Search Market Research Report

Silage Inoculants And Enzymes Market Size, Share Global Analysis Report, 2022 – 2028

Silage Inoculants And Enzymes Market Size, Share, Growth Analysis Report By Type (Homofermentative, Heterofermentative), By Species (Lactobacillus, Pediococcus, Enterococcus), By Enzymes (Fiber-digesting, Starch-digesting), By Crop-Type (Corn, Sorghum, Alfalfa, Clovers, Others (Barley, Oats, Rye, Legumes, And Grasses)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

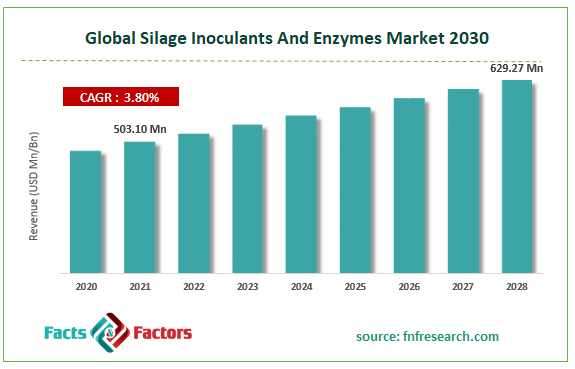

[215+ Pages Report] According to Facts and Factors, the global silage inoculants & enzymes market size was worth USD 503.10 million in 2021 and is estimated to grow to USD 629.27 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.80% over the forecast period. The report analyzes the silage inoculants & enzymes market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the silage inoculants & enzymes market.

Market Overview

Market Overview

To further aid in crop preservation, silage inoculant contains microorganisms that help control the fermentation process in silage. These inoculants can aid in raising the levels of fermentation-related enzymes. Silage inoculants of high grade are known to develop more swiftly and effectively. Low dry matter waste, enhanced animal performance, and little energy loss is the end consequences. Improved meat or milk production performance may result from silage inoculants' ability to increase silage quality and decrease shrinkage. Inoculants break down only a small portion of the hay's fibers and starch. Silage is a possible fermented substance used as cow fodder. Silage aids in keeping the forage crop's natural nutrients for use in feeding cattle.

Silage additives are applied to increase the forage's nutritional content and enhance the silage's general hygiene. Meat quality and some other items obtained from animals are improved by silage. Silage inoculants are used to speed up enzyme production, improve the pace of fermentation, and break down part of the hay's fiber & starch. Global market growth is attributed to rising feed grain and compound feed costs, rising livestock population, declining grazing and pastureland area, and rising demand for livestock production. However, several challenges are limiting this market, particularly in the Asia-Pacific and Latin American countries, including the high setup cost of ensiling and lack of understanding of the advantages of silage.

Covid-19 Impact:

Covid-19 Impact:

Governments worldwide are collaborating with pharmaceutical and biotech businesses to combat the COVID-19 epidemic, from fostering the creation of vaccinations to preparing for issues with the distribution of medical supplies. Given the severe scarcity of these medications in many industrialized nations, the extremely high demand for these medications has created enormous potential for producers of COVID-19 management medications. In light of this, the biotechnology sector is anticipated to experience rapid expansion in the next years due to the need for COVID-19 vaccines and medications.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global silage inoculants & enzymes market value is expected to grow at a CAGR of 3.80% over the forecast period.

- In terms of revenue, the global silage inoculants & enzymes market size was valued at around USD 503.10 million in 2021 and is projected to reach USD 629.272 million by 2028.

- Silage inoculants are supplements used to control and improve the fermentation of haylage and corn silage. They include anaerobic lactic acid bacteria. The rising demand for silage inoculants & enzymes from animal husbandry is anticipated to fuel the market's expansion.

- By type, the homofermentative category dominated the market in 2021.

- By species, the lactobacillus category dominated the market in 2021.

- North America dominated the global silage inoculants & enzymes market in 2021.

Growth Drivers

Growth Drivers

- Rising feed grain and compound feed prices will propel market expansion during the projection period.

Animals absorb the important nutrients in silage inoculants and enzymes to generate milk and meat. It's critical to keep them. The kind and quantity of bacteria that produce acid in a pasture or crop will determine how much dry matter and nutrients are lost during the ensiling process. Silage inoculants and enzymes supply the proper strains of bacteria in the right quantities for quick, effective fermentation. The animals can produce more milk or meat from every tone of grass or crop it can ensile by helping to seal in nutrients and dry matter. Therefore, expanding livestock populations, declining grazing and pastureland areas, and rising feed grain and compound feed prices are key factors driving the global silage inoculants and enzymes market.

Restraints

Restraints

- Costlier silage inoculants and enzymes will prevent the market from expanding.

Demand for silage inoculants and enzymes has increased due to rising population, rising standards of living in emerging countries, limited arable land availability, climate changes, and export limitations by various governments. As a consequence, the cost of silage inoculants and enzymes has significantly increased, which has increased the usage of agricultural inoculants. This may reduce the ability of agricultural land to produce. In the anticipated time frame, this aspect will restrain the market's expansion for silage inoculants & enzymes.

Segmentation Analysis

Segmentation Analysis

The global silage inoculants & enzymes market is segregated based on type, species, enzyme, and crop type.

Based on type, the market is segmented into homofermentative and heterofermentative. In 2021, the homofermentative sector accounted for the biggest proportion of the market for silage inoculants and enzymes. The most widely used inoculants on the market are homofermentative. The primary objective of employing these inoculants at first was to maintain the quality of the ensiled plants as close as possible to the original levels. To do this, homofermentative bacteria lower pH, minimize dry matter losses (2–3%), decrease proteolysis (protein breakdown), reduce ammonia generation, and increase lactic acid and dry matter. Fast pH declines can also prevent clostridial bacteria from producing butyric acid, a malodorous byproduct of unfavorable fermentation.

Based on species, the market is classified into lactobacillus, pediococcus, and Enterococcus. In 2021, lactobacillus species retained the biggest market share for silage inoculants and enzymes. There are several lactobacillus species. These healthy bacteria often coexist in the urinary, vaginal, and digestive systems without harming humans. Additionally, certain fermented foods like yogurt and nutritional supplements include lactobacillus. Lactobacillus is most frequently given orally to treat and prevent diarrhea, especially infectious diarrhea and diarrhea associated with taking antibiotics. Many other illnesses for which lactobacillus is taken orally—including general digestive issues, IBS, infant colic, inflammatory bowel disease (IBD), colon inflammation, stomach discomfort, constipation, and many others—are not well supported by scientific research.

Based on the enzyme, the market is classified into fiber-digesting and starch-digesting. Starch digesting dominated the market in 2021. Over time, the agricultural, biotechnology, and food sectors have benefited from the development of starch-digesting enzymes. The ongoing study and creation of high-quality silage inoculants and enzymes also assist in the market's expansion.

Based on crop type, the market is classified into corn, sorghum, alfalfa, clovers, and others (barley, oats, rye, legumes, and grasses). In 2021, the corn sector accounted for the highest proportion of the market for silage inoculants and enzymes. Due to the widespread cultivation of corn, there is a strong demand worldwide for silage inoculants and enzymes. Global grain production and consumption are rising. As a result, farmers must concentrate more on improving the yield and quality of their crops by employing efficient silage inoculants and enzymes. The greater lactic acid, lesser acidic acid, and lower Ph of corn silage make fermentation simpler. It also has a reduced buffering capacity. Corn silage's fermentation can be improved, although it is more challenging.

Recent Developments:

Recent Developments:

- August 2021: The biggest dairy nutrition firm, Volac, has revealed that it has purchased Micron BioSystems, a UK-based provider of bioscience solutions. At its facilities in Virginia and Bridgwater, UK, Micron Bio-Systems manufactures and distributes silage additives, mycotoxin remediation, nutraceuticals, and environmental goods.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 503.10 Million |

Projected Market Size in 2028 |

USD 629.27 Million |

CAGR Growth Rate |

3.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

du Pont de Nemours and Company, ADDCON GROUP GmbH, Kemin Industries, E. I. Archer Daniels Midland Company, Chr. Hansen A/S., Volac International Ltd., Agri-King Inc., Biomin Holding GmbH, Lallemand Inc., Schamann BioEnergy GmbH., and Others |

Key Segment |

By Type, Species, Enzymes, Crop-Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominates the silage inoculants & enzymes market in 2021

North America dominated the global silage inoculants and enzymes market in 2021. The economies of North America are mostly impacted by those of the U.S. and Canada, although the situation is changing with increasing foreign direct investment for the region's economic development. The agriculture industry is expanding rapidly in North American nations. Globally, North America produces and exports a vast range of agricultural goods. Beyond the disease's transmission and containment attempts, the coronavirus pandemic has had far-reaching effects. There are currently no widespread supply chain disruptions recorded in North America since the agricultural output is widely distributed. The demand and supply chains for silage inoculants and enzymes have been divested in the area. The current state of lockdown in the region is also impacting supply and output.

Competitive Landscape

Competitive Landscape

- du Pont de Nemours and Company

- ADDCON GROUP GmbH

- Kemin Industries

- E. I. Archer Daniels Midland Company

- Chr. Hansen A/S.

- Volac International Ltd.

- Agri-King Inc.

- Biomin Holding GmbH

- Lallemand Inc.

- Schamann BioEnergy GmbH.

The Global Silage Inoculants And Enzymes Market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Homofermentative

- Heterofermentative

By Species Segment Analysis

By Species Segment Analysis

- Lactobacillus

- Pediococcus

- Enterococcus

By Enzymes Segment Analysis

By Enzymes Segment Analysis

- Fiber-digesting

- Starch-digesting

By Crop-Type Segment Analysis

By Crop-Type Segment Analysis

- Corn

- Sorghum

- Alfalfa

- Clovers

- Others (barley, oats, rye, legumes, and grasses)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- du Pont de Nemours and Company

- ADDCON GROUP GmbH

- Kemin Industries

- E. I. Archer Daniels Midland Company

- Chr. Hansen A/S.

- Volac International Ltd.

- Agri-King Inc.

- Biomin Holding GmbH

- Lallemand Inc.

- Schamann BioEnergy GmbH.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors