Search Market Research Report

Lingerie Market Size, Share Global Analysis Report, 2021 – 2028

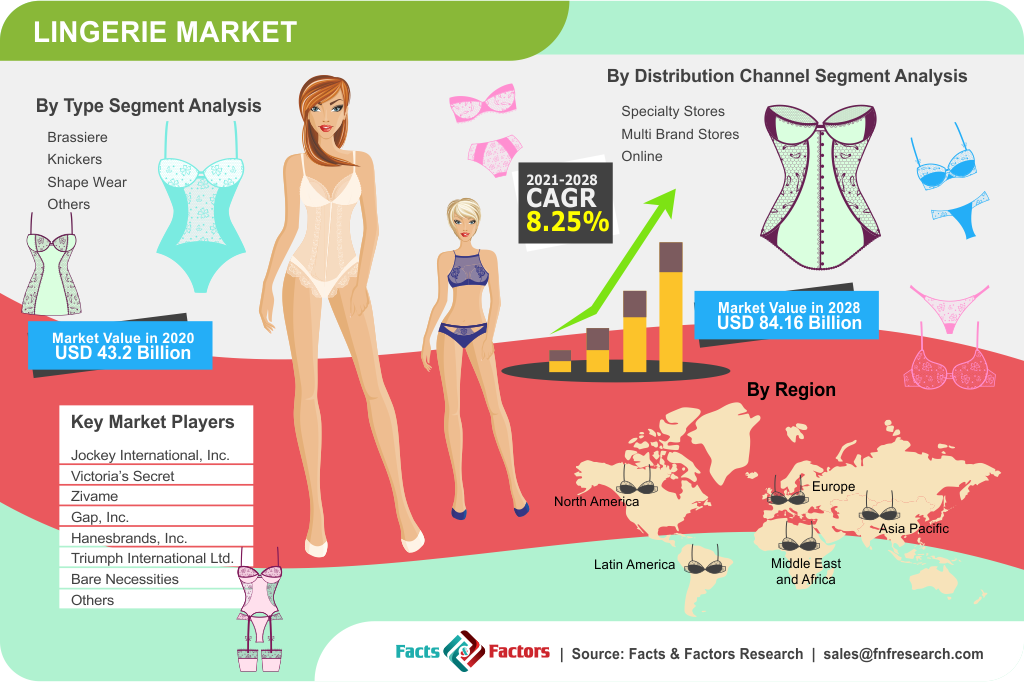

Lingerie Market By Type (Brassiere, Knickers, Shape Wear, & Others), By Distribution Channel (Specialty Stores, Multi Brand Stores, & Online), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2028

Industry Insights

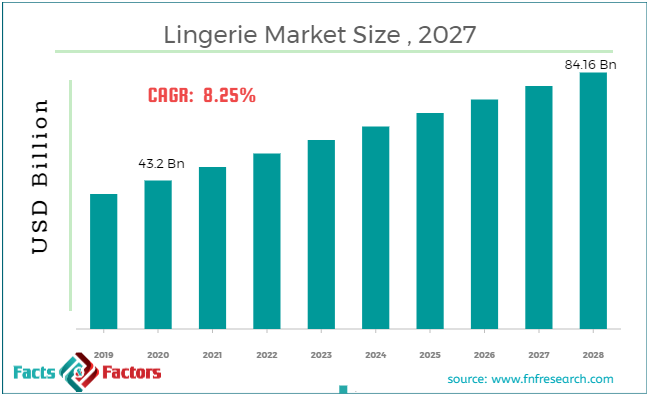

[225+ Pages Report] The latest finding surrounding the “Global Lingerie Market” published by Facts & Factors offers a neatly packaged and comprehensive read. In the current study, the global lingerie market is estimated to reach a projected value of USD 84.16 Billion by 2028 with a growth rate of 8.25% CAGR from an initial value of USD 43.2 Billion in the year 2020.

Market Overview

Market Overview

Lingerie is a category of women’s clothing that includes undergarments, sleepwear, and other formats of light wear robes that are adorned for an aiding alluring and fashionable nature. They are often made up of lightweight, stretchy, smooth, and decorative fabrics such as silk, satin, lycra, charmeuse, and others. These are often produced from natural fibers such as cotton or synthetic fibers like polyester or nylon. The primary role of lingerie is to maintain hygiene.

Key Insights from Primary Research

Key Insights from Primary Research

- As per our analyst, the global lingerie market is set to grow annually at a rate of around 8.25% from 2021 to 2028.

- According to our primary respondents, it was established through primary research that the Lingerie market was valued at around USD 43.2 Billion in 2020 and expected to reach value of USD 84.16 Billion by 2028.

- Based on the type segmentation, the global lingerie market was led by a brassiere. This category held above 42% market share in 2019. Furthermore, the category is expected to grow at a CAGR of around 7.6% during the forecast period.

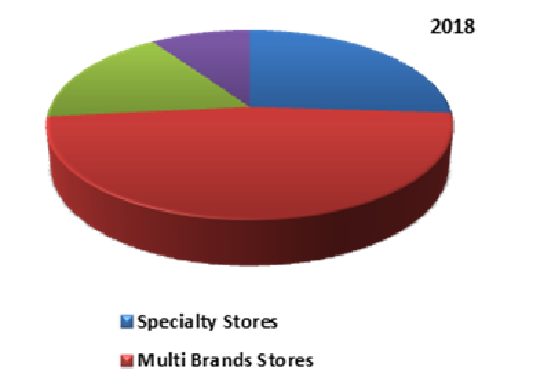

- On the basis of sales channel segmentation, the “Multi Brands Stores” category held the leading share at more than 43%, in 2019.

- By pricing, the watch segment dominated the global lingerie market in 2019. The economic segment accounted for more than 56% share in the global lingerie market in 2019.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per industry expertise, the lingerie demand is surging high due to the growing fashion & apparel sector, because people today are more inclined towards branded products, which are usually sold at higher prices.

- The increasing demand for comfortable, skin-friendly and lightweight products coupled with innovations in the manufacturing processes is anticipated to pose lucrative opportunities in the lingerie market.

- As per our analyst, shifting trends in the lingerie industry have opened the door for smaller, independent brands to come in and disrupt the market. With a focus on inclusivity and body positivity, niche lingerie brands and online start-ups are taking hold of the market.

- Rising westernization among the youth females, increasing consumer spending as well as a rising inclination towards the adoption of lingerie for better comfort and enhanced sex-appeal are some other key aspects driving the demand for lingerie among millennials is expected to cater the growth in the emerging market over the years to come.

- Surging the retail industry along with the increasing investments by the major companies to take an innovative approach to attract consumers is projected to escalate the market’s margin especially in the emerging markets within the estimated period.

Market Demographics – By Sales Channel

Market Demographics – By Sales Channel

Industry Growth Factors

Industry Growth Factors

The primary driving forces for the stagnant rise of the global lingerie market include the rising awareness about the best fit among the millennial population coupled with rising spending power among women to name a few. Additionally, the rising availability of a broader sense of products in the form of sports, bridal wear, and regular wear coupled with the rising popularity of the market owing to rising need among women for highlighting their natural features will increase the footprint of the global lingerie market during the advent of the forecast period. Moreover, the integration of fabrics such as nylon, polyester, satin, lace, and cotton coupled with designers fixating on creating products with lace, embroidery, luxurious materials, and brighter hues will fuel the growth of the global lingerie market during the advent of the forecast period.

The global lingerie market is expected to be driven by the rising influence of social media and innovative marketing strategies over the advent of the forecast period. Factors pertaining to companies increasing budgets pertaining to all shapes and sizes coupled with rising focus on style quotient among women will boost the growth of the global lingerie market during the advent of the forecast period. However, rising concerns over the highly fragmented nature of the market coupled with the increasing prevalence of an unorganized sector will hamper the growth of the global lingerie market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global lingerie market is segmented into type, distribution channel, and region.

The global lingerie market is categorized into brassiere, knickers, shapewear, and others on the basis of type. The brassiere segment is expected to witness the largest market share during the advent of the forecast period owing to the rising availability of fabrics coupled with continuous changes in technology to name a few. Additionally, factors pertaining to innovations in the sector such as laser cut, seamless, model, and full t-shirts brassiere coupled with the integration of elastic laces, pleated polyester, tulle, and microfiber materials is expected to cement the dominant growth of the latter segment during the advent of the forecast period.

Based on distribution channels, the global lingerie market is fragmented into specialty stores, multi-brand stores, and online. The segment pertaining to multi-brand stores is expected to witness the largest market share during the advent of the forecast period owing to rising benefits such as trail facilities and instant scanning of the products in real life to name a few. The online segment is expected to witness the fastest growing CAGR during the advent of the forecast period owing to a rising online consumer base coupled with an increasing number of online retailers introducing their own brand and presence to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 43.2 Billion |

Projected Market Size in 2028 |

USD 84.16 Billion |

CAGR Growth Rate |

8.25% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2028 |

Key Market Players |

Jockey International, Inc., Victoria’s Secret, Zivame, Gap, Inc., Hanesbrands, Inc., Triumph International Ltd., Bare Necessities, Calvin Klein, MAS Holdings, L Brands, AEO Management CO., Yandy LLC, Marks, Spencer plc., Group Chantelle, Hennes & Mauritz AB, LVMH Moet Hennessey Louis Vuitton, and Hunkemoller International B.V., among others. |

Key Segment |

By Type, By Distribution Channels, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Europe is expected to witness the largest market share during the advent of the forecast period owing to a rising presence of prominent players in the region coupled with higher demand for premium and luxury brands to name a few. Additionally, factors pertaining to added focus of key market participants on designs and quality coupled with an increasing number of limited edition products will increase the footprint of the lingerie market during the advent of the forecast period. The wider product availability coupled with an increasing number of online and offline distribution channels will increase the consumer base for the lingerie market during the advent of the forecast period. Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast period owing to changes in lifestyles among consumers coupled with increasing disposable income to name a few.

Competitive Players

Competitive Players

The key market participants for the global lingerie market are :

- Jockey International Inc.

- Victoria’s Secret

- Zivame

- Gap Inc.

- Hanesbrands Inc.

- Triumph International Ltd.

- Bare Necessities

- Calvin Klein

- MAS Holdings

- L Brands

- AEO Management CO.

- Yandy LLC

- Marks

- Spencer plc.

- Group Chantelle

- Hennes & Mauritz AB

- LVMH Moet Hennessey Louis Vuitton

- Hunkemoller International B.V.

By Type Segment Analysis

By Type Segment Analysis

- Brassiere

- Knickers

- Shape Wear

- Others

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Specialty Stores

- Multi Brand Stores

- Online

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Jockey International Inc.

- Victoria’s Secret

- Zivame

- Gap Inc.

- Hanesbrands Inc.

- Triumph International Ltd.

- Bare Necessities

- Calvin Klein

- MAS Holdings

- L Brands

- AEO Management CO.

- Yandy LLC

- Marks

- Spencer plc.

- Group Chantelle

- Hennes & Mauritz AB

- LVMH Moet Hennessey Louis Vuitton

- Hunkemoller International B.V.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors