Search Market Research Report

Smart Electric Meter Market Size, Share Global Analysis Report, 2024 – 2032

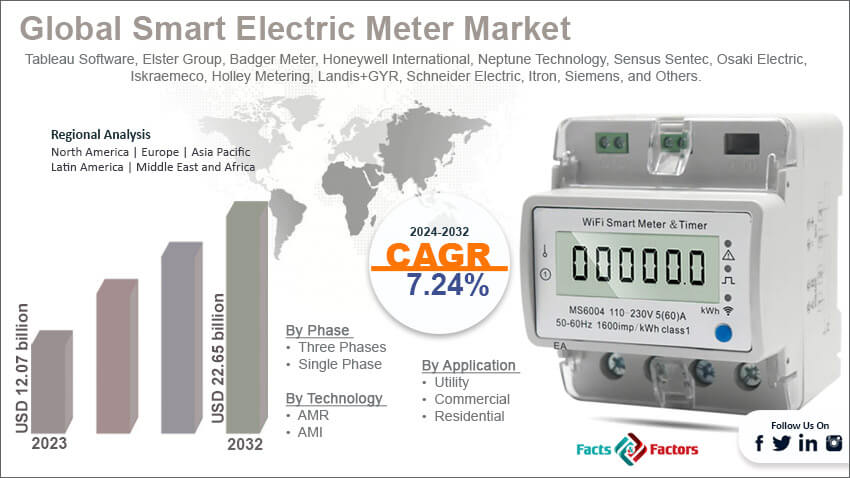

Smart Electric Meter Market Size, Share, Growth Analysis Report By Phase (Three Phases And Single Phase), By Technology (AMR and AMI), By Application (Utility, Commercial, And Residential), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

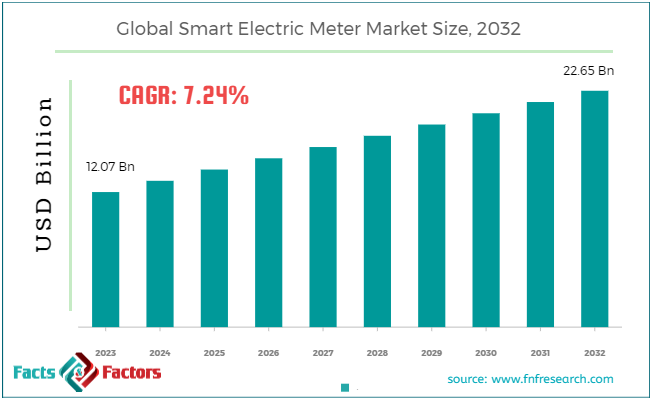

[220+ Pages Report] According to Facts and Factors, the global smart electric meter market size was valued at USD 12.07 billion in 2023 and is predicted to surpass USD 22.65 billion by the end of 2032. The smart electric meter industry is expected to grow by a CAGR of 7.24% between 2024 to 2032.

Market Overview

Market Overview

Smart electric meters are designed to record and measure electricity usage in an interactive and advanced approach that is more sophisticated than traditional analogue meters. These meters improve the overall energy management and also are vital in modernizing the electricity grid. These meters facilitate two-way communication, which opens the way for the exchange of data and real-time information to both parties.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global smart electric meter market size is estimated to grow annually at a CAGR of around 7.24% over the forecast period (2024-2032).

- In terms of revenue, the global smart electric meter market size was valued at around USD 12.07 billion in 2023 and is projected to reach USD 22.65 billion by 2032.

- Growing demand for increased efficiency is driving the growth of the global smart electric meter market.

- Based on the phase, the three-phase segment is growing at a high rate and is projected to dominate the global market.

- Based on the technology, the AMI segment is projected to swipe the largest market share.

- Based on the application, the residential segment is projected to witness a high CAGR during the forecast period.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing grid modernization initiatives are likely to drive the growth of the global market.

Governments all across the globe are investing heavily in modernizing the grid to improve the sustainability, reliability, and efficiency of the electricity grids. Regulatory bodies in many countries are considering various policies and rules to mandate the deployment of these meters. The major reason behind these initiatives is to reduce carbon emissions and improve energy efficiency.

Also, these smart meters help consumers analyze their energy consumption patterns in real time. It will help them make informed decisions. However, the integration of renewable energy sources has significantly boosted the efficiency of smart meters.

Restraints

Restraints

- High deployment cost is expected to hamper the growth of the global market.

The high upfront cost of installing these meters deters the price-sensitive consumers. Also, utility companies face challenges in accessing the funding for the large-scale deployments of these meters. Therefore, such a landscape is expected to hinder the growth of the global smart electric meter market.

Opportunities

Opportunities

- Technological advancements are likely to foster growth opportunities in the global market.

The ongoing technological advancements in metering capabilities are contributing to the high growth rate of the smart electric meter industry. Also, advancements in communication technology and data analytics are encouraging the growth of the industry. However, these advancements are likely to increase the efficiency, security, and functionality of smart metals, which is expected to increase their adoption rate in the market further.

Honeywell said to integrate Verizon LTE Managed Connectivity to smart meters in January 2020. The major aim of this initiative is to offer its customers a wireless network platform as a part of its smart energy services, hardware, and software.

Challenges

Challenges

- Legacy infrastructure is a big challenge in the global market.

The existing infrastructure across the globe does not align with the emerging requirements of smart meter technologies. Also, upgrading or replacing the entire existing energy infrastructure is complex and costly, which is further expected to slow down the growth of the global smart electric meter market. Moreover, the privacy and security concerns are also a big challenge in the market.

Segmentation Analysis

Segmentation Analysis

The global smart electric meter market can be segmented into phase, technology, application, and region.

On the basis of phase, the market can be segmented into three phases and a single phase. The three-phase segment is poised to witness huge developments in the coming years. The three-phase meters are important for monitoring the electricity consumption in large-scale enterprises, commercial buildings, and industrial facilities. The growing rate of these sectors is increasing the demand in the market.

Also, businesses are increasingly focusing on managing their energy consumption while lowering the operational cost. Smart meters like three-phase meters offer real-time data, which helps organizations optimize their energy usage. Governments all across the globe are investing in grid modernization projects.

The three-phase meters play an important role in extending the capabilities of the electrical grid by fostering directional communication between the consumers and utilities. All these growing efforts to fasten the deployment of advanced metering infrastructure are also likely to boost the growth of the segment.

On the basis of technology, the market can be segmented into AMR and AMI. The AMI segment is anticipated to dominate the smart electric meter industry during the forecast period. AMI is an advanced metering infrastructure that involves the integration of data management technologies and advanced communication to offer two-way communications. These systems assist in real-time communication by offering companies and consumers detailed data on energy consumption and other important parameters. Two-way communication helps people to monitor the grid remotely.

Moreover, governments across many regions are taking several initiatives to implement the AMI system. Deployment of these advanced metering infrastructures to achieve energy efficiency goals is encouraging the demand in the market.

Additionally, bidirectional communication facilitates quick response to outages and fault detection, which enhances the reliability and resilience of the electricity grids. These systems also help improve customer engagement rates by offering them information on energy-saving behaviors and energy usage.

On the basis of application, the market can be segmented into utility, commercial, and residential. The residential segment accounts for the largest share of the global smart electric meter market. The rising awareness among consumers in residential areas regarding the benefits of smart meters is boosting the growth of the segment. It helps consumers make informed decisions regarding energy usage, thereby reducing their electricity bills. The government is also offering incentives, subsidies, and mandates, which are likely to play an important role in the high growth rate of the segment.

Also, the growing environmental consciousness among consumers in the residential category to support sustainable living is another major factor impacting the positive growth of the segment. Smart meters help in energy conservation and also facilitate the integration of renewable energy resources, thereby helping in maintaining environmental health.

Smart meters facilitate the implementation of pricing, models and time-of-use tariffs, which help people shift their energy usage to off-peak hours. This is highly advantageous for both utility companies and consumers. Therefore, such a landscape is expected to foster growth opportunities in the segment in the forthcoming years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 12.07 Billion |

Projected Market Size in 2032 |

USD 22.65 Billion |

CAGR Growth Rate |

7.24% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Tableau Software, Elster Group, Badger Meter, Honeywell International, Neptune Technology, Sensus Sentec, Osaki Electric, Iskraemeco, Holley Metering, Landis+GYR, Schneider Electric, Itron, Siemens, and Others. |

Key Segment |

By Phase, By Technology, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global smart electric meter market. The region is investing heavily in grid modernization initiatives. The government is expecting fast deployment of smart meters, which is likely to expand the scope of the regional market extensively in the coming years.

Also, the regulatory mandates in the region support the growth of the market. The state government and provinces are aiming to reduce energy consumption and enhance grid efficiency by aligning the utility operations and fastening the deployment processes.

Furthermore, the high focus of non-profit organizations and other environmental centers on balancing energy efficiency from both the utility and consumer perspective is also likely to encourage the growth of the regional market.

Smart meters aim to offer real-time data on energy consumption, thereby reducing energy usage and helping consumers make informed decisions. Technological advancements like improving data analytic capabilities are increasing the efficiency of these meters in the region.

Also, a growing number of consumers are becoming aware of the advantages of smart meters, which is also driving their acceptance in the regional market. Such a landscape is expected to accentuate the growth of the regional market manifolds in the forthcoming years.

Asia Pacific is also expected to grow steadily during the anticipated period because of various factors like growing urbanization and energy demands in the region. As a result, governments are investing heavily in improving the grid infrastructure and deploying the latest technology to meet the surge demands.

The growth in urbanization and industrial activities is posing a huge demand for electricity, which is also negatively impacting environmental health. Smart meters have emerged as an important solution in the region to balance the demand and align with the goal of resource protection.

Moreover, there are increasing efforts by government and utility companies to establish interoperability standards to ensure that smart meters from various vendors work seamlessly with the entire smart grid ecosystem. Such initiatives are expected to push the growth of the regional market significantly in the coming years.

Competitive Analysis

Competitive Analysis

The key players in the global smart electric meter market include:

- Tableau Software

- Elster Group

- Badger Meter

- Honeywell International

- Neptune Technology

- Sensus Sentec

- Osaki Electric

- Iskraemeco

- Holley Metering

- Landis+GYR

- Schneider Electric

- Itron

- Siemens

Sojitz Corporation entered into an agreement with the Japanese Ministry of Economy, Trade, and Industry in November 2020. The agreement focuses on extending their energy infrastructure abroad.

The global smart electric meter market is segmented as follows:

By Phase Segment Analysis

By Phase Segment Analysis

- Three Phases

- Single Phase

By Technology Segment Analysis

By Technology Segment Analysis

- AMR

- AMI

By Application Segment Analysis

By Application Segment Analysis

- Utility

- Commercial

- Residential

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Tableau Software

- Elster Group

- Badger Meter

- Honeywell International

- Neptune Technology

- Sensus Sentec

- Osaki Electric

- Iskraemeco

- Holley Metering

- Landis+GYR

- Schneider Electric

- Itron

- Siemens

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors