Search Market Research Report

Lithium Cobalt Oxide Cathode Materials Market Size, Share Global Analysis Report, 2025 - 2034

Lithium Cobalt Oxide Cathode Materials Market Size, Share, Growth Analysis Report By Type (4.35V LiCoO2 Material, 4.40V LiCoO2 Material), By Purity Level (High Purity Lithium Cobalt Oxide Cathode Materials, Medium Purity Lithium Cobalt Oxide Cathode Materials, Low Purity Lithium Cobalt Oxide Cathode Materials), By Application (Consumer Electronics, Electric Vehicles [EVs], Energy Storage Systems [ESS], Medical Devices, Aerospace and Defense, Alternatives), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

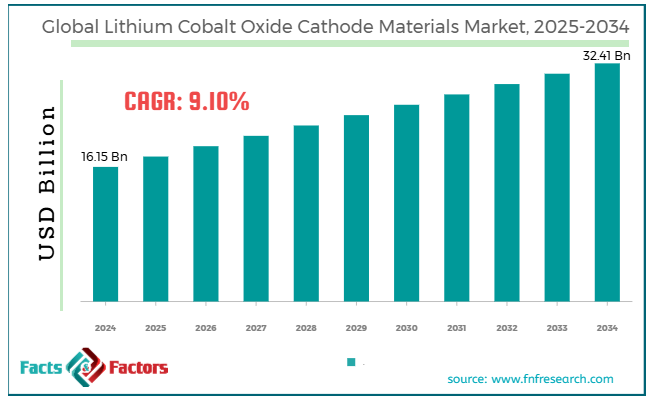

[221+ Pages Report] According to Facts & Factors, the global lithium cobalt oxide cathode materials market size was worth around USD 16.15 billion in 2024 and is predicted to grow to around USD 32.41 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.10% between 2025 and 2034.

Market Overview

Market Overview

Lithium cobalt oxide is a broadly used cathode material in Li-ion batteries, mainly for portable electronics like laptops and smartphones. It offers stable performance and enhanced energy density, increasing its suitability for compact devices. Architecturally, it comprises layered cobalt oxide with Li-ions inserted between the layers, enabling effective charge and discharge cycles. The worldwide lithium cobalt oxide cathode materials market is witnessing remarkable growth, owing to the rising adoption of electric vehicles, the high proliferation of consumer electronics, and battery technology enhancements. The global inclination towards e-vehicles is a leading driver for the lithium cobalt oxide market. LCO batteries are largely used in electric vehicles due to their high energy density, allowing long driving ranges. This demand is supported by government motivations that promote clean energy transportation.

Moreover, the growing dependency on laptops, smartphones, and other devices demands batteries with better compact sizes and high energy density. LCO batteries meet these demands, resulting in broader use of consumer devices. Furthermore, the present R&D efforts are improving the safety and performance of LCO batteries. Modernizations that enhance energy density, thermal stability, and cycle life increase the appeal of LCO batteries for diverse applications. These improvements are projected to spur the market.

Nevertheless, the global market faces challenges due to fluctuations in cobalt prices and ethical and environmental concerns. The cobalt industry is witnessing oversupply, projected to continue till 2028 because of a 17% production rise in 2023. This is notably impacted by Chinese firms' growing output from the Democratic Republic of the Congo. This oversupply drops cobalt prices, affecting the cost structure of LCO batteries.

Also, cobalt mining increases ethical and environmental issues, including human rights violations and habitat destruction. These issues are demanding ethical and sustainable sourcing practices in the battery sector. However, the lithium cobalt oxide cathode materials industry is opportune for recycling & second-life battery uses. With the growing focus on sustainability, recycling lithium cobalt oxide batteries is growing as a promising opportunity.

Moreover, developing cobalt-reduced or cobalt-free technologies is another crucial opportunity, as it retains the advantages of LCO while lowering cobalt reliance. In addition, the growth of IoT and innovative grid ecosystems has increased the demand for high-density and compact energy storage solutions.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global lithium cobalt oxide cathode materials market is estimated to grow annually at a CAGR of around 9.10% over the forecast period (2025-2034)

- In terms of revenue, the global lithium cobalt oxide cathode materials market size was valued at around USD 16.15 billion in 2024 and is projected to reach USD 32.41 billion by 2034.

- The lithium cobalt oxide cathode materials market is projected to grow significantly owing to the rising demand for electric vehicles, mounting demand for consumer electronics, and supportive government initiatives for adopting renewable energy systems.

- Based on type, the 4.35V LiCoO2 material segment is expected to lead the market, while the 4.40V LiCoO2 material segment is expected to grow considerably.

- Based on purity level, the high purity lithium cobalt oxide cathode materials segment is the dominating segment, while the medium purity lithium cobalt oxide cathode materials segment is projected to witness sizeable revenue over the forecast period.

- Based on the application, the electric vehicles (EVs) segment is expected to lead the market compared to the consumer electronics segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- Will the incorporation of energy storage and renewable energy solutions drive the lithium cobalt oxide cathode materials market growth?

With the rising adoption of renewable energy sources like wind and solar, the need and significance of effective energy storage systems rise. Lithium cobalt oxide batteries are best suited for grid energy storage systems owing to their energy stability and density. These systems effectively store surplus energy produced during peak times and release it during high demand, promising a reliable and continuous energy supply.

Furthermore, surging demand for consumer electronics like laptops, smartphones, and other portable devices propels the need for these li-ion batteries, thus impacting the global lithium cobalt oxide cathode materials market.

- Improvements in battery technology considerably fuel the market growth

Constant R&D in battery technologies is improving the safety and performance of lithium cobalt oxide batteries. Improvements like replacing pure lithium cobalt oxide with blended nickel/cobalt oxide and developing thin-film cobalt oxide electrodes have enhanced battery performance and stability. These improvements are increasing the appeal of lithium cobalt oxide batteries for diverse applications, including electric vehicles and consumer electronics.

Restraints

Restraints

- Cobalt supply challenges and price fluctuations negatively impact market progress

Cobalt, a vital part of lithium cobalt oxide batteries, is mainly obtained from the Democratic Republic of the Congo (DRC), which registers for nearly 70% of worldwide production. This focus offers supply risks because of geopolitical instability and restricted high-quality reserves. In addition, cobalt prices have been changing, impacted by the fluctuating demand and mining disturbances from the EV sector.

Opportunities

Opportunities

- How do enhancements in recycling technologies work as a foremost opportunity in the lithium cobalt oxide cathode materials market?

With global concerns about the ethical and environmental impact of cobalt mining, recycling lithium cobalt oxide batteries has significantly progressed. Companies like Li-Cycle and Redwood Materials have demonstrated that recycled lithium cobalt oxide can imitate or exceed the quality of virgin material. This decreases reliance on volatile supply chains, especially from the DRC, which transfers over 70% of universal cobalt. The worldwide battery recycling industry is projected to have a surplus of USD 20 billion by 2030. Reprocessed or recycled materials also appeal to OEMs and ESG-conscious investors. This ecosystem helps comply with sustainability goals and creates a fresh market for improved LCO, promising reduced production costs and circular supply security.

Challenges

Challenges

- Why do trade barriers and geopolitical stresses restrict the growth of the lithium cobalt oxide cathode materials market?

Geopolitical factors, like the United States-China trade tensions, have brought uncertainties in the lithium cobalt supply chain. China manages most of the global lithium-ion battery supply chain, which comprises the processing of vital materials such as lithium and cobalt. Export sanctions and controls may disturb the pricing and accessibility of these materials, impacting global producers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 16.15 Billion |

Projected Market Size in 2034 |

USD 32.41 Billion |

CAGR Growth Rate |

9.10% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Ganfeng Lithium Co. Ltd., Zhejiang Huayou Cobalt Co. Ltd., Ronbay Technology, Valence Technology, NICHIA CORPORATION, Redwood Materials, SEMCORP Group, BTR New Material Group, XTC New Energy Materials, Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution, Samsung SDI, SK Innovation, Panasonic Energy Co. Ltd., Shaanxi Nonferrous Tian Hong, and others. |

Key Segment |

By Type, By Purity Level, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global lithium cobalt oxide cathode materials market is segmented based on type, purity level, application, and region.

Based on type, the global lithium cobalt oxide cathode materials industry is divided into 4.35V LiCoO2 material and 4.40V LiCoO2 material. The ‘4.35V LiCoO2 material' segment registered a notable market share in 2024 and is projected to lead in the upcoming years due to its prominence, cost-effectiveness compared to the 4.40V variant, and excellent balance between energy stability and density. It is broadly used in consumer electronics, especially laptops and smartphones, where compact size and high energy density are needed. Its competitive pricing and proven performance strengthen its dominant position in the industry.

Based on purity level, the global lithium cobalt oxide cathode materials industry is segmented into high-purity lithium cobalt oxide cathode materials, medium purity lithium cobalt oxide cathode materials, and low purity lithium cobalt oxide cathode materials. The ‘high purity lithium cobalt oxide cathode materials’ segment is expected to lead the market considerably due to its high stability, superior energy density, and durability. These features increase its suitability in laptops, smartphones, and electric vehicles. It offers optimum thermal stability and endurance through discharge and charge cycles, which are vital for demanding industries. Despite being expensive, it is largely preferred due to safety, high performance, and cost-efficiency, mainly in the progressing premium consumer electronics and EV markets.

The global market is segmented into consumer electronics, electric vehicles (EVs), energy storage systems (ESS), medical devices, aerospace and defense, and alternatives based on application. The electric vehicles (EVs) led the global market in 2023, with a revenue portion of 69.5%. The universal move towards sustainable transport and the need to decrease carbon emissions have notably surged the demand for electric vehicles. LCO is an essential component in lithium batteries used in e-vehicles because it maintains the cathode's layered framework and offers optimal energy density.

Regional Analysis

Regional Analysis

- What factors help North America dominate the lithium cobalt oxide cathode materials market?

North America is projected to hold a larger share of the lithium cobalt oxide cathode materials market over the forecast period. This growth is attributed to the number of mining initiatives, strategic savings in battery supply chains, supportive government policies, and innovations. North America is home to the majority of cobalt and lithium reserves. The Thacker Pass lithium mine is the biggest lithium deposit in the United States, capable of supplying nearly 25% of the global lithium demand.

Also, establishments like Redwood Materials, started by JB Straubel, are the prominent efforts to build an ecological battery supply chain by recycling Li-ion batteries in Nevada. The initiative plans to produce enough cathode material for roughly 1.3 million electric vehicles.

Moreover, policies for domestic manufacturing of batteries and sourcing vital minerals encourage firms to establish operations in the region. This will decrease reliance on foreign supply chains and strengthen domestic manufacturing of cathode materials. Furthermore, regional companies are leading in the development of improved battery technologies. Innovations like Redwood Material support sustainability and improve the efficiency of LCO cathode materials.

Asia Pacific is expected to progress as the second-leading region in the global lithium cobalt oxide cathode materials market, backed by China's leadership in battery production, abundant supply of raw materials, and growth of the EV market. China is the leader in lithium battery production, accounting for 73% of the worldwide capacity. The nation's large manufacturing infrastructure and well-known supply chains add to the regional share. Australia is the biggest lithium producer, accounting for 53% of the global supply. Most lithium is exported to China for further treatment, boosting the region's share in the lithium cobalt oxide industry.

Moreover, the rising adoption of electric vehicles in nations like India and China surges the demand for high-performing batteries, ultimately fueling the demand for LCO cathode materials. This trend impacts the region's vital player in the worldwide LCO market.

Competitive Analysis

Competitive Analysis

The global lithium cobalt oxide cathode materials market is led by players like:

- Ganfeng Lithium Co. Ltd.

- Zhejiang Huayou Cobalt Co. Ltd.

- Ronbay Technology

- Valence Technology

- NICHIA CORPORATION

- Redwood Materials

- SEMCORP Group

- BTR New Material Group

- XTC New Energy Materials

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution

- Samsung SDI

- SK Innovation

- Panasonic Energy Co. Ltd.

- Shaanxi Nonferrous Tian Hong

Key Market Trends

Key Market Trends

- Standardization of battery material valuing:

The introduction of standardized futures bonds for primary battery materials, comprising lithium carbonate, cobalt hydroxide, and lithium hydroxide, is changing the outlook of the lithium cobalt oxide cathode materials industry. This move, headed by Benchmark Minerals Intelligence in association with the ICE, aims to offer precise pricing mechanisms, fueling industry stability and better risk management for stakeholders.

- Move towards cobalt-free and substitute battery chemistries:

The industry is experiencing a shift towards alternative and cobalt-free battery chemistries like NMC and LFP batteries. These alternatives offer cost benefits and are gaining prominence in various applications, such as energy storage systems and electric vehicles. Supply chain risks, human rights problems with cobalt mining, and ecological impact fuel this trend.

The global lithium cobalt oxide cathode materials market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- 4.35V LiCoO2 Material

- 4.40V LiCoO2 Material

By Purity Level Segment Analysis

By Purity Level Segment Analysis

- High Purity Lithium Cobalt Oxide Cathode Materials

- Medium Purity Lithium Cobalt Oxide Cathode Materials

- Low Purity Lithium Cobalt Oxide Cathode Materials

By Application Segment Analysis

By Application Segment Analysis

- Consumer Electronics

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Medical Devices

- Aerospace and Defense

- Alternatives

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Ganfeng Lithium Co. Ltd.

- Zhejiang Huayou Cobalt Co. Ltd.

- Ronbay Technology

- Valence Technology

- NICHIA CORPORATION

- Redwood Materials

- SEMCORP Group

- BTR New Material Group

- XTC New Energy Materials

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution

- Samsung SDI

- SK Innovation

- Panasonic Energy Co. Ltd.

- Shaanxi Nonferrous Tian Hong

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors