Search Market Research Report

Polymer Fillers Market Size, Share Global Analysis Report, 2022 – 2028

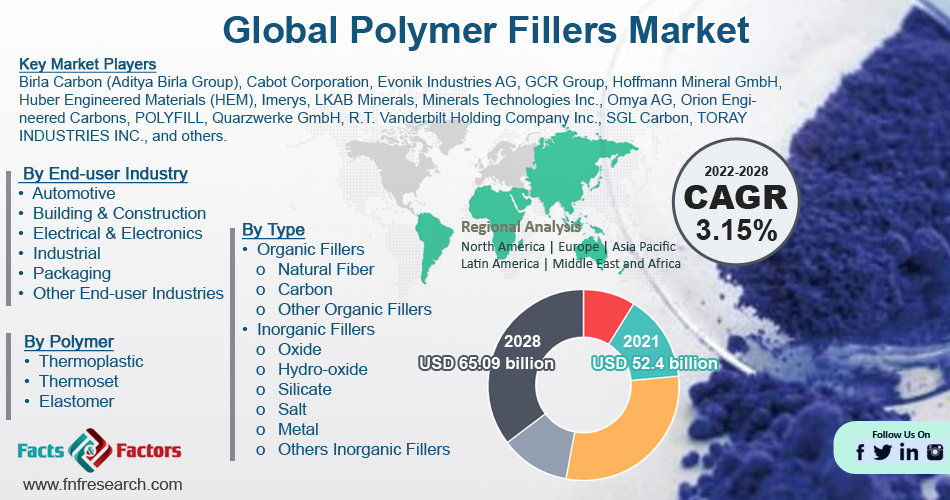

Polymer Fillers Market Size, Share, Growth Analysis Report By Type (Organic Fillers and Inorganic Fillers), By Polymer (Thermoplastic, Thermoset, Elastomer), By End-user Industry (Automotive, Building & Construction, Electrical & Electronics, Industrial, Packaging, and Other End-user Industries), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

[212+ Pages Report] According to the report published by Facts Factors, the global polymer fillers market size was worth around USD 52.4 billion in 2021 and is predicted to grow to around USD 65.09 billion by 2028 with a compound annual growth rate (CAGR) of roughly 3.15% between 2022 and 2028. The report analyzes the global polymer fillers market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polymer fillers market.

Market Overview

Market Overview

Polymer fillers are added as additives in order to increase the modulus of the polymer. Considering the type of filler, other polymer characteristics could be affected, such as melt viscosity could be significantly enhanced through the employment of fibrous materials. Furthermore, mold shrinkage and thermal expansion would be reduced, which is a common effect of most inorganic fillers.

Polymer fillers are available in various shape formats, including, cube, sphere, block, plate, flake, and fiber. Specifically, glass fibers, wollastonite, wood fibers, asbestos fibers, and carbon fibers are available in fiber format. Meanwhile, kaolin, talc, and hydrous alumina are present in plate format, whereas quartz, calcite, silica, and barite are available in block format.

Some of the key functions of polymer filler include, it helps in the modification of mechanical characteristics, enhancement of fire retardancy, modification of surface properties, enhancement of processability, and modification of electrical & magnetic properties.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global polymer fillers market is estimated to grow annually at a CAGR of around 3.15% over the forecast period (2022-2028).

- In terms of revenue, the global polymer fillers market size was valued at around USD 52.4 billion in 2021 and is projected to reach USD 65.09 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, inorganic fillers were predicted to show maximum market share in the year 2021.

- Based on end-user industry segmentation, building & construction were the leading revenue-generating end-user industry in 2021.

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

The global market cap is negatively impacted by the COVID-19 pandemic in 2020, due to the temporary stoppage of construction & automotive manufacturing activities, owing to the government-imposed lockdowns across various nations. However, during the pandemic, the demand for polymer-based packaging products has increased significantly in the food & e-commerce sectors, which has supported the demand for the polymer fillers market.

Furthermore, in 2021, the construction and automotive industries recovered a lot, such that to fill the order backlogs. Moreover, in the post-pandemic scenario, these industries are likely to grow at a significant rate, in the coming years, which will further enhance the demand for the studied market.

Growth Drivers

Growth Drivers

- Growing usage in the building & construction sector to drive market growth during the forecast period.

Polymer fillers are widely used in various polymeric building materials, as they enhance the flexural modulus of the end-products. Various types of fillers are added to enhance the bulk polymer, reduce costs, and improve the characteristics of the polymer products, which are employed in the building & construction industry. Some of the key polymer products used in the construction industry are plastic flooring, window & doors, countertop, wall panels, and others. The rising global building & construction industry is likely to propel the demand for polymer fillers for manufacturing various building and construction industry materials. For instance, the construction market was valued at USD 7.28 trillion in 2021 and is predicted to reach USD 14.41 trillion by 2030. China and the United States of America are among the key countries involved in construction activities. According to the U.S. Census Bureau, the annual value for construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020. Further, in the first 7 months of 2022, the value of construction put in place accounted for USD 1,013,738 million, compared to USD 915,179 million during the same period in 2021. Such trends have boosted the demand for polymer fillers from the building & construction sectors.

Restraints

Restraints

- High processing costs to restrict market expansion

The high cost of processing polymer fillers is likely to hinder the demand for the global polymer fillers market. Compounding costs for filling polymers are higher. The costs may increase significantly if state-of-the-art compounding equipment is used. Moreover, various fillers are being produced through processes that require high energy such as carbon black, which is manufactured by the reaction of a hydrocarbon fuel such as oil or gas, under a limited supply of oxygen, at temperatures of 1,320 to 1,540°C. Such energy requirements increase the processing cost. Also, the high loading of polymer fillers creates issues in melt movement & processing, considering the high viscosity of the filled materials, thereby, to handle that high energy is required, which further enhances the processing cost. Such factors are expected to somehow hinder the growth of the polymer fillers market.

Opportunities

Opportunities

- The development of polymer nanocomposites is expected to provide growth opportunities

Recently, researchers have developed nanocomposite materials, which are manufactured using polymer fillers. Polymer nanocomposites are polymers such as thermoplastics, thermosets, or elastomers that have been reinforced with nano-sized filler materials. The uniform dispersion of nanofillers offers a large interfacial area between the constituents of the nanocomposites. The final output characteristics of filler are dependent on various factors, such as characteristics of the polymer matrix, concentration of polymer & filler, nature & type of nanofiller, particle size & aspect ratio, particle orientation, and particle distribution, among others. Nanocomposites manufactured using polymer fillers can find their potential application in the growing automotive & aerospace industry, building & construction, the electrical sector, and food packaging. One of the most promising fields of technical advancement in the twenty-first century is currently acknowledged to be nanotechnology.

Challenges

Challenges

- High initial investment cost involved in polymer filler business to challenge market cap growth

The initial investment cost is significantly huge in the polymer filler business. Some of the key polymer fillers used are calcium carbonate, talc, feldspar, magnesium oxide, kaolin, carbon black, and others. Calcium carbonate, talc, feldspar, and kaolin are generally produced through mining. Thereby, for starting a polymer filler business, the firm should have land acquisition approvals, mining equipment such as excavators, trucks, etc., and others, which require a high level of expenditure during the initial phase of the business. Meanwhile, for setting up a carbon black plant, the player needs to have a furnace & pyrolysis plant. However, in the long run, the initial investment costs can be recovered easily, as these fillers are used in growing end-user markets such as building & construction, automotive, and others.

Segmentation Analysis

Segmentation Analysis

- The global polymer fillers market is segmented based on type, polymer, end-user industry, and region.

Based on type, the global market segments are organic fillers and inorganic fillers. The organic fillers are further subdivided into natural fiber, carbon, and other organic fillers. Meanwhile, the inorganic fillers are subdivided into oxide, hydro-oxide, silicate, salt, metal, and other inorganic fillers.

Currently, the global market is dominated by inorganic fillers however there is a significant increase in the adoption rate of organic fillers, in recent years, considering their sustainable nature.

Based on polymer, the global market is segmented into thermoplastic, thermoset, and elastomer. Thermoplastic accounted for a major share in the studied market in 2021. More than 85% of polymers produced worldwide are thermoplastics. Some of the key thermoplastics used are polyethylene (PE), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC).

Based on the end-user industry, the global market segments are automotive, building & construction, electrical & electronics, industrial, packaging, and other end-user industries. Currently, the global market is dominated by building & construction. Polymers have become an increasingly essential material for the building & construction sector. Apart from building & construction, polymer filler-based products are also significantly used in the automotive industry, which is the second largest end-user industry for polymer fillers. According to the OICA, global automotive sales accounted for 82.68 million units in 2021, witnessing a growth rate of 5% compared to 78.77 million units sold in 2020.

Recent Developments:

Recent Developments:

- In August 2022, Imerys announced the expansion of the production capacity of its calcium carbonate facility based in Marble Hill, Georgia, United States. Meanwhile, new equipment & automation technology will be installed during the project, which will also support the company’s polymer filler business related to calcium carbonate.

- In April 2022, Imerys announced to expand its calcium carbonate plant production capacity based in Sylacauga, Alabama, United States, considering the growing demand for ground calcium carbonate products from various applications, including polymer filler.

- In March 2022, Orion Engineered Carbons announced the commercial sale of carbon black from its new plant-based in Italy, with a production capacity of 25 kilotons of specialty & technical rubber carbon blacks per annum.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 52.4 Billion |

Projected Market Size in 2028 |

USD 65.09 Billion |

CAGR Growth Rate |

3.15% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Birla Carbon (Aditya Birla Group), Cabot Corporation, Evonik Industries AG, GCR Group, Hoffmann Mineral GmbH, Huber Engineered Materials (HEM), Imerys, LKAB Minerals, Minerals Technologies Inc., Omya AG, Orion Engineered Carbons, POLYFILL, Quarzwerke GmbH, R.T. Vanderbilt Holding Company Inc., SGL Carbon, TORAY INDUSTRIES INC., and others. |

Key Segment |

By Type, Polymer, End-user Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific to lead the studied market, considering rising demand from various regional end-user industries

The global polymer fillers market growth is expected to be driven by Asia-Pacific. It is currently the world’s highest revenue-generating market owing to the presence of various key end-user industries, such as building & construction, automotive, electrical & electronics, and others. China, India, and Japan are the key regional consumers of polymer fillers.

According to the National Bureau of Statistics of China, in the first 8 months of 2022, the production of plastic products in China accounted for 53.07 million tons, compared to 53.32 million tons during the same period in 2021.

In China, according to the National Bureau of Statistics of China, the construction output value in the country was valued at CNY 29.31 trillion in 2021, compared to CNY 26.39 trillion in 2020. The growing trend increased the demand for organic fillers from the Chinese construction sector.

Further, according to OICA, China produced 26,082,220 units of vehicles in 2021, compared to 25,225,242 units of vehicles in 2020, with a growth rate of 3%.

According to the National Bureau of Statistics of China, the annual growth rate of value added in the electronics manufacturing industry in China accounted for 15.7% in 2021, compared to 7.7% in 2020.

In India, according to the Department of Economic Affairs (India), the gross value added (GVA) change in the construction industry in the country accounted for -12.6% Y-O-Y in FY 2021, compared to 1.3% growth in FY 2020.

Moreover, according to OICA, India produced 4,399,112 units of vehicles in 2021, compared to 3,381,819 units of vehicles in 2020, with a growth rate of 30%.

In Japan, according to the Ministry of Finance Japan, the sales revenue of the construction industry in Japan accounted for JPY 136.7 trillion in FY 2021, compared to JPY 133.9 trillion in FY 2020.

Meanwhile, according to JEITA, the total production value of the electronics industry in Japan accounted for JPY 10.95 trillion in 2021, compared to JPY 9.96 trillion in 2020. Thereby, enhancing the demand for polymer fillers from the electrical & electronics segment of the country.

North America is also expected to generate significant revenues owing to the increasing demand from the construction industry in the United States. Other end-user industries such as automotive, packaging, and others are also rising in the United States, which is expected to create a huge demand for the polymer filler market.

Competitive Analysis

Competitive Analysis

- Birla Carbon (Aditya Birla Group)

- Cabot Corporation

- Evonik Industries AG

- GCR Group

- Hoffmann Mineral GmbH

- Huber Engineered Materials (HEM)

- Imerys

- LKAB Minerals

- Minerals Technologies Inc.

- Omya AG

- Orion Engineered Carbons

- POLYFILL

- Quarzwerke GmbH

- R.T. Vanderbilt Holding Company Inc.

- SGL Carbon

- TORAY INDUSTRIES INC.

The global polymer fillers market is segmented as follows:

By Type

By Type

- Organic Fillers

- Natural Fiber

- Carbon

- Other Organic Fillers

- Inorganic Fillers

- Oxide

- Hydro-oxide

- Silicate

- Salt

- Metal

- Others Inorganic Fillers

By Polymer

By Polymer

- Thermoplastic

- Thermoset

- Elastomer

By End-user Industry

By End-user Industry

- Automotive

- Building & Construction

- Electrical & Electronics

- Industrial

- Packaging

- Other End-user Industries

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Birla Carbon (Aditya Birla Group)

- Cabot Corporation

- Evonik Industries AG

- GCR Group

- Hoffmann Mineral GmbH

- Huber Engineered Materials (HEM)

- Imerys

- LKAB Minerals

- Minerals Technologies Inc.

- Omya AG

- Orion Engineered Carbons

- POLYFILL

- Quarzwerke GmbH

- R.T. Vanderbilt Holding Company Inc.

- SGL Carbon

- TORAY INDUSTRIES INC.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors