Search Market Research Report

Macadamia Milk Market Size, Share Global Analysis Report, 2025 - 2034

Macadamia Milk Market Size, Share, Growth Analysis Report By Product (Plain/Unsweetened Milk, Flavored/Sweetened Milk), By Nature (Organic, Conventional), By Packaging (Tetra Pak, Bottles, Cans), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

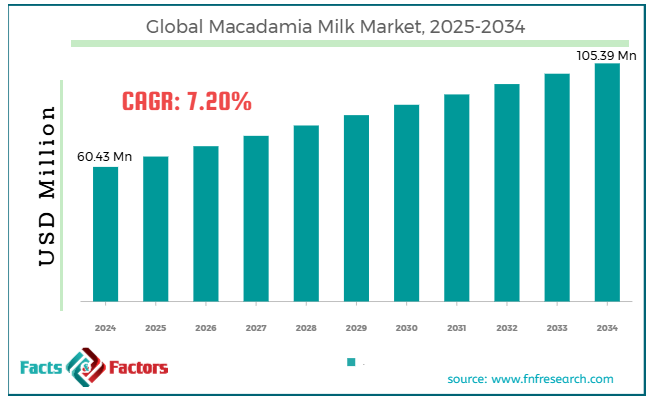

[220+ Pages Report] According to Facts & Factors, the global macadamia milk market size was worth around USD 60.43 million in 2024 and is predicted to grow to around USD 105.39 million by 2034, with a compound annual growth rate (CAGR) of roughly 7.2% between 2025 and 2034.

Market Overview

Market Overview

Macadamia milk is a plant-based substitute for dairy milk, made using macadamia nuts. It is popular for its light, subtle, nutty flavor and smooth texture, and is widely used in baking, smoothies, and coffee. The milk is also the best option for individuals following lactose-free, vegan, and keto diets. The global macadamia milk market is expected to grow substantially in the next 5 years due to the rise in plant-based and vegan diets, flavor expansion, product innovation, and increasing consumer ecological awareness. Many individuals worldwide are adopting vegetarian, vegan, and flexitarian diets. Supporting this trend, macadamia milk is a dairy-free and creamy option that attracts consumers who want to avoid customary animal-based products for environmental, ethical, and health reasons.

Moreover, prominent brands are introducing fortified and flavored versions, such as barista blends, vanilla, chocolate, and vitamin-enhanced choices, to attract a wider audience, mainly coffee drinkers and children. In addition, as people become conscious of the environment, they actively prefer plant-based options with less water and carbon footprints. Although macadamia nuts are comparatively water-intensive, they are still viewed as a more ecological substitute for dairy milk.

Nevertheless, the global market is hampered by a few obstacles, like high production costs and a restricted supply of raw materials. Macadamia nuts are the costliest due to restricted labor-intensive harvesting and limited growing areas. It increases the cost of macadamia milk as compared to other plant-based substitutes.

Also, macadamia trees take many years to bear fruit, and they grow primarily in certain regions like South Africa, Australia, and Hawaii, thus restricting scalability and resulting in supply chain exposures.

Yet, the market is opportune for technological improvements in processing and ethical and sustainable sourcing. Advancements like fermentation, cold-pressing, and enhanced UHT packaging significantly improve texture, shelf life, and nutritional content, offering brands strength.

Moreover, focusing on fair trade, environmentally friendly packaging like recyclable or plant-based cartons may appeal to eco-conscious individuals and distinguish brands from others.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global macadamia milk market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034)

- In terms of revenue, the global macadamia milk market size was valued at around USD 60.43 million in 2024 and is projected to reach USD 105.39 million by 2034.

- The macadamia milk market is projected to grow significantly owing to surging consumer demand for plant-based dairy-free substitutes, a growing health-conscious population, and the introduction of new flavors and variations in macadamia milk.

- Based on product, the plain/unsweetened milk segment is expected to lead the market, while the flavored/sweetened milk segment is expected to register considerable growth.

- Based on nature, the conventional segment leads the global market, while the organic segment will progress considerably over the coming years.

- Based on packaging, the Tetra Pak segment is the dominating segment among others, while the cans segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the supermarkets and hypermarkets segment is expected to lead the market as compared to the online segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Will the growth in plant-based diets and rising awareness of nutritional benefits fuel the macadamia milk market growth?

Macadamia milk is naturally high in healthy fats, essential minerals and vitamins, and proteins, and low in carbohydrates, which increases its appeal among health-conscious consumers. Being naturally free from lactose, the milk caters to people avoiding dairy products due to health issues or individuals who are lactose intolerant. The milk also has low saturated fat content, which supports heart-healthy dietary choices.

Furthermore, rising awareness of environmental sustainability and animal welfare propels the demand for vegan or plant-based diets. Macadamia milk is the best substitute for vegetarians and vegans. Hence, the rising adoption of flexitarian diets, where people lessen but do not eliminate animal-based products, is fueling the base of plant-based milks.

- Flavor diversification and the rise of lactose-intolerant population majorly impact the market progress

The launch of flavored macadamia milk types like chocolate, vanilla, and coffee-infused choices is appealing to a wider consumer base. Leading producers actively offer fortified macadamia milk rich in minerals and vitamins to cater to health-conscious customers.

Also, most of the global populace is lactose intolerant, triggering an inclination towards lactose-free milk substitutes. Also, macadamia milk is not allergenic like almond or soy milk, which increases the appeal among individuals with nut allergy, thus propelling market growth.

Restraints

Restraints

- Why does intense competition from established alternatives unfavorably impact the macadamia milk market progress?

The macadamia milk industry is saturated with established plant-based milks, including those made from oats, soy, almonds, and rice, which dominate retail shelf space and customer preferences. Newbies like Macadamia Milk face key hurdles to entry because of the strong brand names of existing products. Leading brands should invest in marketing and promotion to distinguish their products and hold maximum market share. Legacy brands currently hold a healthy market share, accounting for a total of 60% of sales.

Opportunities

Opportunities

- How do partnerships with food service, cafés, & retail chains and sustainability propel the macadamia milk market growth?

Associating with key food service outlets and retailers like smoothie bars, coffee shops, and more may increase the appeal and trials among a majority of customers. The barista-style formulation with macadamia milk is ideal for frothing and steaming, making them suitable for cafés.

Milkadamia joined hands with Pop Up Grocer in December 2023 to expand its retail reach and market its plant-based products.

Besides, customers, particularly Gen Z and Millennials, prefer products that support with their ethical and environmental values. Underscoring ecological farming processes, responsible sourcing, and environmentally friendly packaging significantly distinguishes macadamia milk from others. This encourages experiments and repeat purchases, enhances brand credibility through trusted venues like specialty stores and cafés, and positions this milk as a café-quality and premium product.

Challenges

Challenges

- Environmental and regulatory challenges limit the growth of the market

Macadamia nut husbandry is subject to strict agricultural rules, and ecological issues associated with land management and water usage may affect production. Obeying these regulations may increase operational prices for producers. Ecological issues may also impact consumer perception, mainly among eco-conscious purchasers.

Prominent international businesses like Coden Alimentarius set food quality and safety standards that impact the macadamia milk market. Obedience to these rules is vital for exporters to enter markets, gain consumers’ confidence, and maintain their trust.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 60.43 Million |

Projected Market Size in 2034 |

USD 105.39 Million |

CAGR Growth Rate |

7.20% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Milkadamia, Suncoast Gold Macadamias, Elmhurst 1925, Califia Farms, Pacific Foods, PureHarvest, Nutura Organic, Plenish, 365 by Whole Foods Market, Rude Health, Ulu Hye, Macamilk, Australia's Own, Lechia, New Barn Organics, and others. |

Key Segment |

By Product, By Nature, By Packaging, By Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global macadamia milk market is segmented based on product, nature, packaging, distribution channel, and region.

Based on product, the global macadamia milk industry is divided into plain/unsweetened milk and flavored/sweetened milk. The plain/unsweetened milk segment registered a significant market share in 2024 and is projected to dominate in the future. The said segment attracts health-conscious individuals, especially those who follow specific diets like sugar-free, low-carb, and keto. Numerous plant-based milk buyers prefer the least additives, thus increasing the popularity of unsweetened forms of macadamia milk. Plant-based unsweetened milk, comprising macadamia, is persistently favored because of its multi-purpose use in sweet applications and savory ones like smoothies, cooking, and coffee.

Based on nature, the global macadamia milk industry is segmented into organic and conventional. The conventional segment held a notable market share in 2024 and is expected to lead in the future. The segment comprises products prepared from non-organic macadamia nuts. These are highly affordable because of lower production costs than organic forms. Conventional products are broadly accessible in supermarkets and hypermarkets, thus increasing their accessibility to a broad consumer base. Due to low prices related to farming and the ability to produce at scale, conventional milk has led the global market in terms of volume. Conventional items are also first chosen for mass-market people and budget-friendly buyers.

Based on distribution channel, the global market is segmented into supermarkets and hypermarkets, convenience stores, online, and others. The supermarkets and hypermarkets segment is expected to lead the market over the estimated period, offering significant visibility for macadamia milk items. The segment registers the maximum share since retail outlets offer broad accessibility and are usually the first purchase destination of consumers. A majority of retailers now carry numerous plant-based milk choices, such as macadamia milk, due to its growing popularity. Hypermarkets and supermarkets hold a broader consumer base. Their extensive geographic reach and large-scale operations contribute to their dominance in sales volume.

Regional Analysis

Regional Analysis

- What factors will aid North America to lead the macadamia milk market over the forecast period?

North America captured a remarkable share of the global macadamia milk market in 2024 and is expected to lead in the future. The key factors contributing to growth include the growing demand for plant-based substitutes, sustainability trends, increased consumer awareness, and a robust e-commerce and retail system.

The growing consumer preference for dairy-free and plant-based products, fueled by ethical, health, and environmental concerns, has propelled the sales of macadamia milk. Consumers in Canada and the United States favor macadamia milk for its health perks like eco-friendly, sustainable production and heart-healthy fats over other plant milks like almond.

Furthermore, heightened marketing efforts from brands such as Milkadamia have increased awareness among people regarding macadamia milk. This helps the milk gain more attention in the market. In addition, strong e-commerce and retail systems in the region make milk easily accessible and affordable, contributing to its prominence.

Europe is projected to progress as the second-leading region in the global macadamia milk market, backed by rising consumer demand for plant-based substitutes, growing environmental and health awareness, and a growing flexitarian and vegan populace. Europe has witnessed notable growth in demand for plant-based substitutes, driven by increasing health awareness and a growing emphasis on ethical and environmental considerations. Many individuals in the region are moving away from dairy-based products towards plant-based foods, including macadamia milk.

Consumers in the area are also becoming environmentally aware and health-conscious, which drives the demand for healthy substitutes. Macadamia milk is considered nutrient-rich and premium, with a lower impact than other milks, such as almond milk.

Besides, the region's rising trend of flexitarian and vegan diets has increased demand for plant-based substitutes. A significant section of the population actively reduces animal-based products and favors plant-based diets, which impels the regional macadamia milk industry.

Competitive Analysis

Competitive Analysis

The global macadamia milk market is led by players like:

- Milkadamia

- Suncoast Gold Macadamias

- Elmhurst 1925

- Califia Farms

- Pacific Foods

- PureHarvest

- Nutura Organic

- Plenish

- 365 by Whole Foods Market

- Rude Health

- Ulu Hye

- Macamilk

- Australia's Own

- Lechia

- New Barn Organics

Key Market Trends

Key Market Trends

- Growing sustainability focus:

People actively prefer sustainability, and macadamia milk is observed as the best ecological option due to the drought-resistant properties of macadamia trees, which need less water than other nuts. This ecological appeal is fueling its progress, especially in environmentally conscious markets like North America and Europe.

- The speedy growth of e-commerce:

The online retail segment is progressing remarkably for vegan products, including macadamia milk. It is fueled by the great convenience offered by home delivery and the rising trend of online grocery shopping. The trend is widespread in Europe and North America, where online shopping is a leading propeller of sales growth.

The global macadamia milk market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Plain/Unsweetened Milk

- Flavored/Sweetened Milk

By NatureSegment Analysis

By NatureSegment Analysis

- Organic

- Conventional

By Packaging Segment Analysis

By Packaging Segment Analysis

- Tetra Pak

- Bottles

- Cans

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Milkadamia

- Suncoast Gold Macadamias

- Elmhurst 1925

- Califia Farms

- Pacific Foods

- PureHarvest

- Nutura Organic

- Plenish

- 365 by Whole Foods Market

- Rude Health

- Ulu Hye

- Macamilk

- Australia's Own

- Lechia

- New Barn Organics

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors