Search Market Research Report

Cell-based Assays Market Size, Share Global Analysis Report, 2022 – 2028

Cell-based Assays Market Size, Share, Growth Analysis Report By Product And Services (Consumables, Cell Lines, Microplates, Probes & Labels, Other Consumables, Instruments & Software, Services), By Application (Drug Discovery, Basic Research, Other Applications), By End User (Pharmaceutical & Biopharmaceutical Companies, CROs, Academic & Research Institutes), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

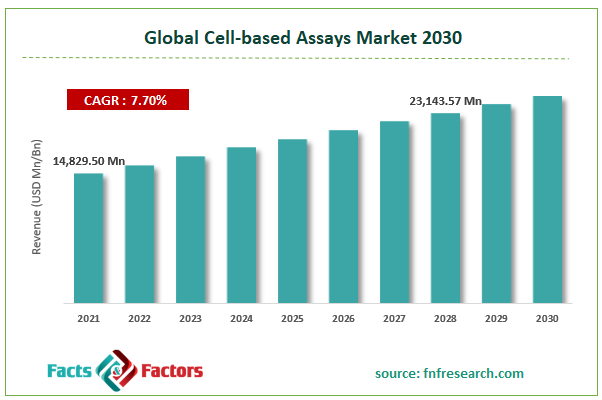

[218+ Pages Report] According to Facts and Factors, the global cell-based assays market size was worth USD 14,829.50 million in 2021 and is estimated to grow to USD 23,143.57 million by 2028, with a compound annual growth rate (CAGR) of approximately 7.70% over the forecast period. The report analyzes the cell-based assay market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the cell-based assay market.

Market Overview

Market Overview

The method of studying live cells based on several criteria is called a cell-based test. They are employed to measure important biochemical or cellular processes. These tests are perfect candidates for downsizing since they rely on corresponding gene assays, which have high awareness due to signal amplification of cell-signaling cascades. The cell-based assays support drug discovery & diagnostics, the creation of a measurable product, and the evaluation of cell motility, toxicity, proliferation, and morphology. Cell-based tests of small-molecule pharmaceutical drugs or biologics are basic and crucial for the FDA's drug support process and commercialization. Pharmaceutical firms, academic research centers, biotechnology firms, governmental agencies, contract research firms, and others employ cell-based assays. Cell-based tests are still used in diagnostics and drug research to assess cells' morphology, toxicity, motility, and proliferation. Research in the fields of stem cells, cancer, immunology, and other subjects is facilitated by cell-based assays.

The growth in chronic illness cases and the need for cell-based assays are the main factors driving the global market for these tests. One of the main drivers of market development is the rising incidence of chronic illnesses and lifestyle disorders, including cancer, cardiovascular, diabetes, and neurological disorders. The market for cell-based assays is anticipated to be driven by major advancements, innovations in technologically sophisticated products, and the need to lower costs compared to drug discovery. Additionally, increasing R&D spending on research, their expanding use in drug development and advancements in automation are key drivers propelling the growth of the global cell-based assays market.

Covid-19 Impact:

Covid-19 Impact:

The World Health Organization (WHO) proclaimed COVID-19 a pandemic and a public health catastrophe of worldwide significance. Globally, COVID-19 has influenced about 210 nations. State-run governments worldwide imposed unavoidable lockdowns and friendly distancing measures in response to the COVID-19 epidemic to prevent the collapse of the healthcare system. States have also imposed restrictions and prohibitions on endeavors and elective procedures. These restrictions still hamper the development of many sectors, and the industry is also affected by the increased reaction to these rules. The implementation of lockdown on a global scale has influenced the manufacturing, distribution, and retail network.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global cell-based assay market value is expected to grow at a CAGR of 7.70% over the forecast period.

- In terms of revenue, the global cell-based assay market size was valued at around USD 14,829.50 million in 2021 and is projected to reach USD 23,143.57 million by 2028.

- Due to the increased incidence of chronic illnesses and lifestyle disorders, rising R&D spending for drug discovery, and the development of new cell-based techniques, the global market for cell-based assays has experienced rapid expansion.

- By product and service, the consumables category dominated the market in 2021.

- By application, the drug discovery category dominated the market in 2021.

- North America dominated the global cell-based assay market in 2021.

Growth Drivers

Growth Drivers

- Increased usage of cell-based assays in drug development drives the market growth

Key steps in the discovery of new drugs include cell-based tests. Comparing cell-based assays to in vitro biochemical assays, there are some benefits. Unlike biochemical experiments, they provide constant tissue-specific responses in a physiologically realistic milieu. Another important obstacle restricting the use of biochemical assays is the inability to produce or purify every target for biochemical assessment. As a result, pharmaceutical and biotechnology firms and CROs are switching from using biochemical assays to cell-based for their lead identification and optimization procedures in drug development.

Restraints

Restraints

- High equipment costs and limitations on reagent usage may hinder the market growth

The reliability of cell-based assays has grown with high-throughput screening (HTS) and high-content screening (HCS) technologies. However, the price of instruments has increased significantly due to these innovations. Additionally, the complexity of the target molecule directly affects the duration and expense of each HTS procedure, the more complicated the target molecule, the more expensive the process. Due to the usage of these pricey methods, biopharmaceutical firms' overall cost of manufacturing biopharmaceuticals has climbed significantly. Due to financial constraints, academic research facilities struggle to acquire such pricey equipment. The total cost of ownership for these instruments rises due to maintenance charges and other indirect expenses.

Segmentation Analysis

Segmentation Analysis

The global cell-based assay market is segregated based on product, service, type, and end-user.

Based on product and service, the market is classified into consumables, cell lines, microplates, probes & labels, other consumables, instruments & software, and services. The consumables category dominated the market in 2021. The variables linked to the segment's growth include increased drug discovery activities, particularly in developing markets.

The market is classified into drug discovery, basic research, and other type based on application. The drug discovery category dominated the market in 2021. The variables contributing to the segment's expansion are linked to a rise in R&D spending by biopharmaceutical firms. The need for cell-based assays for future drug discoveries is also fueled by the rise in chronic illnesses, including cancer, osteoarthritis, cardiovascular disorders, and diabetes.

Based on end-user, the market is segmented into pharmaceutical & biopharmaceutical companies, CROs, and academic & research institutes. The pharmaceutical & biotechnology companies category dominated the market in 2021. Due to its many advantages, cell-based assays are increasingly in demand among pharmaceutical and biotechnology businesses, responsible for the segment's rise.

Recent Development:

Recent Development:

- April 2021: A strategic partnership between Biognosys and Siemens Healthineers has been established to hasten the development of diagnostic protein biomarkers and assays. By entering this agreement, Siemens Healthineers and Biognosys will combine their strengths in developing biomarker assays, laboratory testing, and commercialization.

- May 2021: According to press announcements, Labcorp declared that it had signed a binding contract to buy specific operating assets and intellectual property (IP) from Myriad Genetics' autoimmune business segment, including the Vectra rheumatoid arthritis (RA) test, for $150 million.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 14,829.50 Million |

Projected Market Size in 2028 |

USD 23,143.57 Million |

CAGR Growth Rate |

7.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Thermo Fisher Scientific, Promega Corporation, Enzo Biochem, Ca3 Biosciences Inc. (Neuromics), Danaher Corporation, Merck Kgaa, Becton, Dickinson And Company, Lonza Group, Perkinelmer, Charles River Laboratories, Reaction Biology Corporation, Eurofins Scientific Se, Carna Biosciences Inc, Cell Biolabs, Cell Signaling Technology, Bioagilytix Labs Inc., Aat Bioquest Inc., Pbl Assay Science, Invivogen, Bps Bioscience, and Others |

Key Segment |

By Product and Services, Application, End-user, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the cell-based assays market in 2021

North America led the market for cell-based assays in 2021, followed by Europe. Because of the region's swift adoption of cutting-edge technology, stringent drug development regulations, and accessibility to both public and private funding for life science research, North America holds a sizable market share. North America now has a stranglehold on the global market for these tests due to the region's significant growth in the development and application of cell-based assays, as well as increasing awareness of these assays for drug discovery.

Competitive Landscape

Competitive Landscape

- Thermo Fisher Scientific

- Promega Corporation

- Enzo Biochem

- Ca3 Biosciences Inc. (Neuromics)

- Danaher Corporation

- Merck Kgaa

- Becton

- Dickinson And Company

- Lonza Group

- Perkinelmer

- Charles River Laboratories

- Reaction Biology Corporation

- Eurofins Scientific Se

- Carna Biosciences Inc

- Cell Biolabs

- Cell Signaling Technology

- Bioagilytix Labs Inc.

- Aat Bioquest Inc.

- Pbl Assay Science

- Invivogen

- Bps Bioscience

Global Cell-based Assays Market is segmented as follows:

By Product and Services

By Product and Services

- Consumables

- Cell Lines

- Microplates

- Probes & Labels

- Other Consumables

- Instruments & Software

- Services

By Application

By Application

- Drug Discovery

- Basic Research

- Other Applications

By End-user

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- CROs

- Academic & Research Institutes

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Thermo Fisher Scientific

- Promega Corporation

- Enzo Biochem

- Ca3 Biosciences Inc. (Neuromics)

- Danaher Corporation

- Merck Kgaa

- Becton

- Dickinson And Company

- Lonza Group

- Perkinelmer

- Charles River Laboratories

- Reaction Biology Corporation

- Eurofins Scientific Se

- Carna Biosciences Inc

- Cell Biolabs

- Cell Signaling Technology

- Bioagilytix Labs Inc.

- Aat Bioquest Inc.

- Pbl Assay Science

- Invivogen

- Bps Bioscience

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors