Search Market Research Report

Antistatic Agents Market Size, Share Global Analysis Report, 2022 – 2028

Antistatic Agents Market Size, Share, Growth Analysis Report By Form (Liquid, Powder, Pellets, Microbeads, Others), By Product (Ethoxylated Fatty Acid Amines, Glycerol Monostearate, Diethanolamine's Others (Alkyl Sulfonate, Quaternary Ammonium Salts, Liquid Electrolyte Solutions, Molten Salts, Metals, and Carbon Blacks)), By Polymer (Polypropylene (P.P.), Acrylonitrile Butadiene Styrene (ABS), Polyethylene (P.E.), Polyvinyl Chloride (PVC), Others (Polystyrene, Polyethylene Terephthalate, Polylactic Acid, Ethylene Vinyl Acetate, Wax, Polyesters, Polyamides, and Fluoropolymers)), By End-use Industry (Packaging, Electronics, Automotive, Textiles, Others (Footwear, Pharmaceuticals, and Furniture)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

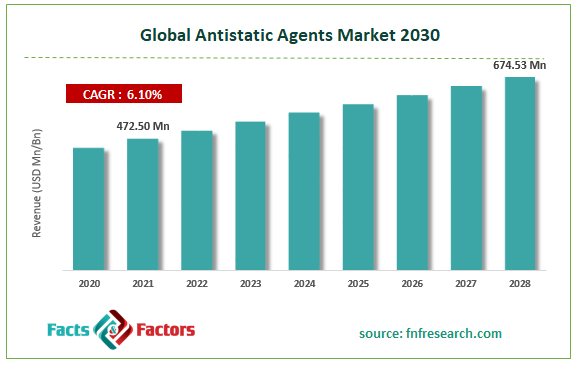

[206+ Pages Report] According to Facts and Factors, the global antistatic agents market size was worth USD 472.50 million in 2021 and is estimated to grow to USD 674.53 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.10% over the forecast period. The report analyzes the antistatic agent market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the antistatic agent market.

Market Overview

Market Overview

Antistatic agents are a broad category of chemical reagents added to polymers to reduce the buildup of static electricity in plastic products. External and internal antistatic compounds come in two different varieties. The exterior agents are sprayed and coated on plastic items, while the internal agents are combined and integrated into the plastic matrix. Among the often-employed antistatic substances are fatty acid esters, ethoxylated amines, glycerol monostearate, diethanolamines, alkyl sulfonates, alkyl phosphates, etc. These chemicals are frequently used to make automobile parts and packaging materials made of polystyrene, polyvinyl chloride (PVC), and polyethylene terephthalate (PET). They are available as liquids, pellets, powders, and microbeads. Rapid industrialization is one of the main drivers fueling the market's expansion, particularly in developing nations.

Antistatic compounds are widely used in various sectors, including packaging, electronics, textiles, and automobiles, to reduce or completely remove the buildup of static charge between items. For instance, the automobile sector's engine's working life and fuel economy are improved because of the lack of static charge. They are also utilized in the textile sector to reduce fabric cling that might result in sparks and other fire risks. Other growth-promoting variables include a variety of product advancements, such as the creation of liquid antistatic agents with improved spreading properties. Since they distribute uniformly over surfaces, liquid variations are generally utilized for spraying and drying applications.

Covid-19 Impact:

Covid-19 Impact:

COVID-19 wreaked devastation on the whole world. It's still an international calamity. Several nations recognized its risk. They thus tried to stop its spread by imposing quarantines and lockdowns. Since they had little impact, they were only temporary. Due to the quarantines and lockdowns, many sectors and marketplaces suffered from having to cease or scale back output temporarily. The market for antistatic products was no different. Since few firms were creating them, companies that created antistatic compounds discovered that the raw components were difficult to get. They had little access to raw supplies, and those they did had high prices. As a result, their production expenses and the final cost of these units went up.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global antistatic agents market size value is expected to grow at a CAGR of 6.10% over the forecast period.

- In terms of revenue, the global antistatic agents market size was valued at around USD 472.50 million in 2021 and is projected to reach USD 674.53 million by 2028.

- This market's expansion may be attributable to the rising demand for antistatic materials from the textile, electronic, and packaging sectors.

- By form, the liquid category dominated the market in 2021.

- By product, the ethoxylated fatty acid amines category dominated the market in 2021.

- Asia-Pacific dominated the global antistatic agents market in 2021.

Growth Drivers

Growth Drivers

- Antistatic compounds are in greater demand across a range of end-use sectors and drive the market growth

Antistatic compounds are continually in demand from various end-use sectors, including packaging, electronics, textiles, and automobiles, to eliminate or diminish the accumulation of static charge that impedes numerous operations. The global food processing and packaging industries have expanded as a result of causes like expanding population, continued urbanization, and rising middle-class disposable income. Along with developing supermarkets and convenience stores, the organized retail industry thrives internationally, raising demand for branded and packaged food products. As a result, the food packaging industry is expanding, which has a considerable positive impact on the rise in demand for antistatic chemicals.

Restraints

Restraints

- The creation and strict enforcement of laws and regulations regarding food and beverage packaging films may hinder the market growth

The U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have developed. They are strictly enforcing rules and regulations regarding the use of antistatic agents in the food and beverage packaging industry, which is anticipated to restrain market growth for antistatic agents. These restrictions prohibit specific antistatic substances in packing sheets that come into contact with food goods. Even though these laws and regulations are frequently updated, they serve as barriers to the market expansion for antistatic chemicals.

Opportunity

Opportunity

- The creation of novel and better antistatic substances presents market opportunities

Antistatic compounds are increasingly in demand from various end-use sectors, including packaging, textiles, and electronics. The most popular films are polyethylene because they prevent static electricity from building up on their surface. They are mostly utilized in the textile and electronics sectors. Therefore, the top market participants for antistatic agents are concentrating on conducting R&D operations to create antistatic agents that can be applied in various sectors for various purposes. There is a need to develop novel antistatic agents due to the rising demand for green antistatic agents and the strict application of rules regulating the use of antistatic agents in the food and beverage sector by various nations.

Challenges

Challenges

- Controlling plastic waste produced by the packaging and electronics sectors may hinder the market growth

The packaging and electronics sectors generate significant amounts of garbage that is not only challenging to dispose of but may also be harmful to the environment. Plastic pollution of the earth's surface harms both human existence and wildlife habitats. Plastics provide health risks to living things due to their sluggish decomposition rate, and they also harm marine life by contaminating the air, water, and land. Low-cost plastics are frequently used to create various packaging materials and films for the food, beverage, and agricultural industries because of their durability. The management of created plastic garbage is challenging for end users.

Segmentation Analysis

Segmentation Analysis

The global antistatic agents market is segregated based on form, products, polymer, and end-use industry.

The market is segmented into liquid, powder, pellets, microbeads, and others. In terms of value, the liquid category is anticipated to have the biggest market share for antistatic agents in 2021. Compared to other types of antistatic agents, liquid antistatic agents have a stronger propensity to migrate along the surfaces of the materials. These substances are mostly utilized in applications for effective dyeing and spraying. Liquid antistatic compounds are applied to provide non-sticky surfaces and effective antistatic qualities, which enhance weaving processes in the textile industry. These ionic liquids can be translucent or clear, and as a result, they don't affect the end goods' optical qualities.

Based on product, the antistatic agent's market has been segmented as Ethoxylated Fatty Acid Amines, Glycerol Monostearate, Diethanolamine, and Others (Alkyl Sulfonate, Quaternary Ammonium Salts, Liquid Electrolyte Solutions, Molten Salts, Metals, and Carbon Blacks). According to the product, the antistatic agents market's ethoxylated fatty acid amines segment is anticipated to see the greatest CAGR in 2021. The great processing stability of ethoxylated fatty acid amines and their enhanced performance advantages compared to other antistatic compounds may be credited for the segment's expansion. Ethoxylated fatty acid amines are the most extensively used antistatic agents in producing films and sheets used in the packaging industry.

Based on polymer, the market is segmented as Polypropylene (P.P.), Acrylonitrile Butadiene Styrene (ABS), Polyethylene (P.E.), Polyvinyl Chloride (PVC), and Others (Polystyrene, Polyethylene Terephthalate, Polylactic Acid, Ethylene Vinyl Acetate, Wax, Polyesters, Polyamides, and Fluoropolymers). During the projection period, the sector for polyethylene is anticipated to increase at the greatest CAGR. Several kinds of antistatic chemicals are on the market, including long-chain aliphatic amines, phosphoric acid esters, quaternary ammonium salts, alkylphenol, polyethylene glycol, ethoxylated amines, and glycerol esters. Over the projection period, physical qualities like high ionic strength and low toxicity are anticipated to help the demand for antistatic compounds.

Based on the end-use industry, the antistatic agents market has been segmented into Packaging, Electronics, Automotive, Textiles, and Others (Footwear, Pharmaceuticals, and Furniture). During the anticipated period, the antistatic agents market is anticipated to be led by the packaging sector. Antistatic is one of the most important functional agents used in the plastics industry to treat plastic resins. One of the biggest issues facing producers of antistatic agents is the effective handling of the trash and disposables produced by the electronics and packaging sectors.

Recent Development:

Recent Development:

- June 2020: Recently, static-reducing functional plastic compounds were introduced by Clariant Plastics & Coatings Healthcare Polymer Solutions, which, when employed in medication delivery systems, enable better dosage reliability. The resins are a component of the larger, "medical grade" MEVOPUR® range, which also includes ready-to-use polymer compounds in various polymers, including P.E. and peeks. Sticking is eliminated by MEVOPUR permanent antistatic chemicals because they lower surface resistance and swiftly dissipate charges.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 472.50 Million |

Projected Market Size in 2028 |

USD 674.53 Million |

CAGR Growth Rate |

6.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Arkema, Clariant, Croda International PLC., DowDuPont, Evonik Industries AG, Nouryon, Solvay S.A., PolyOne Corporation, Riken Vitamin Co. Ltd., Mitsubishi Chemical Corporation, Kao Group, and Others |

Key Segment |

By Form, Product, Polymer, End-use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the antistatic agents market in 2021

In 2021, it was predicted that the Asia Pacific would dominate the market for antistatic agents, followed by the European and North American regions. China is the top antistatic agent user in the Asia Pacific region. The Asia Pacific market is expanding due to the rising demand for antistatic agents in the area, improving consumer lifestyles, rising packaging investments, and thriving electronics, automotive, and textiles sectors in the region. The electronics and packaging sectors in Southeast Asian nations are seeing rising demand, boosting the market for antistatic agents globally. Among the main drivers propelling the expansion of the worldwide consumer electronics industry are the expanding middle class, shifting lifestyle choices, and increased propensity to use smart electronic gadgets. The requirement for internet use and increased consumer disposable income will drive demand for electronic gadgets throughout the predicted period. Governments worldwide are backing digitization more and more, eventually encouraging customers to use different electronic gadgets. This element will fuel the market's expansion for antistatic agents during the anticipated period.

Competitive Landscape

Competitive Landscape

- BASF SE

- Arkema

- Clariant

- Croda International PLC.

- DowDuPont

- Evonik Industries AG

- Nouryon and Solvay S.A.

- PolyOne Corporation

- Riken Vitamin Co. Ltd.

- Mitsubishi Chemical Corporation

- Kao Group.

Global Antistatic Agents Market is segmented as follows:

By Form

By Form

- Liquid

- Powder

- Pellets

- Microbeads

- Others

By Product

By Product

- Ethoxylated Fatty Acid Amines

- Glycerol Monostearate

- Diethanolamine's

- Others (Alkyl Sulfonate, Quaternary Ammonium Salts, Liquid Electrolyte Solutions, Molten Salts, Metals, and Carbon Blacks)

By Polymer

By Polymer

- Polypropylene (P.P.)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (P.E.)

- Polyvinyl Chloride (PVC)

- Others (Polystyrene, Polyethylene Terephthalate, Polylactic Acid, Ethylene Vinyl Acetate, Wax, Polyesters, Polyamides, and Fluoropolymers)

By End-use Industry

By End-use Industry

- Packaging

- Electronics

- Automotive

- Textiles

- Others (Footwear, Pharmaceuticals, and Furniture)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- BASF SE

- Arkema

- Clariant

- Croda International PLC.

- DowDuPont

- Evonik Industries AG

- Nouryon and Solvay S.A.

- PolyOne Corporation

- Riken Vitamin Co. Ltd.

- Mitsubishi Chemical Corporation

- Kao Group.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors