Search Market Research Report

Ethylene Market Size, Share Global Analysis Report, 2020–2026

Ethylene Market By Type (Ethylene oxide, Polyethylene, Ethylene dichloride, and Ethylene benzene), and By End Use( Automotive, Packaging, Agrochemical, Construction, Textile and Others): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

The Ethylene Market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire ethylene market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of both volume (Units) and value (USD Million) from FY 2016 – 2026.

This specialized and expertise-oriented industry research report scrutinizes the technical and commercial business outlook of the Ethylene industry. The report analyzes and declares the historical and current trends analysis of the Ethylene industry and subsequently recommends the projected trends anticipated to be observed in the ethylene market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

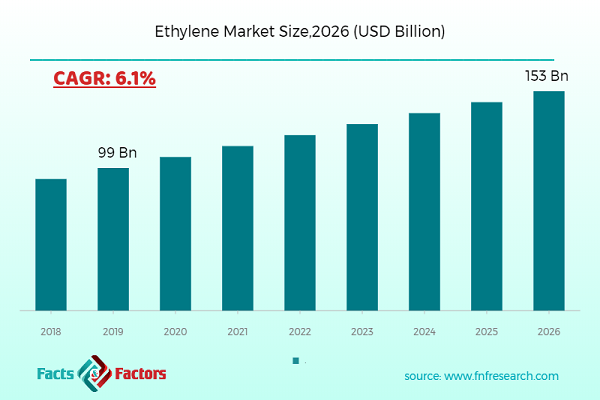

- As per our primary respondents, the ethylene market is set to grow at a rate of around 6%.

- It was established through primary interviews that the ethylene market was valued at around USD 99 Million in 2019.

- APAC will grow the global ethylene market over the forecast period as countries like China and India have a high demand for plastics.

- On the basis of the application segment, the automotive industry dominates the ethylene market in 2019.

- As per primary research, the growing construction industry will raise the demand for ethylene products.

Key Recommendations from Analysts

Key Recommendations from Analysts

- As per our analysts, the global ethylene market is expected to grow significantly over the forecast period.

- The strategic and competitive advantage provided by ‘polyethylene’ is anticipated to be the key factor driving this market globally.

- In recent years, our team of analysts has identified that the growing construction activities worldwide have fueled the demand for high-density polyethylene (HDPE) resins in the manufacture of pipes, plumbing, electrical boxes, and telephone ducts.

- It has boosted the demand for HDPE for other applications such as decorative items, storage tanks, and geosynthetics.

- Overall, the global market has the potential to grow owing to its increasing demand for the automotive industry.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the ethylene industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the ethylene industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the ethylene market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the Ethylene industry. The ethylene market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market positions in the ethylene sector. Key strategic developments in the ethylene market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the ethylene market are appropriately highlighted in the report.

Increasing investment initiatives towards fueling the gas production capacity are influencing the global market of ethylene. Due to the widespread use of ethane gas in various sectors, many companies involved in its development are seeking to increase their production capacity. For instance, in August 2018, ExxonMobil and Saudi Basic Industries Corporation announced their decision to expand the ethylene production facility.

Due to the increasing demand for Polyethylene from the packaging industry, the demand for ethylene oxides and ethylene glycol is anticipated to register a progressive growth. Almost, in every product, ethylene oxide used is used as an essential raw material in the production of fibers for ethylene glycol. End-use industries, such as textile, packaging, building, and automotive, have significant applications of ethylene which are raising the demand for ethylene across the nations. The ever-increasing number of applications in the production of packaging products such as HDPE and LDPE has proliferated the ethylene market across several countries, especially the developing economies such as India, China, and Indonesia among others, for various types of ethylene. The ethylene market research report delivers an acute valuation and taxonomy of the ethylene industry by practically splitting the market on the basis of different types, applications, and regions.

Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the Ethylene industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Further, country-wise data for the ethylene industry is provided for the leading economies of the world.

The ethylene market is segmented based on type and application. On the basis of type segmentation, the market is classified into polyethylene, ethylene oxide, ethylene benzene, and ethylene dichloride. In terms of application segmentation, the market is bifurcated into automotive, packaging, agrochemical, construction, and textile among others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 99 Billion |

Projected Market Size in 2026 |

USD 153 Billion |

CAGR Growth Rate |

6.1% CAGR |

Base Year |

2019 |

Forecast Years |

2019-2026 |

Key Market Players |

Exxon Mobil Corporation, Saudi Basic Industries Corp, Royal Dutch Shell plc, Dow DuPont Inc., Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation, The National Petrochemical Company, LyondellBasell Industries N.V., Lonza Group, and BASF SE among others. |

Key Segment |

By Type, By End-users, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the essential players operating in the ethylene market, but not restricted include:

Some of the essential players operating in the ethylene market, but not restricted include:

- Exxon Mobil Corporation

- Saudi Basic Industries Corp

- Royal Dutch Shell plc

- Dow DuPont Inc.

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- The National Petrochemical Company

- LyondellBasell Industries N.V.

- Lonza Group

- BASF SE

The taxonomy of the ethylene industry by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- Ethylene oxide

- Polyethylene

- Ethylene dichloride

- Ethylene benzene

- Others

By End-Use Segmentation Analysis

By End-Use Segmentation Analysis

- Automotive

- Packaging

- Agrochemical

- Construction

- Textile

- Others

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table of Content

Industry Major Market Players

- Exxon Mobil Corporation

- Saudi Basic Industries Corp

- Royal Dutch Shell plc

- Dow DuPont Inc.

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- The National Petrochemical Company

- LyondellBasell Industries N.V.

- Lonza Group

- BASF SE

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors