Search Market Research Report

Orthopedic Trauma Devices Market Size, Share Global Analysis Report, 2024 – 2032-

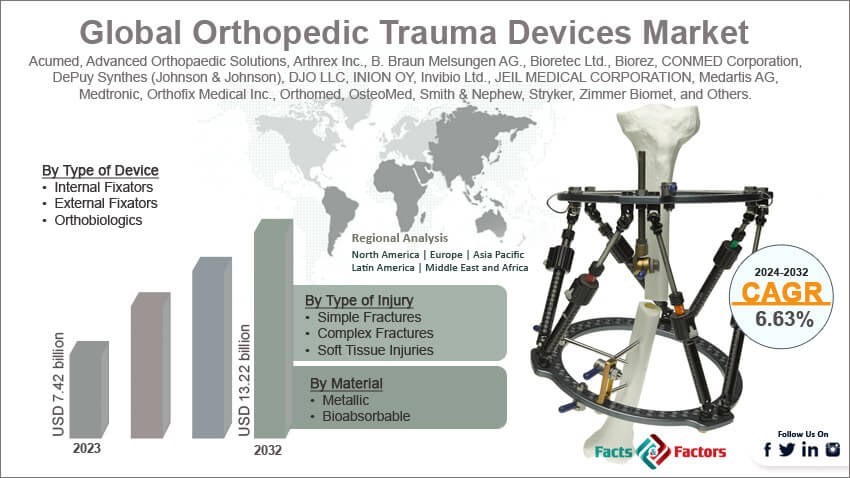

Orthopedic Trauma Devices Market Size, Share, Growth Analysis Report By Type of Device (Internal Fixators, External Fixators, and Orthobiologics), By Material (Metallic and Bioabsorbable), By Type of Injury (Simple Fractures, Complex Fractures, and Soft Tissue Injuries), By End-User (Hospitals, Orthopedic Clinics, and Ambulatory Surgery Centers (ASCs)), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032-

Industry Insights

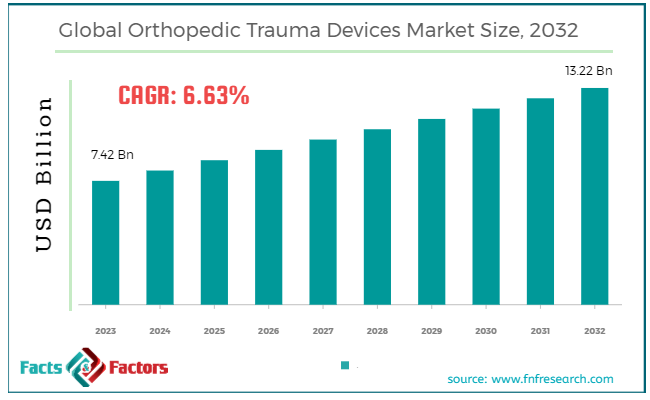

[224+ Pages Report] According to Facts and Factors, According to Facts & Factors, the global orthopedic trauma devices market size in terms of revenue was valued at around USD 7.42 billion in 2023 and is expected to reach a value of USD 13.22 billion by 2032, growing at a CAGR of roughly 6.63% from 2024 to 2032. The global orthopedic trauma devices market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Orthopedic trauma devices are specialized instruments used to treat and manage injuries related to the bones, joints, and their associated soft tissues, including muscles, tendons, and ligaments. These devices are essential in the treatment of injuries that result from traumatic events such as falls, accidents, or sports injuries, as well as conditions that require surgical intervention to correct bone deformities, align fractured bones, and ensure proper healing.

Orthopedic trauma devices play a crucial role in modern medicine by providing solutions that allow patients to recover from skeletal injuries more effectively, thereby restoring function and improving quality of life. These devices are continually evolving with advancements in medical technology, leading to more effective and patient-friendly options.

Key Highlights

Key Highlights

- The orthopedic trauma devices market has registered a CAGR of 6.63% during the forecast period.

- In terms of revenue, the global orthopedic trauma devices market was estimated at roughly USD 7.42 billion in 2023 and is predicted to attain a value of USD 13.22 billion by 2032.

- The growth of the orthopedic trauma devices market is being propelled by the increasing need for fracture treatment, technological advancements, and rising healthcare spending.

- Based on the Type of Device, the Internal fixators segment holds the largest share due to their effectiveness in stabilizing and supporting fractured bones for proper healing.

- Based on End-User, Hospitals are the leading end-users because of their extensive facilities capable of handling various orthopedic trauma surgeries.

- By region, North America currently dominates the market due to its advanced healthcare infrastructure and high adoption rates of new technologies, the Asia-Pacific region is set to experience the highest growth rate, making it a critical area for market players to focus on in the coming years.

Growth Drivers:

Growth Drivers:

- Increasing Incidence of Orthopedic Injuries: The rise in sports-related injuries, road accidents, and falls among the elderly population significantly contributes to the demand for orthopedic trauma devices. As the global population ages, the frequency of osteoporotic fractures also increases, driving further growth.

- Growing Geriatric Population: The global population is aging, and older adults are more susceptible to bone fractures due to osteoporosis and other age-related conditions. This creates a significant market segment for orthopedic trauma devices.

- Technological Advancements: Continuous advancements in materials, design, and minimally invasive surgical techniques are making trauma devices more effective, user-friendly, and biocompatible. This attracts a wider range of patients and surgeons.

- Rising Healthcare Expenditure: Increased healthcare spending globally, particularly in emerging markets, allows for greater investment in orthopedic surgeries and trauma devices.

Restraints:

Restraints:

- High Cost of Devices and Procedures: Orthopedic trauma devices and the associated surgeries can be expensive, limiting accessibility for some patients, especially in regions with limited healthcare budgets.

- Strict Reimbursement Policies: Reimbursement policies by insurance companies can restrict the use of certain trauma devices, impacting market adoption of innovative technologies.

- Stringent Regulatory Requirements: Strict regulations for device development, testing, and approval can delay the market entry of new trauma devices and increase development costs for manufacturers.

Opportunities:

Opportunities:

- Focus on Minimally Invasive Techniques: The growing demand for minimally invasive surgical procedures creates an opportunity for the development and adoption of trauma devices that facilitate these techniques.

- Rising Demand in Developing Countries: Countries like China, India, and Brazil are experiencing rapid increases in healthcare expenditure and are expanding their health services, which presents significant opportunities for the market growth of orthopedic trauma devices.

- Personalized Medicine: The potential for personalized medicine approaches, including custom-designed implants, could cater to specific patient needs and improve outcomes.

- Increased Awareness and Education: Raising public awareness about bone health and the benefits of orthopedic trauma devices can encourage preventative measures and earlier treatment of fractures.

Challenges:

Challenges:

- Post-Surgery Complications: As with any surgery, there are potential risks and complications associated with orthopedic trauma procedures. Addressing these concerns and improving safety protocols is crucial.

- Counterfeit Devices: The presence of counterfeit trauma devices can pose a significant risk to patient safety and market reputation. Effective measures to combat counterfeiting are essential.

- Skilled Labor Shortage: A shortage of skilled orthopedic surgeons and healthcare professionals in some regions can limit the accessibility of orthopedic trauma device procedures.

Orthopedic Trauma Devices Market: Segmentation Analysis

Orthopedic Trauma Devices Market: Segmentation Analysis

The global orthopedic trauma devices market is segmented based on type of device, material, type of injury, end-user, and regions.

By Type of Device Insights

By Type of Device Insights

Based on the Type of Device, the global orthopedic trauma devices market is bifurcated into internal fixators, external fixators, and orthobiologics. Internal fixator devices such as plates, screws, rods, and nails that are implanted inside the body. These devices are used for stabilizing severe fractures and facilitating bone healing. Internal Fixators dominate the market due to their widespread use and reliability in treating a wide range of orthopedic injuries. External fixators are used less frequently and are placed outside the body. They stabilize fractured bones through percutaneous pins and wires connected to a rigid frame. Orthobiologics include bone graft substitutes and materials that promote bone healing naturally and are increasingly used in trauma cases to enhance healing.

By Material Insights

By Material Insights

Based on Material, the global orthopedic trauma devices market is bifurcated into metallic, and bioabsorbable. Metallic materials include stainless steel, titanium, and their alloys, which are commonly used due to their high strength and biocompatibility. This segment still holds a significant share due to factors like established track record and familiarity for surgeons and durability and long-term stability Bioabsorbable materials are designed to be absorbed by the body over time, eliminating the need for a second surgery to remove the implant.

By Type of Injury Insights

By Type of Injury Insights

Based on Type of Injury, the global orthopedic trauma devices market is bifurcated into simple fractures, complex fractures, and soft tissue injuries. Simple fracture injuries require straightforward treatment approaches, often treated with basic internal or external fixators. Complex Fractures include multiple fractures or compound injuries requiring advanced surgical interventions and possibly the use of orthobiologics. Soft Tissue Injuries involve muscles, ligaments, or tendons and may require supportive treatments alongside bone stabilization.

By End-User Insights

By End-User Insights

Based on End-User, the global orthopedic trauma devices market is categorized into Hospitals, Orthopedic Clinics, and Ambulatory Surgery Centers (ASCs). Hospitals are the largest segment that includes trauma centers and hospitals where acute care is provided. Hospitals are the primary users of orthopedic trauma devices due to their capability to perform complex surgeries. Orthopedic clinic facilities handle a significant number of cases involving musculoskeletal injuries and often use a variety of trauma devices. Ambulatory surgery centers (ASCs) are increasingly popular due to the cost-effectiveness and efficiency of handling minor operative trauma treatments.

Recent Developments:

Recent Developments:

- CurvaFix Unveils Implant for Pelvic and Acetabular Fractures (October 2021): CurvaFix Inc. launched its CurvaFix implant in the US market. This implant is designed specifically to address pelvic and acetabular fractures, potentially offering improved treatment options for these complex injuries.

- Zimmer Biomet Introduces Infection-Preventing Implants (June 2021): Zimmer Biomet introduced Bactiguard-coated orthopedic trauma implants in select European and Middle Eastern markets. These implants boast a special coating designed to help prevent infections, a significant concern in orthopedic surgeries. The CE mark approval in January 2021 paves the way for wider adoption in Europe.

- Safe Orthopedics Receives CE Mark for New Spinal Screw (May 2021): Safe Orthopedics secured CE mark approval for their Hickory screw, part of their next-generation SteruiSpine PS product line. This approval signifies compliance with European safety standards and opens doors for marketing this new spinal screw within the European Union.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 7.42 Billion |

Projected Market Size in 2032 |

USD 13.22 Billion |

CAGR Growth Rate |

6.63% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Acumed, Advanced Orthopaedic Solutions, Arthrex Inc., B. Braun Melsungen AG., Bioretec Ltd., Biorez, CONMED Corporation, DePuy Synthes (Johnson & Johnson), DJO LLC, INION OY, Invibio Ltd., JEIL MEDICAL CORPORATION, Medartis AG, Medtronic, Orthofix Medical Inc., Orthomed, OsteoMed, Smith & Nephew, Stryker, Zimmer Biomet, and Others. |

Key Segment |

By Type of Device, By Material, By Type of Injury, By End-User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Orthopedic Trauma Devices Market: Regional Analysis

Orthopedic Trauma Devices Market: Regional Analysis

The orthopedic trauma devices market exhibits distinct regional dynamics, which influence the adoption rates, market growth, and development strategies in the sector. Here is a brief analysis of key regions along with the dominating region based on Compound Annual Growth Rate (CAGR):

North America is a leading market for orthopedic trauma devices, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of major market players. The region's market dominance is supported by the widespread adoption of advanced technologies and a higher incidence of orthopedic injuries due to active lifestyles and a significant elderly population. The market in North America shows a robust CAGR, driven by technological advancements in medical devices and substantial investments in healthcare.

Europe stands out as a major player in the global orthopedic trauma devices market. The growth is fuelled by stringent regulatory standards, well-established healthcare systems, and extensive research and development activities. Countries like Germany, the UK, and France lead the market in Europe due to their technological prowess and comprehensive healthcare policies. The European market also exhibits a strong CAGR, supported by government initiatives aimed at healthcare improvements and the adoption of innovative surgical methods.

Asia-Pacific region is expected to witness the fastest growth in the orthopedic trauma devices market. Factors contributing to this growth include rising healthcare infrastructure, increasing elderly population, and escalating incidences of road accidents and orthopedic diseases in populous countries like China and India. Asia-Pacific's CAGR is the highest among all regions, driven by rapid economic development, improvements in healthcare facilities, and growing public awareness about advanced orthopedic treatments.

Latin America and the Middle East & Africa regions are emerging in the orthopedic trauma devices market, with growth driven by gradual improvements in healthcare infrastructure and increasing access to medical treatments. While the market size is smaller compared to North America, Europe, and Asia-Pacific, these regions offer significant growth opportunities due to untapped markets and rising medical tourism. The CAGR for Latin America and the Middle East & Africa is promising, though lower than Asia-Pacific. The growth is primarily propelled by the increasing adoption of healthcare technologies and government efforts to enhance healthcare standards.

Orthopedic Trauma Devices Market: Competitive Landscape

Orthopedic Trauma Devices Market: Competitive Landscape

Some of the main competitors dominating the global orthopedic trauma devices market include;

- Acumed

- Advanced Orthopaedic Solutions

- Arthrex, Inc.

- B. Braun Melsungen AG.

- Bioretec Ltd.

- Biorez

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson)

- DJO, LLC

- INION OY

- Invibio Ltd.

- JEIL MEDICAL CORPORATION

- Medartis AG

- Medtronic

- Orthofix Medical Inc.

- Orthomed

- OsteoMed

- Smith & Nephew

- Stryker

- Zimmer Biomet

The global orthopedic trauma devices market is segmented as follows:

By Type of Device Segment Analysis

By Type of Device Segment Analysis

- Internal Fixators

- External Fixators

- Orthobiologics

By Material Segment Analysis

By Material Segment Analysis

- Metallic

- Bioabsorbable

By Type of Injury Segment Analysis

By Type of Injury Segment Analysis

- Simple Fractures

- Complex Fractures

- Soft Tissue Injuries

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgery Centers (ASCs)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Acumed

- Advanced Orthopaedic Solutions

- Arthrex, Inc.

- B. Braun Melsungen AG.

- Bioretec Ltd.

- Biorez

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson)

- DJO, LLC

- INION OY

- Invibio Ltd.

- JEIL MEDICAL CORPORATION

- Medartis AG

- Medtronic

- Orthofix Medical Inc.

- Orthomed

- OsteoMed

- Smith & Nephew

- Stryker

- Zimmer Biomet

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors