & Primary Care Centers, Ambulatory Surgical Centers [ASCs], Specialty Cardiac Centers, Corporate & Workplace Wellness Programs), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

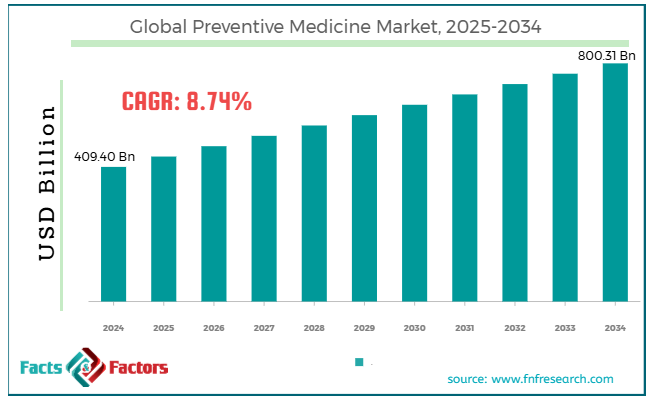

[221+ Pages Report] According to Facts & Factors, the global preventive medicine market size was worth around USD 409.40 billion in 2024 and is predicted to grow to around USD 800.31 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.74% between 2025 and 2034.

Market Overview

Market Overview

Preventive medicine emphasizes promoting health and preventing illness before it happens instead of treating diseases afterward. It comprises measures like regular health screenings, vaccinations, public health initiatives, and lifestyle counseling to minimize risk factors like poor diet, lack of exercise or sleep, and smoking, among others, to enhance the quality of life. The worldwide preventive medicine market is projected to grow considerably in the upcoming years, owing to the growing burden of illness, technological improvements, and an ever-increasing health-conscious population. Chronic conditions, including obesity, hypertension, cardiovascular diseases, etc., are rising on a global scale.

Preventive medicine effectively helps manage these diseases or conditions early or prevents them overall, thus lessening the need for hospital stays and long-term challenges. Improved tools, such as health-monitoring wearable devices like Apple Watch and Fitbit, AI-based diagnostics, and genetic testing, have transformed personalized preventive care and early disease detection.

Furthermore, with improved access to information, individuals are shifting towards maintaining good health via exercise, nutrition, and regular checkups. This inclination drives the need for preventive healthcare products and services.

However, the global market is hampered by restricted insurance reimbursement, significant upfront costs, and imbalances in healthcare access. In several nations, preventive healthcare services like advanced screenings or nutrition counseling are not entirely encompassed by insurance, increasing inaccessibility for the majority of the population.

Moreover, though preventive healthcare saves costs in the future, services like annual screenings or genomic testing may be costly, thus preventing the population from availing these services. Furthermore, underserved and rural populations mostly lack access to basic services because of scarce healthcare experts and poor infrastructure.

Nonetheless, the preventive medicine industry will gain remarkable growth backed by opportunities like the growth of corporate insurance and health associations, digital platforms for counseling, and population health management tools. Insurance companies and employers actively offer wellness incentives and programs associated with health goals. It creates demand for fitness trackers and digital health startups. Teleconsultation services and applications providing personalized diet plans, exercise coaching, and mental health check-ins are gaining prominence, mainly among the young generations. Healthcare payers and systems increasingly invest in predictive analytics solutions to detect high-risk patients beforehand and mediate preventively.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global preventive medicine market is estimated to grow annually at a CAGR of around 8.74% over the forecast period (2025-2034)

- In terms of revenue, the global preventive medicine market size was valued at around USD 409.40 billion in 2024 and is projected to reach USD 800.31 billion by 2034.

- The preventive medicine market is projected to grow significantly owing to the rising prevalence of illnesses, the ever-increasing elderly and health-conscious population, and the incorporation of digital health and telemedicine.

- Based on service type, the screening & early detection services segment is expected to lead the market, while the vaccination & immunization services segment is expected to grow considerably.

- Based on application, the cardiovascular disease prevention segment is the dominating segment among others, while the cancer prevention segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the hospitals & primary care centers segment is expected to lead the market as compared to the corporate & workplace wellness programs segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- The growing assimilation with wellness programs boosts market growth

Preventive medicine is largely integrated into corporate wellness programs and insurance offerings. Insurers and employers understand that supporting their members' and employees' overall wellness and health via preventive measures may decrease absenteeism, reduce healthcare costs, and enhance productivity.

To support this, health insurers also provide incentives to motivate healthy behaviors, such as offering premiums for employees or members who participate in wellness programs and perform regular checkups. This may impact the progress of the global preventive medicine market.

- Will the expansion of remote monitoring and telehealth considerably fuel the preventive medicine market growth?

The rise of remote health monitoring and telemedicine is changing the preventive care outlook by offering individuals easy access to healthcare providers, lessening the need for hospital visits. These solutions allow timely interventions, continuous health monitoring, and better remote management of chronic illnesses, making preventive care more accessible, mainly in rural or underserved areas.

Wearable devices that effectively track blood sugar levels, vital signs, and heart rate are helping patients monitor their health from anywhere.

Restraints

Restraints

- Restricted budgets for prevention hamper the market progress

Despite the rising body of evidence demonstrating that prevention is cheaper than treating illnesses after they occur, several nations on a global scale overspend on curing instead of preventive services.

In Europe, only 3 percent of national health budgets are distributed to preventive measures. This low funding is a major hindrance to the broad adoption of preventive health measures, particularly in emerging economies and low-income regions, where budgets are already low.

This funding disparity means that preventive care initiatives like public health education, vaccination campaigns, healthy lifestyle promotion, and screenings are largely underfunded. This majorly restricts their effectiveness and reach.

Opportunities

Opportunities

- Does the rise of preventive wellness programs positively impact the preventive medicine market growth?

Insurers and employers actively invest in wellness activities and initiatives that prevent chronic diseases and promote healthy lifestyles, resulting in enhanced employee productivity and reduced medical costs.

The worldwide wellness industry was valued at USD 5.6 trillion in 2022, with well-being tourism to exceed USD 1 trillion by 2025, denoting the nation's potential for well-being initiatives.

Luxury hotels are actively investing in affluent travelers' inclination toward longevity by offering high-end treatments, such as full-body MRIs and IV drips, as part of their services, which are shaping the growth of the preventive medicine industry.

Challenges

Challenges

- How do the supply chain disturbances limit the growth of the preventive medicine market?

Preventive care depends on a steady supply of diagnostic tools, vaccines, devices, and medications. Disturbances like the recent COVID-19 pandemic may remarkably restrict access, affecting market progress.

Medical device and pharmaceutical supply chains remain exposed to geopolitical stresses, regional conflicts, and climate change. Most nations rely on imports for vital equipment and drugs. Moreover, scarcity of vaccines, antibiotics, and screening kits may cancel or delay public health interventions.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 409.40 Billion |

Projected Market Size in 2034 |

USD 800.31 Billion |

CAGR Growth Rate |

8.74% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Pfizer Inc., Johnson & Johnson, Merck & Co. Inc., Sanofi, GlaxoSmithKline (GSK), Novartis AG, AstraZeneca, Roche Holding AG, Abbott Laboratories, Moderna Inc., Becton, Dickinson and Company (BD), Siemens Healthineers, Exact Sciences Corporation, 23andMe Holding Co., Thermo Fisher Scientific Inc., and others. |

Key Segment |

By Service Type, By Application, By End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global preventive medicine market is segmented based on service type, application, end-user, and region.

Based on service type, the global preventive medicine industry is divided into screening & early detection services, vaccination & immunization services, health risk assessment services, digital health & remote monitoring services, and genetic & genomic services. The screening & early detection segment captured a significant market share in 2024 and is expected to maintain its lead over the forecast period. The demand for these services is propelled by the rising incidence of diabetes and the increasing focus on personalized medicine. These services comprise personalized diagnostics, automated screening, and other associated advanced solutions that allow early detection of possible health problems.

Supporting the trend, private health scanning services are growing, with firms like Neko, a Swedish startup, spending USD 260 million to transform healthcare via advanced imaging solutions.

Based on application, the global preventive medicine industry is segmented into cardiovascular disease prevention, diabetes prevention, cancer prevention, infectious disease prevention, respiratory disease prevention, and others. The cardiovascular disease prevention category led the global market, with CVDs accounting for roughly 17.9 million deaths yearly. This denotes a significant share of non-communicable diseases on a global scale. Moreover, the global incidences of risk factors like high cholesterol, sedentary lifestyles, and hypertension are elevating the need for preventive medicines and services. Improvements in wearables and diagnostic tools that help with continuous monitoring and early detection are also rising. This is also backed by public health policies and campaigns that aim to minimize cardiovascular risks.

Based on end-user, the global market is segmented as hospitals & primary care centers, ambulatory surgical centers (ASCs), specialty cardiac centers, and corporate & workplace wellness programs. The hospitals & primary care centers segment led the market in the past years and is expected to lead in the future. They are essential in offering the best preventive healthcare services like vaccinations, screenings, and health education initiatives and programs. Their multidisciplinary teams and comprehensive infrastructure enable them to meet unique demographic needs, further strengthening their position in the global industry.

The United Kingdom's NHS launched Edith, an AI-based breast screening program to reduce the waiting period for 7,00,000 women.

Regional Analysis

Regional Analysis

- What factors will aid North America in witnessing significant growth in the preventive medicine market over the forecast period?

North America dominates the preventive medicine market, supported by supportive government policies, strong healthcare infrastructure, an emphasis on modernization, and high healthcare costs. North America brags about its cutting-edge medical technologies and facilities, and a large number of healthcare professionals. It streamlines and supports effective preventive healthcare delivery. Policies, such as the ACA (Affordable Care Act) in the United States, have obligated coverage for preventive medical services, comprising immunizations and screenings, mostly at no cost to individuals. The United States is a forerunner in massive healthcare spending, with significant investments in medical R&D that are nurturing modernization in the field.

Moreover, the region is leading in adopting digital health technologies like wearable devices and telemedicine, improving continuous monitoring and early detection of diseases. Furthermore, growing awareness among individuals regarding the advantages of preventive measures adds to the surge in demand for preventive services.

Europe holds the second-largest position in the global preventive medicine market, driven by an aging population, rising healthcare costs, and an inclination towards value-based models. This trend denotes a sustained focus on preventive services to enhance public health results and decrease future expenses. Nations like Austria, Germany, and Finland have enforced strong public health programs, such as early detection screening and vaccination, adding to high spending on preventive care. The EU's emphasis on preventive care is revealed in its healthcare policies, which focus on minimizing the pressure of preventable illnesses via health promotion and early intervention.

Furthermore, rising public awareness of the benefits of preventive measures, such as lifestyle modifications and regular health screenings, has increased demand for preventive medical services.

Competitive Analysis

Competitive Analysis

The global preventive medicine market is led by players like:

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Sanofi

- GlaxoSmithKline (GSK)

- Novartis AG

- AstraZeneca

- Roche Holding AG

- Abbott Laboratories

- Moderna Inc.

- Becton

- Dickinson and Company (BD)

- Siemens Healthineers

- Exact Sciences Corporation

- 23andMe Holding Co.

- Thermo Fisher Scientific Inc.

Key Market Trends

Key Market Trends

- Growth of digital health interventions:

Digital health interventions like wearables, mobile applications, and digital therapeutics are becoming increasingly prevalent. These solutions facilitate proper self-management of chronic diseases, support remote monitoring, and promote healthy behaviors, thus increasing personalization and accessibility of healthcare.

- Focus on lifestyle and behavioral interventions:

Preventive medicine largely emphasizes behavioral and lifestyle interventions like healthy eating, promoting physical activity, and smoking cessation. These plans address the origins of several chronic diseases, leading to better long-term health outcomes.

The global preventive medicine market is segmented as follows:

By Service Type Segment Analysis

By Service Type Segment Analysis

- Screening & Early Detection Services

- Vaccination & Immunization Services

- Health Risk Assessment Services

- Digital Health & Remote Monitoring Services

- Genetic & Genomic Services

By Application Segment Analysis

By Application Segment Analysis

- Cardiovascular Diseases Prevention

- Diabetes Prevention

- Cancer Prevention

- Infectious Diseases Prevention

- Respiratory Diseases Prevention

- Others

By End User Segment Analysis

By End User Segment Analysis

- Hospitals & Primary Care Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Cardiac Centers

- Corporate & Workplace Wellness Programs

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Sanofi

- GlaxoSmithKline (GSK)

- Novartis AG

- AstraZeneca

- Roche Holding AG

- Abbott Laboratories

- Moderna Inc.

- Becton

- Dickinson and Company (BD)

- Siemens Healthineers

- Exact Sciences Corporation

- 23andMe Holding Co.

- Thermo Fisher Scientific Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors