Search Market Research Report

Cannabis Edibles Market Size, Share Global Analysis Report, 2023 – 2030

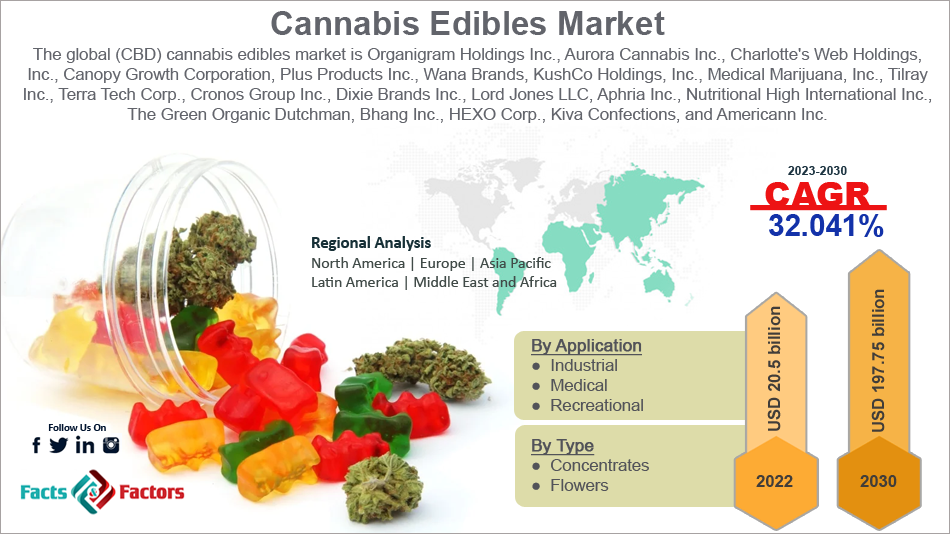

Cannabis Edibles Market Size, Share, Growth Analysis Report By Application (Industrial, Medical, and Recreational), By Type (Concentrates and Flowers), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

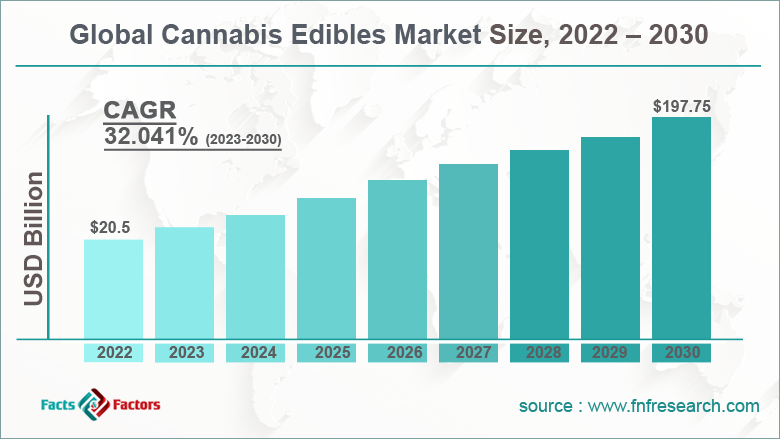

[234+ Pages Report] According to the report published by Facts and Factors, the global cannabis edibles market size was worth around USD 20.5 billion in 2022 and is predicted to grow to around USD 197.75 billion by 2030 with a compound annual growth rate (CAGR) of roughly 32.04% between 2023 and 2030. The report analyzes the global cannabis edibles market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cannabis edibles market.

Market Overview

Market Overview

The industry is a growing part of the larger food & beverages (F&B) industry. The products that are a part of the industry contain a considerable amount of cannabidiol (CBD) which is a non-psychoactive compound found in the infamous cannabis plant.

Any chemical compound that does not have any significant psychoactive impact on the consumer’s central nervous system is called a non-psychoactive compound, Edible items containing CBD are gaining popularity in the commercial market since they offer a convenient way of consuming CBD without the requirement of inhaling it through vaping or smoking process.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global cannabis edibles market is estimated to grow annually at a CAGR of around 32.04% over the forecast period (2022-2030)

- In terms of revenue, the global cannabis edibles market size was valued at around USD 20.5 billion in 2022 and is projected to reach USD 197.75 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing acceptance of cannabis across the world

- Based on application segmentation, recreational was predicted to show maximum market share in the year 2022

- Based on type segmentation, flowers were the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Growing acceptance of cannabis across the world to propel market demand

The global cannabis edibles market is projected to grow owing to the increasing acceptance of cannabis across the globe. The world is currently witnessing the growing legalization of cannabis use for recreational or medical purposes as the awareness about the benefits of cannabis consumption in controlled environments is growing rapidly. Cannabis offers several medicinal benefits since it is known to assist in relieving pain or providing assistance with managing vomiting or nausea along with inflammation reduction.

Restraints

Restraints

- Intense regulatory and legal issues to restrict market expansion

Although there are certain nations that have either legalized controlled amounts of cannabis consumption or are considering such measures. However, there is a large pool of economies in which cannabis production and distribution in any form is illegal or highly regulated.

This aspect also includes the ever-changing laws surrounding cannabis edibles that change from one jurisdiction to another within the same nation. Such restrictions are mainly to the significant harmful impact of CBD edibles consumption, especially when consumed irresponsibly.

Opportunities

Opportunities

- Growing awareness to provide excellent growth opportunities

One of the key opportunities for the global industry players to explore is the growing awareness of the potential benefits of cannabis edibles. The main concern with cannabis is the way it is consumed and if market players can develop efficient or alternate ways of consuming cannabis edibles, they may be able to attract a higher number of consumers.

Furthermore, the potential of the emerging markets is largely untapped, and as, with time, the legalization of CBD edibles is anticipated to spread across continents, the industry players have to be prepared to leverage the offerings of such markets.

Challenges

Challenges

- Lack of standard regulatory measures to challenge market growth

The global industry is highly irregulated in terms of production and consumption. Furthermore, even in countries where related laws are in place, there is a significant lack of standardization since these regulations may change depending on one region to another.

This is a major challenge for the industry players to navigate through along with the already existing social stigma surrounding the consumption of cannabis in any form which could further limit the industry's growth.

Segmentation Analysis

Segmentation Analysis

The global cannabis edibles market is segmented based on application, type, and region.

Based on application, the global market segments are industrial, medical, and recreational.

- The industry witnessed the highest growth in the recreational segment in 2022 since it still remains a major contributor in the market for the last few years

- The growing legalization in the recreational sector for the consumption of marijuana in various states and countries is a major reason for segmental dominance

- Furthermore, a lot of consumers prefer to consume CBD discreetly in the form of edibles to avoid any unwanted attention from legal authorities

- The segment for medical applications is growing steadily as the benefits of CBD edibles are being explored

- A 2017 report by the European authorities found that almost 86.7 million adults in the region have experimented with cannabis at some point in their lives

Based on type, the global market segments are concentrates and flowers

- The market registered the highest growth in the flowers segment in 2022 due to higher preference in the consumer group

- Advanced vaporizers are a leading factor for segmental revenue as the higher boiling temperature of the cannabinoids in comparison to the boiling temperature of the flower itself allows makers to easily extract the compound

- However, the extracts from flowers or concentrates tend to exhibit a strong smell and taste and they are mostly associated with vaporizing

- Withdrawal symptoms associated with cannabis consumption generally sets in after 1 or 2 days post cessation

Recent Developments:

Recent Developments:

- In October 2022, Wyld, an Oregon-based producer of cannabis in several states, announced the launch of a new brand of CBD edible called Good Tide. The brand was launched at the Hall of Flowers trade show held for the cannabis industry and includes a range of cannabis-induced gummies in a variety of flavors

- In February 2023, scholars at the Johns Hopkins Medicine Institute, in a recent study, found out that CBD when consumed in edible form can restrict the breakdown of tetrahydrocannabinol (HC) resulting in longer-lasting and stronger interactions with the drug. Furthermore, the study also stated that higher doses of CBD may intensify the negative impact of THC

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 20.5 Billion |

Projected Market Size in 2030 |

USD 197.75 Billion |

CAGR Growth Rate |

32.04% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Organigram Holdings Inc., Aurora Cannabis Inc., Charlotte's Web Holdings Inc., Canopy Growth Corporation, Plus Products Inc., Wana Brands, KushCo Holdings Inc., Medical Marijuana Inc., Tilray Inc., Terra Tech Corp., Cronos Group Inc., Dixie Brands Inc., Lord Jones LLC, Aphria Inc., Nutritional High International Inc., The Green Organic Dutchman, Bhang Inc., HEXO Corp., Kiva Confections, Americann Inc., and others. |

Key Segment |

By Application, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America dominates the market with the highest growth rate

The global cannabis edibles market is growing at a rapid rate and it is projected to register the highest CAGR in North America with the US and Canada acting as major contributors. The growth rate is attributed to the growing legalization of cannabis consumption in the edible format in many states of the US. Canada legalized cannabis intake for recreational purposes in 2018.

Furthermore, the growing research and development activities to understand and collect more information on CBD edibles could lead to higher growth in the region.

In addition to this, Europe is an important region for overall global revenue since discreet consumption of cannabis edibles is growing at a rapid rate.

However, the regional governments are trying to manage irresponsible consumption or sale of illicit cannabis in the region and market players may have to invest higher to receive legal approvals for sale.

Competitive Analysis

Competitive Analysis

- Organigram Holdings Inc.

- Aurora Cannabis Inc.

- Charlotte's Web Holdings Inc.

- Canopy Growth Corporation

- Plus Products Inc.

- Wana Brands

- KushCo Holdings Inc.

- Medical Marijuana Inc.

- Tilray Inc.

- Terra Tech Corp.

- Cronos Group Inc.

- Dixie Brands Inc.

- Lord Jones LLC

- Aphria Inc.

- Nutritional High International Inc.

- The Green Organic Dutchman

- Bhang Inc.

- HEXO Corp.

- Kiva Confections

- Americann Inc.

The global cannabis edibles market is segmented as follows:

By Application Segment Analysis

By Application Segment Analysis

- Industrial

- Medical

- Recreational

By Type Segment Analysis

By Type Segment Analysis

- Concentrates

- Flowers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Organigram Holdings Inc.

- Aurora Cannabis Inc.

- Charlotte's Web Holdings Inc.

- Canopy Growth Corporation

- Plus Products Inc.

- Wana Brands

- KushCo Holdings Inc.

- Medical Marijuana Inc.

- Tilray Inc.

- Terra Tech Corp.

- Cronos Group Inc.

- Dixie Brands Inc.

- Lord Jones LLC

- Aphria Inc.

- Nutritional High International Inc.

- The Green Organic Dutchman

- Bhang Inc.

- HEXO Corp.

- Kiva Confections

- Americann Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors