Search Market Research Report

Green Tea Market Size, Share Global Analysis Report, 2021 - 2026

Green Tea Market By Form (Tea Bags, Loose Leaves, Loose Powder, Read-to-Drink, & Capsules & Tablets), By Flavor (Flavored & Unflavored), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, & Online Retail), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 - 2026

Industry Insights

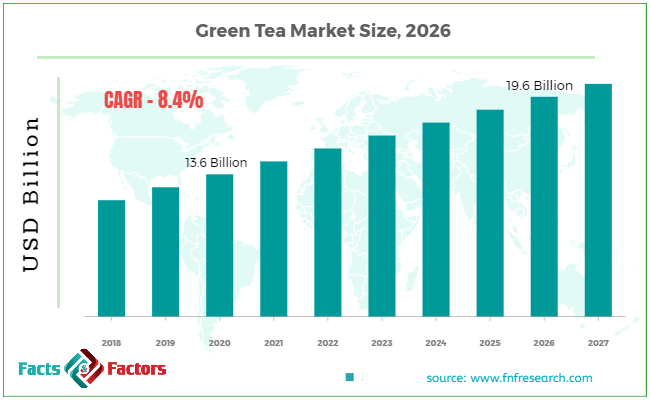

[196+ Pages Report] We at Facts & Factors have recently published a market study “Global Green Tea Market” which focuses as a guide for the latter and aims to capture the highlights and a forecast for the same over the projected duration. We estimate that the global green tea market is estimated to have reached USD 13.6 Billion in 2020 and is further expected to expand at a CAGR of 8.4% to attain a value of USD 19.6 Billion by 2026.

Market Overview

Market Overview

Green Tea has said to be originated from the era of Emperor Shennong which was projected to be during the time period of 618-907 AD. It is a form of tea that is procured from camellia sinensis leaves and buds that have not undergone the oxidation and withering process that is used for fermenting oolong teas and black teas. While the origination of green tea is rooted to China, a majority of the production and manufacturing abilities has been shifted to east Asia. Several categories of green tea exist on a variety of camellia sinensis leaves used, growing conditions, horticulture measures, and duration of harvest.

Industry Growth Factors

Industry Growth Factors

The primary driving factors for the robust growth of the global green tea market can be credited to rising awareness among consumers regarding health benefits of green tea coupled with lifestyle-related changes to name a few. Several studies have indicated that daily regulated amounts of green tea can lead to a larger boost of nutrients required by the human body which can help delay occurrences of a variety of disorders. Rising popularity of functional beverages among millennial and generation Z will incentivize manufacturers to introduce a wider range of flavors and novel types of green tea in order to keep up with the lucrative demands arising. Prevention of certain diseases that are common among the middle aged population will further boost the sales of the global green tea to a larger extent.

Increased concerns regarding maintaining superior health due to the ongoing pandemic rising demand for nutritional beverages will further increase the footprint of the global green tea market. Change of sedentary and stressful lifestyle and increased prevalence of obesity, diabetes, and cardiovascular conditions will open new revenue for the global green tea market during the forecast. Increasing consumer awareness about the health benefits between consumption of antioxidants-based foods and beverages will further nudge the market toward a positive outlook. Disruptions in supply chains due to COVID-19 and volatile price of raw materials is expected to hamper the growth of the global green tea market to a certain extent.

Segmentation Analysis

Segmentation Analysis

The global green tea market can be segmented into form, flavor, distribution channel, and regions.

On the basis of form, the global green tea market can be divided into tea bags, loose leaves, loose powder, read-to-drink, and capsules and tablets. Tea bags are expected to occupy the largest market share during the forecast period owing to easy usability, increased convenience due to modern-day hectic lifestyles, easy storage, and portable measures. Furthermore, the inclusion of eco-friendly tea bags will aid in easy disposal and will further appeal to a wider range of consumers. On the basis of flavor, the global green tea market can be fragmented into flavored and unflavored. Flavored green tea will dominate the market segment during the forecast owing to rising consumer preferences for enticing taste profiles coupled with the nutritional benefits. Furthermore, the inclusion of popular flavors such as honey, citrus, floral, and fruity to name a few will aid in boosting the sales of the flavored green tea, thereby cementing the dominant position of the market. On the basis of distribution channels, the global green tea market can be broken down into supermarkets/hypermarkets, convenience stores, specialty stores, and online retail. Supermarkets/hypermarkets are expected to witness the largest market share during the forecast period owing to rising investment from capitalists and the private sector and an overall easy shopping experience when compared to their counterparts. Rising technological advancements will further help in boosting the sales of green tea through the latter due to adequate providence of product directly to consumers.

Regional Analysis

Regional Analysis

Asia-Pacific is expected to recoup the largest market share during the advent of the forecast in terms of global revenue contribution. A healthy dose of nutrients coupled with rising consumer awareness and risen consumer spending power will aid the growth of the global green tea market in the region during the forecast. Rising disposable income among consumers and the presence of key players in the region will further boost the sales of green tea. China is the main exporter in the region and will contribute to the largest market share from the global perspective. North America is expected to witness the fastest growth during the forecast owing to the rising popularity of the market during the forecast coupled with rising consumer awareness about health benefits and hectic lifestyle changes among a majority of the population.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 13.6 Billion |

Projected Market Size in 2026 |

USD 19.6 Billion |

CAGR Growth Rate |

8.4% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Associated British Food, plc., Unilever, plc., Tata Consumer Products, The Bigelow Tea Company, East West Tea Company, Numi, Inc., Tazo Tea Company, Shangri La Tea Company, The Republic of Tea, Inc., Keurig Dr. Pepper, Inc., Celestial Seasonings, Finlays Beverages, Inc., Frontier Natural Products Co-op, and AMORE Pacific Corp, among others. |

Key Segment |

By Form, By Flavor, By Distribution Channels, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

The key participants in the global green tea market are

The key participants in the global green tea market are

- Associated British Food plc.

- Unilever plc.

- Tata Consumer Products

- The Bigelow Tea Company

- East West Tea Company

- Numi Inc.

- Tazo Tea Company

- Shangri La Tea Company

- The Republic of Tea Inc.

- Keurig Dr. Pepper Inc.

- Celestial Seasonings

- Finlays Beverages Inc.

- Frontier Natural Products Co-op

- AMORE Pacific Corp

- among others.

By Form Segment Analysis

By Form Segment Analysis

- Tea Bags

- Loose Leaves

- Loose Powder

- Read-to-Drink

- Capsules & Tablets

By Flavor Segment Analysis

By Flavor Segment Analysis

- Flavored

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Basil

- Wild Berry

- Jasmine

- Others

- Unflavored

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Associated British Food plc.

- Unilever plc.

- Tata Consumer Products

- The Bigelow Tea Company

- East West Tea Company

- Numi Inc.

- Tazo Tea Company

- Shangri La Tea Company

- The Republic of Tea Inc.

- Keurig Dr. Pepper Inc.

- Celestial Seasonings

- Finlays Beverages Inc.

- Frontier Natural Products Co-op

- AMORE Pacific Corp

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors