Search Market Research Report

Antihypertensive Drugs Market Size, Share Global Analysis Report, 2022 – 2030

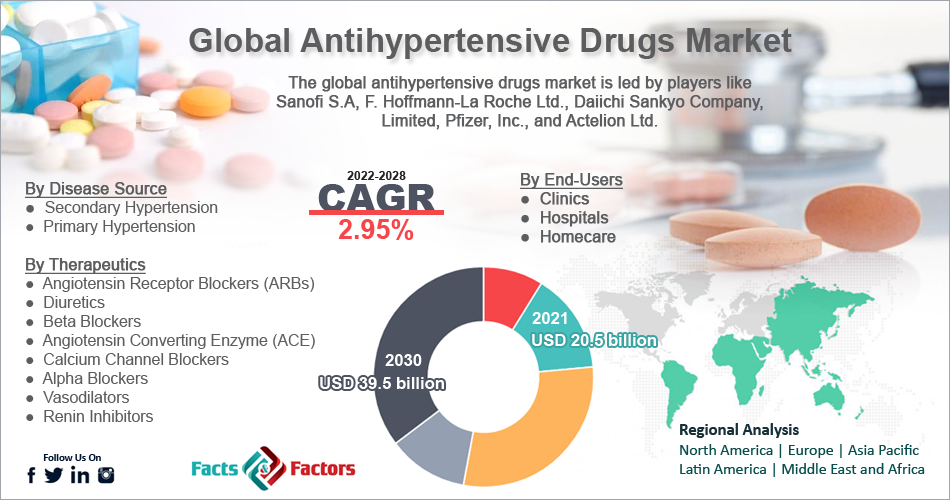

Antihypertensive Drugs Market Size, Share, Growth Analysis Report By Disease Source (Secondary Hypertension and Primary Hypertension), By Therapeutics (Angiotensin Receptor Blockers (ARBs), Diuretics, Beta Blockers, Angiotensin Converting Enzyme (ACE), Calcium Channel Blockers, Alpha Blockers, Vasodilators, and Renin Inhibitors), By End-Users (Clinics, Hospitals, and Homecare), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

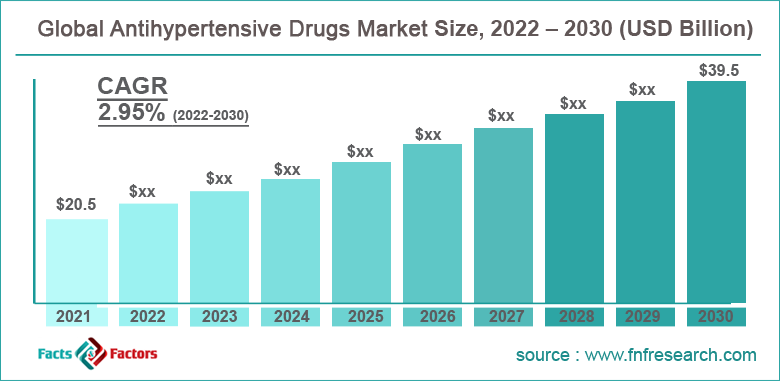

[210+ Pages Report] According to the report published by Facts Factors, the global antihypertensive drugs market size was worth around USD 20.5 billion in 2021 and is predicted to grow to around USD 39.5 billion by 2030 with a compound annual growth rate (CAGR) of roughly 2.95% between 2022 and 2030. The report analyzes the global antihypertensive drugs market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the antihypertensive drugs market.

Market Overview

Market Overview

Hypertension is more commonly known as high blood pressure and is a highly prevalent medical condition that affects the arteries. The force of the blood flow in patients with high blood pressure against the artery walls is higher than normal which means that the heart has to work harder to effectively pump blood throughout the body. The blood pressure reading in hypertensive cases is around 130/80 millimeters of mercury (mmHg) or more.

In a perfectly healthy human, the blood pressure is 120/80 mmHg, whereas in the case of elevated blood pressure the pressure value will reach around 120 to 129 mmHg in the case of the top number and the bottom number will maximum reach 80 to 89 mmHg. If the top number increases to 130 mmHg to 139 mmHg and the bottom number lies between 80 to 89 mmHg, it means the patient is suffering from stage 1 hypertension. In stage 2 hypertension, the values are 140 mmHg or above in the case of the top number and 90 mmHg or above for lower values. If the blood pressure reaches 180/120 mmHg, then the case will be considered as a crisis or hypertensive emergency which requires immediate medical attention.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global antihypertensive drugs market is estimated to grow annually at a CAGR of around 2.95% over the forecast period (2022-2030)

- In terms of revenue, the global antihypertensive drugs market size was valued at around USD 20.5 billion in 2021 and is projected to reach USD 39.5 billion, by 2030.

- The market is projected to grow at a significant rate due to growing cases of hypertension across the world

- Based on disease source segmentation, primary hypertension was predicted to show maximum market share in the year 2021

- Based on end-users segmentation, clinics were the leading users in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Growing cases of hypertension globally to propel market demand

The global antihypertensive drugs market is projected to grow owing to the increasing cases of hypertension across the world. High blood pressure is a common but serious medical condition and as per statistics by the World Health Organization (WHO), more than 1.13 billion people are affected by the condition. Patients suffering from certain medical conditions like obesity or diabetes are at a higher risk of contracting hypertension. Due to the high mortality rate induced by hypertension, international health agencies and government bodies have initiated multiple programs to educate the population about the importance of medical treatment.

For instance, India has initiated the India Hypertension Control Initiative (IHCI) which is consistently working toward managing the widespread disease in the country The association is a joint collaboration between the Government of India, the Indian Council of Medical Research (ICMR), Ministry of Health & Family Welfare, Resolve to Save Lives (Technical partner), and WHO Country Office for India (WHO India).

Restraints

Restraints

- Lack of awareness to restrict market expansion

The impact of the disease is more intense in lower or middle-income families who do not have the necessary access to quality medical care. There is also a significant lack of awareness related to the symptoms of the diseases, medical treatment to follow, and lifestyle choices which are further reinforced by the absence of essential medical treatment. For instance, a 2012 study published by the National Library of Medicine concluded that 17% of Canadian citizens were unaware that they had high blood pressure. 1 in 5 people had uncontrolled hypertension.

Opportunities

Opportunities

- Increasing research & development to provide higher growth opportunities

Hypertension remains a serious medical condition that does not have a permanent cure which has led to the medical community conducting aggressive research to understand more about the causes of the disease and treatment plans. For instance, a research group at the University of Oulu discovered a new high-blood-pressure-inducing circuit that was previously unknown. The discovery was made in May 2022. The study was related to obesity and overweight and is expected to open more doors in the hypertension research field.

Challenges

Challenges

- Managing side-effects associated with antihypertensive drugs to challenge the market expansion

One of the key challenges faced by the producers of antihypertensive drugs is the management of serious side effects associated with the consumption of the medicine. The growing cases of patients feeling dizzy or nervous after consuming antihypertensive drugs greatly act against the efficiency of the medicines. Other side effects include erection problems, consistent cough, headache, constipation, or diarrhea. Even though these may not be serious problems, they impact the patient’s quality of life.

Segmentation Analysis

Segmentation Analysis

The global antihypertensive drugs market is segmented based on disease source, therapeutics, end-users, and region

Based on disease source, the global market divisions are secondary hypertension and primary hypertension. In 2021, the global market was dominated by the latter due to higher reported cases and subsequent demand for accurate medical assistance. As per official reports, primary hypertension accounts for nearly 95% of all cases related to high blood pressure. In case, the cause of hypertension is not known, it is called primary hypertension however, there are certain influential risk factors like a sedentary lifestyle, smoking, improper management of stress, obesity, and poor diet. It is recommended to regularly get a blood pressure check since it remains impossible to zero down on one particular cause.

Based on end-users, the global market segments are clinics, hospitals, and home care. In 2021, the global market was dominated by the clinics segment since in most cases, hypertension is first detected during a routine check which can be taken care of by medical professionals at clinics. Severe cases are referred for hospitalization, which was the second leading segment in 2021. In primary hypertension cases, the condition can be managed by making some changes in lifestyle habits and taking regular medicines and they generally do not require critical care. Hypertension is responsible for over 10 million deaths annually.

Recent Developments:

Recent Developments:

- In September 2022, Lupin, a leading drug maker, announced the launch of the company’s generic hypertension medicine in the US market

- In November 2022, Baxdrostat, a new antihypertensive drug was presented at the American Heart Association Scientific Sessions conference and published in the New England Journal of Medicine. The trial results for the drug have shown positive results

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 20.5 Billion |

Projected Market Size in 2030 |

USD 39.5 Billion |

CAGR Growth Rate |

2.95% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Sanofi S.A, F. Hoffmann-La Roche Ltd., Daiichi Sankyo Company Limited, Pfizer Inc., Actelion Ltd., and others. |

Key Segment |

By Disease Source, Therapeutics, End-Users, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead with the highest market share

The global antihypertensive drugs market is projected to register the highest growth in North America led by the growing research activities and investments in studying the disease and medical drugs with enhanced performance. The US market will be significantly driven by the rising approvals received by generic producers of the medicine from the US Food and Drugs Administration authority. In November 2022, Zydus Lifesciences, an Indian multinational drug manufacturing company, received FDA’s approval to sell the medicine in the US market.

The company will market the medicine with multiple strengths. The approved treatment uses hydrochlorothiazide and bisoprolol fumarate in combination and has proven to be effective in managing the condition. As of September 2022, the tablets had made an annual sale of USD 27 million in the US. Generic medicines have been gaining a lot of global attention due to cost and performance efficiency.

Competitive Analysis

Competitive Analysis

- Sanofi S.A

- F. Hoffmann-La Roche Ltd.

- Daiichi Sankyo Company Limited

- Pfizer Inc.

- Actelion Ltd.

The global antihypertensive drugs market is segmented as follows:

By Disease Source Segment Analysis

By Disease Source Segment Analysis

- Secondary Hypertension

- Primary Hypertension

By Therapeutics Segment Analysis

By Therapeutics Segment Analysis

- Angiotensin Receptor Blockers (ARBs)

- Diuretics

- Beta Blockers

- Angiotensin Converting Enzyme (ACE)

- Calcium Channel Blockers

- Alpha Blockers

- Vasodilators

- Renin Inhibitors

By End-Users Segment Analysis

By End-Users Segment Analysis

- Clinics

- Hospitals

- Homecare

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Sanofi S.A

- F. Hoffmann-La Roche Ltd.

- Daiichi Sankyo Company Limited

- Pfizer Inc.

- Actelion Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors