Search Market Research Report

Forklift Truck Market Size, Share Global Analysis Report, 2022 – 2028

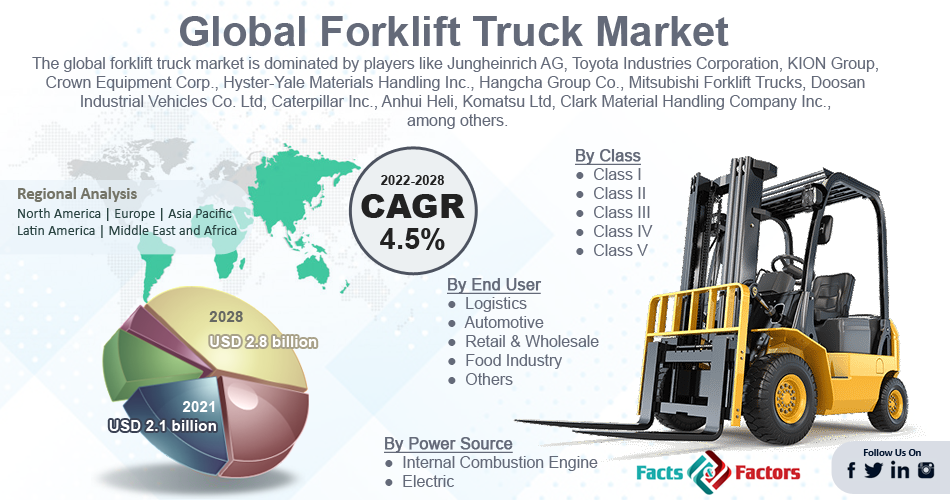

Forklift Truck Market Size, Share, Growth Analysis Report By Power Source (Internal Combustion Engine and Electric), By Class (Class I, Class II, Class III, Class IV, and Class V), By End User (Logistics, Automotive, Retail & Wholesale, Food Industry, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

[207+ Pages Report] According to Facts and Factors, the global forklift truck market size was worth around USD 2.1 billion in 2021 and is predicted to grow to around USD 2.8 billion by 2028 with a compound annual growth rate (CAGR) of roughly 4.5% between 2022 and 2028. The report analyzes the global forklift truck market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the forklift truck market.

Market Overview

Market Overview

A forklift truck is one of the most commonly used machines for a variety of tasks. They range from warehouse applications to large-scale industries with multiple locations. They make heavy object lifting faster and easier than manual lifting. There is a wide range of forklifts available to meet one's specific needs and requirements. Rough terrain forklift trucks are typically used in new construction work areas and areas where people might be walking on dirt or loose gravel. Forklift trucks can run on propane, electricity, gasoline, or diesel. Electric forklift trucks are powered by batteries. Propane or gasoline forklifts are faster or stronger than electric forklifts, but they require more maintenance and are more expensive to run. Electric forklift trucks are ideal for warehouse use because they do not emit noxious fumes like gas-powered machines.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Forklift Truck market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2022-2028).

- In terms of revenue, the global Forklift Truck market size was valued at around USD 2.1 billion in 2021 and is projected to reach USD 2.8 billion, by 2028.

- Due to a variety of driving factors, the market is predicted to rise at a significant rate. The global forklift truck market is projected to grow owing to the increasing e-commerce industry.

- Based on the power source, the electric segment accounted for the largest market share in 2021.

- Based on class, the class III segment is expected to dominate the market during the forecast period.

- Based on end users, the retail & wholesale segment is expected to hold the largest market share during the forecast period.

- Based on region, the Asia Pacific is projected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Growing e-commerce industry to drive the market growth

The e-commerce industry is still growing quickly. The requirement for warehouse space to store goods before they are sent in bulk to retail outlets via pallet loads and cases has expanded due to the rise in consumer product demand. To deliver the goods without inflicting any damage, a variety of distribution strategies and warehouse technologies are employed. To save time and space, forklift trucks are used in warehouses to properly place and arrange merchandise. These trucks are available in a variety of configurations, such as counterbalanced sit-down riders, swing-reach turrets, and order pickers, and they have access to a variety of power sources, such as electric, natural gas, diesel, and gasoline. As a result, the expansion of the e-commerce sector is fueling the growth of the global forklift truck market.

Restraints

Restraints

- A safety-related concern might be hampering the market expansion

Over the past several years, the number of forklift truck accidents has soared, going from about 1,000 to 1,300 per year. More than half of those injured in these incidents were drivers or pedestrians who got out of their vehicles. The forklift is also one of the riskiest workplace vehicles because it is regularly used close to pedestrians and is more likely to become unstable, especially if it is not properly loaded or operated. Thus, the safety-related concern might be hampering the growth of the global forklift truck market expansion.

Opportunities

Opportunities

- Production of hydrogen fuel cell forklifts is expected to offer a lucrative opportunity for the market growth

In recent years, producers of electric-powered forklifts have made major efforts to surpass internal combustion (I.C.) engines. Long-term and sustainable renewable energy solutions are in high demand due to environmental concerns and the depletion of natural resources like coal, oil, and gas. Hydrogen fuel is a great alternative to traditional powering equipment and machinery when it comes to material handling equipment, industries, and autos. Hydrogen fuel cell trucks are more environmentally friendly since they produce less noise, carbon emissions, and air pollution. Due to the advantages afforded by fuel cell forklifts, top forklift truck manufacturers are producing new lines of forklifts with this technology, leading to considerable growth for industry players. For instance, Toyota Material Handling, one of the major forklift truck manufacturers, revealed a new three-wheeled fuel cell forklift at ProMat 2019 with several performance and environmental benefits. Making hydrogen fuel cell forklifts is therefore a lucrative market expansion opportunity.

Segmentation Analysis

Segmentation Analysis

The global forklift truck market is segmented based on the power source, class, end user, and region

Based on the power source, the global market is bifurcated into internal combustion engines and electric. The electric segment accounted for the largest market share of over 60% in 2021 and is expected to show its dominance during the forecast period. Electric forklifts are a more environmentally friendly alternative to gasoline and diesel-powered forklifts. Furthermore, compared to vehicles powered by internal combustion engines, electric vehicles have lower maintenance costs. Several countries around the world, including the United Kingdom, India, and France, are in the process of discontinuing sales of combustion engine vehicles. Electric vehicle benefits and favorable government initiatives are expected to drive demand for electric forklifts over the forecast period. Besides, due to strict environmental restrictions in developed countries, the internal combustion category is predicted to experience moderate development during the projection period. The governments of developed and developing nations are enacting a variety of restrictions to lessen the environmental impact of carbon emissions, which is motivating OEMs and factory owners to switch to gas- or electric-powered vehicles. Fuel-cell-powered vehicles are predicted to see rapid technology breakthroughs that will lead to enhancements like high power, increased dependability, and lower greenhouse gas emissions. To keep ahead of the competition, vendors in this market, including Toyota Industries Corporation, Hexagon Purus, and Ballard Power Systems, are applying this technology.

Based on class, the global forklift truck market is segmented into class I, class II, class III, class IV, and class V. The class III segment is expected to dominate the market during the forecast period. Pallet jacks and electric warehouse pedestrian trucks are examples of class 3 forklifts. Their demand has grown in warehouses and distribution centers because they are less expensive to buy and maintain than forklifts. On the other hand, the class I segment is projected to show remarkable growth during the forecast period. The segment expansion is anticipated to be supported by the significant demand for electric rider trucks across end-use industries including factories, food service, retail, and manufacturing. Additionally, the demand for electric rider trucks is being fueled by their ability to fit in small locations and provide fast operating speeds.

Based on end users, the market is segmented into logistics, automotive, retail & wholesale, food industry, and others. The retail & wholesale segment is expected to hold the largest market share during the forecast period. The continually changing wholesale and retail sectors are suitable for forklift trucks since they are effective, highly productive trucks. To satisfy the expanding needs of the shops, these vehicles have been adapted and outfitted with a variety of alternatives. They aid in the production of air conditioning. An integrated system of motors, controls, and accompanying software. The design efficiency of forklifts makes them perfect for the wholesale sector because they can transport more goods per hour on a single battery charge. Forklift use in the retail and wholesale sectors makes it possible to load and unload trailers quickly and efficiently with little risk of product damage, which is what is driving the market for forklift trucks in these sectors to expand.

Recent Developments:

Recent Developments:

- In July 2021, with high-voltage lithium-ion batteries, Hangcha unveiled its new XH series of electric forklift trucks, weighing 2.0 to 3.5 tonnes. These trucks have high-voltage lithium batteries built in, which can run for up to 12 hours after a full hour of charging. Additionally, with a rapid charging station, these may be charged during frequent work breaks and run all day long without the need for additional battery changes.

- In January 2022, KION Group inaugurated a brand-new forklift truck manufacturing facility in China and established the foundation for more supply chain solutions facilities. The figure of about USD 136 million will be used in Jinan to produce industrial trucks and supply chain solutions in the future. At the location, it is intended to add more than 1,000 new jobs.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2.1 Billion |

Projected Market Size in 2028 |

USD 2.8 Billion |

CAGR Growth Rate |

4.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Jungheinrich AG, Toyota Industries Corporation, KION Group, Crown Equipment Corp., Hyster-Yale Materials Handling Inc., Hangcha Group Co., Mitsubishi Forklift Trucks, Doosan Industrial Vehicles Co. Ltd, Caterpillar Inc., Anhui Heli, Komatsu Ltd, Clark Material Handling Company Inc., and others. |

Key Segment |

By Power Source, Class, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific region accounted for the largest global forklift truck market share of more than 40% in 2021 and is expected to show its dominance during the forecast period. The growth in the region is attributed to the increasing inclination of manufacturers toward plant automation. For Instance, according to the World Industrial Truck Statistics (WITS) in 2018, Orders of forklift trucks in the Asia Pacific increased from 0.56 million in 2017 to 0.63 million in 2018, with a surge of 12.15%. Furthermore, forklifts improve the operational productivity and workflow of production processes while streamlining supply chain distribution activities. Several regional players are concentrating on the launch of new products to draw in more clients and broaden their clients. For instance, the debut of FH100-160-1 forklifts was announced by Komatsu Ltd., a manufacturer of construction equipment, in August 2021. Thus, due to the aforementioned factors, the market is growing at a significant rate during the forecast period.

Competitive Analysis

Competitive Analysis

- Jungheinrich AG

- Toyota Industries Corporation

- KION Group

- Crown Equipment Corp.

- Hyster-Yale Materials Handling Inc.

- Hangcha Group Co.

- Mitsubishi Forklift Trucks

- Doosan Industrial Vehicles Co. Ltd

- Caterpillar Inc.

- Anhui Heli

- Komatsu Ltd

- Clark Material Handling Company Inc.

The global forklift truck market is segmented as follows:

By Power Source

By Power Source

- Internal Combustion Engine

- Electric

By Class

By Class

- Class I

- Class II

- Class III

- Class IV

- Class V

By End User

By End User

- Logistics

- Automotive

- Retail & Wholesale

- Food Industry

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Jungheinrich AG

- Toyota Industries Corporation

- KION Group

- Crown Equipment Corp.

- Hyster-Yale Materials Handling Inc.

- Hangcha Group Co.

- Mitsubishi Forklift Trucks

- Doosan Industrial Vehicles Co. Ltd

- Caterpillar Inc.

- Anhui Heli

- Komatsu Ltd

- Clark Material Handling Company Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors