Search Market Research Report

Cell Therapy Manufacturing Market Size, Share Global Analysis Report, 2025 – 2034

Cell Therapy Manufacturing Market Size, Share, Growth Analysis Report By Therapy (Allogenic Cell Therapy, Autologous Cell Therapy), By Technology (Somatic Cell Technology, Cell Immortalization Technology, Viral Vector Technology, Genome Editing Technology, Cell Plasticity Technology, 3D Technology), By Source (IPSC [Induced Pluripotent Stem Cell], Bone Marrow, Umbilical Cord, Adipose Tissues, Neural Stem), By Application (Musculoskeletal, Cardiovascular, Gastrointestinal, Neurological, Oncology, Dermatology, Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

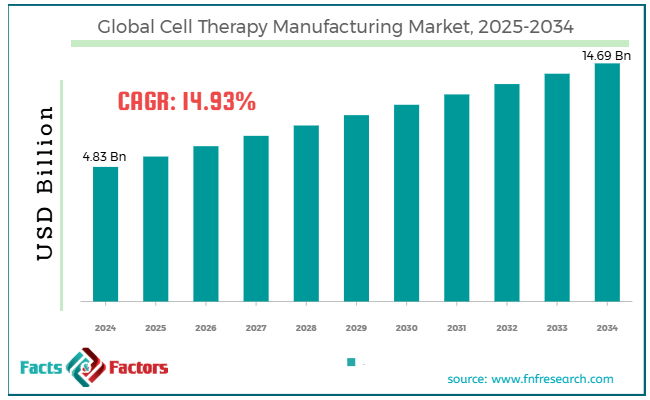

[221+ Pages Report] According to Facts & Factors, the global cell therapy manufacturing market size was worth around USD 4.83 billion in 2024 and is predicted to grow to around USD 14.69 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.93% between 2025 and 2034.

Market Overview

Market Overview

Cell therapy manufacturing is the creation of therapeutic cells for medication or treatment. It comprises expansion, isolation, quality control, and modification of cells, which are later used to treat injuries or diseases. The procedure should comply with stringent regulatory protocols to ensure efficacy, safety, and consistency.

The global cell therapy manufacturing market is projected to grow substantially due to the rising demand for advanced therapies, growing investment in biopharmaceutical research, and increasing emphasis on personalized medicine.

With the increasing cases of autoimmune disorders, diabetes, and cancer, the demand for innovative treatments and remedies is surging. Cell-based therapies used for cancer are showing promise, thus fueling their demand.

Also, significant investments are being made by private companies, governments, and research institutions in the cell therapy domain. This investment backs modernization in cell therapies, thus enhancing manufacturing processes and minimizing production costs.

Furthermore, cell therapies, especially those comprising autologous cells, support the rising trend of personalized or precision medicine. These therapies are modified as per the patient's genotype. This increases interest and investment in the cell therapy manufacturing field.

Nevertheless, some major factors restraining the growth of the global market include significant manufacturing costs and a complex regulatory outlook. Creating cell therapies is an expensive procedure, mainly due to the growing need for expert facilities, equipment, and labor. These high costs may hamper the accessibility and affordability of these treatments, especially in low-budget nations.

Moreover, with the growing regulatory support, gaining permission for novel cell therapies is time-consuming and complicated. This may slow down the entry of new therapies and treatments.

Yet, the global market is opportune for adopting AI, automation, and growing cell therapy applications. Incorporating AI and automation may simplify processes, enhance efficiency, and reduce errors. Automated infrastructures also increase stability and lessen costs, showcasing major growth prospects.

In addition, since cancer therapy has been a key focus area, cell therapy has expanded use in fields like neurological disorders, cardiovascular diseases, and autoimmune illnesses. Thus, increasing the scope of cell therapies is a key opportunity for industry growth.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global cell therapy manufacturing market is estimated to grow annually at a CAGR of around 14.93% over the forecast period (2025-2034)

- In terms of revenue, the global cell therapy manufacturing market size was valued at around USD 4.83 billion in 2024 and is projected to reach USD 14.69 billion by 2034.

- The cell therapy manufacturing market is projected to grow significantly owing to the growing demand for innovative treatments, the development of novel technologies, and rising investments in biopharmaceutical research.

- Based on therapy, the autologous cell therapy segment is expected to lead the market, while the allogenic cell therapy segment is expected to register considerable growth.

- Based on technology, the viral vector technology segment dominated the market, while the genome editing technology segment will register considerable growth.

- Based on source, the IPSC (Induced Pluripotent Stem Cell) segment is the dominating segment among others, while the bone marrow segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the oncology segment is expected to lead the market compared to the musculoskeletal segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- The rise in cancer immunotherapies fuels the cell therapy manufacturing market growth

CAR-T therapies are the most famous improvements in cell therapy that offer fresh treatments for diverse cancer forms. These therapies include altering an individual's T-cells to prompt a receptor specific to cancer cells. As clinical experiments show the efficiency of CAR-T therapies, the need for large-scale and efficient manufacturing rises.

Imfinzi therapy by AstraZeneca gained permission from the FDA in April 2024. As more manufacturing firms grow their CAR-T portfolios, the need for expert manufacturing infrastructure grows. This highlights the growth potential in the cell therapy manufacturing industry.

- The development of cell therapy uses beyond cancer contributes to the market growth

While cancer therapies have led to the primary stage of cell therapy adoption, the domain is currently expanding to cure a broader range of disorders, comprising autoimmune illnesses, genetic disorders, and cardiovascular diseases. Gene-edited cells and stem cell therapies offer adaptive potential in regenerating damaged organs and tissues.

Gene therapy experiments have increased by approximately 28 percent from 2021 to 2023, with more than 1,000 experiments emphasizing diverse therapeutic fields like cardiovascular, genetic, and neurological disorders.

In March 2024, a leading life sciences company, Cytiva, declared the development of a novel platform focused on generating stem cell-based treatments for spinal cord injuries and heart diseases. This growth in regenerative medicine is crucial in expanding cell therapies beyond just oncology.

Restraints

Restraints

- Manufacturing complexity and scalability hamper the cell therapy manufacturing market progress

The intricacy of manufacturing cell therapies, mainly personalized therapies, such as autologous therapies, offers a major barrier. Unlike traditional drugs, which are mass-produced in standardized quantities, cell therapies are primarily specific to patients, needing customization for every patient. This increases the challenge of scaling up production in terms of time and cost, thus affecting the growth of the cell therapy manufacturing market.

Global production capacity of CAR-T therapies is projected to satisfy just 20% of the worldwide demand by 2025, signifying a huge gap in supply.

Autologous CAR-T therapies need nearly 3-6 weeks to manufacture per individual. This increases the challenge of balancing production for a large patient pool.

Opportunities

Opportunities

- Development of allogeneic (off-the-shelf) treatments fuels the cell therapy manufacturing market growth

The inclination towards allogeneic therapies over autologous therapies denotes a key opportunity for the cell therapy manufacturing market. Allogenic therapies may be manufactured in bulk, preserved, and circulated to numerous needy individuals, unlike autologous treatments, which need customized manufacturing as per patient. This inclination not only increases the treatment affordability but also supports scalability, thus allowing producers to meet the growing global demand.

In February 2024, Fate Therapeutics declared positive preclinical outcomes for off-the-shelf CAR-T treatments. The growth of these treatments may significantly lessen the time and cost of the patient's treatment. This will be a potential advancement for manufacturers and patients.

Challenges

Challenges

- Supply chain issues and raw material shortages limit the growth of the cell therapy manufacturing market

Cell therapy manufacturing depends on the accessibility of dedicated raw materials like viral vectors, cell culture media, gene-editing tools, and bioreactors. Disturbances in the supply of these products may postpone production schedules, affect the ability of manufacturers to satisfy the increasing demand, and increase prices. In addition, supply chain problems associated with storage conditions, transportation, and global disturbances may bring challenges to the manufacturing processes.

Sarepta Therapeutics announced a major delay in the supply chain in February 2024. This was associated with preserving viral vectors, crucial for gene therapies. This delay resulted in clinical trials and production setbacks.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 4.83 Billion |

Projected Market Size in 2034 |

USD 14.69 Billion |

CAGR Growth Rate |

14.93% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Gilead Sciences Inc., Novartis AG, Bristol Myers Squibb, Sarepta Therapeutics Inc., Bluebird Bio Inc., Celyad Oncology, Atara Biotherapeutics Inc., Celltrion Inc., GenScript Biotech Corporation, Fate Therapeutics, Medpace Inc., Stemcell Technologies Inc., Axovant Gene Therapies, Miltenyi Biotec, Intellia Therapeutics Inc., and others. |

Key Segment |

By Therapy, By Technology, By Source, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global cell therapy manufacturing market is segmented based on therapy, technology, source, application, and region.

Based on therapy, the global cell therapy manufacturing industry is divided into allogenic cell therapy and autologous cell therapy. The autologous cell therapy segment held a notable market share and will lead in the future as well. The said therapy uses an individual's cells, which are gathered, modified, and reintroduced into their body.

The segmental prominence of autologous treatments is backed by their high efficacy and personalized nature in treating diseases like cancer and other genetic disorders. Autologous therapies have numerous FDA-permitted products, fueling the industry's growth and adoption in clinical uses.

Based on technology, the global cell therapy manufacturing market is segmented as somatic cell technology, cell immortalization technology, viral vector technology, genome editing technology, cell plasticity technology, and 3D technology. The viral vector technology segment captured a maximum market share owing to its importance in gene modification and delivery, and its significance for genome editing. The technology is broadly used in cell modification and gene therapy, where viruses are engineered to provide therapeutic genes in individual cells.

Viral vectors are also used in gene editing tools, such as CRISPR. This enables accurate modifications of cells' genetic materials, thus making them vital for modern cell and gene therapies.

Based on application, the global market is segmented as musculoskeletal, cardiovascular, gastrointestinal, neurological, oncology, dermatology, and others. Among others, the oncology segment leads the global market due to its efficiency in treating hematologic cancers, FDA-approved treatments, and substantial unmet demand for cancer.

Cell therapies have shown great promise in treating diverse cancer forms, comprising hematologic malignancies and solid tumors. CAR-T therapies have transformed cancer treatments like lymphoma, leukemia, and multiple myeloma.

Furthermore, the permission of CAR-T therapies has remarkably improved the applications of cell therapies in the oncology domain. Cancer is still the leading cause of death on a global scale, and this fuels the demand for modernized treatments.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America is the leading region in the global cell therapy manufacturing market owing to factors like a strong healthcare system, higher R&D investment, and supportive FDA regulations. North America, mainly the U.S., has a well-developed healthcare infrastructure that comprises modernized manufacturing facilities, specialized hospitals, and research centers. The United States is a leader in pharmaceutical research and development and biotech innovations, with the private sector and government heavily investing in cell therapy and gene development.

Moreover, the FDA has permitted innovative therapies like CAR-T cell therapies, for instance, Yescarta, Kymriah, and others, to support the industry growth.

Asia Pacific is projected to progress as the second-leading region on the back of growing biotech and healthcare infrastructure, rising demand for improved therapies, and cost-efficient outsourcing and manufacturing. Nations like Japan, China, and South Korea heavily invest in cell therapy and biotechnology infrastructure, comprising modernized manufacturing amenities.

The region also has a large population with leading cases of diseases like neurological disorders, musculoskeletal conditions, and cancer, which increases the demand for cell-based treatments.

Asia Pacific offers comparatively lower manufacturing costs than Europe and North America. This makes the region an appealing location for businesses to build manufacturing facilities for cell therapy.

Competitive Analysis

Competitive Analysis

The global cell therapy manufacturing market is led by players like:

- Gilead Sciences Inc.

- Novartis AG

- Bristol Myers Squibb

- Sarepta Therapeutics Inc.

- Bluebird Bio Inc.

- Celyad Oncology

- Atara Biotherapeutics Inc.

- Celltrion Inc.

- GenScript Biotech Corporation

- Fate Therapeutics

- Medpace Inc.

- Stemcell Technologies Inc.

- Axovant Gene Therapies

- Miltenyi Biotec

- Intellia Therapeutics Inc.

Key Market Trends

Key Market Trends

- Growing use of 3D Bioprinting in cell therapy manufacturing:

3D bioprinting is currently used to develop more physiologically related cell-based models for therapeutic and research applications. This trend is enhancing the personalization and efficiency of treatments.

- Rise in allogeneic cell therapies:

Allogenic cell treatments, which use donor-sourced cells, are gaining popularity over autologous treatments owing to their cost-efficiency and scalability. These therapies are projected to grow as off-the-shelf goods are becoming widely available.

The global cell therapy manufacturing market is segmented as follows:

By Therapy Segment Analysis

By Therapy Segment Analysis

- Allogenic Cell Therapy

- Autologous Cell Therapy

By Technology Segment Analysis

By Technology Segment Analysis

- Somatic Cell Technology

- Cell Immortalization Technology

- Viral Vector Technology

- Genome Editing Technology

- Cell Plasticity Technology

- 3D Technology

By Source Segment Analysis

By Source Segment Analysis

- IPSC (Induced Pluripotent Stem Cell)

- Bone Marrow

- Umbilical Cord

- Adipose Tissues

- Neural Stem

By Application Segment Analysis

By Application Segment Analysis

- Musculoskeletal

- Cardiovascular

- Gastrointestinal

- Neurological

- Oncology

- Dermatology

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Gilead Sciences Inc.

- Novartis AG

- Bristol Myers Squibb

- Sarepta Therapeutics Inc.

- Bluebird Bio Inc.

- Celyad Oncology

- Atara Biotherapeutics Inc.

- Celltrion Inc.

- GenScript Biotech Corporation

- Fate Therapeutics

- Medpace Inc.

- Stemcell Technologies Inc.

- Axovant Gene Therapies

- Miltenyi Biotec

- Intellia Therapeutics Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors