Search Market Research Report

Osteoporosis Drugs Market Size, Share Global Analysis Report, 2024 – 2032

Osteoporosis Drugs Market Size, Share, Growth Analysis Report By Distribution Channels (Online Pharmacies, Hospital Pharmacies, And Retail Pharmacies & Stores), By Route of Administration (Parenteral And Oral), By Drug Class (RANK Ligand Inhibitors, Selective Estrogen Inhibitor Modulators (SERM), Hormone Replacement Theory, Bisphosphonates, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

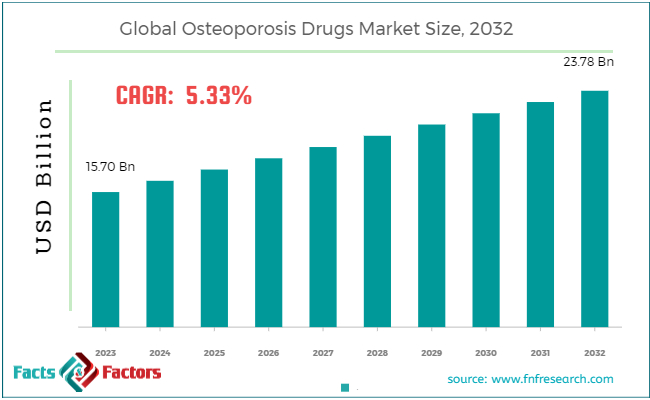

[209+ Pages Report] According to Facts and Factors, the global osteoporosis drugs market size was valued at USD 15.70 billion in 2023 and is predicted to surpass USD 23.78 billion by the end of 2032. The osteoporosis drugs industry is expected to grow by a CAGR of 5.33% between 2024 to 2032.

Market Overview

Market Overview

Osteoporosis drugs help healthcare professionals treat osteoporosis conditions in humans. This medication helps reduce the risk of factors and increases bone density in people. Healthcare professionals help their patients come over or stereopsis easily by inhibiting bone resorption and promoting bone formation.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global osteoporosis drugs market size is estimated to grow annually at a CAGR of around 5.33% over the forecast period (2024-2032).

- In terms of revenue, the global osteoporosis drugs market size was valued at around USD 15.70 billion in 2023 and is projected to reach USD 23.78 billion by 2032.

- The increasing prevalence of osteoporosis is driving the growth of the global osteoporosis drugs market.

- Based on the distribution channels, the hospital pharmacies segment is growing at a high rate and is projected to dominate the global market.

- Based on the route of administration, the parenteral segment is projected to swipe the largest market share.

- Based on the drug class, the bisphosphonates segment is projected to witness a high CAGR during the forecast period.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing prevalence of osteoporosis is likely to drive the growth of the global market.

The growing awareness of osteoporosis all across the globe is propelling the growth of the global osteoporosis drugs market. The major reason behind the high growth rate of osteoporosis is lifestyle disorders like dietary habits and the sedentary workstyle of people.

Also, the increasing aging population has emerged as a crucial factor impacting the growth trajectory of the industry. Additionally, the ongoing research and development activities in the pharmaceutical sector are also likely to support the growth trajectory of the regional market. The emergence of novel medication with high efficacy and fewer side effects also contributes to the high growth rate of the market.

Upgradation in drug delivery technology and bone density measurement techniques helps in the precise diagnosis of osteoporosis and treatment. Such a landscape helps healthcare professionals to effectively treat osteoporosis, which in turn is also likely to be a big factor in encouraging the growth of the market.

For instance, Amgen got approval from Evenity in 2019 for the treatment of osteoporosis in postmenopausal women who are at high risk of fracture.

Restraints

Restraints

- Limited patient awareness is likely to hamper the growth of the global market.

A lack of understanding among people regarding the successful treatment of osteoporosis is expected to hinder the growth of the osteoporosis drug industry. The government is making several initiatives to raise awareness among people. However, there are still certain regions and groups that are not aware of the benefits and easy availability of process treatments in the market.

Opportunities

Opportunities

- Increasing healthcare expenditure is expected to foster growth opportunities in the global market.

The continuously increasing healthcare spending by people all across the globe is expected to foster growth opportunities in the global osteoporosis drugs market. Also, the easy availability of generic osteoporosis drugs is increasing sales in the market. Changes in lifestyle, like dietary habits and physical activity, impact bone health.

However, the growing awareness among people regarding the importance of health is pushing people to adopt preventive measures and is also anticipated to widen the scope of the industry during the forecast period. For instance, Sandoz said to accept the Biologics License application in February 2023 for the biosimilar denosumab by the FDA.

Challenges

Challenges

- Generic competition is a big challenge in the global market.

The easy availability of generic osteoporosis drugs is hyping the competition by lowering the price of these counterfeit pharmaceutical drugs. However, such a landscape is a big barrier to the growth of the osteoporosis drugs industry.

Segmentation Analysis

Segmentation Analysis

The global osteoporosis drugs market can be segmented into distribution channels, route of administration, drug class, and region.

On the basis of distribution channels, the market can be segmented into online pharmacies, hospital pharmacies, and retail pharmacies & stores. The hospital pharmacies segment accounts for the largest share of the osteoporosis drugs industry.

Many osteoporosis drugs need intravenous administration, which boosts the growth of the segment. Hospitals are a convenient medium to administer these types of drugs to the human body, thereby making them a crucial point of care.

Also, a large number of people visit hospitals for specialist treatment, which leads to high sales revenue for hospital pharmacies. Moreover, coordinating care for patients is another primary factor boosting the growth of the segment.

On the basis of the route of administration, the market can be segmented into parenteral and oral. The parenteral segment is poised to witness huge developments in the coming years. The parenteral administration of drugs refers to the process of injecting the drugs directly into the body, bypassing the digestive system.

However, the continuous development in delivery technology is propelling the growth of the segment. These technologies help patients and healthcare professionals deliver drugs conveniently. Also, it offers many advantages to patients, like ease of administration and dosing frequency.

Moreover, the parenteral administration offers better efficacy, thereby focusing on enhancing the therapeutic outcomes of the formulas. Additionally, pharmaceutical companies are also expected to encourage the growth of the segment in the market by exploring novel parenteral formulations.

On the basis of drug class, the market can be segmented into RANK ligand inhibitors, Selective Estrogen inhibitor modulators (SERM), hormone replacement theory, bisphosphonates, and others. The bisphosphonates segment is likely to see significant growth during the anticipated period. Bisphosphonates are known to have high efficacy in lowering bone loss and fractures in people with osteoporosis. This is a highly validating clinical practice that has gained a wider acceptance in society. It is considered to be a first line of treatment, which in turn is expected to be a primary factor for the growth of the segment.

Also, healthcare professionals prefer bisphosphonates over other possible alternatives in the market for treating a large number of patients. Additionally, bisphosphonates are easily available in different kinds of formulations in the market, which increases the flexibility for healthcare professionals to choose the ideal format based on the history and current situation of the patients.

Nowadays, a large number of bisphosphonates are available in generic formats, thereby making them more cost-effective for a broad population. Additionally, these are used for handling fractures in people apart from the treatment of osteoporosis. All these factors are likely to accentuate the growth rate of the segment during the anticipated period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 15.70 Billion |

Projected Market Size in 2032 |

USD 23.78 Billion |

CAGR Growth Rate |

5.33% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Cipla Inc., DAIICHI SANKYO COMPANY, Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Amgen Inc., Merck & Co. Inc., Allergan, AbbVie Inc., Bayer AG, Johnson & Johnson Services Inc., Sanofi, Bristol-Myers Squibb Company, Takeda Pharmaceutical Company Limited., Pfizer Inc., Astrazeneca, Eli Lilly and Company, Novartis AG, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc., and Others. |

Key Segment |

By Distribution Channels, By Route of Administration, By Drug Class, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global osteoporosis drugs market because of the growing prevalence of osteoporosis. The region is witnessing a growing aging population, which leads to a high demand for osteoporosis medications.

However, the wide availability of treatment options is also likely to offer a competitive edge to the regional market. The region has technological innovations and advanced medical science that help patients get access to a wide range of treatment options for osteoporosis.

Moreover, the presence of a well-established healthcare infrastructure in the region also contributes heavily to the growth of the regional market. Regulatory agencies like the FDA also support the growth of the regional market by offering fast approval of emerging osteoporosis drugs. The ongoing research and development activities in the market to develop new and improved osteoporosis treatments led to the introduction of novel drugs in the market. Therefore, such a landscape is likely to boost the growth of the regional market.

Asia Pacific is also likely to grow steadily in the market in the coming years because of the fast-growing aging population in the region. Countries like China and Japan have a high population base of adults susceptible to bone-associated problems. The growing investments in the region to upgrade the healthcare infrastructure also contribute to the positive growth of the regional market.

Furthermore, the rising awareness among people regarding the successful treatment of osteoporosis further leads to the high demand for proactive treatment of the disorder. The presence of growing economies like India and China is also supporting the growth of the market because of the increased healthcare spending in these nations. Pharmaceutical companies are also expanding their business in the region because of the high potential in the market. For instance, Theramex came up with Livogive, an osteoporosis medicine in Europe, in January 2021.

Competitive Analysis

Competitive Analysis

The key players in the global osteoporosis drugs market include:

- Cipla Inc.

- DAIICHI SANKYO COMPANY

- Novo Nordisk A/S

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Amgen Inc.

- Merck & Co. Inc.

- Allergan

- AbbVie Inc.

- Bayer AG

- Johnson & Johnson Services Inc.

- Sanofi

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company Limited.

- Pfizer Inc.

- Astrazeneca

- Eli Lilly and Company

- Novartis AG

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc.

For instance, Enzene Biosciences Ltd got marketing authorization in August 2021 from the drug controller general of India for the treatment of osteoporosis among adults.

The global osteoporosis drugs market is segmented as follows:

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies & Stores

By Route of Administration Segment Analysis

By Route of Administration Segment Analysis

- Parenteral

- Oral

By Drug Class Segment Analysis

By Drug Class Segment Analysis

- RANK Ligand Inhibitors

- Selective Estrogen Inhibitor Modulators (SERM)

- Hormone Replacement Theory

- Bisphosphonates

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Cipla Inc.

- DAIICHI SANKYO COMPANY

- Novo Nordisk A/S

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Amgen Inc.

- Merck & Co. Inc.

- Allergan

- AbbVie Inc.

- Bayer AG

- Johnson & Johnson Services Inc.

- Sanofi

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company Limited.

- Pfizer Inc.

- Astrazeneca

- Eli Lilly and Company

- Novartis AG

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors