Search Market Research Report

Lottery Market Size, Share Global Analysis Report, 2022 – 2028

Lottery Market Size, Share, Growth Analysis Report By Type (Terminal-Based Games, Scratch-off Games, Sports Lotteries), By Mode (Offline, Online), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

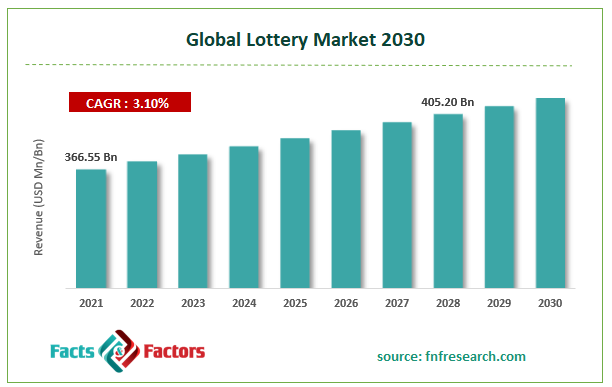

[231+ Pages Report] According to the report published by Facts Factors, the global lottery market was worth USD 366.55 billion in 2021 and is estimated to grow to USD 405.20 billion by 2028, with a compound annual growth rate (CAGR) of approximately 3.10% over the forecast period. The report analyzes the lottery market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the lottery market.

Market Overview

Market Overview

A lottery is a form of gaming in which winning numbers are chosen randomly. While some governments outright ban lotteries, others go so far as to establish a federal or state lottery. Governments routinely control the sale of lottery tickets; the most common regulation is the ban on sales to minors and the need for retailers to have a license before selling lottery tickets. Although lotteries were common in the US and a few other countries during the 19th century, by the turn of the century, most forms of gambling, including lotteries and sweepstakes, had been outlawed in the US and most of Europe, and a few other nations. In the 1960s, casinos and lotteries made a comeback worldwide as a method for governments to raise money without increasing taxes. There are numerous formats for lotteries. The prize could, for instance, be a specific amount of cash or goods. In this model, the organizer could lose money if not enough tickets are sold. The online lottery system is another lottery format that has grown in popularity recently. A person can register to play an online game and win or lose. There are internet platforms for things like online betting and gaming. Almost every sport has an internet betting option in today's society.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has impacted the lottery business due to stringent regulations by many nations to stop the virus's spread. Post-pandemic, however, there has been a significant uptake in the market's internet component. Offline lottery ticket sellers and other gaming enterprises were forced to close due to the COVID-19-related lockdown. Internet gambling has become more popular, which could increase sales of online lotteries and maintain industry stability during the epidemic. The constant betting of gamblers with a lot of free time leads to significant losses. Gambling addiction may result from this. To help those who have been impacted, all gambling platforms must offer responsible gambling services.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the lottery market value is expected to grow at a CAGR of 3.10% over the forecast period.

- In terms of revenue, the lottery market was worth USD 366.55 billion in 2021 and is estimated to grow to USD 305.20 billion by 2028.

- The cost of fixed internet broadband has dramatically decreased due to greater R & D spending and more competition in the broadband sector.

- By type, the terminal-based games category dominated the market in 2021.

- By mode, the online segment dominated the market in 2021.

- North America dominated the global lottery market in 2021

Growth Drivers

Growth Drivers

- The expanding use of online lotteries has driven market growth

The increasing prevalence of online lottery is one of the major reasons propelling growth in the lottery market. The increased use of smartphones and the Internet is blamed for expanding the online lottery. Customers can easily participate in the lottery thanks to the availability of numerous mobile apps and online platforms, as well as the convenience with which the Internet is accessible. Vendors are utilizing cutting-edge technologies to enhance the consumer appeal of the online lottery, including interactive bots and graphics that have become common in the gaming industry. Vendors are using the adoption of online platforms to serve their clients better and capitalize on the rising popularity of smartphones among consumers.

Restraints

Restraints

- Government restrictions on the lottery hamper the market growth

During the projection period, the lottery market will face significant challenges due to the strict laws on lotteries in many regions. One of the forms of gambling that is strictly regulated in many nations is the lottery. Due to the industry's tight relationship with social responsibility, it is only natural to be highly regulated. Additionally, it ensures that the public interest is safeguarded and that lottery sales proceeds are fairly distributed to players and society for various charitable purposes. In many nations, the lottery is operated by government-owned organizations or is licensed by the government to private organizations. Governments frequently regulate gambling in all forms due to the high risk involved and significant socioeconomic impact, which limits the ability of private companies to enter the market and slows its expansion.

Opportunities

Opportunities

- The use of technology by operators of lotteries is a new opportunity for the market

One development in the lottery business anticipated to have a beneficial effect in the upcoming years is the deployment of technologies by lottery operators. It is challenging to grow the business due to the worldwide lottery market being tightly controlled and largely dominated by governmental organizations. Instead of conducting business as usual, vendors began concentrating on developing new strategies for engaging customers. To achieve this, businesses need to pinpoint cutting-edge technology that can enhance the appeal of the offline lottery.

Consumers' increasing usage of online platforms has given vendors several opportunities. Lottery providers need to move away from traditional instant games by giving players more social engagement and experience when playing in groups. The global lottery market's future will shift due to big data's significance and the proliferation of the Internet of Things (IoT) devices. Vendors can grow their customer base and keep a competitive edge by utilizing technology in sales channels and other areas of the lottery industry.

Segmentation Analysis

Segmentation Analysis

The lottery market has been segmented into type, mode, and region.

The global lottery market is divided into terminal-based games, scratch-off games, sports lotteries, and others. The terminal-based games segment held the largest market share in the global lottery market in 2021. This is majorly driven by the increased demand for gaming among millennials along with the growing product enhancement by key players in this category. Moreover, the increased demand for terminal-based games in emerging economies such as India, Brazil, and others is further estimated to enhance the category growth during the forecast period.

The global lottery market has been divided into online and offline based on mode. During the forecast period, the lottery market's online segment will experience the fastest increase. One of the main drivers of the lottery market's expansion is the notable increase in lottery prize money. Additionally, it is projected that the easing of government rules and the enormous growth of online lottery merchants would favor the demand for the lottery on the global market.

Recent Developments

Recent Developments

- In 2021: The formal launch of Lotto.com Inc. in New Jersey was announced. It is the first digital platform that enables lottery ticket purchases via any device without downloading an app or making a deposit. The business collaborated with QuickChek to establish a dot.com and physical convenience store.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 366.55 Billion |

Projected Market Size in 2028 |

USD 405.20 Billion |

CAGR Growth Rate |

3.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Camelot GroupChina, LotSynergy Holdings Ltd., Florida Lottery, International Game Technology plc, Lotto NZ, New York State Gaming Commission, Scientific Games Corp., Brookfield Business Partners, California State Lottery, INTRALOT SA., and others. |

Key Segment |

By Type, Mode, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America expected to dominate the lottery market in 2021

The North American region is anticipated to increase at the highest CAGR in 2021 in the global lottery market. One of the key drivers of the increase in lottery demand in the North American market is the heavily increasing emphasis on entertainment options. Due to cell phones being so widely used, the North American lottery market is regarded as the most well-liked worldwide. Additionally, US lotteries offer an online platform so that players can participate from the comfort of their own homes. Additionally, many of the world's investors now favor INTRALOT SA, one of the most well-known US lotteries. The Lotto Max, 6/49, and Lotto Daily Grand are other extremely popular Canadian lottery games. These lottery games are open to non-residents and available on plenty of online sites.

Competitive Landscape

Competitive Landscape

- Camelot GroupChina

- LotSynergy Holdings Ltd.

- Florida Lottery

- International Game Technology plc

- Lotto NZ

- New York State Gaming Commission

- Scientific Games Corp.

- Brookfield Business Partners

- California State Lottery

- INTRALOT SA.

Global Lottery Market is segmented as follows:

By Type

By Type

- Terminal-based games

- Scratch-off games

- Sports lotteries

By Mode

By Mode

- Online

- Offline

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Camelot GroupChina

- LotSynergy Holdings Ltd.

- Florida Lottery

- International Game Technology plc

- Lotto NZ

- New York State Gaming Commission

- Scientific Games Corp.

- Brookfield Business Partners

- California State Lottery

- INTRALOT SA.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors