Search Market Research Report

Tampon Market Size, Share Global Analysis Report, 2022 – 2028

Tampon Market Size, Share, Growth Analysis Report By Source (Organic, Conventional), By Nature (Scented, Unscented), By Pack Size (Less Than 10, 10-30, 31-50, 50 & Above), By Price Range (Economy, Mid-range, Premium), By Sales Channel (Wholesalers/Distributors, Hypermarkets/ Supermarkets, Drug Stores/ Pharmacies, Multi-brand Stores, Specialty Stores, Online Retailers, Other Sales Channels), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

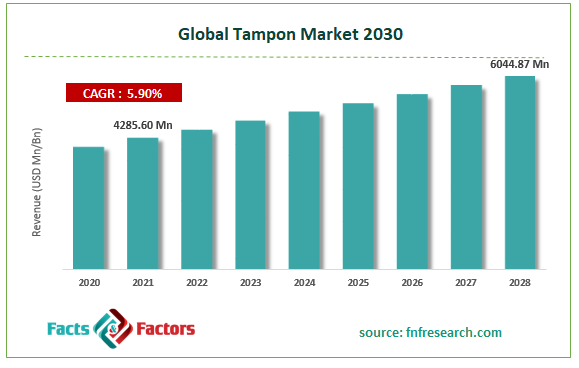

[210+ Pages Report] According to Facts and Factors, the tampon market size was worth USD 4285.60 million in 2021 and is estimated to grow to USD 6044.87 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.90% over the forecast period. The report analyzes the tampon market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the tampon market.

Market Overview

Market Overview

Tampons are a type of feminine hygiene item used to absorb menstrual fluid by inserting them into the vagina. When a tampon is placed correctly, the vagina holds it in place as it swells to absorb menstrual fluid. Most tampons are made of rayon or a combination of rayon and cotton. There are many absorbency ratings for tampons. Some tampons have an applicator to make it easier to insert them. The end of the tampons is knotted with a string to make it easy to draw them out. Currently, producers are concentrating on using only organic cotton to make tampons. Organic cotton is farmed without artificial fertilizers or pesticides and is used to make organic tampons. Cotton and rayon are frequently used in non-organic fashions. Using no plastic, organic cotton aims to make tampons more environmentally friendly. The tampon market is anticipated to expand significantly throughout the forecast period due to rising demand for these goods and greater awareness of sophisticated, feminine hygiene products. Tampons are also frequently used to manage odors and are more practical and hygienic than sanitary pads. Because they are constructed of materials of a medical grade, tampons are safe to use. Tampons may require more mess and effort to insert and remove. Tampons can occasionally induce allergic responses, restricting the market's expansion.

COVID-19 Impact:

COVID-19 Impact:

There is ample proof that the hormones generated by the female population impact rates of severe mortality and morbidity. COVID-19 has, in some cases, led to a heavier menstrual flow, which can be uncomfortable and disrupt the menstrual cycle. Surveys of symptoms rarely include questions on menstrual period symptoms because it is unclear what exactly causes them. Reproductive health may suffer from indirect impacts such as stress, worry, hunger, and changes in sleep, physical activity, and diet. Menstrual irregularities appear to be more prevalent now than they were before the pandemic. It has become evident that the COVID-19 epidemic has had a substantial impact on girls and women's capacity to control their menstruation and health.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the tampon market value is expected to grow at a CAGR of 5.90% over the forecast period.

- In terms of revenue, the tampon market size was valued at around USD 4285.60 million in 2021 and is projected to reach USD 6044.87 million by 2028.

- The tampon market is anticipated to expand significantly throughout the forecast period due to rising demand for these goods and greater awareness of sophisticated, feminine hygiene products

- By price range, the mid-range dominated the market in 2021.

- By Sales Channel, the online retailers dominated the market in 2021.

- North America dominated the tampon market in 2021.

Growth Drivers

Growth Drivers

- Increasing sales by raising awareness of female hygiene drive the market

In the upcoming years, it is anticipated that the market for feminine hygiene goods, particularly tampons, will expand significantly as government officials try to support the development of ecologically friendly organic feminine hygiene products. The tampon market is anticipated to rise throughout the forecast period due to increased demand for such goods and greater knowledge of advanced feminine hygiene products. In addition to being more hygienic and comfortable than sanitary pads, tampons also lessen odor.

Restraints

Restraints

- The use of tampons is more difficult and messier, which may hinder the market growth

Tampons may require more mess and effort to insert and remove. Since tampons must be placed into the body, women are reluctant to switch to them. It makes sense that they might frighten some people. Tampons can occasionally induce allergic responses, restricting the market's expansion. TSS risk may rise with tampon use. When strep bacteria grow in the vagina and enter the bloodstream, TSS is the result.

Segmentation Analysis

Segmentation Analysis

The tampon market is segregated based on source, nature, pack size, price range, and sales channel.

Based on the source, the market is divided into organic and conventional. Among these, the organic segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Additionally, many manufacturers make tampons from organic materials. When compared to other options, these tampons are frequently more affordable.

Based on nature, the market is divided into scented and unscented. Among these, the unscented segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. The unscented is usually preferred since they are cheaper and feel more secure.

Based on pack size, the market is divided into less than 10, 10-30, 31-50 and 50 & above. Among these, the less than 10 segments led the market in 2021 and are expected to maintain their dominance throughout the forecast period. Women like to buy them in small quantities since most are still warming up to the idea of using tampons.

The market is divided into economy, mid-range, and premium based on price range. Among these, the mid-range segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Most brands target this segment, which has a very high traction rate.

Based on sales channels, the market is divided into wholesalers/distributors, hypermarkets/supermarkets, drug stores/ pharmacies, multi-brand stores, specialty stores, online retailers, and other sales channels. Among these, the online retailers' segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. The major elements causing the online channel to have a significant growth rate over time are the adoption of internet services and a tendency for customer convenience. Additionally, due to a lack of information, it cannot be easy to find items like organic tampons in grocery stores.

Recent Developments

Recent Developments

- November 2021: As part of their commitment to sustainability, Lil-lets Group Limited stopped producing its plastic tampon applicator and switched to a reusable alternative. This action will assist the business in luring more clients.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4285.60 Million |

Projected Market Size in 2028 |

USD 6044.87 Million |

CAGR Growth Rate |

5.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Svenska Cellulosa AB, Procter and Gamble Co., Edgewell Personal Care Company, Masmi, Lil-Lets UK Limited, Cora, Kimberly-Clark Corporation, Unicharm Corporation, Johnson & Johnson Inc., Corman SpA, First Quality Enterprises Inc., First Quality Enterprises Inc, Bella, Bodywise Ltd., and Others |

Key Segment |

By Source, Nature, Pack Size, Price Range, Sales Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the tampon market in 2021

Due to the highest number of women increasing their tampon use in this region, North America in 2021 became the tampon's largest market. Expanding the tampon sector in this area would also be supported by increasing government initiatives to make women's hygiene accessible to most of the population. The large growth in the number of activities intended to raise knowledge of the benefits of tampon use is one important factor projected to boost women's adoption during the projection timeframe.

Competitive Landscape

Competitive Landscape

- Svenska Cellulosa AB

- Procter and Gamble Co.

- Edgewell Personal Care Company

- Masmi

- Lil-Lets UK Limited

- Cora

- Kimberly-Clark Corporation

- Unicharm Corporation

- Johnson & Johnson Inc.

- Corman SpA

- First Quality Enterprises Inc.

- First Quality Enterprises Inc

- Bella

- Bodywise Ltd.

Global Tampon Market Market is segmented as follows:

By Source

By Source

- Organic

- Conventional

By Nature

By Nature

- Scented

- Unscented

By Pack Size

By Pack Size

- Less than 10

- 10-30

- 31-50

- 50 & above

By Price Range

By Price Range

- Economy

- Mid-range

- Premium

By Sales Channel

By Sales Channel

- Wholesalers/Distributors

- Hypermarkets/Supermarkets

- Drug stores/ Pharmacies

- Multi-Brand Stores

- Specialty Stores

- Online Retailers

- Other Sales Channels

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Svenska Cellulosa AB

- Procter and Gamble Co.

- Edgewell Personal Care Company

- Masmi

- Lil-Lets UK Limited

- Cora

- Kimberly-Clark Corporation

- Unicharm Corporation

- Johnson & Johnson Inc.

- Corman SpA

- First Quality Enterprises Inc.

- First Quality Enterprises Inc

- Bella

- Bodywise Ltd

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors