15-Jan-2020 | Facts and Factors

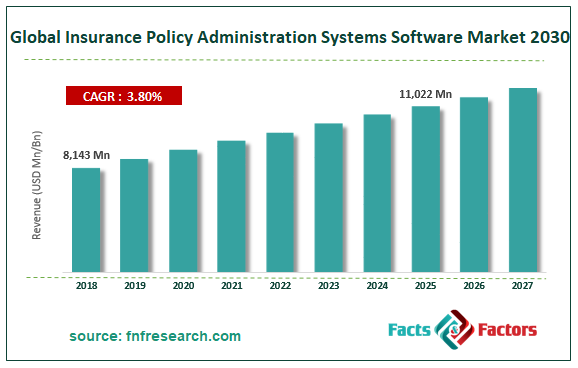

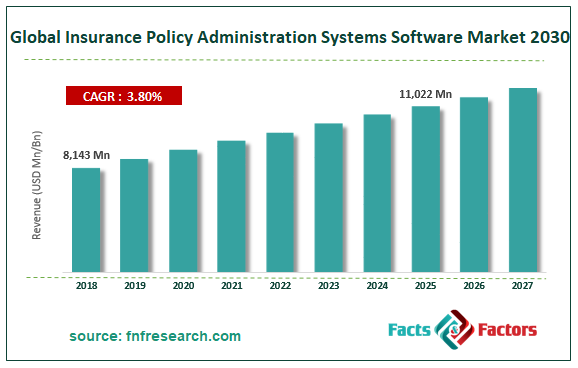

Facts and Factors Market Research has published a new report titled “Insurance Policy Administration Systems Software Market By Offerings (Standalone Software and Integrated Platform), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By End-User (Conventional Insurance Providers and Bancassurance Companies): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2025”. According to the report, the global Insurance Policy Administration Systems Software market was valued at approximately USD 8,143 million in 2018 and is expected to reach a value of around USD 11,022 million by 2025, at a CAGR of around 3.8% between 2019 and 2025.

Insurance Policy Administration Systems Software implements insurance functions comprising rating, issuing, endorsements, quoting, binding, and renewals. Earlier these systems were neither flexible nor customizable and were costly. Today, these modern core insurance systems for policy administration have proved to be efficient, cost-effective, and flexible with the adoption of microservices architecture and cloud hosting solutions.

Browse the full “Insurance Policy Administration Systems Software Market By Offerings (Standalone Software and Integrated Platform), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By End-User (Conventional Insurance Providers and Bancassurance Companies): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2025” Report at https://www.fnfresearch.com/insurance-policy-administration-systems-software-market-by-offerings-313

Furthermore, the insurance policy administration systems software services enable quick launching of insurance products, reduction in the overhead costs, minimization of growth timeline, and creating customized solutions for fulfilling the business objectives of the insurers.

Large-scale acceptance of cloud services to steer the market growth

In the current era, cloud-based asset management services have gained huge popularity with growing technological expansion along with a high preference for AI & big data analytics by the firms for proficiently managing business operations. Moreover, shifting of business functions to the cloud is predicted to benefit the firms in case of the later possessing lesser resources and a lower budget. All these aforementioned factors are predicted to steer the expansion of the market over the forecast timeline.

Furthermore, the growing utilization of the digital business model in the insurance sector to positively influence business expansion over the forecast period. The digital revolution has greatly influenced the business fraternity and insurance business is no exception to this. Moreover, the digital revolution has enabled the consumers to shift towards personalized insurance coverage encompassing usage-based, on-demand, and all-in-one insurance lifestyle items. This, in turn, is predicted to accentuate the expansion of the Insurance Policy Administration Systems Software market over the forecast period. However, data security concerns & stringent laws governing the use of the product will hinder the market growth over the forecast period.

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 8,143 million |

Projected Market Size in 2025 |

USD 11,022 million |

CAGR Growth Rate |

3.8% CAGR |

Base Year |

2018 |

Forecast Years |

2019-2025 |

Key Market Players |

Andesa Services, Damco Group, DXC Technology Company, Ebix Inc., EXL, FINEOS, FIS, InsPro Technologies, Oceanwide Canada Inc., OneShield Inc., Oracle, Pegasystems Inc., Sapiens International, Scorto Inc., Solartis, and Target Group. |

Key Segment |

By Offerings, By Deployment Mode, By Organization Size, By End-User and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Cloud-based segment to register highest CAGR over the forecast period

The cloud-based segment is anticipated to record the highest growth rate of over 5% during the period from 2019 to 2025. The growth of the segment is attributed to the myriad advantages offered by cloud-based installation including cost-efficacy, scalability, high computing speed, and reduced spending on IT infrastructure facilities.

Large enterprises to dominate the organization size segment over the forecast period in terms of revenue

The growth of the large enterprises segment during the timespan from 2019 to 2025 is owing to the massive demand for Insurance Policy Administration Systems Software from giant firms.

Asia Pacific market to record the highest CAGR over the forecast timeline

The Insurance Policy Administration Systems Software market in the Asia Pacific is set to register the highest growth rate of over 4% during the period from 2019 to 2025. The regional market expansion over the forecast timespan is owing to the massive demand for the product in countries like China, India, Japan, and Australia.

Some of the key players in the market include Andesa Services, Damco Group, DXC Technology Company, Ebix Inc., EXL, FINEOS, FIS, InsPro Technologies, Oceanwide Canada Inc., OneShield Inc., Oracle, Pegasystems Inc., Sapiens International, Scorto, Inc., Solartis, and Target Group.

This report segments the Insurance Policy Administration Systems Software market as follows:

Global Insurance Policy Administration Systems Software Market: By Offerings Segment Analysis

- Standalone Software

- Integrated Platform

Global Insurance Policy Administration Systems Software Market: By Organization Size Segment Analysis

- Large Enterprises

- Small & Medium-Sized Enterprises

Global Insurance Policy Administration Systems Software Market: By Deployment Mode Segment Analysis

Global Insurance Policy Administration Systems Software Market: By End-User Segment Analysis

- Conventional Insurance Providers

- Bancassurance Companies

Global Insurance Policy Administration Systems Software Market: Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com