Search Market Research Report

Packaging Foam Market Size, Share Global Analysis Report, 2024 – 2032

Packaging Foam Market Size, Share, Growth Analysis Report By Material (Polyvinyl Chloride, Polyurethane, Polystyrene, And Others), By End-user (Personal Care, Consumer Packaging, Automotive, Electrical & Electronics, Aerospace & Defense, Medical & Pharmaceuticals, Food & Beverages, And Others), By Product (Flexible And Rigid), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

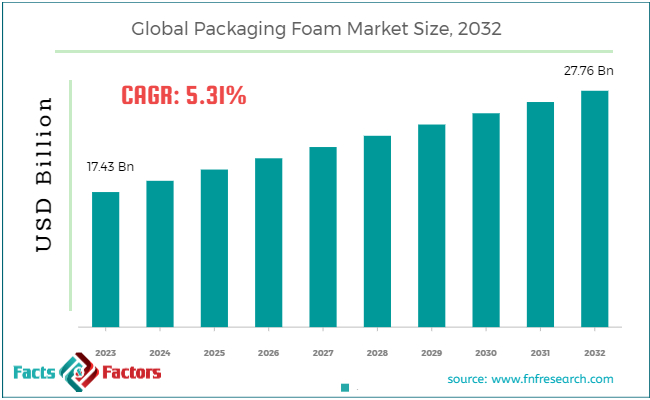

[205+ Pages Report] According to Facts and Factors, the global packaging foam market size was valued at USD 17.43 billion in 2023 and is predicted to surpass USD 27.76 billion by the end of 2032. The packaging foam industry is expected to grow by a CAGR of 5.31% between 2024 and 2032.

Market Overview

Market Overview

Packaging foam is the material used to manufacture packaging solutions to offer protection, cushioning, and insulation to the products during transportation and storage. Foam packaging is highly shock absorbent and, therefore, prevents damage to fragile items.

Different kinds of foam materials are used for different applications. Some of the common packaging foam include polyurethane, foam polythene, foam expanded polythene, polypropylene foam, and others.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global packaging foam market size is estimated to grow annually at a CAGR of around 5.31% over the forecast period (2024-2032).

- In terms of revenue, the global packaging foam market size was valued at around USD 17.43 billion in 2023 and is projected to reach USD 27.76 billion by 2032.

- Growing demand for sustainable packaging is driving the growth of the global packaging foam market.

- Based on the material, the polyurethane segment is growing at a high rate and is projected to dominate the global market.

- Based on the end-user, the food & beverages segment is projected to swipe the largest market share.

- Based on the product, the flexible segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for sustainable packaging is driving the growth of the global market.

Increasing awareness among people regarding environmental health is driving the growth of the global packaging foam market. Companies are looking forward to eco-friendly alternatives and recyclable foam materials to come up with sustainable packaging solutions. Moreover, packaging foam is ideal for the transportation of fragile and sensitive goods, which is another major factor propelling the growth of the global marketplace.

Also, there is a high need for protective packaging materials to transport various items like glassware, electronics, and medical equipment easily. Therefore, all these factors are expected to drive the growth of the global market. For instance, Flipkart said to partner with Adani Group to improve logistics and data center capabilities in 2021.

Restraints

Restraints

- Volatility in raw material prices is likely to hinder the growth of the global market.

Fluctuations in the prices of raw materials are likely to hamper the growth of the global market. Materials like polyurethane and polystyrene are highly subjected to volatile prices. These fluctuations impact the overall production cost, which is expected to negatively impact the growth of the industry.

Opportunities

Opportunities

- Advancements in material technology are expected to foster growth opportunities in the global market.

The ongoing advancements in foam manufacturing technology are leading to the growth of the global packaging foam market. Companies are improving their research and development activities to come up with unique materials with improved properties like shock absorption, enhanced cushioning, and insulation capabilities. Therefore, all these factors are expected to drive the growth of the market.

For instance, Zoatfoams unveiled the opening of its new unit in Brez in February 2021. The unit is spread over an area of 13,000 square meters with a capacity of 50,000-meter cubes of annual foams.

Challenges

Challenges

- Poor recycling infrastructure is a big challenge in the global market.

All the foams cannot be easily recycled due to the lack of proper recycling infrastructure in the market. Moreover, the recycling rates are quite high, which deters the price-sensitive consumers. Therefore, all these factors are a big challenge in the global market.

Segmentation Analysis

Segmentation Analysis

The global packaging foam market can be segmented into material, end-user, product, and region.

By material, the market can be segmented into polyvinyl chloride, polyurethane, polystyrene, and others. The polyurethane segment accounts for the largest share of the global market during the forecast period. Polyurethane foam is versatile in nature and can be tailored according to the requirements of different applications. It offers excellent cushioning and shock-absorbing properties, making it suitable for the packaging of fragile or sensitive items.

Also, it can easily be available in different forms, thicknesses, and densities, thereby making it ideal for a wide range of products. Polyurethane foam is highly resistant to temperature variation, thereby helping end-users protect products under different environmental conditions. Polyurethane foam is more durable and offers convenience in shipping and handling items during long-distance travel. Also, it is light in weight, which reduces the packaging weight and overall transportation costs.

By end-user, the market can be segmented into personal care, consumer packaging, automotive, electrical & electronics, aerospace & defense, medical & pharmaceuticals, food & beverages, and others. Food & beverage is the fastest-growing segment in the global packaging foam market during the anticipated period. The growing demand for convenience food like ready-to-eat meals poses a huge demand for packaging foam solutions in the market. Specialized packaging forms offer protection and maintain the freshness of these food products.

Moreover, the rising popularity of e-commerce in the food and beverage sector is boosting the growth of the segment significantly. There is an emerging habit of online grocery shopping and food delivery services all across the globe, which is also posing a huge demand for secure and protective foam packaging solutions in the market.

Additionally, the food and beverage sector demands packaging solutions that can protect food products against temperature fluctuations. Also, people are becoming more conscious of environmental health, thereby posing a high demand for eco-friendly and sustainable products. All these factors contribute heavily to the growth of the segment.

By product, the market can be segmented into flexible and rigid. The flexible segment is expected to dominate the global market in the forthcoming years. Flexible packaging foam is much in demand in the market because of its ability to conform to different shapes and sizes according to the product. It is highly useful for products with irregular shapes.

Additionally, these are light in weight, which helps end users save on transportation and logistics costs. However, it also aligns with the emerging trend of using eco-friendly products as these are sustainable and less harmful to the environment. Flexible foam materials offer excellent cushioning properties and protect the products during transit.

Moreover, flexible packaging foam is also efficient because of its space utilization property, which further helps optimize supply chain processes. These are highly customizable and can meet all the requirements of the end-user sector, ranging from size and thickness to specific protective properties.

However, this property makes it ideal for a wide range of applications. Also, it is versatile for all the end users sectors like food & beverage pharmaceuticals, electronics, and many more. Therefore, such a landscape is expected to propel the growth of the segment significantly during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 17.43 Billion |

Projected Market Size in 2032 |

USD 27.76 Billion |

CAGR Growth Rate |

5.31% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

FoamPartner Group, Arkema, Kaneka Corporation, Rogers Corporation, Synthos SA, Sealed Air Corporation, BASF SE, Zotefoams Plc, JSP, Armacell, and Others. |

Key Segment |

By Material, By End-user, By Product, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market

North America accounts for the largest share of the global packaging foam market because of many factors like consumer preferences, emerging industry trends, and regulatory compliances. Polyurethane foams and expanded polystyrene foams are widely used for packaging applications in the region because of their high cushioning properties and lightweight. It is a prime factor in the growth of the regional market.

Moreover, the fast-growing end-user sector like healthcare, food & beverage, automotive, and electronics in the region is another major factor positively influencing the growth of the regional market. These industries are posing a huge demand for specific protective packaging in the market.

Moreover, the rising e-commerce activities in the region are also playing an important role in accentuating the demand for the product. Also, the growing concerns regarding the environmental impact of traditional packaging solutions are fostering demand for sustainable solutions in the regional market.

Many companies are looking forward to eco-friendly alternatives to address the sustainability challenges in the regional market, which in turn is also expected to positively influence the growth of the industry in the forthcoming years.

Europe is also anticipated to see huge developments in the coming years due to technological advancements, regulatory standards, and changing industry dynamics in the region. Europe is at the forefront of environmental sustainability initiatives which is a major reason for the high growth rate of the region.

Companies in the region are focusing on eco-friendly and recyclable packaging solutions, thereby posing a huge demand for packaging foam in the market. For instance, Flipkart improved its grocery portfolio in May 2021 to serve the consumer demand across India.

Competitive Analysis

Competitive Analysis

The key players in the global packaging foam market include:

- FoamPartner Group

- Arkema

- Kaneka Corporation

- Rogers Corporation

- Synthos SA

- Sealed Air Corporation

- BASF SE

- Zotefoams Plc

- JSP

- Armacell

For instance, Recticel successfully took over FoamPartner in March 2021. FoamPartner is a global Swiss-based vendor of technical foams. Both companies came together to launch the Recticel Engineered Foam business line.

The global packaging foam market is segmented as follows:

By Material Segment Analysis

By Material Segment Analysis

- Polyvinyl Chloride

- Polyurethane

- Polystyrene

- Others

By End-user Segment Analysis

By End-user Segment Analysis

- Personal Care

- Consumer Packaging

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Medical & Pharmaceuticals

- Food & Beverages

- Others

By Product Segment Analysis

By Product Segment Analysis

- Flexible

- Rigid

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- FoamPartner Group

- Arkema

- Kaneka Corporation

- Rogers Corporation

- Synthos SA

- Sealed Air Corporation

- BASF SE

- Zotefoams Plc

- JSP

- Armacell

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors