Search Market Research Report

Precious Metals Market Size, Share Global Analysis Report, 2019–2026

Precious Metals Market By Type (Gold, Silver, Platinum, Palladium, Others) and By End-User (Individual, Broker): Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

This professional and specialized report study examines the technical and business perspective of the precious metals industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the precious metals market. The report study analyzes the market statistics at the global as well as the regional levels to gain an in-depth perspective of the overall precious metals market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of value (USD Billion) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the precious metals market in our study.

Key Insights from Primary Research

Key Insights from Primary Research

- After conducting extensive interviews with C-level executives operating in the precious metals market, we analyzed that the global market is anticipated to foresee a considerable growth by the end of 2026.

- In 2019, the precious metals generated revenues worth more than USD 290 billion owing to the use of precious metals in various end-use industries such as jewelry, automotive, electronics, etc. and is predicted the market to witness the lucrative growth of the market during the forecast period.

- Geographically, Europe was the second-largest market for precious metals in 2019. This growth is attributed due to the high demand for gold, silver, and platinum in this region.

- Based on type, the goldcategory penetrated the market with higher shares in 2019. Gold was followed by silver, generated revenue of more than USD 100 billion in 2019.However, our primary respondents believe that the silver segment is projected to witness significant growth over the future years.

- Considering application segment, an individual category penetrated the market with around USD 220 billion in 2019 and is further anticipated to grow in the near future owing to increasing consumer interest in investment of gold and silver.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend,gold category is expected to exibit to grow at faster pace attributed tothe increasing customer demand forthe gold in the from of jewelry, coins, bars, biscuits, etc.

- Due to the increasing interest and knowledge of customers about the trading of precious metals, the individual segment is anticipated to grow at a highest market share in the near future.

- The significant CAGR of nearly 6% is observed by the global precious metals market and is set to bring profitable opportunities for the players owing to the increasing demand for precious metals globally.

- Asia-Pacific is expected to be the fastest-growing market for precious metals during the coming years due to the increasing investments in the region. Moreover, the changing fashion trends, the growing demand for traditional and temple golden jewelry specifically for big-fat Indian weddings in this region. This parameter is projected to witness the robust demand for precious metal in the region over the upcoming years.

- Precious metal serves as a strong barrier during economic collapse and market volatility. Precious metals have no credit risk.Because of these reasons, our analysts predicted that the precious metals market will grow in the forthcoming years.

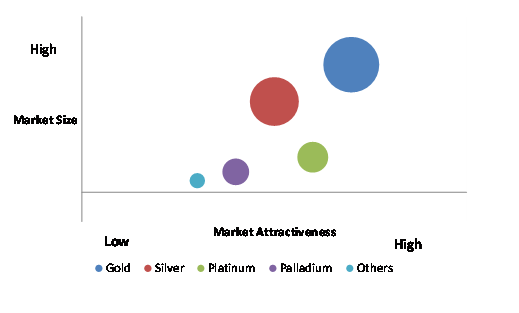

Market Attractiveness by Type

Market Attractiveness by Type

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the precious metals market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the precious metals market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the precious metals market.

The research study provides a critical assessment of the precious metals industry by logically segmenting the market on the basis of type, end-user, and regions. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026. The regional segmentation of the precious metals industry includes the holistic bifurcation of all the five major continents including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Precious metals occur naturally and very rare metallic elements that have important economic value. By property, they are lustrous, malleable, and good conductors of electricity and heat. Generally, metals are solid at room temperature. Precious metals are industrial product and it is primarily considered as an investment. Gold and platinum are some of the most well-known precious metals of the industry. While the coinage metal and silver are used in industrial applications, such as jewelry, and art.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 290 Billion |

Projected Market Size in 2026 |

USD XX Billion |

CAGR Growth Rate |

6.0% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

AvaTrade, Plus500 Ltd., AxiTrader, EToro Ltd., Forex.com, XM Global Limited, Henyep Capital Markets (HYCM), Pepperstone, XTB, Goodwill Wealth Management Private Limited, iForex, and others. |

Key Segment |

By Drive Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Due to growing uncertainty in the market, investors are seeking a safe haven in the precious metals commodity. Increasing mining activities for precious metals is supporting market growth. Increasing demand for precious metals in various end-use industries such as jewelry, automotive, electronic, chemical, oil, and gas, etc. is driving the demand for precious metals. This, in turn, is supporting the precious metals market growth. Intensifying reportage of dirty gold and issues around where and in what way the metals are sourced and how it is moved through the supply chain are the factors may restrain the market growth. Illegal gold mining activities may hamper the market growth. Demand for precious metals such as gold, platinum, silver, etc. mainly comes from jewelry, everyday technological products, and for investment purposes. Growing end-use industries is anticipated to offer a lucrative opportunity for market growth. Precious metals have often been used as a safe investment. Hence, it is the most preferred commodity by the people for investment. The fluctuating stock market, uncertainty in the profit gain is likely to fuel the precious metals market growth in the near future.

The precious metals market is segmented based on type and end-user. On the basis of type segmentation, the market is classified into gold, silver, platinum, palladium, and others. In terms of end-user, the market is bifurcated into an individual and broker.

Some of the essential players operating in the Precious Metals market, but not restricted to include

Some of the essential players operating in the Precious Metals market, but not restricted to include

- AvaTrade

- XM Global Limited

- XTB

- Pepperstone

- AxiTrader

- EToro Ltd.

- Forex.com

- Plus500 Ltd.

- Henyep Capital Markets (HYCM)

- Forex

- Goodwill Wealth Management Private Limited

The taxonomy of the Precious Metals Market by its scope and segmentation is as follows:

By Type Segmentation Analysis

By Type Segmentation Analysis

- Gold

Silver

- Platinum

- Palladium

- Others

By End-User Segmentation Analysis

By End-User Segmentation Analysis

- Individual

- Broker

Regional Segmentation Analysis

Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Industry Major Market Players

- AvaTrade

- XM Global Limited

- XTB

- Pepperstone

- AxiTrader

- EToro Ltd.

- Forex.com

- Plus500 Ltd.

- Henyep Capital Markets (HYCM)

- Forex

- Goodwill Wealth Management Private Limited

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors