Search Market Research Report

Biobanking Market Size, Share Global Analysis Report, 2022 – 2030

Biobanking Market Size, Share, Growth Analysis Report By Biospecimen Type (Human Tissues, Blood Products, Nucleic Acids, Cell Lines, and Others), By Product (Software & Services, Consumables, and Equipment), By Storage Type (Automated, and Manual), By Application (Clinical Diagnostics, Therapeutics, Drug Discovery & Development, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

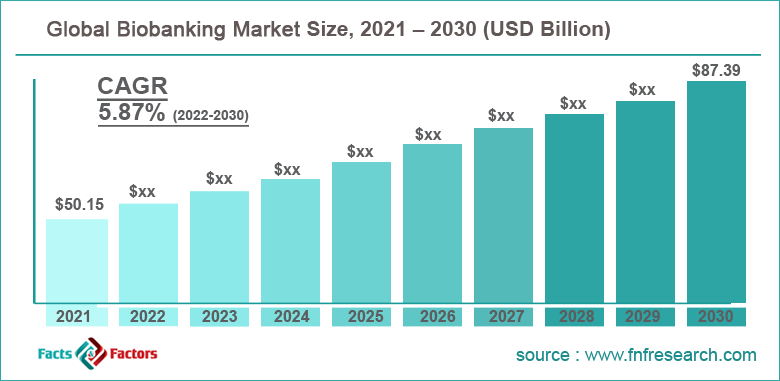

[212+ Pages Report] According to the report published by Facts Factors, the global biobanking market size was worth around USD 50.15 billion in 2021 and is predicted to grow to around USD 87.39 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.87% between 2022 and 2030. The report analyzes the global biobanking market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the biobanking market.

Market Overview

Market Overview

Biobanks, as the name suggests, are storing units for biological samples. In most cases, the samples stored are from humans. A biobank is a sub-type of biorepository, a facility responsible for collecting, cataloging, and storing biological samples for research purposes. Biobanks have increasingly become important in the field of medical research since they support multiple contemporary fields like personalized medicine or genomics. Biobanks provide researchers access to sample data that represents a large section of the population. Both the sample and the data derived from them are used extensively by research groups across the world.

One such instance is the use of biosamples to understand various genetic associations from a bunch of thousands of samples collected and stored in biobanks, to help medical and research professions zero down on viable disease biomarkers. Before the use of biobanks, the research community had to struggle hard to obtain samples to conduct studies and reach high conclusions. Biobanking is relatively recent and the term first appeared in 1998. Generally, biobanks are made of cryogenic facilities that help to store samples in the right form and under the correct conditions. Although there may be variations in the size of the unit, these sections are well maintained by hospitals or other medical units.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global biobanking market is estimated to grow annually at a CAGR of around 5.87% over the forecast period (2022-2030)

- In terms of revenue, the global biobanking market size was valued at around USD 50.15 billion in 2021 and is projected to reach USD 87.39 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing investments in research & development in the healthcare field

- Based on biospecimen type segmentation, blood products were predicted to show maximum market share in the year 2021

- Based on storage type segmentation, automated was the leading type in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Growing investments in research & development to drive market growth

The global biobanking market is projected to grow owing to the increasing investment in research & development in the healthcare sector. These activities have gained further momentum post-Covid-19 as a means to stay better prepared for any other biological disease outbreak. Medicine plays an important role in the continuous existence of living organisms including. However, biological concerns are extremely unpredictable. This is one of the major reasons why government agencies and domestic and international healthcare bodies lay extreme emphasis on continuous research to either prepare themselves for future biological problems or find cures to already existing concerns that are currently prevalent without any cure.

As per a recent Statista report, the global funding in the R&D wing of the pharmaceutical industry totaled up to USD 238 billion in 2021. The number stood at USD 132 billion in 2012. In one decade, the investment has risen by almost 100%. Since biobanking seems like a promising solution for some of the hurdles that were earlier faced by the research community in the healthcare sector, more investments are expected in the coming years.

Restraints

Restraints

- Concerns over privacy to restrict market expansion

The global market may face certain growth restrictions owing to the growing concerns over privacy as collecting samples from humans gives direct access to researchers and other involved parties to the person’s biological information. The guidelines distinguishing them as what constitutes the correct biobank ethics are still vague and need more clarity for the system to be adopted by new medical units. Some of the leading controversies around biobanks include genetic discrimination, commercialization, the privacy of research participants, public consultation, and resource sharing.

Opportunities

Opportunities

- Increasing awareness about the conservation of stem cells in infants to provide growth opportunities

The global biobanking market is anticipated to benefit from the rising awareness amongst parents about the benefits of conserving cord stem cells from newborn babies. Since cord blood is home to cells called hematopoietic cells which when used during transplant can cure diseases like immunity deficiency, blood disorders, certain types of cancer, and metabolic diseases, new parents promptly agree to store the newborn’s cord blood. As per estimates, around 3% of American citizens are known to store cord blood at the time of the child’s birth.

Challenges

Challenges

- Maintaining security in biobanks poses a major challenge

One of the key challenges that the global market players face is the installation of highly advanced security systems and their maintenance at biobanks. Since these units store extremely valuable samples and related information, they are highly prone to attacks which is more prevalent in the case of digital data storage. This is also why most hospitals may choose not to run biobanks as the total cost increases considerably and leads to breaches of information.

Segmentation Analysis

Segmentation Analysis

The global biobanking market is segmented based on biospecimen type, product, storage type, application, and region

Based on biospecimen type, the global market segments are human tissues, blood products, nucleic acids, cell lines, and others. In 2021, the global market witnessed the highest growth in the blood products segment owing to the growing use of analysis of deoxyribonucleic acid (DNA) and ribonucleic acid (RNA). Blood samples are predominantly used to conduct a multitude of biological research and are influenced by the downstream application of the blood sample, it is collected in tubes filled with additives or preservatives. To conduct tests on DNA, around 5 ml of blood sample is required.

Based on storage type, the global market divisions are automated and manual with the former leading the global market growth in 2021. Since biobanks have gained rapid popularity, facility providers have to make use of technology to deliver performance efficiency. Automation is one way of achieving it as it offers various advantages as compared to manual methods of storing. One of the main advantages is that specimens can be delivered 24 hrs in a day, and 7 days a week, which is impossible in the case of manual storing.

Recent Developments:

Recent Developments:

- In September 2022, The International Livestock Research Institute (ILRI) in Uganda, inaugurated a new biobank to store biological samples of livestock and help in data management. This move is projected to help the country’s project called Boosting Uganda’s Investment in Livestock Development (BUILD)

- In February 2019, The International Agency for Research on Cancer launched a new biobank learning platform free of cost to aid learning activities in professionals working in the biobank field.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 50.15 Billion |

Projected Market Size in 2030 |

USD 87.39 Billion |

CAGR Growth Rate |

5.87% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Brooks Automation Inc., PHC Holdings Corporation (Panasonic Healthcare), Chart Industries Inc., Micronic, Merck KGaA, Hamilton Company, and others. |

Key Segment |

By Biospecimen Type, Product, Storage Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead with the highest market share

The global biobanking market is projected to witness the highest growth in North America owing to the increasing adoption of advanced technologies in healthcare and medical field-related research and innovation. As the number of professionals working in this field grows, the regional market is projected to generate higher revenue. The US offers some of the best research programs to potential students which attracts more students to opt for these study programs.

The National Institutes of Health (NIH), the place that is home to the largest research activities in the US, is estimated to spend more than 45 billion on medical research. The growing adoption of biobanking systems is expected to garner more revenue in the coming years as hospitals have the necessary funds to open and maintain such centers. Europe may also grow at a high CAGR as demand for cord blood collection grows among parents.

Competitive Analysis

Competitive Analysis

- Brooks Automation Inc.

- PHCHoldings Corporation(Panasonic Healthcare)

- Chart Industries Inc.

- Micronic

- Merck KGaA

- Hamilton Company.

The global biobanking market is segmented as follows:

By Biospecimen Type Segment Analysis

By Biospecimen Type Segment Analysis

- Human Tissues

- Blood Products

- Nucleic Acids

- Cell Lines

- Others

By Product Segment Analysis

By Product Segment Analysis

- Software & Services

- Consumables

- Equipment

By Storage Type Segment Analysis

By Storage Type Segment Analysis

- Automated

- Manual

By Application Segment Analysis

By Application Segment Analysis

- Clinical Diagnostics

- Therapeutics

- Drug Discovery & Development

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Brooks Automation Inc.

- PHCHoldings Corporation(Panasonic Healthcare)

- Chart Industries Inc.

- Micronic

- Merck KGaA

- Hamilton Company.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors