Search Market Research Report

Frozen Food Manufacturing Market Size, Share Global Analysis Report, d Manufacturing Market By Category Into Ready-To-Eat, Ready-To-Cook, Ready-To-Drink, And Other Frozen Food Types; By Type Into Frozen Fruits And Vegetables, Frozen Meat And Fish, Frozen-Cooked Ready Meals, Frozen Desserts, Frozen Snacks, And Other Applications; By Freezing Technique Into Individual Quick Freezing (IQF), Blast Freezing, Belt Freezing, And Other Freezing Techniques; And By Distribution Channel Into Supermarkets & Hypermarkets, Convenience Stores, Online Channels, And Others: Global & Regional Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2021 – 2026

Frozen Food Manufacturing Market By Category Into Ready-To-Eat, Ready-To-Cook, Ready-To-Drink, And Other Frozen Food Types; By Type Into Frozen Fruits And Vegetables, Frozen Meat And Fish, Frozen-Cooked Ready Meals, Frozen Desserts, Frozen Snacks, And Other Applications; By Freezing Technique Into Individual Quick Freezing (IQF), Blast Freezing, Belt Freezing, And Other Freezing Techniques; And By Distribution Channel Into Supermarkets & Hypermarkets, Convenience Stores, Online Channels, And Others: Global & Regional Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2021 – 2026

Industry Insights

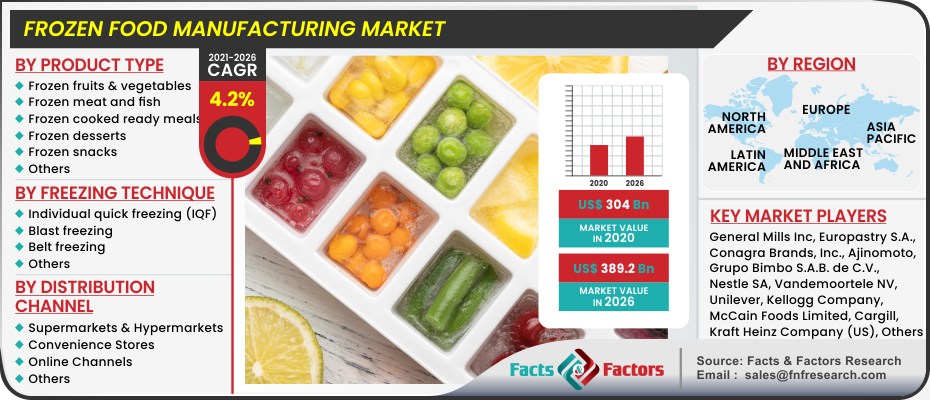

[205+ Pages Report] According to Facts and Factors researchers, the global frozen food manufacturing market was valued at over USD 304 Billion in the year 2020 and is projected to reach USD 389.2 Billion by the end of 2026, with a CAGR of around 4.2% between 2021 and 2026.

Market Overview

Market Overview

Frozen food is defined as food that has been frozen and kept at a low temperature for a long time. Ready meals, vegetables and fruits, potatoes, meat products, meat and seafood, and soup are one of the food goods commercially available. Packaged ready-to-eat foods, bakeries, snacks, and desserts would be included in frozen ready meals. Hotels, caterers, restaurants, and fast-food chains are among the most frequent purchasers of frozen food goods such as frozen vegetables and fruits, potatoes, and non-vegetable goods and services. Perhaps they just are kept fresh by freezing and storing them before cooking. Due to rising customer demands, it seems to have a significant market. The freezing method preserves the food's original state until it is consumed. There are two types of freezing processes used in this industry: mechanical and cryogenic. The freezing process is necessary to protect the product's quality and outside surface. The food's original cell structure is preserved thanks to the quick freezing. Because it maintains a low fluid nitrogen temperature of roughly -196 degrees Celsius, cryogenic freezing is one of the fastest procedures.

Industry Growth Factors

Industry Growth Factors

Because frozen items involve less time and effort than cooking from scratch, rising customer preference for convenience foods indirectly encourages rising demand for frozen products. Because of customers' busy lifestyles, the processed food business is driven by a higher need for convenience. As a result, the demand for frozen items rises. Increasing disposable income is another aspect that has a significant impact on the frozen food market's growth because it boosts consumers' purchasing power. The industry is being driven by changes in the retail landscape, increased demand for convenience foods, and technological developments in the cold chain sector.

On a global scale, the growing relevance of Ready-to-Eat (RTE) food products as a result of hectic lives among working-class individuals are predicted to grow the industry growth in the coming years. Furthermore, rising consumer expenditure on shelf-stable foods is expected to boost the frozen food market shortly. Rising disposable income, the advent of longer shelf-life products, more impulse spending, and high demand for frozen food goods due to a lack of time are all driving the industry. The outlook for the frozen food business has never been more promising. With increasing knowledge of food trends, customers are turning to home cooking to prepare fresh, preservative-free meals. They need frozen foods for this, which come in a variety of categories these days, including dairy-free, vegan, gluten-free, sugar-free, low-fat, and so on. The availability of high-quality frozen foods facilitates market expansion and reduces the risk of negative fluctuations. Recent technological advancements have created cryogenic freezing, which eliminates the need for artificial preservatives while retaining little microbial growth. It is a practical and accessible choice for a working-class culture that is always busy and always short on time.

Segmentation Analysis

Segmentation Analysis

The Frozen Food Manufacturing Market is segmented based on application, route of administration and distribution channel:

As per by category into ready-to-eat, ready-to-cook, ready-to-drink, and other frozen food types; by type into frozen fruits and vegetables, frozen meat and fish, frozen-cooked ready meals, frozen desserts, frozen snacks, and other applications; by freezing technique into individual quick freezing (IQF), blast freezing, belt freezing, and other freezing techniques; and by distribution channel into supermarkets & hypermarkets, convenience stores, online channels, and others. Contrary to popular beliefs on millennials being irresponsible buyers, the frozen food market heavily relies on their purchasing trends. Millennials are ready to experiment and invest in novel things, unlike the generation before them. This generation, which drowns in student debts, and underpaying jobs rely majorly on the frozen food market for their nutritional needs and with many lucrative growth opportunities in the coming years.

Regional Analysis

Regional Analysis

The highest market share in the market was held by Europe. The demand for frozen food in the region is being driven by population expansion, rapid urbanisation, and increased consumer knowledge of the benefits of frozen food. In 2020, Europe was the most important market, accounting for the largest share. Consumer spending power and economic stability are two of the most important factors driving product market growth in the European region. Furthermore, the busy lifestyle of customers is a major driver of the frozen food market's growth. Due to an increase in health-conscious consumers in the region, the frozen ready-to-eat healthy breakfast niche has grown in popularity in recent years. Because it is home to multiple foods and bakery businesses, Europe has been one of the most lucrative markets for frozen food. Furthermore, these market players are constantly working to expand their market share through effective research and development and product innovation. In addition, businesses are forming strategic alliances with one another to use each other's strengths and outperform their competitors. Aryzta, for example, has maintained its dominance in the high-end frozen bakery sector thanks to its efficient operational excellence and research and development capabilities.

Covid-19 Analysis

Covid-19 Analysis

Due to the nationwide lockdowns induced by the Covid-19 epidemic, the frozen food sector saw a sharp reduction in sales. Frozen goods, along with other necessities, were among the first food goods to be sold during the lockdown because of their longer shelf life. Due to the limited workforce at manufacturing operations, there were little to no stockpiles of these products as time passed. This has an impact on consumer purchasing habits. People began working from home, which altered the way they ate. As a means of reprioritizing their food expenditure, people began to cook their food. This resulted in a decrease in frozen food sales. Lockdowns are gradually being lifted in stages, although the foodservice businesses in several countries remain closed. This industry, which is facing a significant decline in sales, uses the bulk of frozen food goods.

On the plus side, as individuals return to their busy and hectic schedules, the market is projected to rebound, with internet food orders leading the drive. Consumers in the United States, for example, observed a surge in online food selling platforms during the pandemic.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 304 Billion |

Projected Market Size in 2026 |

USD 389.2 Billion |

CAGR Growth Rate |

4.2% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

General Mills Inc, Conagra Brands, Inc., Grupo Bimbo S.A.B. de C.V., Nestle SA, Unilever, Kellogg Company, McCain Foods Limited, Kraft Heinz Company (US), Associated British Foods plc, Ajinomoto, Vandemoortele NV, Lantmannen Unibake International, Cargill, Europastry S.A., JBS, Kidfresh, Aryzta, Kuppies, OOB Organics, Omar International Pvt Ltd, Bubba Foods, Shishi He Deming, Chevon Agrotech Pvt Ltd, and Omar International Pvt Ltd. among others. |

Key Segment |

By Product Type, By Freezing Technique, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

Some of the essential players operating in the frozen food manufacturing market are :

- General Mills Inc

- Conagra Brands Inc.

- Grupo Bimbo S.A.B. de C.V.

- Nestle SA

- Unilever

- Kellogg Company

- McCain Foods Limited

- Kraft Heinz Company (US)

- Associated British Foods plc

- Ajinomoto

- Vandemoortele NV

- Lantmannen Unibake International

- Cargill

- Europastry S.A.

- JBS

- Kidfresh

- Aryzta

- Kuppies

- OOB Organics

- Omar International Pvt Ltd

- Bubba Foods

- Shishi He Deming

- Chevon Agrotech Pvt Ltd

- Omar International Pvt Ltd.

Frozen Food Manufacturing Market: By Product Type

Frozen Food Manufacturing Market: By Product Type

- Frozen fruits and vegetables

- Frozen meat and fish

- Frozen-cooked ready meals

- Frozen desserts

- Frozen snacks

- Others

Frozen Food Manufacturing Market: By Freezing Technique

Frozen Food Manufacturing Market: By Freezing Technique

- Individual quick freezing (IQF)

- Blast freezing

- Belt freezing

- Others

Frozen Food Manufacturing Market: By Distribution Channel

Frozen Food Manufacturing Market: By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Channels

- Others

Frozen Food Manufacturing Market: Regional Segment Analysis

Frozen Food Manufacturing Market: Regional Segment Analysis

- North America

- United States

- Canada

- Europe

- Spain

- United Kingdom

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- ASEAN

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of South America

- Middle East and Africa

- South Africa

- GCC

- Rest of the Middle East and Africa

Table of Content

Industry Major Market Players

- General Mills Inc

- Conagra Brands Inc.

- Grupo Bimbo S.A.B. de C.V.

- Nestle SA

- Unilever

- Kellogg Company

- McCain Foods Limited

- Kraft Heinz Company (US)

- Associated British Foods plc

- Ajinomoto

- Vandemoortele NV

- Lantmannen Unibake International

- Cargill

- Europastry S.A.

- JBS

- Kidfresh

- Aryzta

- Kuppies

- OOB Organics

- Omar International Pvt Ltd

- Bubba Foods

- Shishi He Deming

- Chevon Agrotech Pvt Ltd

- Omar International Pvt Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors