Search Market Research Report

Thin Film Solar Cell Market Size, Share Global Analysis Report, 2023 – 2030

Thin Film Solar Cell Market Size, Share, Growth Analysis Report By Installation (Off-Grid and On-Grid), By Type (Copper Indium Gallium Selenide, Cadmium Telluride, Thin-film Polycrystalline Silicon, Microcrystalline Tandem Cells, and Others), By Application (Commercial, Residential, and Utility), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

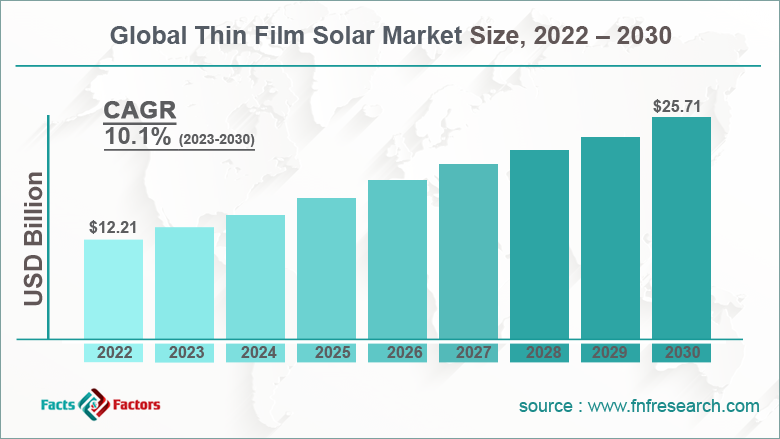

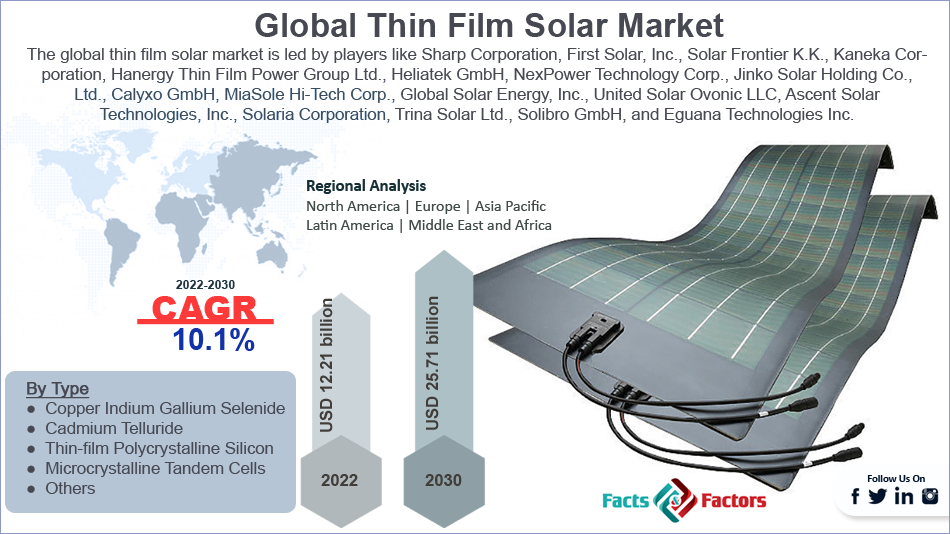

[233+ Pages Report] According to the report published by Facts & Factors, the global thin film solar cell market size was worth around USD 12.21 billion in 2022 and is predicted to grow to around USD 25.71 billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.1% between 2023 and 2030. The report analyzes the global thin film solar cell market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the thin film solar cell market.

Market Overview

Market Overview

Thin film solar panels are a part of the solar panel segment that makes use of an extremely thin layer of photovoltaic (PV) material, such as cadmium telluride (CdTe), amorphous silicon (a-Si), or copper indium gallium selenide (CIGS) to produce electricity using sunlight. The industry deals with the production and distribution of thin-film solar panels.

These products are typically flexible, and lightweight but are capable of producing large volumes of electricity at considerable low-cost manufacturing techniques. This is one of the major reasons why the industry is growing and the technology is one of the promising systems that can be used for the production of large-scale energy using solar power. The industry includes enterprises that are involved in the processes of production, sale & distribution, installation, and maintenance of thin film solar panels. In recent years, the fraternity has grown tremendously and is expected to continue the same trend in the coming years.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global thin film solar cell market is estimated to grow annually at a CAGR of around 10.1% over the forecast period (2022-2030)

- In terms of revenue, the global thin film solar cell market size was valued at around USD 12.21 billion in 2022 and is projected to reach USD 25.71 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing demand for cost-effective energy solutions

- Based on the application segmentation, the utility was predicted to show maximum market share in the year 2022

- Based on installation segmentation, on-grid was the leading installation in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Growing demand for cost-effective energy solutions to propel market demand

The global thin film solar cell market is projected to grow owing to the rising demand for cost-effective solutions for energy production. The expense associated with the production of thin-film solar panels is gradually reducing but the impact of the product has remained consistent over the years.

A critical reason for declining product costs is improved manufacturing efficiency since market players have achieved efficient and better-streamlined production processes. Furthermore, the reduction in the cost of raw materials required to produce the panels is also an important factor. These panels also require fewer raw materials as compared to traditional bulky panels which contribute to the final cost of the product.

Restraints

Restraints

- Relatively lower efficiency to restrict the market growth

Thin film solar panels are relatively less efficient than traditional solar panels in terms of energy production. Generally, they convert a lesser degree of sunlight into energy. Although with years of existence, the market has shown growth in terms of technological advancements, there is a significant gap in the performance index of thin film solar panels and regular panels which leads to consumers preferring the latter, especially in situations where the demand for energy is high.

Opportunities

Opportunities

- Increasing demand for renewable energy to provide growth opportunities

With the rising rate of environmental pollution, excessive dependency on non-renewable sources of energy, and growing health concerns due to the intense level of pollution across the globe, the demand for clean energy has risen in the last decade.

Governments, international and domestic regulatory bodies, and consumer groups have undertaken proactive measures to control the dependency and use of non-renewable sources leading to more demand for energy generated from renewable sources like solar and wind energy. Thin film solar panels provide efficient output by using solar power and the growing demand for clean energy could assist in generating more revenue during the projection period.

Challenges

Challenges

- Competition from traditional solar panels acts as a major challenge

One of the key challenges faced by the global industry players is the tough competition from sellers and producers of traditional solar panels. The latter has existed for a long time in the commercial market and has a dedicated set of consumer databases due to a better awareness rate. The industry for thin film solar panels is relatively new and has a restrictive awareness rate. The competition from traditional solar panel makers is consistently rising

and is a major drawback for the industry players.

Segmentation Analysis

Segmentation Analysis

The global thin film solar cell market is segmented based on installation, type, application, and region.

Based on the installation, the global market segments are off-grid and on-grid

- The industry was led by the on-grid thin film solar panels in 2022 and these systems are typically used or connected to the utility grid

- These systems can efficiently feed excess power back to the grid thus resulting in a reduced requirement for expensive energy storage systems

- They can further be used for net metering allowing consumers to earn credits for the production of excess energy

- The average cost of thin film solar panels was between USD 0.3 to USD 0.8 per watt as of 2021

Based on type, the global market is divided into copper indium gallium selenide, cadmium telluride, thin-film polycrystalline silicon, microcrystalline tandem cells, and others.

Based on application, the global industry segments are commercial, residential, and utility

- Utility-scale applications were the largest contributors in the segment in 2022

- These installation systems refer to units of large solar panels that are typically installed and maintained by independent or utility power providers

- They can generate megawatts or gigawatts of power and the design allows the system to feed power back into the grid directly

- The cost and performance efficiency associated with utility installations are the main reasons for segmental growth

- The Tengger Desert Solar Park in China is 1.5 gigawatts solar power plant

Recent Developments:

Recent Developments:

- In December 2022, engineers at the Massachusetts Institute of Technology (MIT) developed a solar cell that is paper-thin and has the capability to turn any surface into a power source. To achieve this, the engineers worked on developing a scalable fabrication technique that was used in the production of lightweight and ultrathin solar cell

- In February 2023, Thin Films Chemical Technologies initiated the 5GSolar Project at their TalTech laboratory. The project intends to promote the production of next-generation photovoltaics in the European region

- In November 2021, Solar Frontier, a Japanese manufacturer of thin film solar panels, announced the closure of its CIS module production and forayed into the manufacturing of 250W monocrystalline products aiming to target the residential market

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 12.21 Billion |

Projected Market Size in 2030 |

USD 25.71 Billion |

CAGR Growth Rate |

10.1% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Sharp Corporation, First Solar Inc., Solar Frontier K.K., Kaneka Corporation, Hanergy Thin Film Power Group Ltd., Heliatek GmbH, NexPower Technology Corp., Jinko Solar Holding Co. Ltd., Calyxo GmbH, MiaSole Hi-Tech Corp., Global Solar Energy Inc., United Solar Ovonic LLC, Ascent Solar Technologies Inc., Solaria Corporation, Trina Solar Ltd., Solibro GmbH, Eguana Technologies Inc., and others. |

Key Segment |

By Installation, Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to continue its dominance

The global thin film solar cell market is projected to continue growing with the highest CAGR in Asia-Pacific with Japan, India, and China leading the regional expansion. The growing demand and subsequent investment in renewable energy to meet the surging need for power supply for its growing population is the major reason for the high regional CAGR. Furthermore, the regions are moving at a high rate in terms of urbanization along with rapid industrialization which has led to growth in the demand for power supply.

Furthermore, favorable government policies promoting the production of thin film solar panels may work in the favor of the regional market. Europe and North America are significant contributors to the global industry with Germany and the US acting as major contributors respectively. Growing awareness, increased product adoption, and a rise in the number of players are crucial propellers in the region.

Competitive Analysis

Competitive Analysis

- Sharp Corporation

- First Solar Inc.

- Solar Frontier K.K.

- Kaneka Corporation

- Hanergy Thin Film Power Group Ltd.

- Heliatek GmbH

- NexPower Technology Corp.

- Jinko Solar Holding Co. Ltd.

- Calyxo GmbH

- MiaSole Hi-Tech Corp.

- Global Solar Energy Inc.

- United Solar Ovonic LLC

- Ascent Solar Technologies Inc.

- Solaria Corporation

- Trina Solar Ltd.

- Solibro GmbH

- Eguana Technologies Inc.

The global thin film solar cell market is segmented as follows:

By Installation Segment Analysis

By Installation Segment Analysis

- Off-Grid

- On-Grid

By Type Segment Analysis

By Type Segment Analysis

- Copper Indium Gallium Selenide

- Cadmium Telluride

- Thin-film Polycrystalline Silicon

- Microcrystalline Tandem Cells

- Others

By Application Segment Analysis

By Application Segment Analysis

- Commercial

- Residential

- Utility

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sharp Corporation

- First Solar Inc.

- Solar Frontier K.K.

- Kaneka Corporation

- Hanergy Thin Film Power Group Ltd.

- Heliatek GmbH

- NexPower Technology Corp.

- Jinko Solar Holding Co. Ltd.

- Calyxo GmbH

- MiaSole Hi-Tech Corp.

- Global Solar Energy Inc.

- United Solar Ovonic LLC

- Ascent Solar Technologies Inc.

- Solaria Corporation

- Trina Solar Ltd.

- Solibro GmbH

- Eguana Technologies Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors