Search Market Research Report

Sodium-ion Battery Market Size, Share Global Analysis Report, 2022–2028

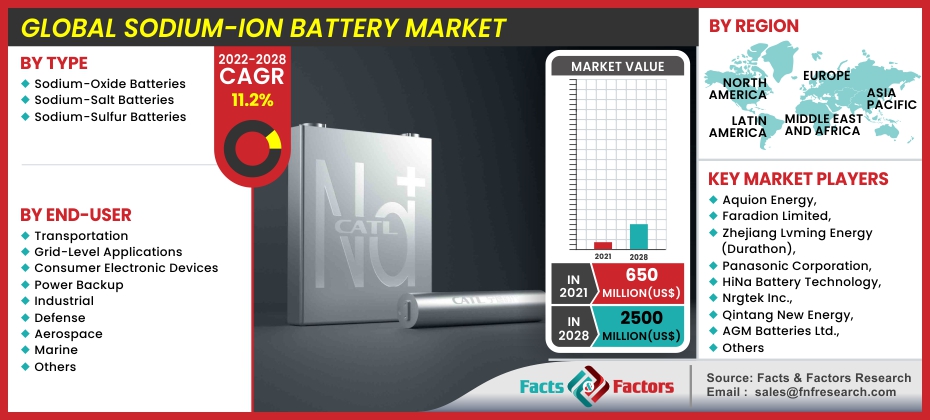

Sodium-ion Battery Market By Type (Sodium-Oxide Batteries, Sodium-Salt Batteries, and Sodium-Sulfur Batteries), By End-User (Transportation, Grid-Level Applications, Consumer Electronic Devices, Power Backup, Industrial, Defense, Aerospace, Marine, and Others), and By Region-Global and Regional Industry Outline, Market Insights, Inclusive Analysis, Statistical Data, and Forecast 2022–2028

Industry Insights

[220+ Pages Report] According to Facts and Factors, during the forecast period of 2022 to 2028, the global sodium-ion battery market is estimated to develop at a compound annual growth rate (CAGR) of 11.2%. The global sodium-ion battery market was valued at USD 650 Million in 2021, and it is predicted to exceed USD 2500 Million by 2028. The study investigates several elements and their consequences on the growth of the sodium-ion battery market.

Market Overview

Market Overview

A sodium-ion battery is a rechargeable battery that employs sodium ions as charged particles. The operation of sodium-ion batteries is the same as that of other commonly available batteries, like lithium-ion batteries. A sodium-ion battery consists of a cathode produced of any sodium-containing material, a fluid electrolyte of Na salts in polar molecules, and an anode. Sodium has electrochemical properties as well as a large specific discharge capacity, making it an efficient power storage system. Sodium-ion batteries are widely used in a variety of industries, including electronics, automobiles, healthcare, and power tools.

COVID-19 Impact

COVID-19 Impact

The outbreak of the global pandemic has resulted in a significant decline in the global economy, resulting in a reduction in consumer disposable income. As a result, demand for electronics and appliances has decreased significantly, which has had a direct impact on market demand for sodium-ion batteries.

Furthermore, the government's nationwide lockdown has had an impact on manufacturing facilities around the world, which were already suffering from a labor shortage during the pandemic. This has had an even greater impact on the global sodium-ion battery market.

Growth Drivers

Growth Drivers

- Rising adoption of sodium-ion batteries to boost market growth

Increased preference for sodium-ion batteries, particularly in the electronic and electrical industries, has led to the expansion of the global sodium-ion battery market. Because of the abundant supply of sodium metal in the earth's crust and its ease of access, sodium-ion batteries are a better choice than the highly-priced lithium-ion batteries. Because of the high availability of sodium, the prices of the cathode and electrolyte drop to around 50% of the total cost of the cell, significantly lowering the overall price of the battery. Moreover, the depletion of lithium resources, as well as the higher costs associated with lithium mining and processing, has compelled major corporations to switch to sodium-ion batteries.

Furthermore, the handling of sodium-based substances can be done using the same devices that are used to perform lithium-ion components, which favors the manufacturers' transition to sodium battery cells. The wide availability of sodium metal contributes significantly to the sustainability of sodium-ion batteries, further meeting the market's rising demands for a steady source of power supply.

Restraints

Restraints

- Presence of lithium-ion batteries as an alternative acts as a market restraint

While lithium-ion batteries have been around for a while, sodium-ion batteries are a newer addition to the commercial landscape. The current market situation and the lack of a robust industrial supply chain are not conducive to the active use of sodium-ion batteries, thereby restraining the growth of the global sodium-ion battery market.

Opportunities

Opportunities

- R&D capabilities in the battery technology sector to generate new opportunities

To meet the accelerating demand for energy storage, current R&D capabilities in the battery tech sector are rapidly expanding. The primary goal of researchers looking for feasible non-lithium battery options is to relieve global pressure on lithium reserves.

For example, the National Science Foundation of the United States partially funded research that contributed to the development of a fast and reliable sodium-ion battery that withstands dendrite growth and minimizes the fire risk or explosion. UC San Diego researchers partnered with other investigators to develop and produce a new solid electrolyte to improve the stability, efficiency, and lifespan of solid-state sodium-ion batteries.

Some of the factors encouraging the growth of environmentally sustainable and socially aware energy storage technologies are decarbonization, the increasing assimilation of renewable sources into power grids, and soaring electric vehicle implementation.

The globalization of sodium-ion batteries is being accelerated by worldwide R&D efforts. The electric vehicle market, in particular, is likely to reap the R&D advantages of sodium-ion battery technology to boost operating effectiveness, cut costs, and drive more revenue.

Challenges

Challenges

- Commercialization is essential in order to sustain market position

With the rate of advancement in sodium-ion battery technology, it is projected that this cutting-edge battery technology will emerge as a serious opponent in the rechargeable battery arena, transitioning it from the emerging stage to the growing stage. However, this can only be accomplished with additional investment in sodium-ion battery research and development in order to commercialize this technology for low-cost, scalable, and large-scale electrical energy storage.

Segmentation Analysis

Segmentation Analysis

The global sodium-ion battery market is segregated on the basis of type, end-user, and region.

By type, the market is classified into sodium-oxide batteries, sodium-salts batteries, and sodium-sulfur batteries. A sodium-sulfur battery is a molten-salt battery composed of liquid sodium and sulfur that has a high energy density, a high discharge & charge efficiency, and a long lifecycle. This is propelling the growth of this market segment.

The electrolyte in a sodium-salt battery is a saline solution, which is easily recyclable and less combustible than those made with hazardous or toxic materials. Sodium-oxygen battery research has increasingly gained popularity. The rechargeable sodium-oxide battery combines an intriguing novel metal-air battery system for transportation applications with a conceptual specific capacity of 1600 Wh/kg and an equilibrium release potential of 2.2 Volt.

By end-user, the market is divided into transportation, grid-level applications, consumer electronic devices, power backup, industrial, defense, aerospace, marine, and others. Transportation applications and consumer electronic devices powered by sodium-ion batteries captured the largest market share of 6% cumulatively in 2021 and are expected to remain the largest segment until 2028.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 650 Million |

Projected Market Size in 2028 |

USD 2500 Million |

CAGR Growth Rate |

11.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Aquion Energy, Faradion Limited, Zhejiang Lvming Energy (Durathon), Panasonic Corporation, HiNa Battery Technology, Nrgtek Inc., Qintang New Energy, AGM Batteries Ltd., NGK, and Liaoning Hongcheng., among others |

Key Segment |

By Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- In North America, the sodium-ion battery market is expected to be lucrative

The sodium-ion battery market in North America is anticipated to be lucrative due to strategies for large capacity extensions of wind and solar power in the future, as well as rising electric vehicle revenues in the region. Some countries in the Latin American region, including the Caribbean Islands, Columbia, Venezuela, and Chile, have poor power distribution networks. To meet the region's growing power demand, local governments in the aforementioned countries, as well as Uruguay and Brazil, are focusing on expanding solar capacity. The increase in solar capacity in the region is expected to fuel the sodium-ion battery market's growth in the region.

The European Union is focusing on transitioning to renewable energy sources and encouraging local governments to implement electric vehicle systems. Rising revenues from electric vehicles and the expansion of the region's renewable industry are anticipated to drive sodium-ion battery market growth over the projected period. Renewable energy capacity has increased significantly in the Middle East region. Setups in Saudi Arabia, the United Arab Emirates, and South Africa are some of the key drivers of renewable energy growth in Africa and the Middle East. The region's increased renewable energy capacity is estimated to propel the sodium-ion battery market.

Asia Pacific region seems to have a healthy and rapidly expanding renewable energy market. Capacity extensions in India, China, and Japan are among the primary drivers of the region's renewable energy market growth. The expansion of the renewables industry is anticipated to boost the growth of sodium-ion revenues in the Asia Pacific region in the future.

Recent Developments

Recent Developments

- January 2022: Reliance Industries revealed that its affiliated Reliance New Energy Solar Limited has made an agreement with Faradion and its shareholders to obtain 100 percent of Faradion's equity shares via secondary transactions for a sum of GBP 94.45 million. Reliance will also use Faradion's cutting-edge technology at its suggested completely integrated storage technology giga-factory as a component of the Dhirubhai Ambani Green Energy Giga Complex venture in Jamnagar, according to the company.

- July 2021: Contemporary Amperex Technology Co., Ltd. released a new version of the first-ever sodium-ion battery as well as its AB backup battery solution, which can merge sodium-ion and lithium-ion cells into a single pack.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global sodium-ion battery market are

- Aquion Energy

- Faradion Limited

- Zhejiang Lvming Energy (Durathon)

- Panasonic Corporation

- HiNa Battery Technology

- Nrgtek Inc.

- Qintang New Energy

- AGM Batteries Ltd.

- NGK

- Liaoning Hongcheng.

The global sodium-ion battery market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Sodium-Oxide Batteries

- Sodium-Salt Batteries

- Sodium-Sulfur Batteries

By End-User Segment Analysis

By End-User Segment Analysis

- Transportation

- Grid-Level Applications

- Consumer Electronic Devices

- Power Backup

- Industrial

- Defense

- Aerospace

- Marine

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aquion Energy

- Faradion Limited

- Zhejiang Lvming Energy (Durathon)

- Panasonic Corporation

- HiNa Battery Technology

- Nrgtek Inc.

- Qintang New Energy

- AGM Batteries Ltd.

- NGK

- Liaoning Hongcheng.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors