Search Market Research Report

Metalworking Fluids Market Size, Share Global Analysis Report, 2022 – 2028

Metalworking Fluids Market Size, Share, Growth Analysis Report By Product (Mineral, Synthetic, Bio-based), By Application (Neat Cutting Oils, Water Cutting Oils, Corrosion Preventive Oils, Others), By End-Use (Metal Fabrication, Transportation Equipment, Machinery, Others), By Industrial End-Use (Construction, Electric & Power, Agriculture, Automobile, Aerospace, Rail, Marine, Telecommunication, Healthcare), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

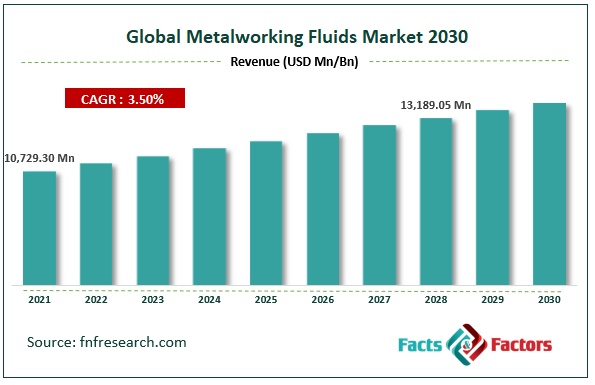

[221+ Pages Report] According to Facts and Factors, the global metalworking fluids market size was worth USD 10,729.30 million in 2021 and is estimated to grow to USD 13,189.05 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.50% over the forecast period. The report analyzes the metalworking fluids market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the metalworking fluids market.

Market Overview

Market Overview

In metallurgy and metal construction, metalworking fluids refer to various oils and lubricants used in several operations. During fabrication, these fluids reduce friction, reducing the heat caused by the same. During fabrication, these fluids reduce friction, reducing the heat caused by the same. Additionally, they are highly useful for removing metal chips extruded from the surface. Mechanical workshops use these fluids extensively for cutting and shaping metal worldwide. In addition, they improve the surface finish and texture of welded metals, thereby extending their life by maintaining lubrication, reducing wear and tear, and preventing thermal and physical deformation.

The strong automotive sector primarily drives the market's expansion. Metals are frequently used in automobiles to give structural durability and strength. Metal removal, chemical processing, and tool protection all need the use of metalworking fluids. The market has expanded due to people spending more money on vehicle modifications.

COVID-19 Impact:

COVID-19 Impact:

Lockdowns brought forth by the COVID-19 outbreak caused minor production and transportation delays in several nations. The new coronavirus increased its grip through several succeeding waves, disrupting economic activity and harming the market for metalworking fluids. The manufacturing of metalworking fluids will be hampered by a lack of raw materials, which will hurt forming fluid sales. The epidemic has impacted industry manufacturing chains by creating a significant supply-demand gap. The demand for any industrial activity has been impacted by a mix of supply chain interruptions, labor shortages, and slow logistics, impacting sectors that largely rely on metalworking fluids.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global metalworking fluids market value is expected to grow at a CAGR of 3.50% over the forecast period.

- In terms of revenue, the global metalworking fluids market size was valued at around USD 10,729.30 million in 2021 and is projected to reach USD 13,189.05 million by 2028.

- The strong automotive sector primarily drives the market's expansion. Metals are frequently used in automobiles to give structural durability and strength. Metal removal, chemical processing, and tool protection all need the use of metalworking fluids.

- By product, the mineral category dominated the market in 2021.

- By application, the neat cutting oils category dominated the market in 2021.

- The Asia Pacific dominated the global metalworking fluids market in 2021.

Growth Drivers

Growth Drivers

- The thriving automotive industry to drive market growth

A strong automobile sector mainly drives this market. Metal plays a significant structural and durability role in automotive vehicles. Therefore, metalworking fluids make it easier to remove metal, treat it chemically, protect it, and lengthen the tool's total lifespan. Increased consumer expenditure on vehicle modifications has also expanded the market. The market is anticipated to be fueled by a switch from conventional metal alloys to titanium, aluminum, and stainless steel. These metals offer highly sought-after qualities like durability and lightness on the market. Additionally, it is anticipated that in the upcoming years, the demand for metalworking fluids will be propelled by the expansion of original equipment manufacturers' (OEM) research and development (R&D) efforts to make more metal components with guaranteed energy efficiency.

Restraints

Restraints

- The various government regulations hinder the market growth

Metalworking fluid sales have fallen due to restrictions placed by the government on using and manufacturing hazardous synthetic metalworking fluids and a change in customer preferences toward greener solutions. Consequently, it is challenging for end-user businesses to select the appropriate product for particular applications.

Segmentation Analysis

Segmentation Analysis

The global metalworking fluids market has been segmented into product, application, end-user, and industrial end-use.

Based on product, the market is divided into mineral, synthetic and bio-based. In 2021, the mineral segments dominated the global metalworking fluids market. The most common metalworking fluid is mineral-grade, which is the most cost-efficient compared to synthetic and bio-based fluids. Further, these fluids are widely used as lubrication and cooling fluids. The basic components of mineral oil are refiner's oils, pressure additives, and anticorrosion agents.

Based on application, the market is classified into neat cutting oils, water cutting oils, corrosion preventive oils and others. In 2021, the neat cutting oils category dominated the global market. The neat cutting oil is usually used when tapping, broaching, hobbing, grinding, or drilling; heavy-duty cutting gear is needed. Based on end-use, the market is classified into metal fabrication, transportation equipment, machinery and others. The machinery segment dominated the market in 2021.

Based on end-use, the market is classified into metal fabrication, transportation equipment, machinery and others. The machinery segment dominated the market in 2021. The need is linked to an increase in the use of MWFs in agricultural machinery, construction machinery, and automotive parts. The market for MWFs is anticipated to develop significantly, helped by increased demand from construction equipment manufacturers. To increase the life of the sump during machining processes and ultimately save manufacturers money, metalworking fluids are employed.

Based on industrial end-use, the market is classified into construction, electric & power, agriculture, automobile, aerospace, rail, marine, telecommunication and healthcare. In 2021, the construction segment dominated the market due to the rising demand for construction equipment and accessories needed for residential, commercial, and industrial development. Excavators, loaders, dozers, forklifts, cranes, and other pieces of machinery are just a few examples of the construction sector's equipment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 10,729.30 Million |

Projected Market Size in 2028 |

USD 13,189.05 Million |

CAGR Growth Rate |

3.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Houghton International Inc., Blaser Swisslube AG, BP plc, Exxon Mobil Corp., Total S.A., FUCHS, Chevron Corp., China Petroleum & Chemical Corp., Kuwait Petroleum Corp., and Others |

Key Segment |

By Product, Application, End-Use, Industrial End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments-

Recent Developments-

- June 2021: Idemitsu and IHI Corporation has a contract to create an ammonia supply chain network.

- April 2021: With the high-tech coolant control and distribution system supplier Grindaix GmbH, based in Germany, Quaker Houghton formed an exclusive joint venture.

Regional Landscape

Regional Landscape

The Asia Pacific dominated the metalworking fluids market in 2021

In 2021, it was predicted that the Asia Pacific region would dominate the global market for metalworking fluids due to rising demand from the automotive and transportation sectors. The availability of inexpensive land and labor in countries like India, China, and Indonesia, as well as the expansion of the manufacturing industry, are mostly to blame for the expansion of this market. In the near future, important growth engines for the Asia Pacific area are anticipated to be water-cutting fluids, synthetic metalworking fluids, and semi-synthetic metalworking fluids. The governments of China and India have acted decisively and offered the manufacturing sector considerable support, contributing to the region's dominance in market share.

Competitive Landscape

Competitive Landscape

- Houghton International Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Global Metalworking Fluids Market is segmented as follows:

By Product

By Product

- Mineral

- Synthetic

- Bio-based

By Application

By Application

- Neat Cutting Oils

- Water Cutting Oils

- Corrosion Preventive Oils

- Others

By End-Use

By End-Use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

By Industrial End-Use

By Industrial End-Use

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunication

- Healthcare

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Houghton International Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors