Search Market Research Report

Monkeypox Vaccine and Treatment Market Size, Share Global Analysis Report, 2025 – 2034

Monkeypox Vaccine and Treatment Market Size, Share, Growth Analysis Report By Product Type (Vaccine, Drugs, Vaccinia Immune Globulin [VIG]), By Gender Type (Male, Female, and Others), By Route of Administration (Oral, Injectable), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

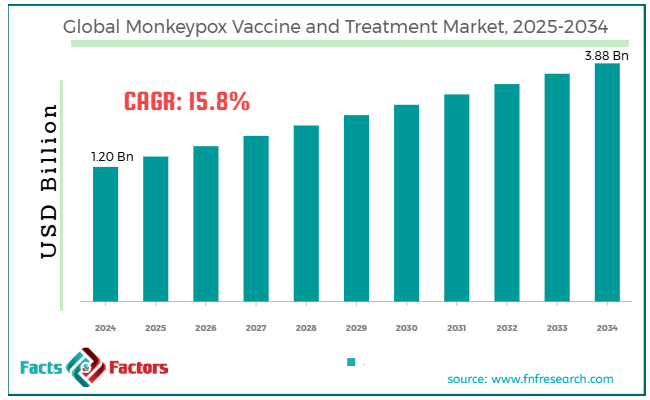

[221+ Pages Report] According to Facts & Factors, the global monkeypox vaccine and treatment market size was worth around USD 1.20 billion in 2024 and is predicted to grow to around USD 3.88 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.8% between 2025 and 2034.

Market Overview

Market Overview

The monkeypox vaccine is highly effective in preventing monkeypox, a rare viral infection mainly occurring in West and Central Africa. It belongs to the family of viruses, such as smallpox, and the said vaccine defends against monkeypox, an altered version of the smallpox vaccine.

The global monkeypox vaccine and treatment market is expected to grow remarkably over the forecast period, owing to the surging cases of monkeypox, rising education and awareness of zoonotic diseases, and supportive government and public health initiatives.

The growth in periodic outbreaks and monkeypox cases in 2022 has elevated the need for effective treatments and vaccines. This growth in cases has resulted in higher demand for antivirals and vaccines.

Furthermore, with a rising emphasis on zoonotic illnesses, there is a higher focus on monitoring monkeypox-like diseases. A growing number of awareness campaigns are driving the need for improved treatment options and vaccine coverage.

In addition, governments on a global scale are heavily investing in preparedness programs and vaccine distribution to control severe outbreaks. Organizations like the World Health Organization are backing efforts to treat and vaccinate people in vulnerable populations.

Nevertheless, the global market is hampered by key restraining factors like low education and awareness, and the high cost of vaccination programs.

While the awareness of monkeypox has increased, it is still lacking in many unexplored regions with the least knowledge or understanding. This majorly results in delayed and underreported responses.

Also, the manufacturing and distribution costs may be significant, restricting availability in remote or low-income regions, thus hindering its broader adoption.

Yet, the market is opportune for heavy investment in vaccine development and a growing number of pediatric vaccination programs. The current investment in R&D to enhance the efficiency, accessibility, and safety of vaccines will fuel industry growth. This comprises launching new-generation vaccines with fewer side effects and improved protection.

Moreover, the opportunity to create vaccines, mainly for the endangered or children population, may expand the horizons for development.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global monkeypox vaccine and treatment market is estimated to grow annually at a CAGR of around 15.8% over the forecast period (2025-2034)

- In terms of revenue, the global monkeypox vaccine and treatment market size was valued at around USD 1.20 billion in 2024 and is projected to reach USD 3.88 billion by 2034.

- The monkeypox vaccine and treatment market is projected to grow significantly owing to the rising cases of monkeypox on a global scale, supportive governmental initiatives, and substantial investments in research and development.

- Based on product type, the vaccine segment is expected to lead the market, while the drugs segment is expected to register considerable growth.

- Based on gender type, the male segment leads the market, while the female segment will progress considerably over the estimated period.

- Based on route of administration, the injectable segment is the dominating segment among others, while the oral segment is projected to witness sizeable revenue over the forecast period.

- Based on distribution channel, the hospital pharmacies segment is expected to lead the market compared to the retail pharmacies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Growth Drivers

Growth Drivers

- Improvements in treatment and vaccine technologies to impact the market growth

Notable technological developments in antiviral treatment and vaccine development have fueled the growth of the global monkeypox vaccine and treatment market. These developments make treatments more accessible, safer, and highly effective.

A modified live virus vaccine, named 'The JYNNEOS', was the first to be accepted, mainly for the monkeypox virus. Its usage expanded to more than 40 nations by 2024, including emergencies during the pandemic.

Currently, research is being performed on oral antiviral treatments that may streamline the treatment of viruses in outpatient settings or at home, thus lowering hospital admission costs.

- The development of healthcare infrastructure in developing markets contributes to market growth

The growth of healthcare infrastructure in developing nations has significantly enhanced treatment accessibility and vaccine distribution competencies. This allowed broader access to crucial resources during pandemic-like situations.

As a unit of global health security, the Vaccine Alliance, named Gavi, is associated with the WHO and COVAX to strengthen vaccine accessibility in nations with sufficient healthcare infrastructure. This has notably contributed to distributing millions of JYNNEOS doses to the vulnerable population globally.

Gavi and Africa’s CDC partnered to secure nearly 5,00,000 doses of JYNNEOS vaccine to fight monkeypox. This marked a crucial step in reinforcing the healthcare systems in the developing regions.

Restraints

Restraints

- Public reluctance and vaccine hesitancy adversely impact the market progress

Vaccine uncertainty due to issues regarding misinformation, safety, and low awareness is still a key concern in expanding the worldwide acceptance of monkeypox vaccines. This is one of the key hindrance factors in the monkeypox vaccine and treatment industry.

As per the study conducted by The Lancet in 2023, vaccine uncertainty in Africa and Europe reduced vaccination campaigns, with a few nations reporting a nearly 42% drop in vaccination rates after the primary rollout.

The CDC in the United States introduced a campaign named 'Trust the Vaccine' in 2023 to resolve misleading information regarding monkeypox vaccines. Nonetheless, notwithstanding the campaign, the 2023 data denoted high reluctance rates among the susceptible population.

Opportunities

Opportunities

- Development of novel treatment options and vaccines positively affects the monkeypox vaccine and treatment industry growth

The demand for enhanced and novel treatments and vaccines provides a key opportunity for pharmaceutical companies to widen the market and satisfy different patient needs. The 'new vaccines industry' is anticipated to progress at a 9% CAGR over the coming ten years.

Moderna declared in January 2024 that it is currently experimenting with an mRNA vaccine for monkeypox after its success with COVID-19. This modernization may shorten production time and improve the effectiveness of vaccines.

Challenges

Challenges

- Distribution and supply chain blockages limit the growth of the monkeypox vaccine and treatment market

The distribution and production of treatments and vaccines for monkeypox may experience key challenges with respect to cold chain supply and logistical problems needed for some vaccines. These barriers could hamper the speedy utilization of vaccines during the pandemic, mainly in low-resource facilities.

In late 2023, Gavi and WHO experienced distribution interruptions in many African economies due to restricted local storage facilities and cold chain barriers. This significantly hampered efforts to control the pandemic.

Bavarian Nordic and Moderna are working on solutions to enhance the supply chain by associating with regional manufacturing partners in developing regions to ensure that vaccines are easily accessible.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.20 Billion |

Projected Market Size in 2034 |

USD 3.88 Billion |

CAGR Growth Rate |

15.8% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Bavarian Nordic, Valneva SE, Sanofi, Gilead Sciences, Moderna Inc., Viralgen, Pfizer Inc., Merck & Co. Inc., Janssen Pharmaceuticals (Johnson & Johnson), Hoffmann-La Roche, Emergent BioSolutions, GlaxoSmithKline (GSK), Viroclinics Biosciences, Alnylam Pharmaceuticals, Astellas Pharma Inc., and others. |

Key Segment |

By Product Type, By Gender Type, By Route of Administration, By Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global monkeypox vaccine and treatment market is segmented based on product type, material type, end-user industry, and region.

Based on product type, the global industry is divided into vaccines, drugs, and Vaccinia Immune Globulin (VIG). The vaccines segment is the dominating segment since it is the basic prevention technique, mainly during pandemic situations. Vaccines are experiencing surging demand, primarily the ACAM2000 and JYNNEOS (Imvamune), which are used against monkeypox.

Since the said virus is zoonotic, vaccines are vital in preventing infections, and prominent organizations like the WHO and CDC are focusing on vaccination initiatives and programs to control the epidemic.

Based on route of administration, the global monkeypox vaccine and treatment industry is segmented into oral and injectable. The injectable segment led the global market and will continue to dominate over the estimated period. Vaccines like JYNNEOS are essential for preventing monkeypox, and their administration (injectable) is preferred for viral infections.

Although injectables are not as broadly used as vaccines, they are still a key component for managing serious monkeypox cases.

Several vaccines, like ACAM2000 and JYNNEOS (Imvamune), are delivered via injection. This increases its prominence for treatment and prevention.

Based on distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacies segment registered a notable market share in 2024 and will lead in the future as well. Monkeypox is a severe disease that needs immediate monitoring, attention, and expert care.

Hospitals play a key role in handling pandemics, where health experts directly administer treatments and vaccines, mainly to patients with severe complications or symptoms. The inpatient department offers improved access to medical care, essential for managing and treating vaccine side effects.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America held a notable industry share of the global monkeypox vaccine and treatment market in 2024, owing to factors like higher adoption and coverage of vaccines, improved healthcare infrastructure, and leading research and development.

North America holds larger vaccination campaigns, mainly in Canada and the United States. JYNNEOS (Imvamune) has experienced maximum distribution, with more than one million dosages delivered in the United States alone in the past year.

The region also holds well-developed healthcare systems on a global scale. This allows the speedy distribution of antivirals and vaccines, like Tecovirimat (TPOXX), and proven treatments during outbreaks.

North America also brags about its key pharmaceutical companies, such as Siga Technologies and Bavarian Nordic, makers of Tecovirimat and JYNNEOS, respectively. This boosts the region's industry growth in terms of swift commercialization and innovations.

Asia Pacific also holds a significant share in the monkeypox vaccine and treatment industry after North America, backed by increased awareness, rising healthcare infrastructure, and preparedness for regional pandemics. Governments in the region are heavily investing in reinforcing their healthcare infrastructures.

Nations like China and India are swelling their potential for healthcare preparedness and vaccine distribution, making Asia Pacific a leader in the monkeypox vaccines and treatments market. The region has also made major developments in enhancing its distribution networks, thus increasing the accessibility of treatments and vaccines, mainly in the urban regions.

Moreover, with outbreaks occurring in surrounding areas and growing awareness among people, nations in the region are more familiar with the significance of early treatment and vaccination. This noticeably fuels the demand for associated treatments and monkeypox vaccines.

Competitive Analysis

Competitive Analysis

The global monkeypox vaccine and treatment market is led by players like:

- Bavarian Nordic

- Valneva SE

- Sanofi

- Gilead Sciences

- Moderna Inc.

- Viralgen

- Pfizer Inc.

- Merck & Co. Inc.

- Janssen Pharmaceuticals (Johnson & Johnson)

- Hoffmann-La Roche

- Emergent BioSolutions

- GlaxoSmithKline (GSK)

- Viroclinics Biosciences

- Alnylam Pharmaceuticals

- Astellas Pharma Inc.

Key Market Trends

Key Market Trends

- Government readiness and stockpiling:

Governments, mainly in Europe and North America, are amassing antiviral drugs and vaccines to ensure speedy availability during pandemic-like situations. The United States has been a leading player, with more than a million dosages of JYNNEOS stored in case of emergency outbreaks.

- Emphasis on antiviral treatments:

With vaccines, there is also a rising curiosity about antiviral treatments, such as Tecovirimat (TPOXX), for handling serious cases of monkeypox. This trend is fueled by the rising need for efficient remedies for the emergence of complex cases and people who are already infected.

The global monkeypox vaccine and treatment market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Vaccine

- Drugs

- Vaccinia Immune Globulin (VIG)

By Gender Type Segment Analysis

By Gender Type Segment Analysis

- Male

- Female

- Others

By Route of Administration Segment Analysis

By Route of Administration Segment Analysis

- Oral

- Injectable

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bavarian Nordic

- Valneva SE

- Sanofi

- Gilead Sciences

- Moderna Inc.

- Viralgen

- Pfizer Inc.

- Merck & Co. Inc.

- Janssen Pharmaceuticals (Johnson & Johnson)

- Hoffmann-La Roche

- Emergent BioSolutions

- GlaxoSmithKline (GSK)

- Viroclinics Biosciences

- Alnylam Pharmaceuticals

- Astellas Pharma Inc.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors