Search Market Research Report

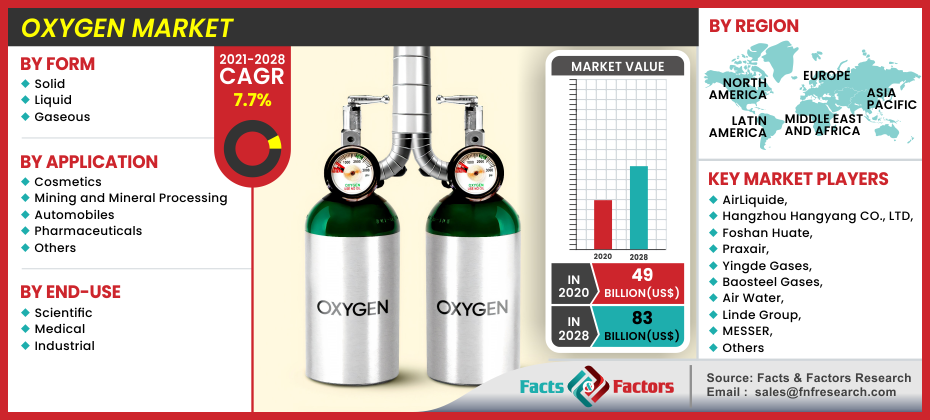

Oxygen Market Size, Share Global Analysis Report, 2021–2028

Oxygen Market - By Form (Solid, Liquid, and Gaseous), By Application (Cosmetics, Mining & Mineral Processing, Automobiles, Pharmaceuticals, and Others), By End-Use (Scientific, Medical, and Industrial), and By Region: Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2021–2028

Industry Insights

[207+ Pages Report] According to Facts and Factors, the global oxygen market was worth about 49 (USD billion) in 2020 and is predicted to grow to around 83 (USD billion) by 2028, with a compound annual growth rate (CAGR) of around 7.7% during the forecast period. The report examines the oxygen market’s drivers and restraints, as well as the impact they have on the demand during the forecast period. In addition, the report analyses global opportunities in the oxygen market.

Oxygen Market: Overview

Oxygen Market: Overview

The most prevalent technique of producing oxygen is by separating air using a cryogenic distillation process or a pressure/vacuum/hybrid swing absorption process. However, the absorption technique has a very high production cost. Innovative and cost-effective ways for producing oxygen, such as gas separation, are actively finding greater uses in a variety of industries. Industries have a moderate demand for highly pure oxygen with purity levels of up to 45 percent. Oxygen is typically stored in liquid tanks and cylinders.

Steel production sectors and metal refineries are the largest consumers of oxygen. Oxygen is also utilized in petroleum processing, medicines, glass & ceramic manufacturing, effluent plant treatment, and paper & pulp manufacturing. Steel industries, which are key oxygen users, use oxygen to raise combustion temperatures, minimizing the consumption of other energy materials. In the pharmaceutical industry, oxygen is employed in the production of propylene oxides, ethylene oxides, and synthesis gas. Oxygen is utilized as a regenerator catalyst in refineries to improve the quality of air feed in catalytic cracking units. The usage of oxygen as a catalyst and oxidizing agent in various industries has expanded, increasing the size of the global oxygen market.

Furthermore, the increasing use of oxygen in breathing devices and apparatus in hospitals, as well as in trekking and diving adventures, is fueling the expansion of the oxygen market. However, the expense of oxygen remains a key impediment to expansion in smaller-scale applications. Furthermore, ongoing innovation in transportable concentrators is altering the dynamics of the oxygen market, notably in the healthcare sector.

Oxygen Market: Growth Drivers

Oxygen Market: Growth Drivers

Pollution levels have risen dramatically as a result of rising vehicle use and industrialization. This has resulted in an increase in the demand for and production of breathing aids, fueling the market's expansion. Furthermore, the rise of industries such as agriculture, automobiles, food & drinks, construction, and medicine has resulted in an increase in global demand for oxygen. This has been a primary driving force in the growth of the global oxygen market.

Also, the diverse applications of oxygen as a catalyst and oxidizing agent in the chemical industry have aided the market in establishing a firm foothold. Another element driving the global oxygen market's expansion is the use of oxygen in mining and mineral processing. Oxygen improves the overall effectiveness of these operations, lowering production costs. Furthermore, developments in oxygen therapy and flow controlling devices have fueled the industry's expansion.

The use of oxygen in water treatment facilities to remove impurities from water has created new growth potential for the oxygen market. Furthermore, the increasing use of oxygen in the cosmetic and cosmetics business for hyperbaric therapies and oxygen facials has fueled the industry's growth. Also, the expanding elderly population has increased the demand for mobility assistance. This has increased demand for portable oxygen concentrators, hastening the expansion of the oxygen market.

On the other hand, there are a few constraints that could lead to a global oxygen shortage. Lack of understanding about oxygen therapy, as well as a hefty initial expenditure, may limit the market's growth. Furthermore, the safety difficulties involved with oxygen handling, which can result in severe accidents, may function as a market impediment. Nonetheless, recent breakthroughs in the medicine and healthcare industries, as well as new technical developments, would mitigate the effects of the limitations, ushering in market growth.

Segmentation Analysis

Segmentation Analysis

The global oxygen market can be segmented into form, application, end-use, and region.

By form, the oxygen market is classified into solid, liquid, and gaseous. The gaseous form of oxygen is expected to account for more than 68 percent of the market by 2026 while maintaining the most utilized type of oxygen during the time.

By application, the oxygen market is segmented into cosmetics, mining & mineral processing, automobiles, pharmaceuticals, and others. By 2026, the mining & mineral processing and automobile industry are predicted to dominate consumption, with a combined market share of more than 80%. During the projection period of 2020 to 2026, oxygen consumption in mining & mineral processing is predicted to expand in tandem with the global oxygen market, with a CAGR of roughly 8%.

By end-use, the oxygen market is segmented into scientific, medical, and industrial. The industrial oxygen market is said to have the largest segment of the oxygen market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 49 Billion |

Projected Market Size in 2028 |

USD 83 Billion |

CAGR Growth Rate |

7.7% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2028 |

Key Market Players |

AirLiquide, Hangzhou Hangyang CO., LTD, Foshan Huate, Praxair, Yingde Gases, Baosteel Gases, Air Water, Linde Group, MESSER, SCGC, Taiyo Nippon Sanso, Air Product, Airgas, among others |

Key Segment |

By Form, By Application, By End-Use, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Development

Recent Development

- December 2021 - The Government of India has increased oxygen production to 18, 836 metric tons (MT) in preparation for the impending Covid-19 wave. During the second wave, oxygen production ranged from 7127 metric tons (MT) to 9690 MT per day.

- In April 2021, the state-owned CIL (Coal India Limited) corporation, announced that three of its subsidiaries are exploring constructing oxygen-producing plants to alleviate the shortage of life-saving gas.

Regional Landscape

Regional Landscape

Due to the thriving healthcare industry, Asia Pacific accounts for the greatest share of the global oxygen market. A rising manufacturing sector has also contributed to the region's market growth. Japan, China, and India are the primary contributors to the Asia Pacific market's expansion.

China is currently the world's greatest steel manufacturer, with the blast oxygen furnace accounting for more than three-quarters of regional steel production. As a result, China has been designated as the world's largest consumer of high purity oxygen, accounting for more than one-third of global consumption. Further, because of the rising use of oxygen in scientific activities, Europe and North America are expected to expand steadily during the predicted period.

Competitive Landscape

Competitive Landscape

Some of the main players in the global oxygen market include

- AirLiquide

- Hangzhou Hangyang CO. LTD

- Foshan Huate

- Praxair

- Yingde Gases

- Baosteel Gases

- Air Water

- Linde Group

- MESSER

- SCGC

- Taiyo Nippon Sanso

- Air Product

- Airgas

The global oxygen market is segmented as follows:

By Form Segment Analysis

By Form Segment Analysis

- Solid

- Liquid

- Gaseous

By Application Segment Analysis

By Application Segment Analysis

- Cosmetics

- Mining and Mineral Processing

- Automobiles

- Pharmaceuticals

- Others

By End-Use Segment Analysis

By End-Use Segment Analysis

- Scientific

- Medical

- Industrial

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- AirLiquide

- Hangzhou Hangyang CO. LTD

- Foshan Huate

- Praxair

- Yingde Gases

- Baosteel Gases

- Air Water

- Linde Group

- MESSER

- SCGC

- Taiyo Nippon Sanso

- Air Product

- Airgas

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors